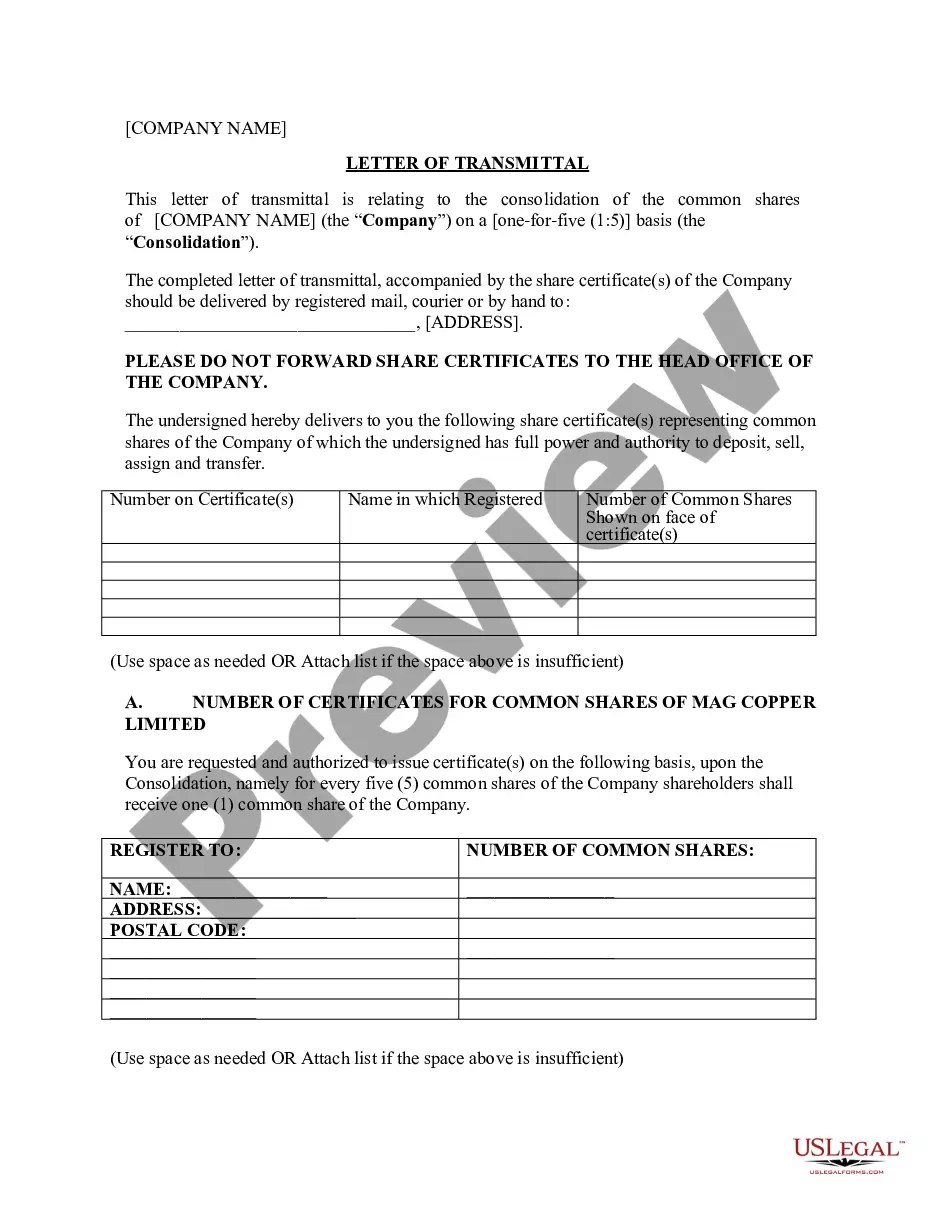

A Conversion of Reserved Overriding Royalty Interest to Working Interest form. The assignee shall be entitled to recover, out of the total proceeds derived from the sale of oil and gas produced from each well drilled and completed as a well capable of producing oil or gas in paying quantities on the Land, the total cost of drilling, completing, and equipping such well together with the cost of operating such well until the time of such recovery.

Georgia Conversion of Reserved Overriding Royalty Interest to Working Interest

Description

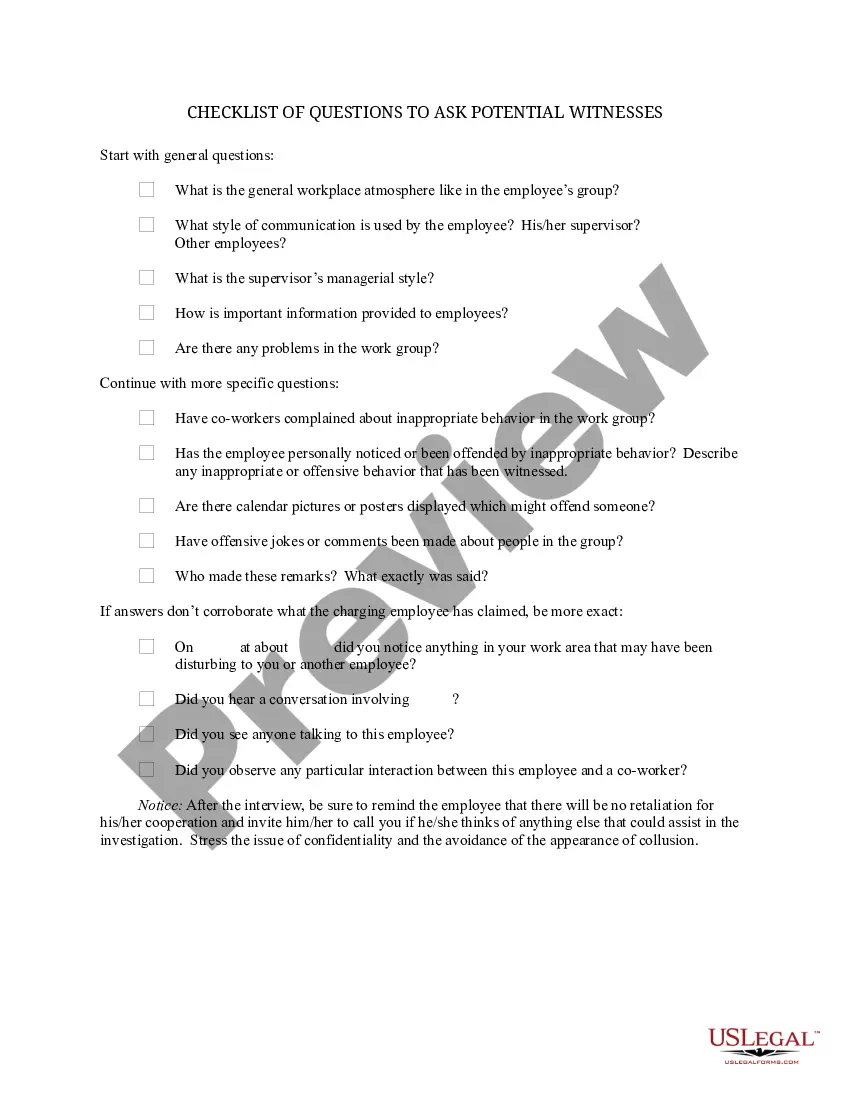

How to fill out Conversion Of Reserved Overriding Royalty Interest To Working Interest?

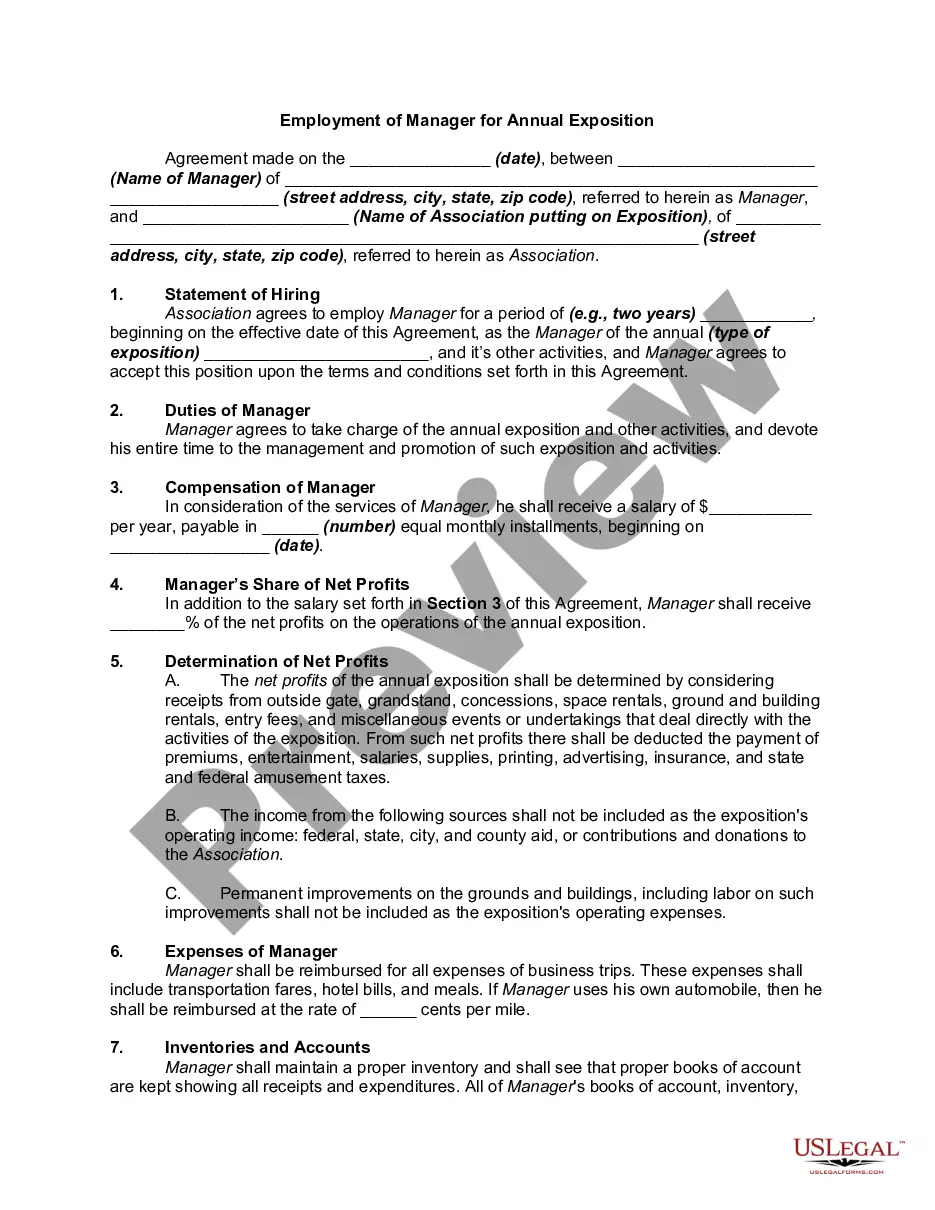

It is possible to commit time on-line attempting to find the legitimate file web template which fits the state and federal requirements you want. US Legal Forms gives a large number of legitimate varieties that are evaluated by specialists. You can easily acquire or printing the Georgia Conversion of Reserved Overriding Royalty Interest to Working Interest from the assistance.

If you have a US Legal Forms account, you may log in and then click the Download switch. Following that, you may complete, modify, printing, or signal the Georgia Conversion of Reserved Overriding Royalty Interest to Working Interest. Every legitimate file web template you buy is your own property forever. To have an additional version for any purchased develop, proceed to the My Forms tab and then click the related switch.

If you use the US Legal Forms site for the first time, stick to the basic guidelines under:

- Initially, make sure that you have chosen the correct file web template for your area/metropolis that you pick. Read the develop explanation to ensure you have picked out the correct develop. If readily available, utilize the Preview switch to look throughout the file web template at the same time.

- In order to locate an additional model of the develop, utilize the Look for area to obtain the web template that meets your requirements and requirements.

- Upon having located the web template you would like, click on Purchase now to continue.

- Find the rates program you would like, type in your references, and register for your account on US Legal Forms.

- Complete the deal. You should use your Visa or Mastercard or PayPal account to purchase the legitimate develop.

- Find the formatting of the file and acquire it to your system.

- Make modifications to your file if required. It is possible to complete, modify and signal and printing Georgia Conversion of Reserved Overriding Royalty Interest to Working Interest.

Download and printing a large number of file web templates using the US Legal Forms site, that provides the largest variety of legitimate varieties. Use expert and status-distinct web templates to take on your small business or person requires.

Form popularity

FAQ

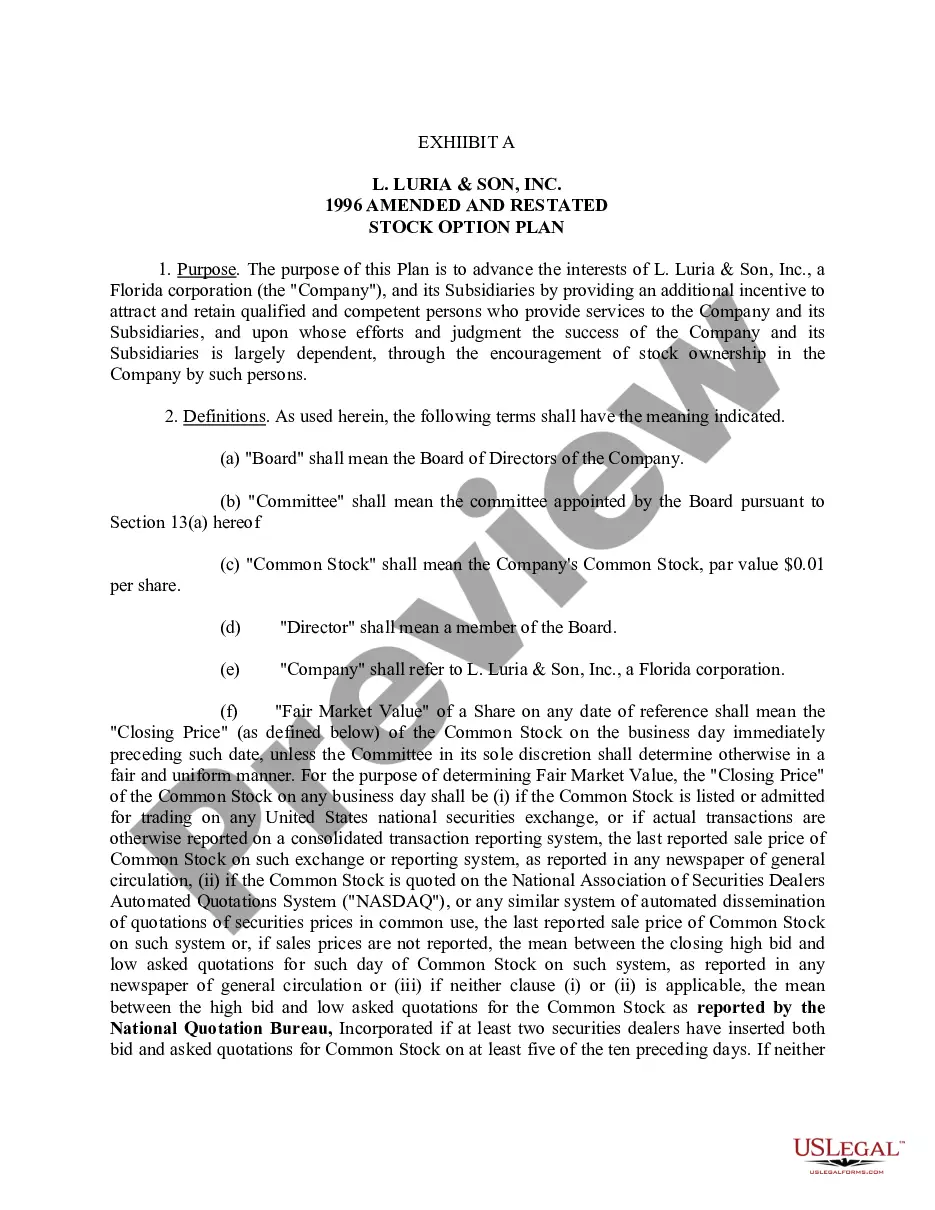

Overriding Royalty Interest (ORRI) ORRIs are created out of the working interest in a property and do not affect mineral owners. An overriding royalty interest (ORRI) is often kept or assigned to a geologist, landman, brokerage, or any entity that was able to reserve an interest in the properties.

Transfer by deed: You can sell your mineral rights to another person or company by deed. Transfer by will: You can specify who you want to inherit your mineral rights in your will. Transfer by lease: You can lease mineral rights to a third party through a lease agreement.

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

Overriding Royalty Interest Conveyance means an assignment, in form and substance acceptable to Lender, pursuant to which Borrower grants in favor of Lender an overriding royalty interest equal to six and one-fourth percent (6.25%) of Hydrocarbons produced, saved and sold or used off the premises of the relevant Lease, ...

What Determines the Value of an Overriding Royalty Interest? Mineral interest location. One in a shale basin with high production is worth more. Producing oil and gas wells. Wells currently producing are valued more. ... Production reserves and levels. ... Prices.

If there is more than one mineral owner, multiply the net revenue by the fractional interest of each owner to determine their respective royalty interest.

Several things determine what the ORRI value is, including: Mineral interest location. One in a shale basin with high production is worth more. Producing oil and gas wells. Wells currently producing are valued more. ... Production reserves and levels. ... Prices.