This guide provides an overview of the Fair Credit and Reporting Act Red Flags rule and gives step-by-step guidance on how businesses may develop a program to comply with the law's requirements. Links to additional resources for developing an Identity Theft Prevention Program are included.

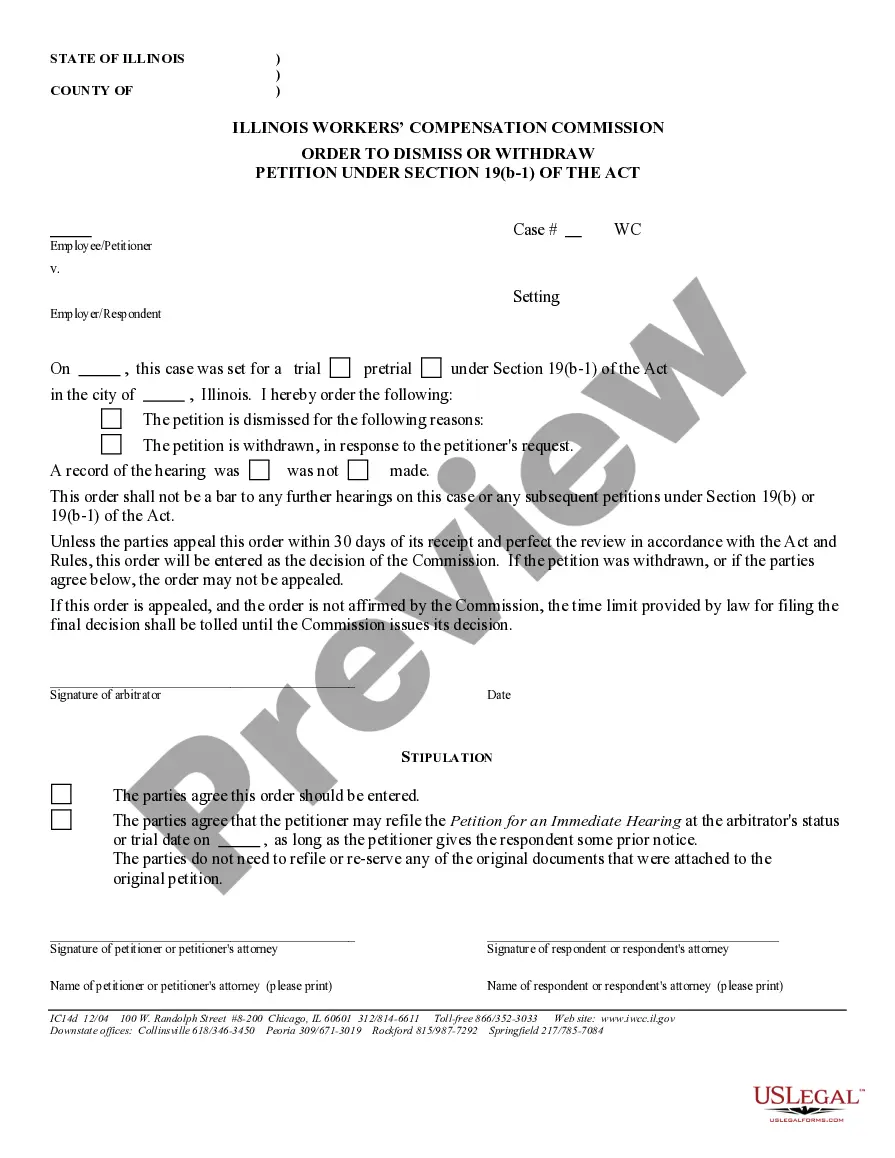

Note: The preview only shows the 1st two pages of the document.

Title: Georgia How-To Guide for Fighting Fraud and Identity Theft With the FCRA and FACT Red Flags Rule: Protecting Your Personal Information Introduction: In Georgia, just like in other states, staying informed and equipped with knowledge about fraud prevention and identity theft is crucial. The Fair Credit Reporting Act (FCRA) and the Fair and Accurate Credit Transactions Act (FACT) Red Flags Rule provide guidelines and regulations to help individuals safeguard their personal information effectively. In this comprehensive guide, we will delve into the vital information and strategies necessary to combat fraud and identity theft, tailored specifically for Georgia residents. 1. Understanding Fraud and Identity Theft in Georgia: — Definition and types of fraud and identity theft prevalent in Georgia — Common tactics and schemes used by fraudsters targeting Georgia residents — The potential consequences and risks associated with falling victim to fraud and identity theft 2. Overview of the FCRA and FACT Red Flags Rule: — Detailed explanation of the FCRA and FACT Red Flags Rule and their significance in Georgia — How these regulations work together to protect individuals from identity theft — Key requirements and provisions outlined by the FCRA and FACT Red Flags Rule 3. Identity Theft Prevention Strategies for Georgia Residents: — Steps to secure personal information and prevent identity theft — Guidelines to strengthen passwords and protect online accounts — Tips for effectively managing and disposing of sensitive documents — Best practices for detecting and reporting suspicious activities related to potential identity theft 4. Recognizing Warning Signs of Identity Theft in Georgia: — Identifying common red flags and warning signs of potential identity theft — Steps to take if you suspect that your identity has been compromised — The importance of monitoring your credit reports and accounts regularly 5. Reporting Fraud and Pursuing Legal Action in Georgia: — Overview of reporting procedures for fraud and identity theft incidents in Georgia — Contact information for relevant law enforcement agencies and consumer protection organizations — Guidance on documenting evidence and pursuing legal action against fraudsters and identity thieves 6. Resources for Georgia Residents: — A curated list of resources, websites, and helpline numbers specifically beneficial for Georgia residents — Additional tools, apps, and services to assist in monitoring credit, protecting personal information, and resolving identity theft issues Conclusion: By familiarizing yourself with the FCRA and FACT Red Flags Rule and implementing the preventive measures described in this Georgia How-To Guide for Fighting Fraud and Identity Theft, you can significantly reduce your risk of falling victim to these crimes. Remain vigilant, stay informed, and take the necessary steps to protect your personal information in an ever-evolving digital landscape.

Title: Georgia How-To Guide for Fighting Fraud and Identity Theft With the FCRA and FACT Red Flags Rule: Protecting Your Personal Information Introduction: In Georgia, just like in other states, staying informed and equipped with knowledge about fraud prevention and identity theft is crucial. The Fair Credit Reporting Act (FCRA) and the Fair and Accurate Credit Transactions Act (FACT) Red Flags Rule provide guidelines and regulations to help individuals safeguard their personal information effectively. In this comprehensive guide, we will delve into the vital information and strategies necessary to combat fraud and identity theft, tailored specifically for Georgia residents. 1. Understanding Fraud and Identity Theft in Georgia: — Definition and types of fraud and identity theft prevalent in Georgia — Common tactics and schemes used by fraudsters targeting Georgia residents — The potential consequences and risks associated with falling victim to fraud and identity theft 2. Overview of the FCRA and FACT Red Flags Rule: — Detailed explanation of the FCRA and FACT Red Flags Rule and their significance in Georgia — How these regulations work together to protect individuals from identity theft — Key requirements and provisions outlined by the FCRA and FACT Red Flags Rule 3. Identity Theft Prevention Strategies for Georgia Residents: — Steps to secure personal information and prevent identity theft — Guidelines to strengthen passwords and protect online accounts — Tips for effectively managing and disposing of sensitive documents — Best practices for detecting and reporting suspicious activities related to potential identity theft 4. Recognizing Warning Signs of Identity Theft in Georgia: — Identifying common red flags and warning signs of potential identity theft — Steps to take if you suspect that your identity has been compromised — The importance of monitoring your credit reports and accounts regularly 5. Reporting Fraud and Pursuing Legal Action in Georgia: — Overview of reporting procedures for fraud and identity theft incidents in Georgia — Contact information for relevant law enforcement agencies and consumer protection organizations — Guidance on documenting evidence and pursuing legal action against fraudsters and identity thieves 6. Resources for Georgia Residents: — A curated list of resources, websites, and helpline numbers specifically beneficial for Georgia residents — Additional tools, apps, and services to assist in monitoring credit, protecting personal information, and resolving identity theft issues Conclusion: By familiarizing yourself with the FCRA and FACT Red Flags Rule and implementing the preventive measures described in this Georgia How-To Guide for Fighting Fraud and Identity Theft, you can significantly reduce your risk of falling victim to these crimes. Remain vigilant, stay informed, and take the necessary steps to protect your personal information in an ever-evolving digital landscape.