Georgia Dissolution of Unit

Description

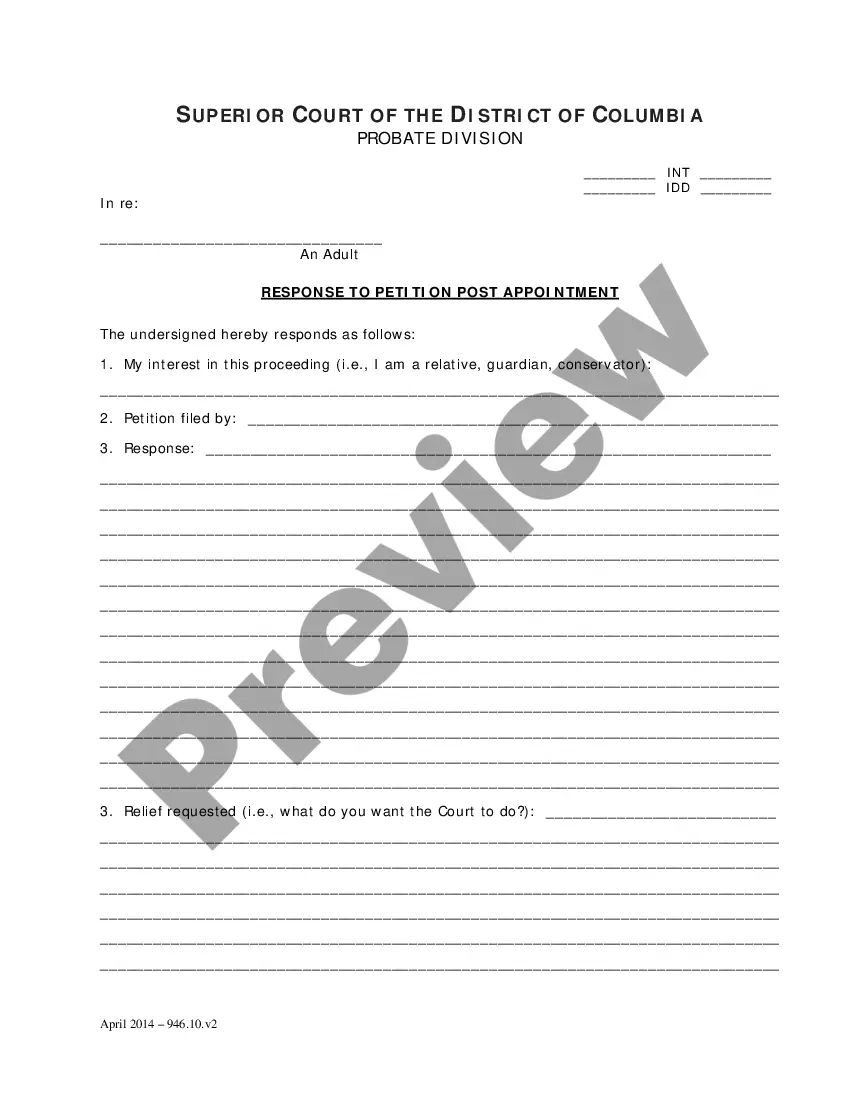

How to fill out Dissolution Of Unit?

US Legal Forms - one of several largest libraries of legitimate types in the United States - offers a variety of legitimate document web templates you are able to download or print out. Utilizing the website, you will get 1000s of types for company and person functions, categorized by classes, claims, or key phrases.You can get the most up-to-date variations of types such as the Georgia Dissolution of Unit within minutes.

If you already have a monthly subscription, log in and download Georgia Dissolution of Unit in the US Legal Forms library. The Down load switch will appear on every form you perspective. You gain access to all earlier delivered electronically types within the My Forms tab of your own bank account.

If you want to use US Legal Forms for the first time, here are simple directions to help you began:

- Be sure you have selected the best form to your town/area. Click on the Preview switch to review the form`s content. Read the form outline to actually have chosen the correct form.

- If the form does not fit your demands, make use of the Search discipline at the top of the display to find the one who does.

- In case you are content with the form, confirm your option by visiting the Acquire now switch. Then, select the pricing program you prefer and provide your qualifications to sign up for the bank account.

- Process the transaction. Utilize your bank card or PayPal bank account to finish the transaction.

- Choose the formatting and download the form on your own system.

- Make modifications. Fill up, revise and print out and indicator the delivered electronically Georgia Dissolution of Unit.

Each format you included in your account does not have an expiration particular date and it is your own property for a long time. So, if you wish to download or print out one more duplicate, just proceed to the My Forms segment and click in the form you require.

Obtain access to the Georgia Dissolution of Unit with US Legal Forms, probably the most substantial library of legitimate document web templates. Use 1000s of professional and state-particular web templates that satisfy your small business or person requires and demands.

Form popularity

FAQ

Your LLC's operating agreement may explain the grounds for and procedure for removing a member. The usual method of involuntary removal is a vote by the other members followed by some sort of buyout based on the share of LLC ownership the departing member has.

Judicial and Administrative Dissolution; Reservation of Name. On application by or for a member, the court may decree dissolution of a limited liability company whenever it is not reasonably practicable to carry on the business in conformity with the articles of organization or a written operating agreement.

A nonprofit corporation that has commenced activities may dissolve by filing a Notice of Intent to Dissolve pursuant to O.C.G.A. 14-3-1404 and Articles of Dissolution pursuant to O.C.G.A. 14-3-1409. Form CD 525 and CD 530 may be used for this purpose.

First, you need to be sure to include the legal name of your company. Second, your articles of dissolution should state the date when your company will be dissolved. Finally, there should be a statement that your corporation's board of directors or your LLC's members approved the dissolution.

To end a Georgia LLC, just file form CD-415, Certificate of Termination, with the Georgia Secretary of State, Corporations Division (SOS). The certificate of termination is available on the Georgia SOS website or your Northwest Registered Agent online account. You are not required to use SOS forms.

How to Dissolve an LLC in Georgia in 7 Steps Review Your LLC's Operating Agreement. ... Vote to Dissolve an LLC. ... File Articles of Dissolution. ... Notify Tax Agencies and Pay Remaining Taxes. ... Inform Creditors and Settle Existing Debt. ... Wind Up Other Business Affairs. ... Distribute Remaining Assets.

To cancel an entity's registration in Georgia, file an Application for Withdrawal of Certificate of Authority with the Georgia Secretary of State, Corporations Division (SOS). There is one form for all entities, so indicate which type of entity the application is for.

A corporation that has issued shares and commenced business may dissolve by filing a Notice of Intent to Dissolve pursuant to O.C.G.A. 14-2-1403 and Articles of Dissolution pursuant to O.C.G.A. 14-2-1408. Form CD 410 and CD 412 may be used for this purpose.