The Georgia Investors Rights Agreement is a legal document that outlines the rights, privileges, and protections of investors in the state of Georgia. This agreement serves as a formal contract between the company seeking investment and the individual investors, establishing the terms and conditions that will govern their relationship throughout the investment process. By signing the Georgia Investors Rights Agreement, investors gain certain rights and safeguards to protect their interests. This agreement typically includes provisions that outline the specific rights of investors, such as the right to receive regular updates on the company's progress and financial performance, the right to participate in important decision-making processes, and the right to withdraw their investment under certain circumstances. The agreement may also cover matters related to equity ownership, including the rights of investors to purchase additional shares, the anti-dilution protection mechanisms, and the conversion or redemption rights. It may detail the process for resolving disputes, such as through arbitration or mediation, and lay out the responsibilities and obligations of both the company and the investors involved. It is important to note that different types of Georgia Investors Rights Agreements exist to cater to specific investment structures or stages. Some common types include: 1. Seed Investors Rights Agreement: This agreement is typically used during the seed funding stage, where investors provide early-stage capital to help a company get off the ground. It may address unique rights and provisions specific to this initial funding phase. 2. Series A Investors Rights Agreement: As a company progresses and secures additional rounds of funding, it may enter into a series A investors rights agreement. This agreement may involve more complex provisions and rights, including participation in subsequent funding rounds, protective provisions, and board representation rights. 3. Convertible Note Investors Rights Agreement: In cases where a company raises capital through convertible notes instead of equity, a convertible note investors rights agreement may be executed. It outlines the rights of investors who hold convertible notes and addresses potential conversion scenarios. Ultimately, the Georgia Investors Rights Agreement is a crucial document that safeguards the interests and rights of both companies and investors. It establishes a fair framework for the investment relationship, encouraging transparency, accountability, and mutual respect throughout the investment process in the state of Georgia.

Georgia Investors Rights Agreement

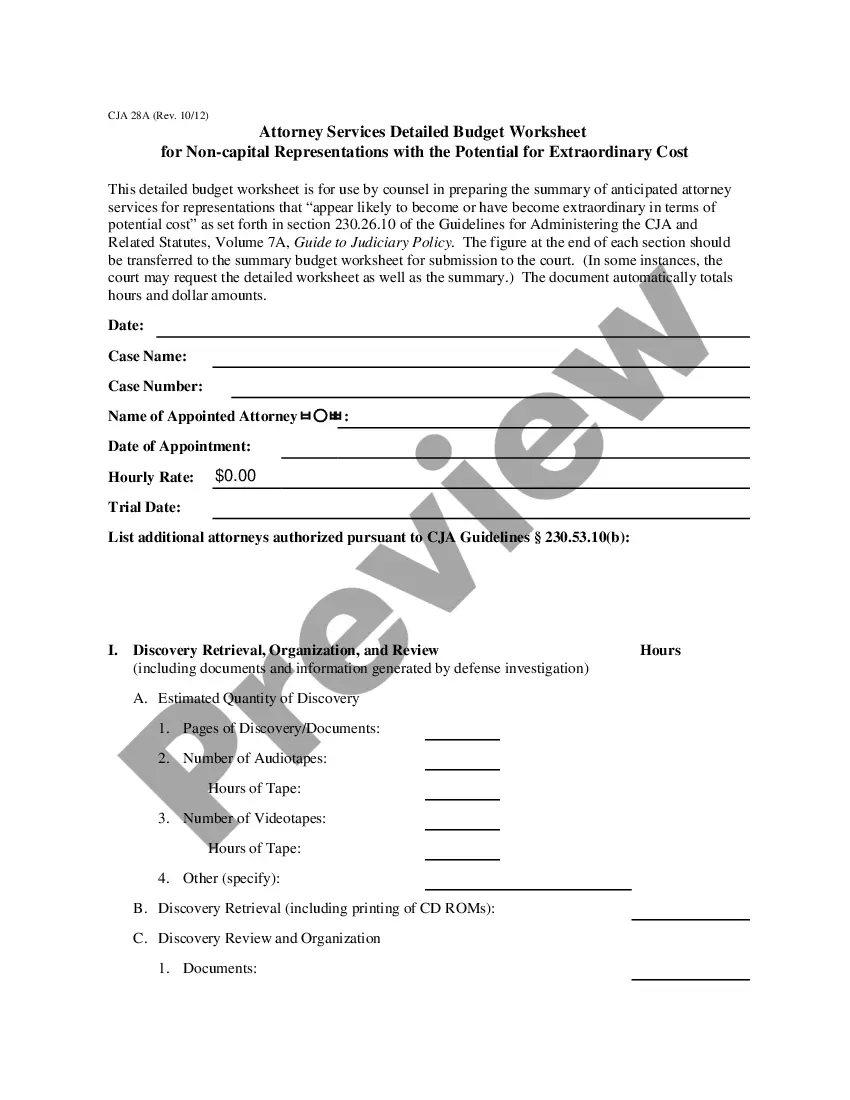

Description

How to fill out Georgia Investors Rights Agreement?

US Legal Forms - one of several most significant libraries of legitimate kinds in the USA - delivers a wide range of legitimate papers templates you may download or printing. Utilizing the web site, you may get a large number of kinds for organization and individual functions, sorted by types, says, or keywords and phrases.You can find the latest variations of kinds like the Georgia Investors Rights Agreement within minutes.

If you already possess a subscription, log in and download Georgia Investors Rights Agreement from the US Legal Forms catalogue. The Obtain button will show up on each and every kind you look at. You gain access to all earlier acquired kinds in the My Forms tab of your own profile.

If you would like use US Legal Forms for the first time, allow me to share straightforward guidelines to help you started:

- Ensure you have selected the right kind to your area/county. Go through the Review button to check the form`s information. See the kind outline to actually have selected the appropriate kind.

- In the event the kind does not fit your specifications, make use of the Lookup discipline near the top of the monitor to discover the one who does.

- When you are content with the form, validate your option by clicking on the Buy now button. Then, pick the prices plan you like and offer your qualifications to sign up to have an profile.

- Procedure the purchase. Utilize your Visa or Mastercard or PayPal profile to perform the purchase.

- Find the structure and download the form in your system.

- Make modifications. Complete, modify and printing and indicator the acquired Georgia Investors Rights Agreement.

Each and every design you included in your money lacks an expiration day and is the one you have for a long time. So, in order to download or printing yet another version, just proceed to the My Forms segment and click around the kind you need.

Get access to the Georgia Investors Rights Agreement with US Legal Forms, one of the most considerable catalogue of legitimate papers templates. Use a large number of specialist and condition-certain templates that meet up with your business or individual requires and specifications.