Georgia Runner Agreement — Self-Employed Independent Contractor is a legally binding contract that outlines the terms and conditions between a runner and a client in the state of Georgia. This agreement is specifically designed for individuals who provide delivery, errand, or courier services as independent contractors. Key Components: 1. Parties: The agreement identifies the runner (contractor) and the client (hiring party). 2. Services: It clearly defines the type of services the runner will provide, such as delivery, courier, or errand services. 3. Independent Contractor Status: This section establishes the runner's status as an independent contractor, not an employee, emphasizing that the runner is solely responsible for taxes, insurance, and other legal obligations. 4. Payment: The agreement details the payment structure, including the runner's compensation, payment methods, and any additional expenses that may be reimbursed. 5. Term and Termination: It specifies the start and end date of the agreement, along with provisions for termination or renewal. 6. Confidentiality: If necessary, the agreement may include a confidentiality clause to protect sensitive information that may be shared between the parties during the engagement. 7. Indemnification: This section outlines the responsibilities and liabilities of each party, ensuring that both parties indemnify and hold harmless each other in case of a claim or dispute arising during the contract. 8. Governing Law: It establishes that the agreement will be governed by and interpreted in accordance with the laws of the state of Georgia. Different types of Georgia Runner Agreement — Self-Employed Independent Contractor: 1. Delivery Runner Agreement: This agreement specifically focuses on runners who provide delivery services, whether it is food, packages, or documents. 2. Courier Runner Agreement: Designed for individuals who offer courier services, transporting critical items from one location to another within the state of Georgia. 3. Errand Runner Agreement: This specific agreement caters to runners who specialize in running personal or business errands for clients, such as grocery shopping, purchasing supplies, or conducting various tasks. In conclusion, the Georgia Runner Agreement — Self-Employed Independent Contractor is a comprehensive contract that ensures a clear understanding between the runner and the client, outlining the services provided, payment terms, and other crucial aspects necessary for a successful and legally compliant professional engagement in Georgia.

Georgia Runner Agreement - Self-Employed Independent Contractor

Description

How to fill out Georgia Runner Agreement - Self-Employed Independent Contractor?

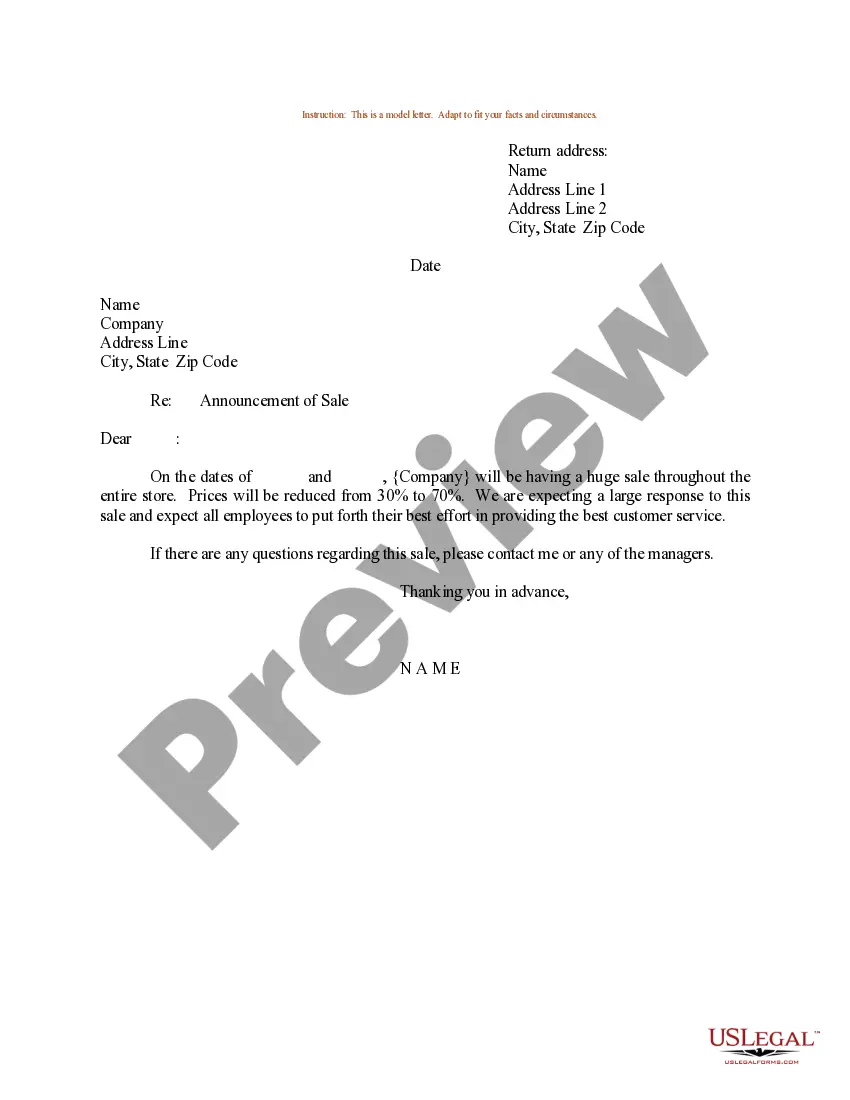

If you wish to total, acquire, or printing lawful file templates, use US Legal Forms, the most important collection of lawful forms, that can be found on the Internet. Use the site`s simple and easy convenient look for to get the paperwork you require. Various templates for company and individual reasons are sorted by groups and states, or key phrases. Use US Legal Forms to get the Georgia Runner Agreement - Self-Employed Independent Contractor in just a few mouse clicks.

In case you are currently a US Legal Forms client, log in for your bank account and click on the Download option to get the Georgia Runner Agreement - Self-Employed Independent Contractor. You may also accessibility forms you in the past delivered electronically from the My Forms tab of the bank account.

If you use US Legal Forms the very first time, refer to the instructions listed below:

- Step 1. Be sure you have selected the shape for the right town/nation.

- Step 2. Use the Preview solution to check out the form`s content. Do not overlook to read the description.

- Step 3. In case you are unsatisfied with the type, utilize the Research area at the top of the display to find other models of your lawful type web template.

- Step 4. Once you have found the shape you require, click on the Purchase now option. Choose the rates plan you like and add your accreditations to sign up to have an bank account.

- Step 5. Procedure the deal. You can use your bank card or PayPal bank account to finish the deal.

- Step 6. Choose the file format of your lawful type and acquire it on the product.

- Step 7. Complete, revise and printing or signal the Georgia Runner Agreement - Self-Employed Independent Contractor.

Each lawful file web template you purchase is the one you have eternally. You possess acces to each type you delivered electronically with your acccount. Select the My Forms section and choose a type to printing or acquire once again.

Remain competitive and acquire, and printing the Georgia Runner Agreement - Self-Employed Independent Contractor with US Legal Forms. There are thousands of professional and status-distinct forms you can use for your company or individual needs.

Form popularity

FAQ

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees. In contrast, actual company employees are considered W-2 employees.

The general rule is that you will be: An employee if you work for someone and do not have the risks of running a business. Self-employed if you have a trade, profession or vocation, are in business on your own account and are responsible for the success or failure of that business.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Independent contractors report their income on Schedule C (Form 1040), Profit or Loss from Business (Sole Proprietorship). Also file Schedule SE (Form 1040), Self-Employment Tax if net earnings from self-employment are $400 or more.

How do I create an Independent Contractor Agreement?State the location.Describe the type of service required.Provide the contractor's and client's details.Outline compensation details.State the agreement's terms.Include any additional clauses.State the signing details.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

The three types of self-employed individuals include:Independent contractors. Independent contractors are individuals hired to perform specific jobs for clients, meaning that they are only paid for their jobs.Sole proprietors.Partnerships.

Remember that an independent contractor is considered to be self-employed, so in effect, you are running your own one-person business. Any income that you earn as an independent contractor must be reported on Schedule C. You'll then pay income taxes on the total profit.