Georgia Investment - Grade Bond Optional Redemption (with a Par Call)

Description

How to fill out Investment - Grade Bond Optional Redemption (with A Par Call)?

Have you been within a position that you will need paperwork for either business or person functions nearly every day? There are tons of legitimate papers templates available online, but locating versions you can rely is not straightforward. US Legal Forms delivers a large number of kind templates, such as the Georgia Investment - Grade Bond Optional Redemption (with a Par Call), which can be created to fulfill federal and state specifications.

When you are currently informed about US Legal Forms internet site and possess a free account, simply log in. Next, you are able to obtain the Georgia Investment - Grade Bond Optional Redemption (with a Par Call) format.

If you do not offer an account and want to begin using US Legal Forms, follow these steps:

- Get the kind you require and make sure it is for your right area/county.

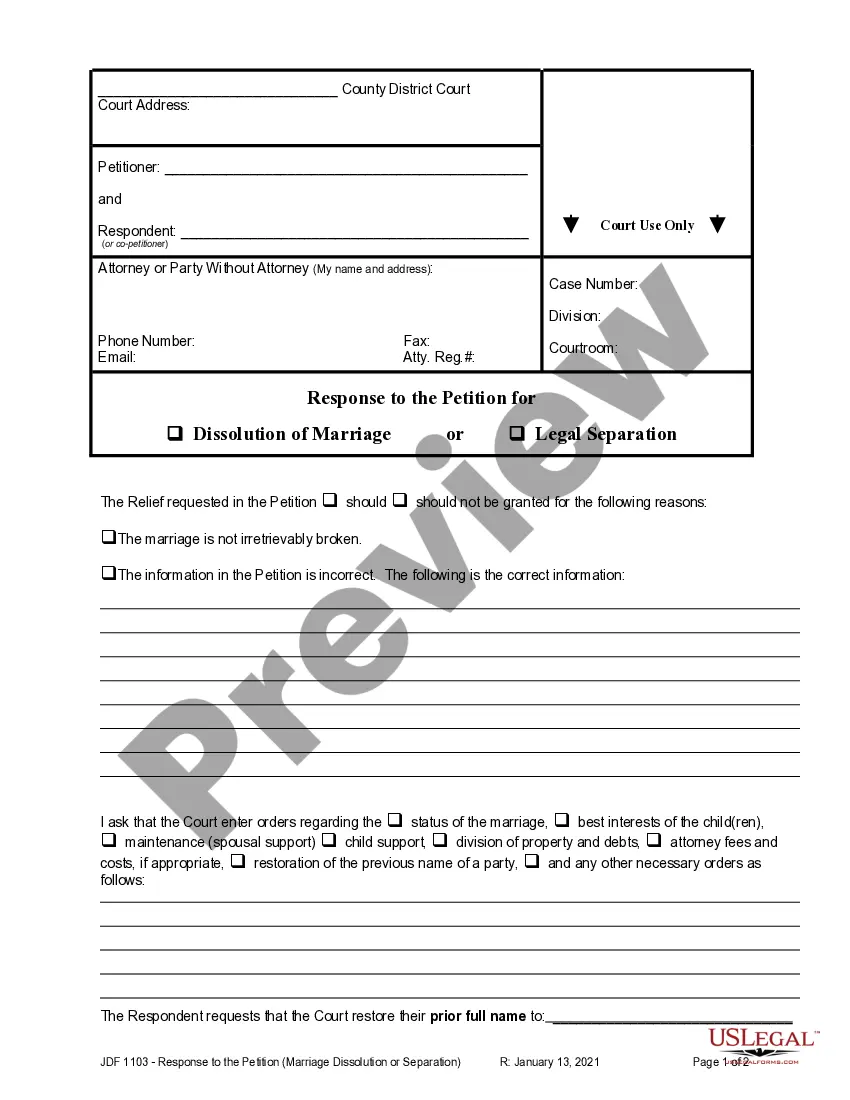

- Utilize the Preview option to check the form.

- Read the explanation to ensure that you have chosen the correct kind.

- When the kind is not what you`re seeking, make use of the Look for field to find the kind that suits you and specifications.

- If you obtain the right kind, click on Buy now.

- Opt for the costs program you desire, fill in the specified information and facts to make your account, and buy the transaction utilizing your PayPal or bank card.

- Select a convenient data file formatting and obtain your backup.

Get all of the papers templates you have purchased in the My Forms food selection. You can get a additional backup of Georgia Investment - Grade Bond Optional Redemption (with a Par Call) anytime, if needed. Just go through the necessary kind to obtain or printing the papers format.

Use US Legal Forms, one of the most substantial assortment of legitimate forms, to save lots of efforts and steer clear of blunders. The support delivers professionally created legitimate papers templates which can be used for a range of functions. Produce a free account on US Legal Forms and start generating your daily life a little easier.

Form popularity

FAQ

If a bond is redeemed early (called) by the issuer, the holder (investor) is made whole on forgone coupon payments as the make-whole call payment is equal to the net present value of all coupon payments forgone because of the early redemption.

On the other hand, callable bonds mean higher risk for investors. If the bonds are redeemed, the investors will lose some future interest payments (this is also known as refinancing risk). Due to the riskier nature of the bonds, they tend to come with a premium to compensate investors for the additional risk.

Thus, the value of a callable or putable bond can be calculated by discounting the bond's future cash flows at the appropriate one-period forward rates, taking into consideration the decision to exercise the option.

Callable or redeemable bonds are bonds that can be redeemed or paid off by the issuer prior to the bonds' maturity date. When an issuer calls its bonds, it pays investors the call price (usually the face value of the bonds) together with accrued interest to date and, at that point, stops making interest payments.

A callable bond allows the issuer to redeem the bond on a call date before the bond matures at a defined call price, and usually offers a higher yield than simple bonds without the callable feature. As a general rule, when the interest rate bottoms out, the issuer will be less likely to call back the bond.

A callable?redeemable?bond is typically called at a value that is slightly above the par value of the debt. The earlier in a bond's life span that it is called, the higher its call value will be. For example, a bond maturing in 2030 can be called in 2020. It may show a callable price of 102.