Georgia Shoring Services Contract - Self-Employed

Description

How to fill out Georgia Shoring Services Contract - Self-Employed?

Choosing the right authorized papers template might be a battle. Needless to say, there are tons of templates available on the Internet, but how will you find the authorized form you need? Utilize the US Legal Forms site. The services delivers thousands of templates, for example the Georgia Shoring Services Contract - Self-Employed, that can be used for business and personal demands. Each of the varieties are inspected by specialists and meet federal and state specifications.

Should you be presently listed, log in to your profile and click the Down load option to obtain the Georgia Shoring Services Contract - Self-Employed. Make use of your profile to look from the authorized varieties you possess bought earlier. Check out the My Forms tab of your profile and get one more duplicate in the papers you need.

Should you be a fresh customer of US Legal Forms, listed below are simple directions so that you can comply with:

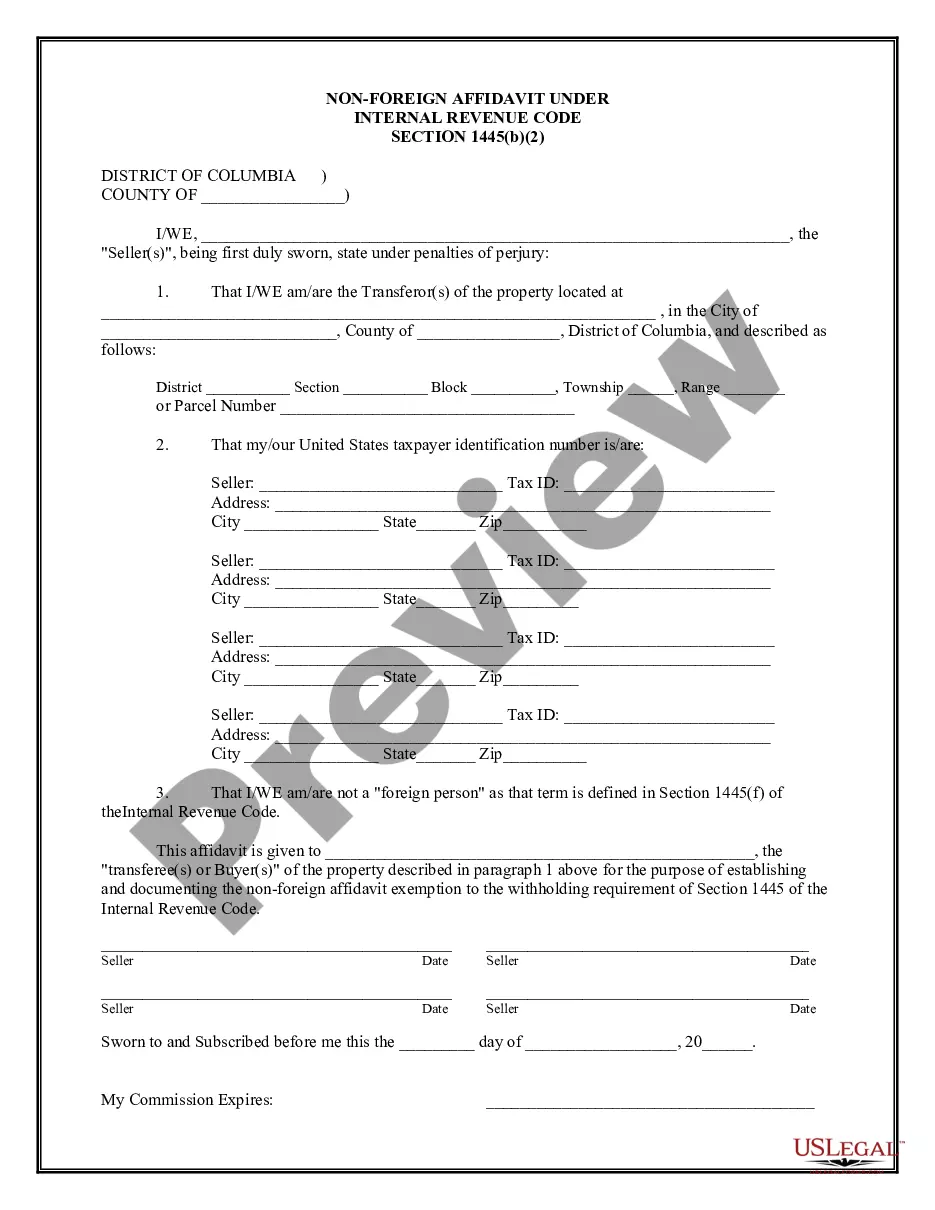

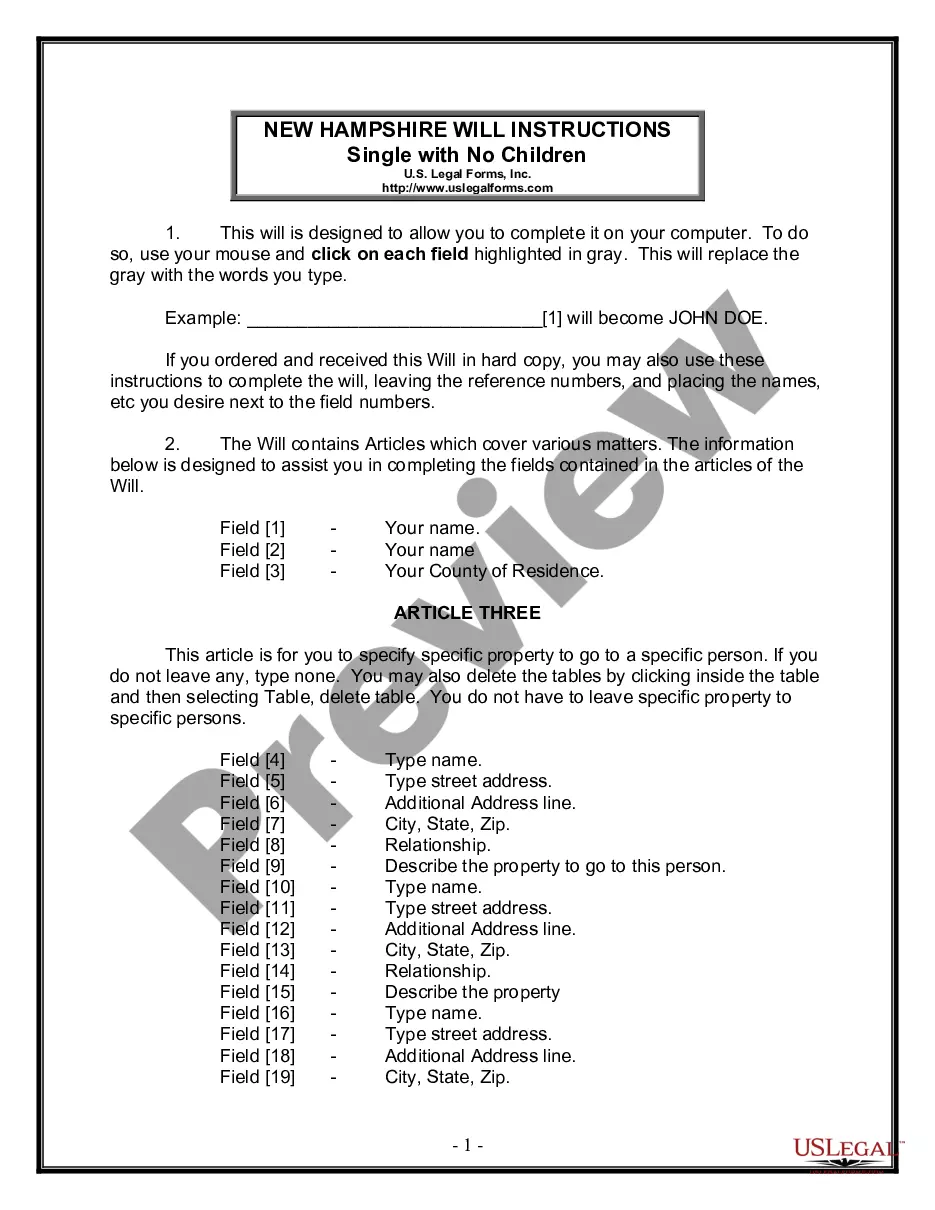

- Initial, be sure you have chosen the proper form for your personal metropolis/area. You can examine the form while using Preview option and study the form explanation to make certain it will be the right one for you.

- In the event the form fails to meet your preferences, utilize the Seach discipline to find the appropriate form.

- When you are certain that the form is proper, click the Buy now option to obtain the form.

- Choose the rates program you desire and type in the necessary details. Create your profile and pay for your order making use of your PayPal profile or Visa or Mastercard.

- Select the data file format and down load the authorized papers template to your device.

- Total, revise and print out and signal the received Georgia Shoring Services Contract - Self-Employed.

US Legal Forms is the biggest catalogue of authorized varieties for which you can see different papers templates. Utilize the company to down load professionally-produced paperwork that comply with express specifications.

Form popularity

FAQ

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

Before you hire an independent contractor, you need to have three important documents: A W-9 form with the person's contact information and taxpayer ID number, A resume to verify the person's qualifications, and. A written contract showing the details of the agreement between you and the independent contractor.

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

1099 Worker Defined A 1099 worker is one that is not considered an employee. Rather, this type of worker is usually referred to as a freelancer, independent contractor or other self-employed worker that completes particular jobs or assignments. Since they're not deemed employees, you don't pay them wages or a salary.

An independent contractor agreement is a contract between a freelancer and a company or client outlining the specifics of their work together. This legal contract usually includes information regarding the scope of the work, payment, and deadlines.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.