Georgia Assignment of Overriding Royalty Interests of a Percentage of Assignor's Net Revenue Interest, After Deductions of Certain Costs - Effectively A Net Profits

Description

How to fill out Assignment Of Overriding Royalty Interests Of A Percentage Of Assignor's Net Revenue Interest, After Deductions Of Certain Costs - Effectively A Net Profits?

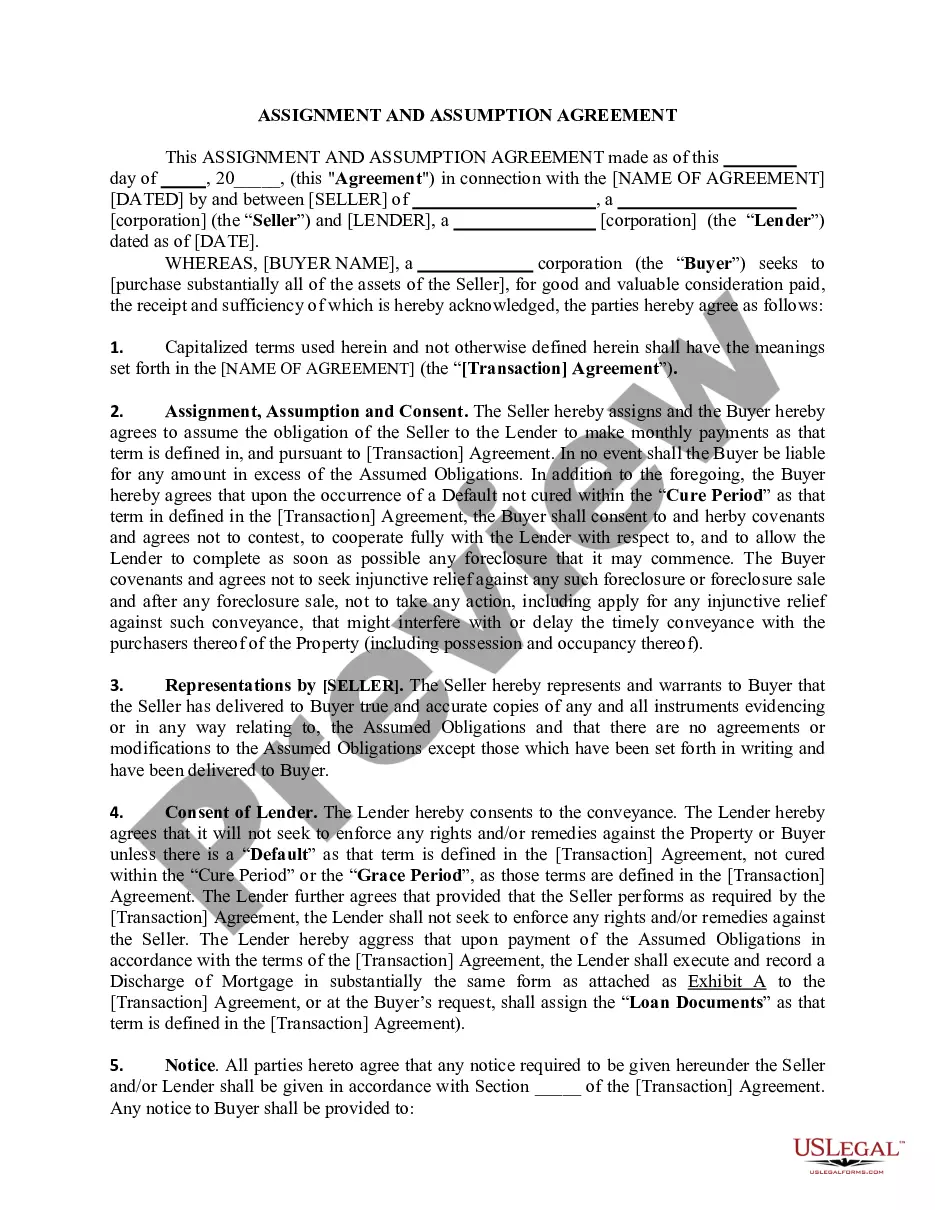

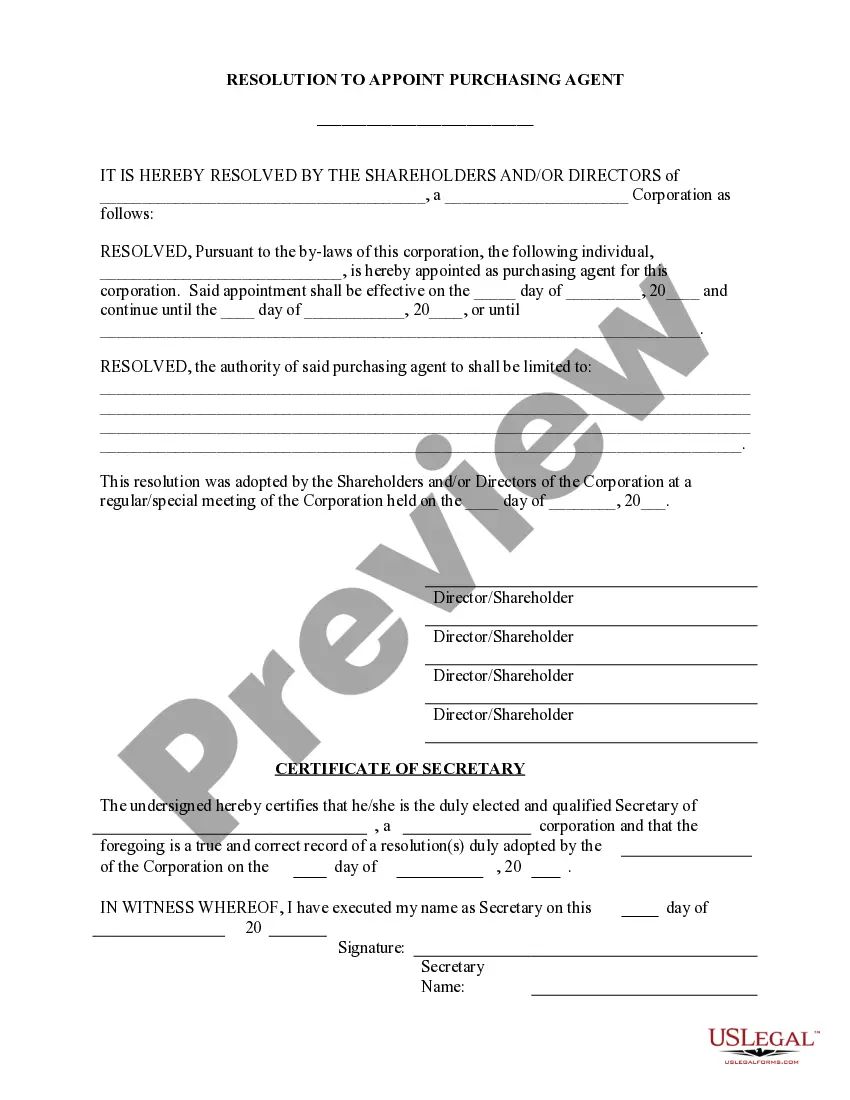

Are you in a placement where you will need documents for sometimes organization or individual reasons almost every day time? There are plenty of legitimate record layouts available on the net, but locating ones you can rely isn`t simple. US Legal Forms delivers 1000s of form layouts, just like the Georgia Assignment of Overriding Royalty Interests of a Percentage of Assignor's Net Revenue Interest, After Deductions of Certain Costs - Effectively A Net Profits, that are created to satisfy federal and state specifications.

If you are previously acquainted with US Legal Forms website and also have a free account, merely log in. Afterward, you can obtain the Georgia Assignment of Overriding Royalty Interests of a Percentage of Assignor's Net Revenue Interest, After Deductions of Certain Costs - Effectively A Net Profits design.

Unless you provide an bank account and wish to start using US Legal Forms, follow these steps:

- Obtain the form you want and ensure it is to the right town/area.

- Make use of the Review button to review the form.

- Read the description to actually have selected the right form.

- If the form isn`t what you`re seeking, take advantage of the Lookup area to discover the form that meets your requirements and specifications.

- Once you get the right form, simply click Acquire now.

- Select the pricing strategy you desire, submit the specified information and facts to produce your bank account, and pay money for an order making use of your PayPal or Visa or Mastercard.

- Choose a practical data file format and obtain your duplicate.

Discover each of the record layouts you may have bought in the My Forms food list. You can obtain a more duplicate of Georgia Assignment of Overriding Royalty Interests of a Percentage of Assignor's Net Revenue Interest, After Deductions of Certain Costs - Effectively A Net Profits whenever, if possible. Just click the necessary form to obtain or print the record design.

Use US Legal Forms, probably the most substantial selection of legitimate kinds, to conserve time and steer clear of blunders. The support delivers appropriately made legitimate record layouts that you can use for a range of reasons. Produce a free account on US Legal Forms and commence generating your daily life a little easier.

Form popularity

FAQ

An overriding royalty interest (ORRI) is similar to a royalty interest in that it is also a portion of the proceeds from the sale of production. However, it is not retained under the terms of the oil and gas lease. An ORRI is granted, assigned and created under the terms of a separate document.

To calculate the number of net royalty acres I'm selling, I use this formula: [acres in tract] X [% of minerals owned] X 8 X [royalty interest reserved in lease] X [fraction of royalty interest being sold]. 640 acres X 25% X 8 X 1/4 X 1/2 = 160 net royalty acres.

Overriding Royalty Interests To calculate the ORRI, multiply the gross production revenue by the ORRI interest percentage, and the figure gotten is what the ORRI owner is entitled to. How to Calculate Oil and Gas Royalty Payments? - Pheasant Energy pheasantenergy.com ? how-to-calculate-oil-... pheasantenergy.com ? how-to-calculate-oil-...

How to calculate the overriding royalty interest? ORRI = NRI * 5 percent. $750,000 * 0.005 = $3,750.

Overriding Royalty Interest: A given interest severed out of the record title interest or lessee's share of the oil, and not charged with any of the cost or expense of developing or operation. The interest provides no control over the operations of the lease, only revenue from lease production.

ORRIs are created out of the working interest in a property and do not affect mineral owners. An overriding royalty interest (ORRI) is often kept or assigned to a geologist, landman, brokerage, or any entity that was able to reserve an interest in the properties. Non-Participating Royalty Interest (NPRI) Endeavor Energy Resources, LP ? 2019/07 Endeavor Energy Resources, LP ? 2019/07 PDF

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12. Information and Procedures for Transferring Overriding Royalty ... blm.gov ? article ? Information-and-Procedu... blm.gov ? article ? Information-and-Procedu...