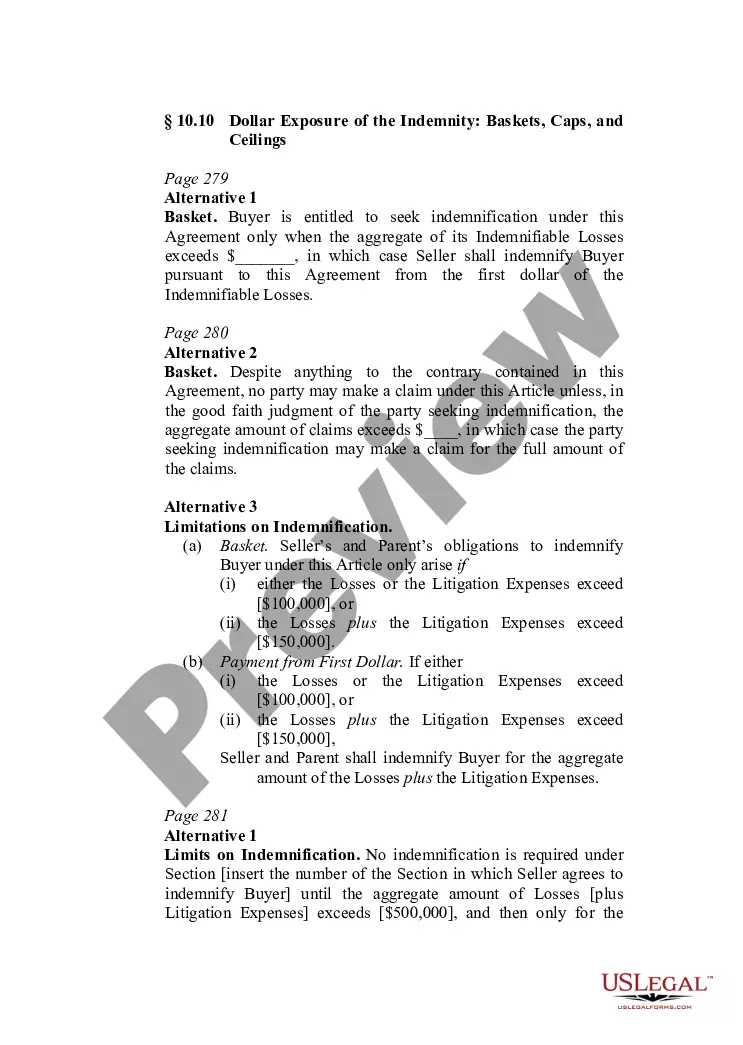

This form provides boilerplate contract clauses that restrict or limit the dollar exposure of any indemnity under the contract agreement with regards to taxes or insurance considerations.

Georgia Indemnity Provisions - Dollar Exposure of the Indemnity regarding Tax and Insurance Considerations

Description

How to fill out Indemnity Provisions - Dollar Exposure Of The Indemnity Regarding Tax And Insurance Considerations?

You can spend hrs on-line searching for the lawful record format which fits the federal and state specifications you need. US Legal Forms supplies thousands of lawful varieties that happen to be evaluated by professionals. It is possible to down load or print out the Georgia Indemnity Provisions - Dollar Exposure of the Indemnity regarding Tax and Insurance Considerations from my service.

If you already possess a US Legal Forms accounts, you are able to log in and click the Obtain button. Next, you are able to total, edit, print out, or indicator the Georgia Indemnity Provisions - Dollar Exposure of the Indemnity regarding Tax and Insurance Considerations. Each and every lawful record format you get is yours forever. To acquire one more duplicate of the obtained form, proceed to the My Forms tab and click the related button.

Should you use the US Legal Forms web site the very first time, stick to the straightforward directions beneath:

- First, make sure that you have chosen the right record format for your area/city of your liking. See the form information to ensure you have picked out the right form. If accessible, take advantage of the Preview button to check from the record format too.

- In order to locate one more variation of the form, take advantage of the Research industry to obtain the format that meets your requirements and specifications.

- Upon having discovered the format you would like, click Get now to continue.

- Find the pricing strategy you would like, type in your credentials, and register for your account on US Legal Forms.

- Complete the deal. You may use your charge card or PayPal accounts to pay for the lawful form.

- Find the file format of the record and down load it to your gadget.

- Make adjustments to your record if required. You can total, edit and indicator and print out Georgia Indemnity Provisions - Dollar Exposure of the Indemnity regarding Tax and Insurance Considerations.

Obtain and print out thousands of record templates utilizing the US Legal Forms site, that provides the largest selection of lawful varieties. Use skilled and express-certain templates to deal with your company or individual needs.

Form popularity

FAQ

Hear this out loud PauseQ: What is a bank letter of indemnity? A: A bank letter of indemnity is a legal document that protects banks from financial losses that may occur when they release goods or documents to a customer without receiving the necessary collateral or original documents. Q: When is a bank letter of indemnity required?

Example 1: A service provider asking their customer to indemnify them to protect against misuse of their work product. Example 2: A rental car company, as the rightful owner of the car, having their customer indemnify them from any damage caused by the customer during the course of the retnal.

How to Write an Indemnity Agreement Consider the Indemnity Laws in Your Area. ... Draft the Indemnification Clause. ... Outline the Indemnification Period and Scope of Coverage. ... State the Indemnification Exceptions. ... Specify How the Indemnitee Notifies the Indemnitor About Claims. ... Write the Settlement and Consent Clause.

Hear this out loud PauseAbove £100,000 value the cost is likely to be between 1% and 1.5% of the value. In high value cases and for corporate or overseas shareholders the rate may well be higher. Why does a counter-signature cost so much? The indemnity is an onerous document.

An indemnification clause should clearly define the following elements: who are the indemnifying party and the indemnified party, what are the covered claims or losses, what are the obligations and duties of each party, and what are the exclusions or limitations of the indemnity.

Hear this out loud PauseIn a business transaction, a letter of indemnity (LOI) is a contractual document guaranteeing that specific provisions will be met between two parties in the event of a mishap leading to financial loss or damage to goods. An LOI is drafted by third-party institutions such as banks or insurance companies.

How to Write an Indemnity Agreement Consider the Indemnity Laws in Your Area. ... Draft the Indemnification Clause. ... Outline the Indemnification Period and Scope of Coverage. ... State the Indemnification Exceptions. ... Specify How the Indemnitee Notifies the Indemnitor About Claims. ... Write the Settlement and Consent Clause.

Letters of indemnity should include the names and addresses of both parties involved, plus the name and affiliation of the third party. Detailed descriptions of the items and intentions are also required, as are the signatures of the parties and the date of the contract's execution.