Georgia Partial Release of Mortgage / Deed of Trust on A Mineral / Royalty Interest Sold by Grantor

Description

How to fill out Partial Release Of Mortgage / Deed Of Trust On A Mineral / Royalty Interest Sold By Grantor?

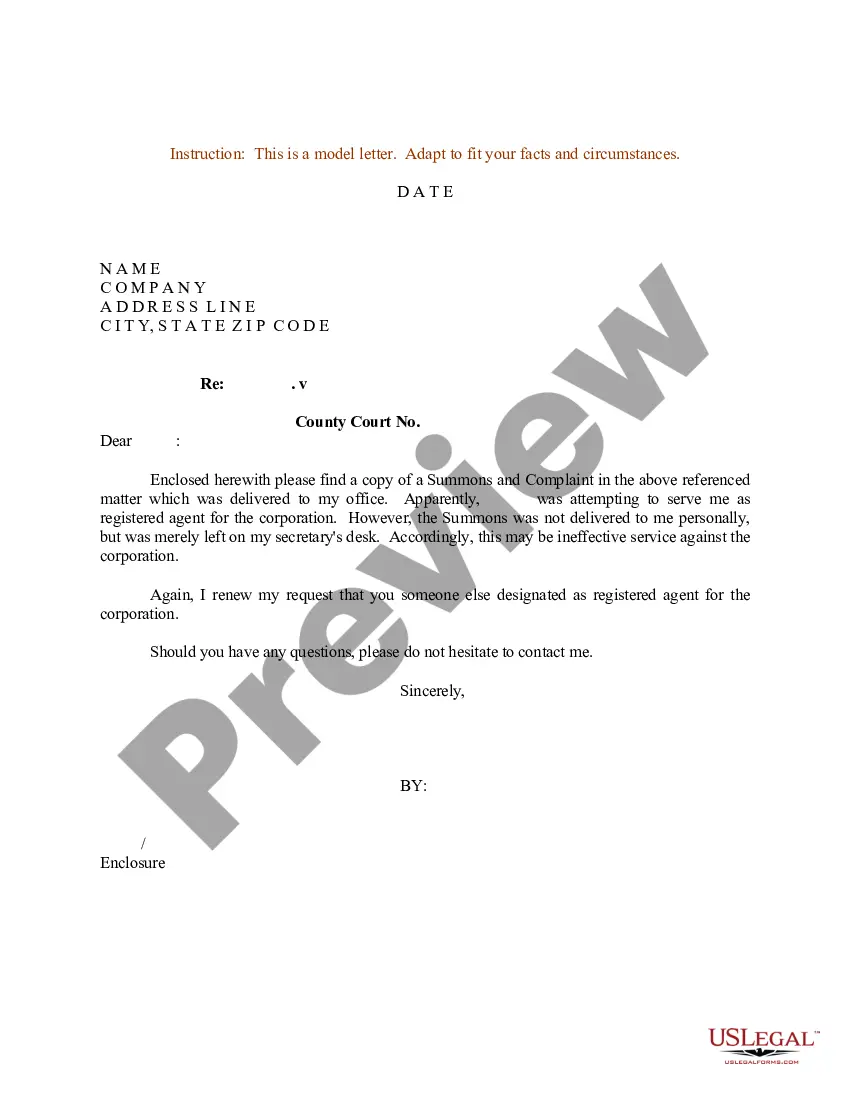

Choosing the right legal papers web template might be a have difficulties. Of course, there are a variety of templates available on the Internet, but how do you get the legal develop you require? Use the US Legal Forms site. The assistance delivers a huge number of templates, including the Georgia Partial Release of Mortgage / Deed of Trust on A Mineral / Royalty Interest Sold by Grantor, which you can use for enterprise and personal demands. Each of the forms are examined by pros and fulfill state and federal needs.

In case you are presently registered, log in for your profile and then click the Down load key to obtain the Georgia Partial Release of Mortgage / Deed of Trust on A Mineral / Royalty Interest Sold by Grantor. Use your profile to search from the legal forms you have bought earlier. Go to the My Forms tab of your own profile and obtain another backup in the papers you require.

In case you are a new end user of US Legal Forms, listed here are straightforward instructions for you to stick to:

- Very first, ensure you have chosen the appropriate develop for your metropolis/region. You may examine the form using the Preview key and read the form description to make certain it is the best for you.

- In case the develop will not fulfill your needs, take advantage of the Seach discipline to get the proper develop.

- When you are sure that the form is proper, go through the Buy now key to obtain the develop.

- Pick the rates plan you want and enter the necessary info. Design your profile and purchase your order making use of your PayPal profile or charge card.

- Opt for the document file format and obtain the legal papers web template for your device.

- Complete, change and print out and indicator the obtained Georgia Partial Release of Mortgage / Deed of Trust on A Mineral / Royalty Interest Sold by Grantor.

US Legal Forms is the most significant local library of legal forms where you will find various papers templates. Use the company to obtain appropriately-manufactured files that stick to state needs.

Form popularity

FAQ

Mortgages are used, but they are rare. A security deed (deed to secure debt) is the customary security instrument in Georgia. Georgia does not use a Deed of Trust. Two witnesses are required to witness the signature of the grantor for a security deed to be recorded. Georgia Real Estate Practices - Virtual Underwriter virtualunderwriter.com ? real-estate-practices virtualunderwriter.com ? real-estate-practices

Both Deeds of Trust and Mortgages are used. A trustee can be: A licensed Arkansas Attorney. A Bank or S & L authorized to do business in Arkansas. Arkansas Real Estate Practices - Virtual Underwriter virtualunderwriter.com ? real-estate-practices virtualunderwriter.com ? real-estate-practices

Georgia is a redeemable deed state, which means that they sell you the deed, but the property owner is given a year to redeem it. If the property owner redeems, then you get all of your money back plus 20%.

Deeds of trust are the most common instrument used in the financing of real estate purchases in Alaska, Arizona, California, Colorado, the District of Columbia, Idaho, Maryland, Mississippi, Missouri, Montana, Nebraska, Nevada, North Carolina, Oregon, Tennessee, Texas, Utah, Virginia, Washington, and West Virginia, ...

A mortgage involves two parties, while a deed of trust has three, and. mortgages are usually foreclosed judicially, while deeds of trust typically go through a nonjudicial foreclosure process (but not always).

In the State of Georgia, the instrument used to secure a debt on property is called a "Deed to Secure Debt" or "Security Deed." Under Georgia law, the lender is deeded the property, but in a lesser form of a deed that becomes activated if the borrower defaults in some way. Commonly Used Deeds and Mortgage Instruments Explained georgiatitle.com ? Georgia-Deeds-Mortgages georgiatitle.com ? Georgia-Deeds-Mortgages

In addition to the requirement that deeds be prepared in writing, the written deed in Georgia must contain the following elements and conventions: Grantor name The person with the legal capacity to contract and convey, usually the seller Could also be an executor, administrator, sheriff, or person giving a gift Grantee ...

If your circumstances change any you are no longer able to make your payments, your Trust Deed may fail and you will still be liable for your debts or even forced into bankruptcy. Advantages and Disadvantages of a Trust Deed - Wilmott Turner wilmottturner.com ? trust-deeds ? the-pros-and-co... wilmottturner.com ? trust-deeds ? the-pros-and-co...

In Alabama, Arizona, Arkansas, Illinois, Kentucky, Maryland, Michigan, Montana and South Dakota, the lender has the choice of either a mortgage or deed of trust. In any other state, you must have a mortgage. Deed of Trust vs. Mortgage: Key Differences - SmartAsset SmartAsset ? mortgage ? deed-of-trust-vs-... SmartAsset ? mortgage ? deed-of-trust-vs-...

Foreclosure process: Mortgages typically go through a judicial foreclosure process, through your county court system. Deeds of trust use a non-judicial foreclosure process. Length of time to foreclose: Mortgage foreclosures usually take significantly longer than non-judicial foreclosures with a deed of trust. Deed of Trust vs. Mortgage: What's the Difference? - Credible credible.com ? blog ? mortgages ? deed-of-t... credible.com ? blog ? mortgages ? deed-of-t...