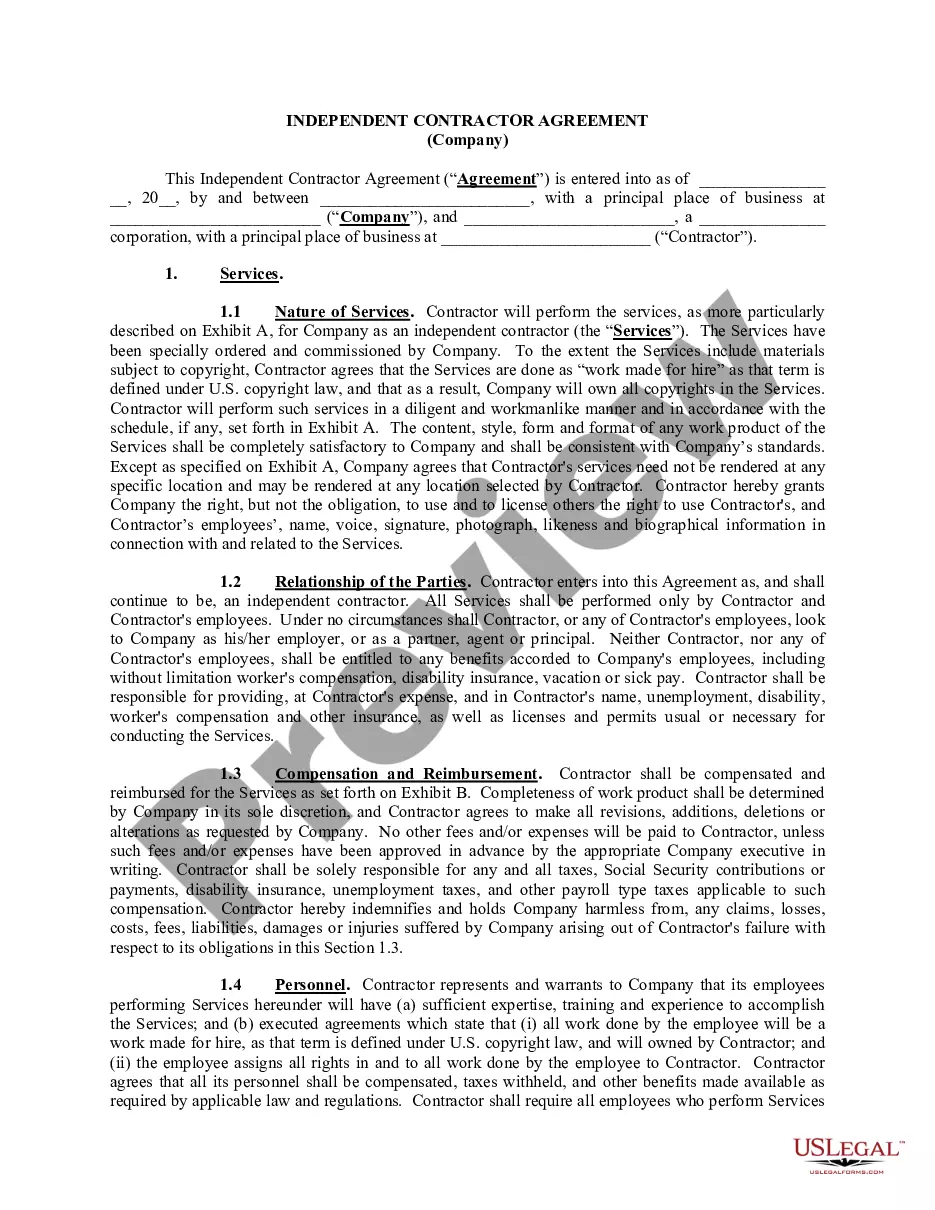

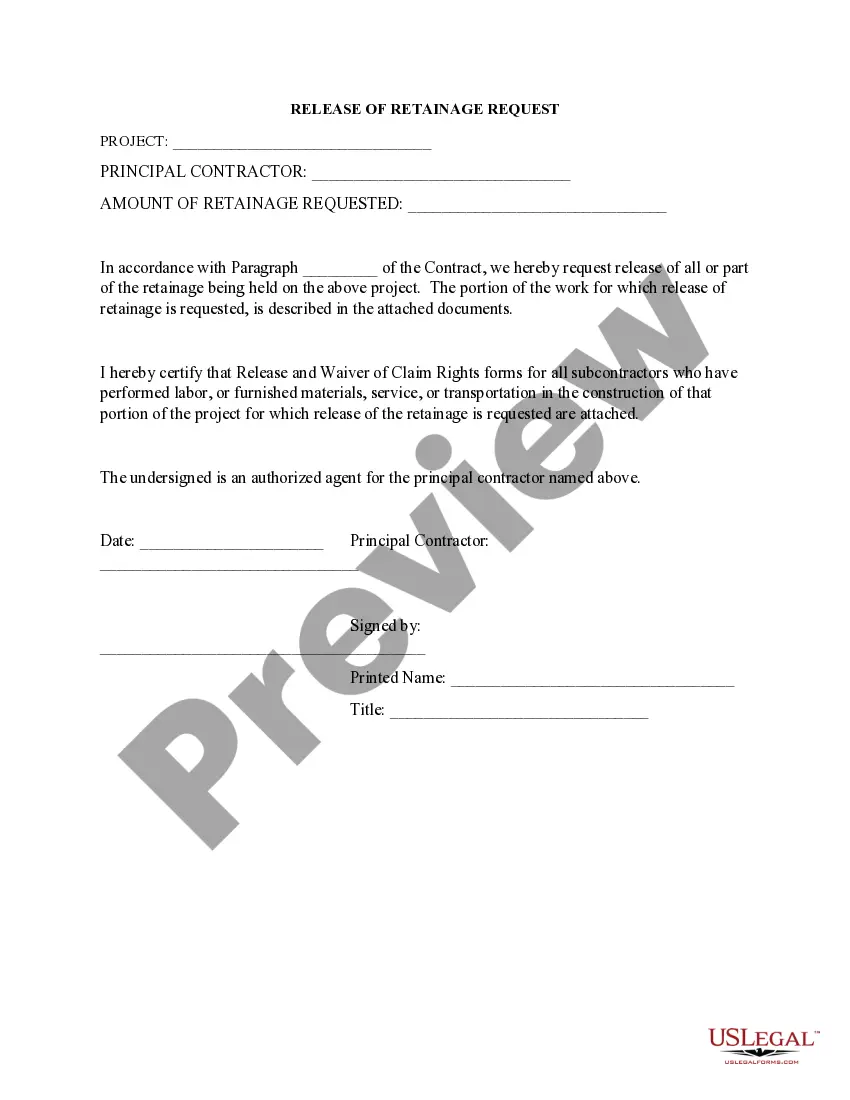

A Georgia Shared Earnings Agreement between a fund and a company is a legal agreement that outlines the terms and conditions of an investment partnership. This agreement is typically used when a fund invests in a company and seeks to share in the profits or earnings generated by that company. Key terms and keywords relevant to a Georgia Shared Earnings Agreement may include: 1. Fund: Refers to the entity providing the investment capital, such as a venture capital fund, private equity fund, or angel investor. 2. Company: Refers to the entity receiving the investment and entering into the agreement. This can be a startup, a small or medium-sized enterprise (SME), or any other business seeking funding. 3. Shared Earnings: Describes the mechanism through which the fund participates in the company's profits or earnings. This can be in the form of a percentage of revenue, net income, or other agreed-upon metrics. 4. Equity: Refers to the ownership or shares of the company that the fund may acquire as part of the investment. The fund's ownership stake is often proportional to the invested capital. 5. Investment Amount: Specifies the amount of capital the fund is contributing to the company. This can differ depending on the stage of company growth, the industry, and the fund's investment strategy. 6. Profit Sharing Mechanism: Outlines how the shared earnings will be calculated and distributed between the fund and the company. This can be a predetermined formula or based on specific financial milestones. 7. Reporting and Disclosure Obligations: The agreement may include provisions that require the company to provide regular financial and operational reports to the fund. This allows the fund to monitor the company's performance and ensure transparency. 8. Exit Strategy: Specifies the methods by which the fund can exit its investment, such as through the sale of shares, an initial public offering (IPO), or other liquidity events. This aspect is crucial for both parties to plan for the potential future divestment. Different types of Georgia Shared Earnings Agreements between a fund and a company can vary based on factors such as: 1. Stage of Investment: The agreement terms and conditions may differ depending on whether the investment is made in a seed-stage startup, early-stage company, or a mature business. 2. Industry Specifics: Agreements can be tailored to specific industries, such as technology, healthcare, or real estate, taking into account industry dynamics and associated risks. 3. Participation Rights: The agreement can outline the rights and privileges the fund may have, such as voting rights, board representation, or priority in future financing rounds. 4. Risk Allocation: Different agreements may allocate risks and potential liabilities between the fund and the company in various ways to protect both parties' interests. In conclusion, a Georgia Shared Earnings Agreement is a legal contract that defines the terms of investment and profit sharing between a fund and a company operating in the state of Georgia. Variations in these agreements exist depending on factors such as investment stage, industry, participation rights, and risk allocation.

Georgia Shared Earnings Agreement between Fund & Company

Description

How to fill out Georgia Shared Earnings Agreement Between Fund & Company?

You may spend several hours on the web looking for the lawful document web template that fits the state and federal specifications you want. US Legal Forms offers thousands of lawful varieties which can be evaluated by experts. You can actually acquire or printing the Georgia Shared Earnings Agreement between Fund & Company from our support.

If you already possess a US Legal Forms profile, you may log in and click on the Acquire option. Next, you may full, modify, printing, or indicator the Georgia Shared Earnings Agreement between Fund & Company. Each lawful document web template you buy is your own for a long time. To get another backup for any bought kind, visit the My Forms tab and click on the related option.

If you are using the US Legal Forms site the first time, stick to the easy guidelines listed below:

- Initial, make sure that you have chosen the proper document web template for that state/area of your choice. See the kind outline to make sure you have selected the appropriate kind. If available, make use of the Review option to appear through the document web template as well.

- If you want to find another version of your kind, make use of the Research discipline to discover the web template that meets your needs and specifications.

- After you have identified the web template you need, click on Buy now to proceed.

- Find the costs plan you need, enter your accreditations, and sign up for a free account on US Legal Forms.

- Comprehensive the purchase. You may use your bank card or PayPal profile to purchase the lawful kind.

- Find the formatting of your document and acquire it to the product.

- Make adjustments to the document if necessary. You may full, modify and indicator and printing Georgia Shared Earnings Agreement between Fund & Company.

Acquire and printing thousands of document web templates utilizing the US Legal Forms Internet site, that provides the greatest collection of lawful varieties. Use skilled and state-particular web templates to take on your company or specific needs.