Georgia Self-Employed Independent Contractor Construction Worker Contract

Description

How to fill out Georgia Self-Employed Independent Contractor Construction Worker Contract?

You can spend hours on-line searching for the legitimate file web template which fits the state and federal specifications you need. US Legal Forms offers thousands of legitimate kinds which are evaluated by experts. You can easily down load or print out the Georgia Self-Employed Independent Contractor Construction Worker Contract from my services.

If you already have a US Legal Forms account, it is possible to log in and click on the Obtain button. Following that, it is possible to total, edit, print out, or signal the Georgia Self-Employed Independent Contractor Construction Worker Contract. Each legitimate file web template you get is your own property permanently. To obtain an additional version for any acquired develop, visit the My Forms tab and click on the related button.

If you use the US Legal Forms web site the very first time, adhere to the straightforward guidelines below:

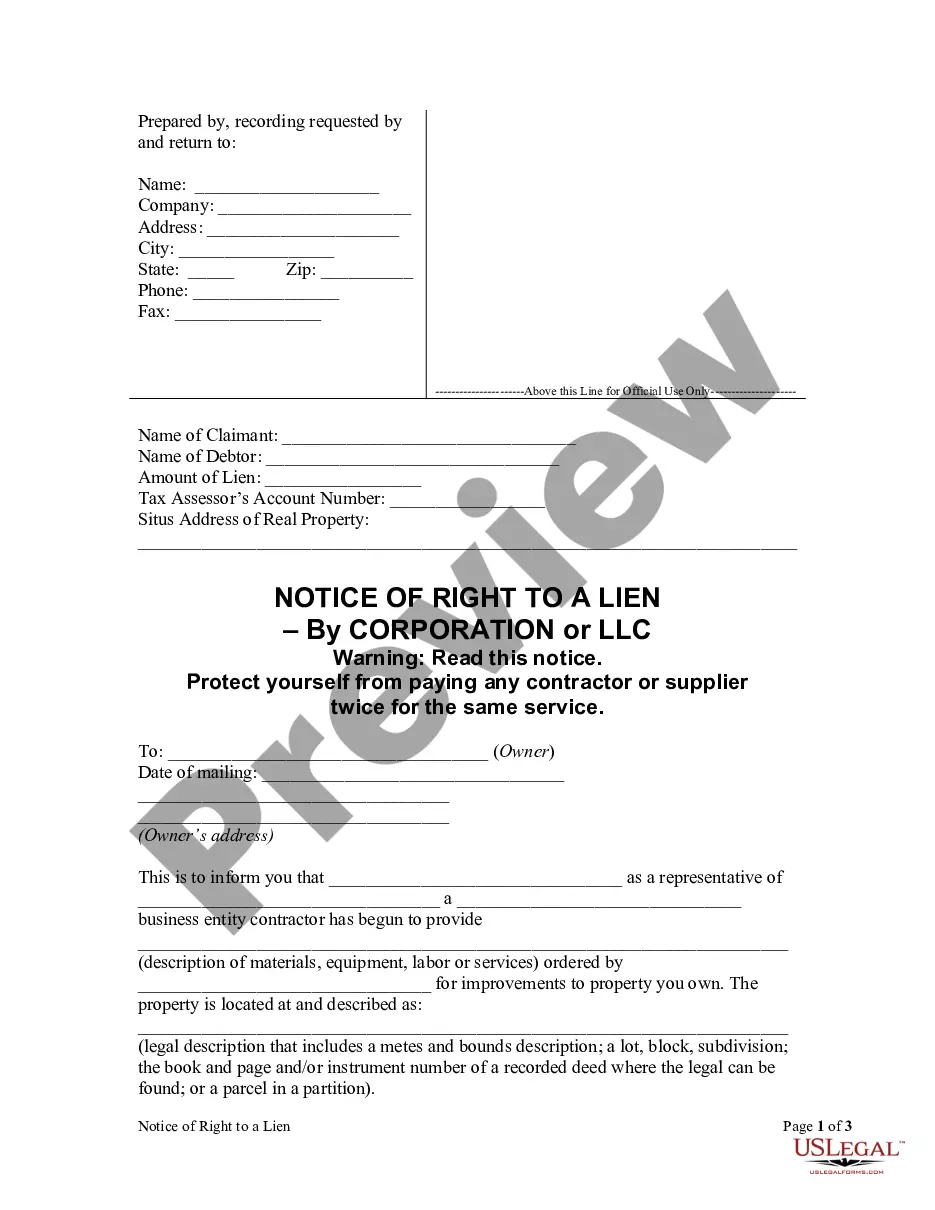

- Initially, make sure that you have selected the proper file web template for the state/city of your liking. Read the develop explanation to ensure you have picked out the proper develop. If accessible, utilize the Review button to search with the file web template too.

- If you want to get an additional edition of the develop, utilize the Search field to discover the web template that fits your needs and specifications.

- When you have discovered the web template you want, just click Get now to proceed.

- Pick the prices prepare you want, type your qualifications, and sign up for a free account on US Legal Forms.

- Comprehensive the financial transaction. You can utilize your Visa or Mastercard or PayPal account to fund the legitimate develop.

- Pick the format of the file and down load it to your device.

- Make modifications to your file if possible. You can total, edit and signal and print out Georgia Self-Employed Independent Contractor Construction Worker Contract.

Obtain and print out thousands of file templates making use of the US Legal Forms Internet site, that offers the greatest variety of legitimate kinds. Use skilled and status-particular templates to handle your small business or person requires.

Form popularity

FAQ

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

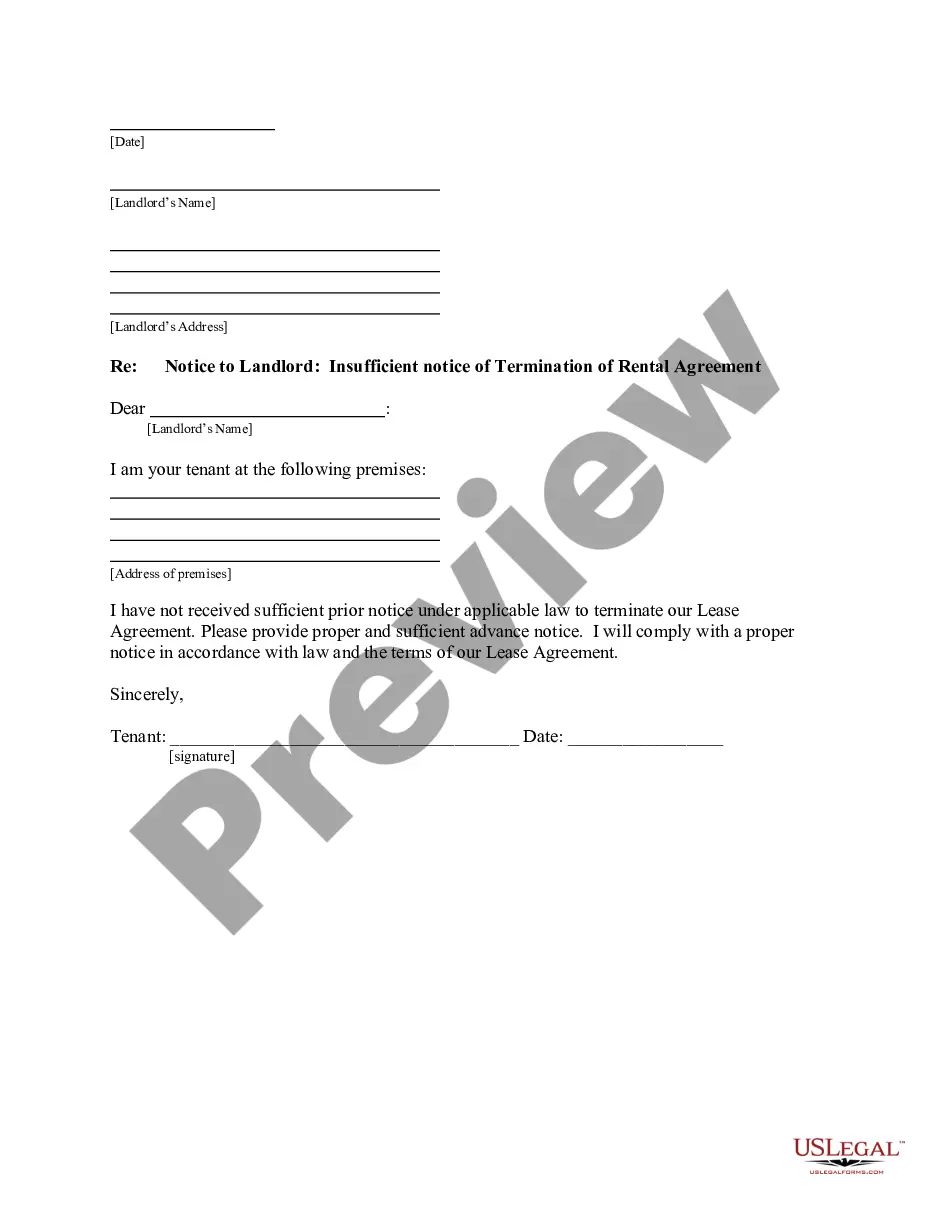

The law does not require you to complete a contract with your self-employed or freelance workers - a verbal contract can exist even when there is nothing in writing.

What should be included in a Contractor Agreement?Statement of Relationship.Project Description.Payment and Billing Terms.Responsibilities of Each Party.Project Timeline and Deadlines.Termination Conditions.Nondisclosure Terms, and Confidentiality and Non-Compete Clauses.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

An independent contractor agreement is a contract between a freelancer and a company or client outlining the specifics of their work together. This legal contract usually includes information regarding the scope of the work, payment, and deadlines.

An attorney or accountant who has his or her own office, advertises in the yellow pages of the phone book under Attorneys or Accountants, bills clients by the hour, is engaged by the job or paid an annual retainer, and can hire a substitute to do the work is an example of an independent contractor.

For most types of projects you hire an independent contractor (IC) to do, the law does not require you to put anything in writing. You can meet with the IC, agree on the terms of your arrangement, and have an oral contract or agreement that is legally binding. Just because you can doesn't mean you should, however.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

What Should Be in a Construction Contract?Identifying/Contact Information.Title and Description of the Project.Projected Timeline and Completion Date.Cost Estimate and Payment Schedule.Stop-Work Clause and Stop-Payment Clause.Act of God Clause.Change Order Agreement.Warranty.More items...