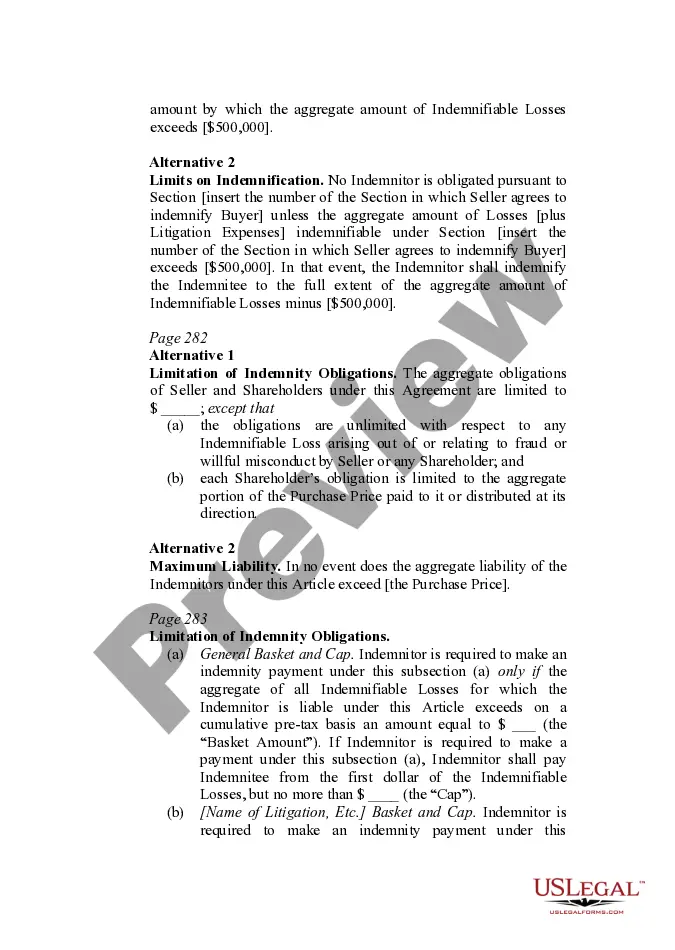

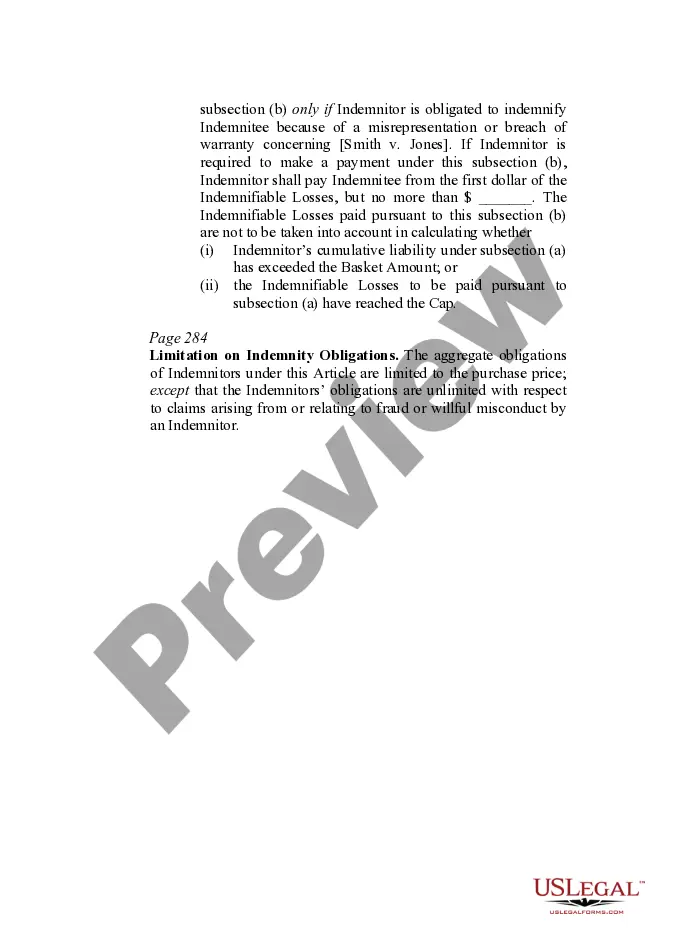

This form provides boilerplate contract clauses that restrict or limit the dollar exposure of any indemnity under the contract agreement. Several different language options are included to suit individual needs and circumstances.

Georgia Indemnity Provisions — Dollar Exposure of the Indemnity regarding Baskets, Caps, and Ceilings refer to specific clauses in indemnity agreements used in legal contracts and transactions in the state of Georgia. These provisions establish the financial limits and thresholds applicable to the indemnity obligations, defining the extent of potential monetary liability for each party involved. 1. Basket Provisions: Basket provisions are commonly included in indemnity agreements to establish a certain threshold or minimum amount that must be reached before indemnity obligations are triggered. By setting a basket amount, the indemnity is not obligated to indemnify the indemnity for losses or damages that fall below this threshold. This provision aims to protect the indemnity from claims of minimal value or insignificant damages. 2. Cap Provisions: Cap provisions put a limit on the maximum amount of financial responsibility that the indemnity has to bear in case of a breach or loss. The cap defines the upper limit beyond which the indemnity's liability ceases or is capped. Once the losses or damages incurred by the indemnity surpass the predetermined cap amount, the indemnity is not obligated to cover the excess amount. 3. Ceiling Provisions: Ceiling provisions, similar to caps, determine the maximum liability of the indemnity. However, with ceiling provisions, the indemnity's total liability is restricted to a certain percentage or proportion of the transaction or contract's total value. For instance, the indemnity's liability may be capped at 10% of the contract value, regardless of the actual incurred losses. These different types of Georgia Indemnity Provisions — Dollar Exposure of the Indemnity regarding Baskets, Caps, and Ceilings are designed to allocate risk and define the financial boundaries for indemnification. They safeguard the indemnity from excessive financial exposure in potential breach or loss situations while ensuring the indemnity receives adequate protection. In summary, these provisions play a vital role in determining the extent of indemnity and the financial implications involved in Georgia indemnity agreements. Basket provisions establish minimum thresholds, cap provisions limit the maximum liability, and ceiling provisions restrict liability based on a percentage of the total contract value. By utilizing these provisions effectively, parties in Georgia can clarify their indemnification obligations and protect themselves against unnecessary financial risks.