Georgia Specialty Services Contact - Self-Employed

Description

How to fill out Georgia Specialty Services Contact - Self-Employed?

US Legal Forms - among the largest libraries of lawful varieties in America - provides a variety of lawful document templates it is possible to obtain or produce. Making use of the website, you may get 1000s of varieties for business and individual purposes, sorted by groups, says, or keywords.You can get the most recent versions of varieties much like the Georgia Specialty Services Contact - Self-Employed in seconds.

If you already have a membership, log in and obtain Georgia Specialty Services Contact - Self-Employed through the US Legal Forms library. The Acquire option can look on every develop you see. You get access to all previously saved varieties from the My Forms tab of your respective accounts.

If you wish to use US Legal Forms initially, listed here are basic guidelines to help you began:

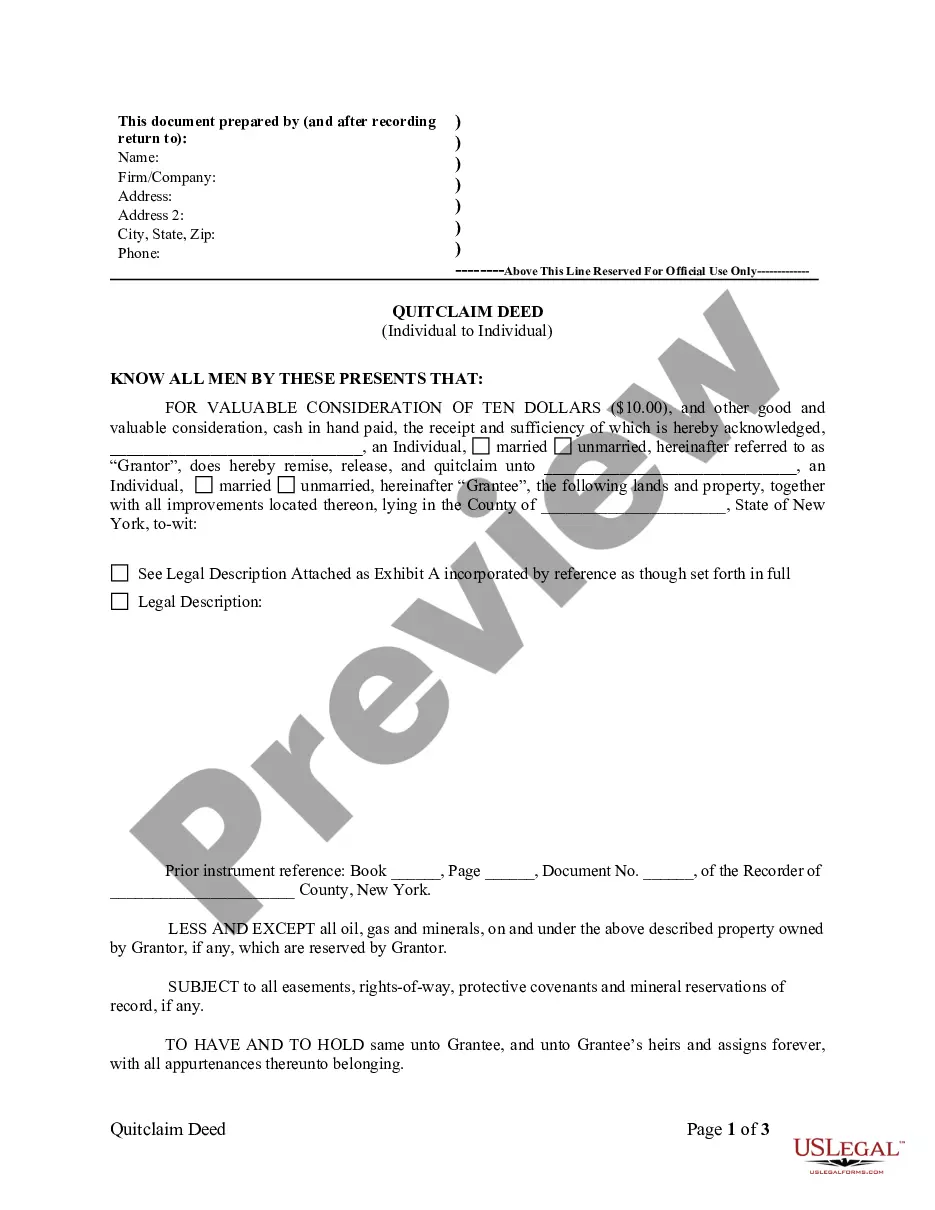

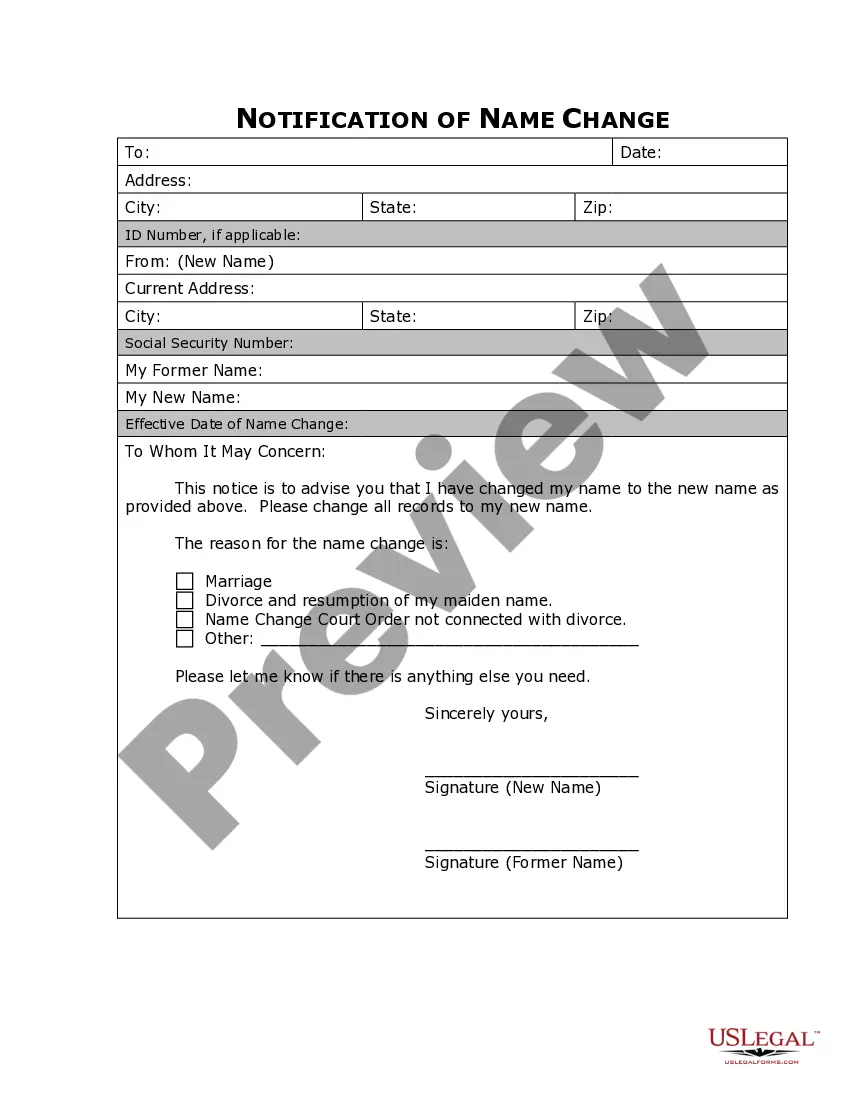

- Ensure you have chosen the right develop for your personal city/area. Click on the Review option to examine the form`s information. Look at the develop description to ensure that you have selected the appropriate develop.

- When the develop doesn`t satisfy your needs, utilize the Look for area at the top of the monitor to discover the one that does.

- In case you are happy with the shape, verify your choice by simply clicking the Purchase now option. Then, choose the prices prepare you favor and offer your accreditations to sign up to have an accounts.

- Method the financial transaction. Make use of credit card or PayPal accounts to accomplish the financial transaction.

- Select the formatting and obtain the shape on your own device.

- Make alterations. Fill out, change and produce and sign the saved Georgia Specialty Services Contact - Self-Employed.

Each and every format you added to your money does not have an expiry time and is also yours eternally. So, in order to obtain or produce one more copy, just check out the My Forms section and click on on the develop you will need.

Gain access to the Georgia Specialty Services Contact - Self-Employed with US Legal Forms, by far the most considerable library of lawful document templates. Use 1000s of skilled and condition-particular templates that meet your small business or individual requirements and needs.

Form popularity

FAQ

Some ways to prove self-employment income include:Annual Tax Return. This is the most credible and straightforward way to demonstrate your income over the last year since it's an official legal document recognized by the IRS.1099 Forms.Bank Statements.Profit/Loss Statements.Self-Employed Pay Stubs.

Call the state helpline at 855-436-7365. Call your local DOL Career Center - click here for a list of locations.

If your payment shows as "pending," this means we are still processing it, and there is nothing more you need to do. If you received a confirmation number, rest assured your claim is in process, and you will receive the full amount to which you are entitled.

Acceptable documents can include paycheck stubs, state or federal employer identification numbers, business licenses, tax documents, business receipts or a signed affidavit. This documentation must be provided within 90 days of the initial application or when requested by ODJFS, whichever is later.

PUA benefits were available if you did not qualify for regular unemployment benefits and were out of business or had significantly reduced your services as a direct result of the pandemic. The following were eligible for PUA: Business owners. Self-employed workers.

Normally, it takes about 2 to 3 weeks to receive your unemployment benefits, but it may take much longer depending on the state where you work and the circumstances surrounding your claim for benefits.

The most common proof of employment is an employment verification letter from an employer that includes the employee's dates of employment, job title, and salary. It's also often called a "letter of employment," a "job verification letter," or a "proof of employment letter."

If you applied for PUA in 2020 and are still collecting in 2021, you just need a single document that shows you were working at some point between January 2019 and your application for PUA. It could be pay stubs, tax documents, contracts, business licenses, letters, etc.

Acceptable 2019 or 2020 income documents, depending on the year you filed your claim, may include one or more of the following:Federal tax return (IRS Form 1040, Schedule C or F).State tax return (CA Form 540).W-2.Paycheck stubs.Payroll history.Bank receipts.Business records.Contracts.More items...?

Retroactive claims can be filed by calling 877-600-2722 or by completing a Weekly Claim form for each week.