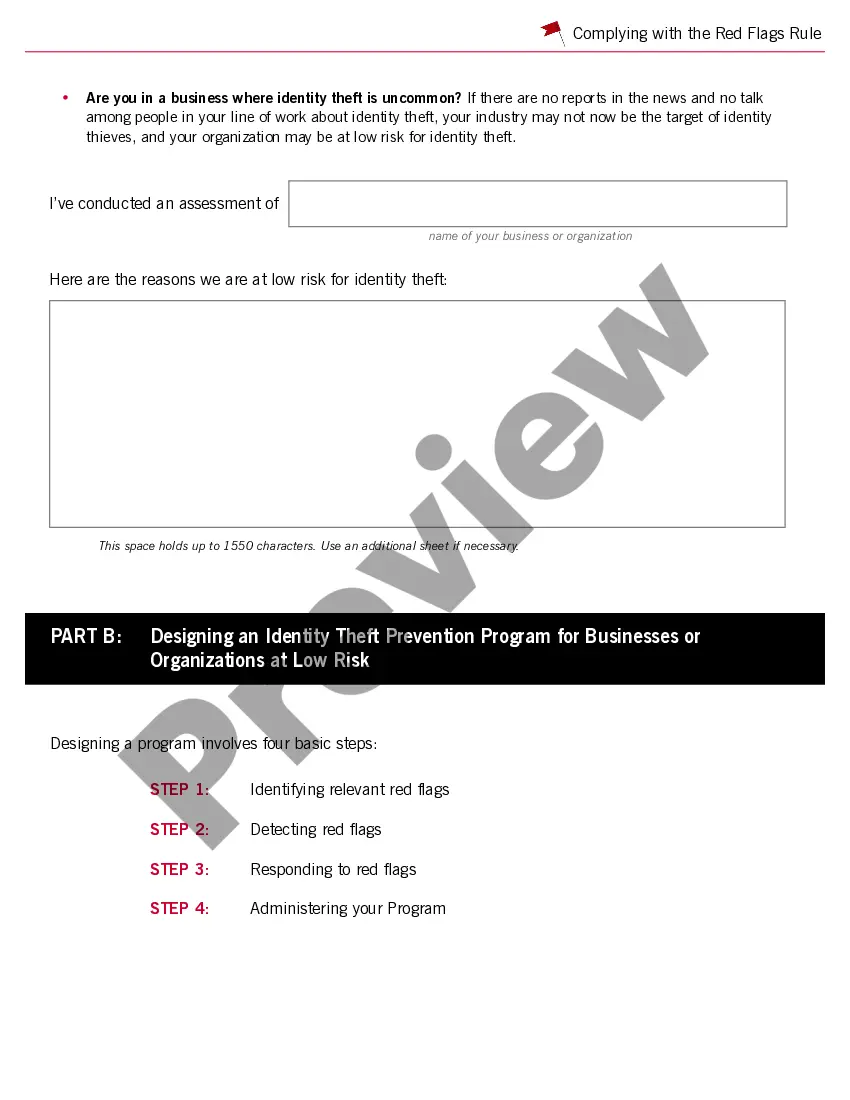

This guide has two parts: Part A to help you determine whether your business or organization is at low risk, and Part B to help you design your written Identity Theft Prevention Program if your business is in the low risk category.

Note: The preview only shows the 1st page of the document.

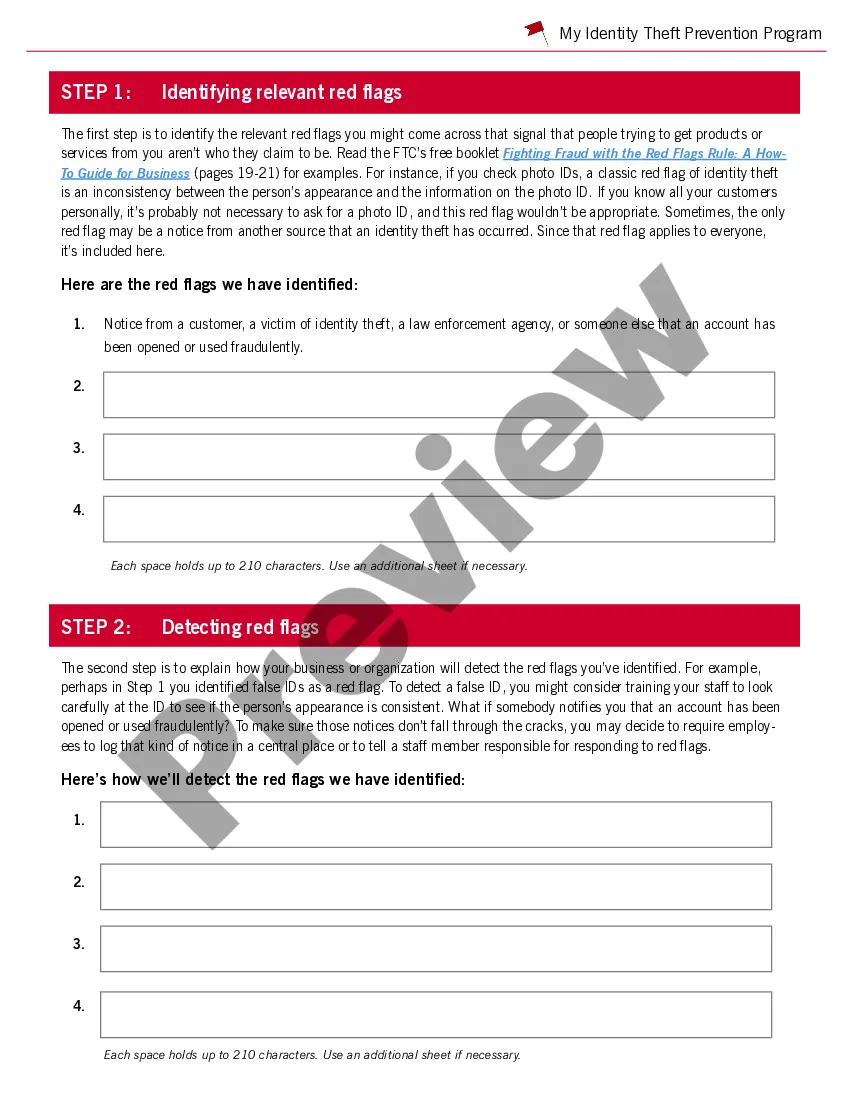

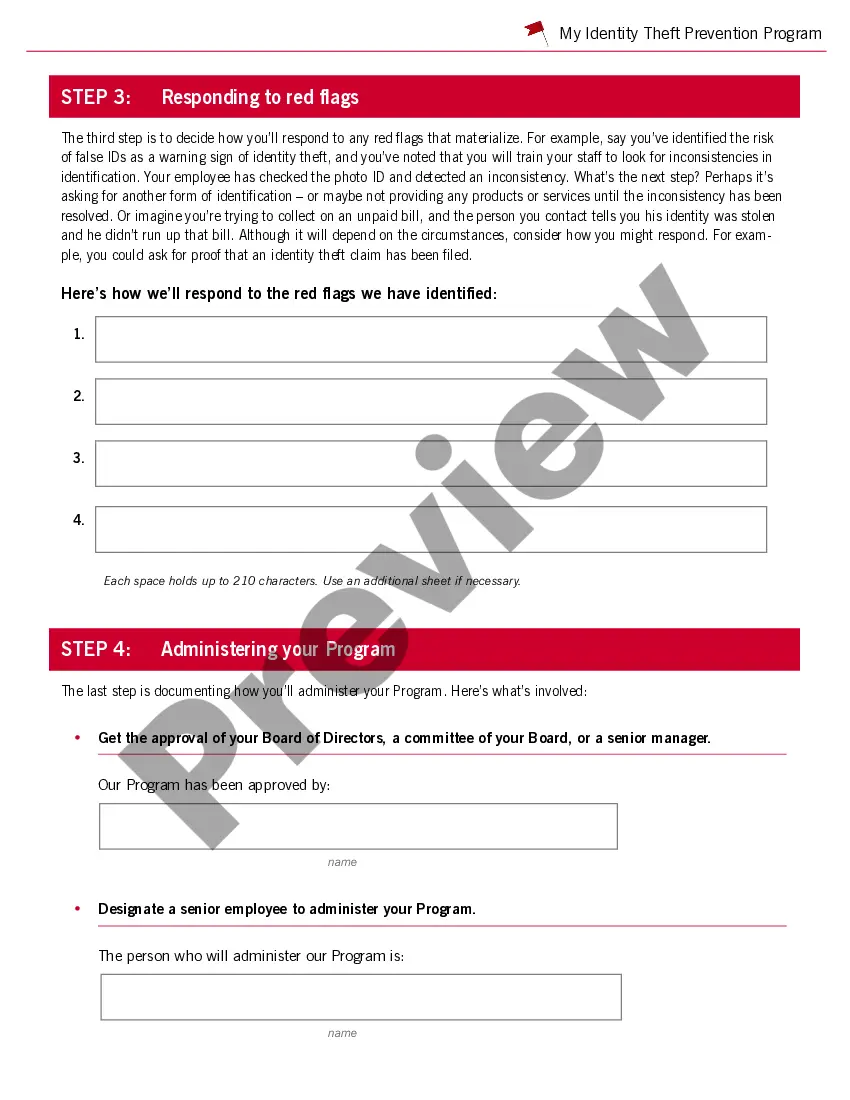

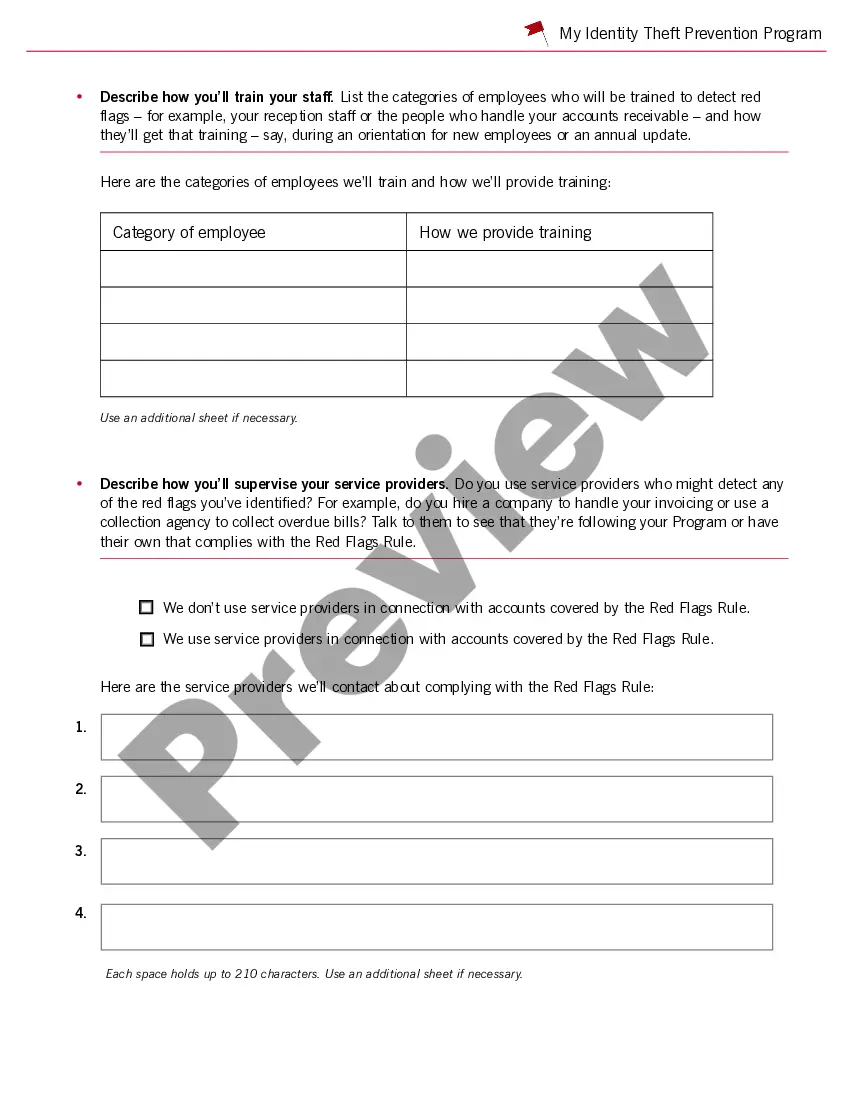

Title: Georgia Guide to Complying with the Red Flags Rule under FCRA and FACT Introduction: The Georgia Guide to Complying with the Red Flags Rule under the Fair Credit Reporting Act (FCRA) and the Fair and Accurate Credit Transactions Act (FACT) provides comprehensive information and resources for businesses operating in Georgia. This detailed description aims to clarify the requirements of the Red Flags Rule in Georgia, highlighting key keywords and differentiating between various types of guides available. Keywords: — GeorgiGoodid— - Complying with the Red Flags Rule — FCR— - FACTA - businesses in Georgia - identity theft prevention — consumer crediinformationio— - suspicious activities — fraud detectio— - data breaches - identity theft red flags 1. Overview of the Red Flags Rule: The guide offers an extensive overview of the Red Flags Rule, which requires certain businesses to implement identity theft prevention programs. Understand the scope of the rule and its importance in protecting consumer credit information in Georgia. 2. Identifying Red Flags for Identity Theft: Learn about the various red flags that indicate potential identity theft, such as suspicious activities or account discrepancies. Gain insights into what constitutes a red flag and how to effectively detect and respond to these indicators. 3. Developing a Compliant Identity Theft Prevention Program: Discover the necessary steps to create an identity theft prevention program specific to Georgia's requirements. Understand the elements and components that need to be incorporated, including employee training, risk assessment, and responsive actions when red flags are detected. 4. Assessing and Addressing Data Breaches: Explore guidelines on how to handle data breaches effectively, minimizing potential harm to consumers and ensuring compliance with legal obligations. Learn how to assess the breach, notify affected parties, and implement measures to prevent future incidents. 5. Leveraging Technology for Fraud Detection: Understand the role of technology in combating identity theft and fraudulent activities. Discover tools and software available to aid businesses in Georgia in detecting red flags and preventing potential fraud. 6. Compliance and Reporting Obligations: Learn about the reporting requirements under the Red Flags Rule in Georgia, including record keeping, annual reports, and interactions with regulatory authorities. Ensure your business is compliant and prepared to handle any inquiries related to your identity theft prevention program. Types of Georgia Guides Available: 1. Georgia Guide for Small Businesses: This guide specifically caters to small businesses and provides practical, tailored advice on complying with the Red Flags Rule. It considers the unique challenges and resources available to smaller enterprises. 2. Georgia Guide for Financial Institutions: Financial institutions have specific obligations under the Red Flags Rule. This guide provides detailed insights, examples, and best practices for banks, credit unions, and other financial service providers operating in Georgia. 3. Georgia Guide for Healthcare Providers: Healthcare providers handle sensitive personal information on a daily basis. This guide focuses on the unique requirements and challenges faced by the healthcare industry, offering practical steps for compliance within the Red Flags Rule. Conclusion: The Georgia Guide to Complying with the Red Flags Rule under FCRA and FACT serves as a valuable resource for Georgia businesses in their efforts to prevent identity theft and protect consumer credit information. By following the guidelines detailed in the relevant guides and leveraging technology, businesses can enhance their fraud detection capabilities, mitigate risks, and ensure compliance with regulatory obligations.Title: Georgia Guide to Complying with the Red Flags Rule under FCRA and FACT Introduction: The Georgia Guide to Complying with the Red Flags Rule under the Fair Credit Reporting Act (FCRA) and the Fair and Accurate Credit Transactions Act (FACT) provides comprehensive information and resources for businesses operating in Georgia. This detailed description aims to clarify the requirements of the Red Flags Rule in Georgia, highlighting key keywords and differentiating between various types of guides available. Keywords: — GeorgiGoodid— - Complying with the Red Flags Rule — FCR— - FACTA - businesses in Georgia - identity theft prevention — consumer crediinformationio— - suspicious activities — fraud detectio— - data breaches - identity theft red flags 1. Overview of the Red Flags Rule: The guide offers an extensive overview of the Red Flags Rule, which requires certain businesses to implement identity theft prevention programs. Understand the scope of the rule and its importance in protecting consumer credit information in Georgia. 2. Identifying Red Flags for Identity Theft: Learn about the various red flags that indicate potential identity theft, such as suspicious activities or account discrepancies. Gain insights into what constitutes a red flag and how to effectively detect and respond to these indicators. 3. Developing a Compliant Identity Theft Prevention Program: Discover the necessary steps to create an identity theft prevention program specific to Georgia's requirements. Understand the elements and components that need to be incorporated, including employee training, risk assessment, and responsive actions when red flags are detected. 4. Assessing and Addressing Data Breaches: Explore guidelines on how to handle data breaches effectively, minimizing potential harm to consumers and ensuring compliance with legal obligations. Learn how to assess the breach, notify affected parties, and implement measures to prevent future incidents. 5. Leveraging Technology for Fraud Detection: Understand the role of technology in combating identity theft and fraudulent activities. Discover tools and software available to aid businesses in Georgia in detecting red flags and preventing potential fraud. 6. Compliance and Reporting Obligations: Learn about the reporting requirements under the Red Flags Rule in Georgia, including record keeping, annual reports, and interactions with regulatory authorities. Ensure your business is compliant and prepared to handle any inquiries related to your identity theft prevention program. Types of Georgia Guides Available: 1. Georgia Guide for Small Businesses: This guide specifically caters to small businesses and provides practical, tailored advice on complying with the Red Flags Rule. It considers the unique challenges and resources available to smaller enterprises. 2. Georgia Guide for Financial Institutions: Financial institutions have specific obligations under the Red Flags Rule. This guide provides detailed insights, examples, and best practices for banks, credit unions, and other financial service providers operating in Georgia. 3. Georgia Guide for Healthcare Providers: Healthcare providers handle sensitive personal information on a daily basis. This guide focuses on the unique requirements and challenges faced by the healthcare industry, offering practical steps for compliance within the Red Flags Rule. Conclusion: The Georgia Guide to Complying with the Red Flags Rule under FCRA and FACT serves as a valuable resource for Georgia businesses in their efforts to prevent identity theft and protect consumer credit information. By following the guidelines detailed in the relevant guides and leveraging technology, businesses can enhance their fraud detection capabilities, mitigate risks, and ensure compliance with regulatory obligations.