Georgia Clerical Staff Agreement - Self-Employed Independent Contractor

Description

How to fill out Clerical Staff Agreement - Self-Employed Independent Contractor?

Are you currently in a situation where you need documents for both business or personal purposes on a daily basis.

There are many legitimate document templates available online, but locating ones you can trust is challenging.

US Legal Forms provides thousands of document templates, including the Georgia Clerical Staff Agreement - Self-Employed Independent Contractor, which are designed to comply with federal and state regulations.

When you find the right form, simply click Get now.

Select the payment plan you want, fill in the required information to create your account, and pay for your order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Georgia Clerical Staff Agreement - Self-Employed Independent Contractor template.

- If you do not have an account and would like to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/state.

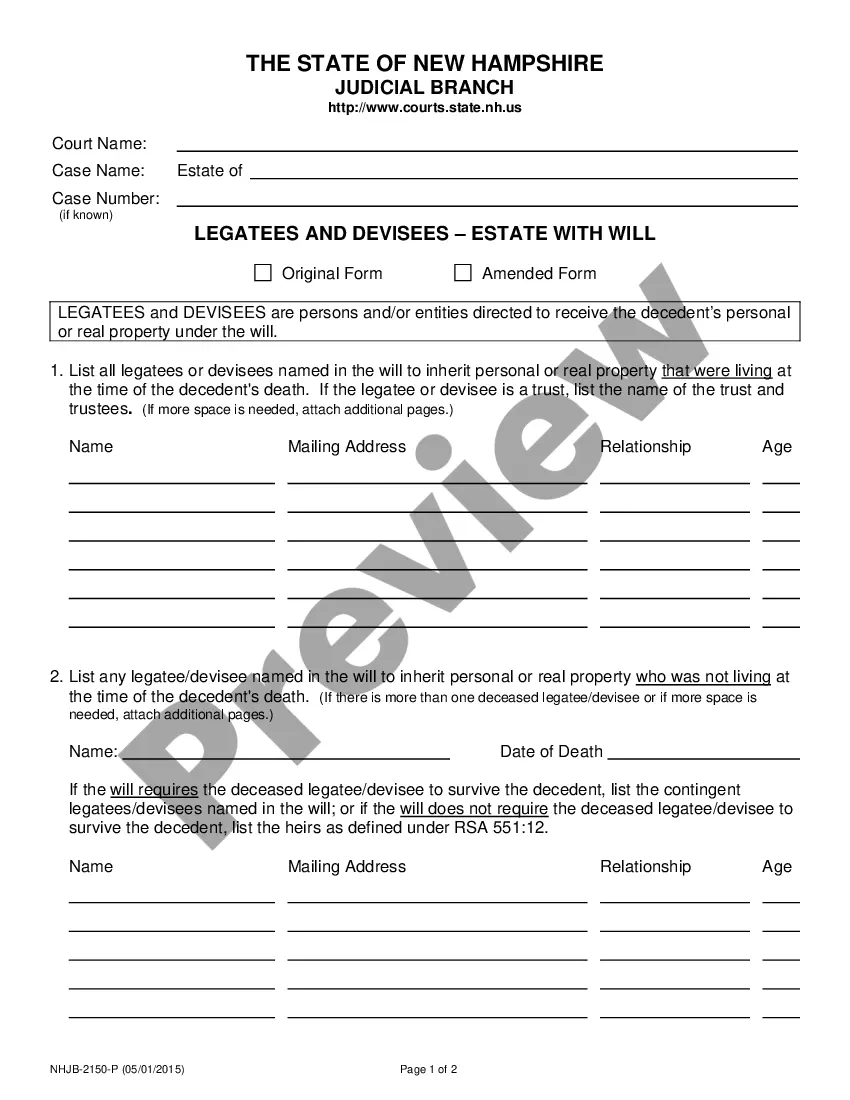

- Use the Preview button to review the document.

- Check the description to make sure you have selected the correct form.

- If the form is not what you are looking for, utilize the Search field to find the form that meets your requirements.

Form popularity

FAQ

Creating a Georgia Clerical Staff Agreement - Self-Employed Independent Contractor involves several key steps. Start by clearly defining the scope of work and the responsibilities of both parties involved. Ensure you include payment terms, deadlines, and any specific requirements for the job. Utilizing a reliable platform like US Legal Forms can provide you with templates and guidance, making it easier to draft a comprehensive agreement tailored to your needs.

The independent contractor agreement in Georgia is a legal document that outlines the terms between a business and a self-employed contractor. This agreement defines the nature of the work, payment arrangements, and the independent status of the relationship. It is crucial for a Georgia Clerical Staff Agreement - Self-Employed Independent Contractor. Utilizing a platform like UsLegalForms can help you create a compliant agreement tailored to your needs, making the process straightforward and efficient.

Filling out an independent contractor form begins with entering the contractor's information, such as name, address, and Social Security number. Specify the nature of work, compensation details, and duration to provide clarity. In the case of a Georgia Clerical Staff Agreement - Self-Employed Independent Contractor, highlight the project specifics to set expectations. After filling out the form completely, ensure both parties sign it to validate the agreement.

Writing an independent contractor agreement involves outlining the key terms of the engagement clearly. Start with the names and addresses of both parties, followed by a description of the services to be performed and payment conditions. Incorporate provisions about confidentiality, project timelines, and the independent nature of the Georgia Clerical Staff Agreement - Self-Employed Independent Contractor. Make sure to review the document carefully before finalizing and signing.

To fill out an independent contractor agreement, start by entering your name and the contractor's name at the top of the document. Next, include details about the services to be provided, payment terms, and the duration of the agreement. Ensure you define the relationship's independent status, which is essential for a Georgia Clerical Staff Agreement - Self-Employed Independent Contractor. Finally, both parties should sign the agreement to make it legally binding.

The main pieces of employment legislation, chief among which are the Labour Relations Act 66 of 1995 (LRA) the Basic Conditions of Employment Act 75 of 1997 (BCEA) and the Employment Equity Act 55 of 1998 (EEA), apply to employees and not independent contractors.

Payroll refers to the tasks an employer must execute to ensure employees are paid accurately and on time. An independent contractor is not an employee; therefore, he's not paid through the payroll.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

Here are some steps you may use to guide you when you write an employment contract:Title the employment contract.Identify the parties.List the term and conditions.Outline the job responsibilities.Include compensation details.Use specific contract terms.Consult with an employment lawyer.Employment.More items...?