Georgia Exhibit Schedule of Oil and Gas Leases Form 2

Description

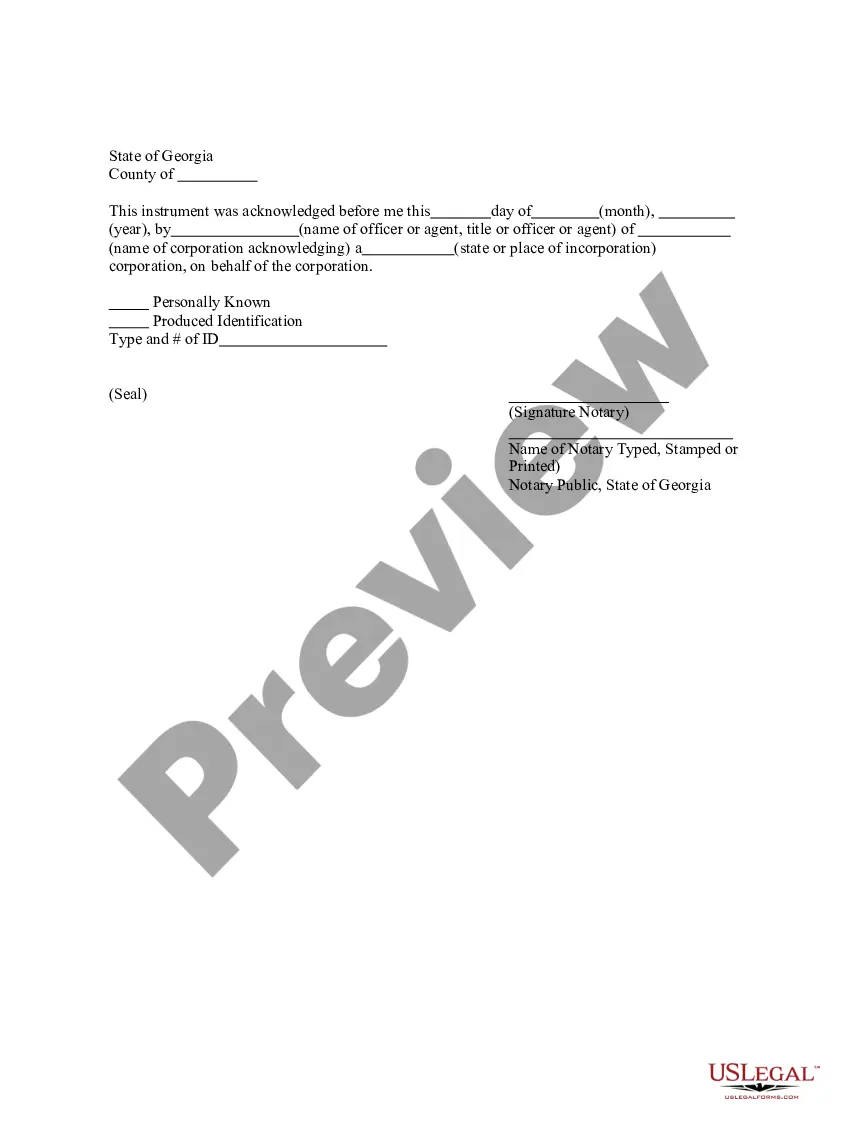

How to fill out Exhibit Schedule Of Oil And Gas Leases Form 2?

Discovering the right legitimate document design might be a have difficulties. Of course, there are tons of layouts available on the Internet, but how can you get the legitimate kind you want? Use the US Legal Forms internet site. The services gives 1000s of layouts, like the Georgia Exhibit Schedule of Oil and Gas Leases Form 2, which can be used for business and private requires. Each of the varieties are inspected by professionals and satisfy state and federal needs.

If you are already authorized, log in for your profile and click on the Download option to have the Georgia Exhibit Schedule of Oil and Gas Leases Form 2. Make use of your profile to check with the legitimate varieties you may have acquired earlier. Visit the My Forms tab of your profile and have another duplicate from the document you want.

If you are a brand new customer of US Legal Forms, listed below are simple directions for you to comply with:

- Initially, make sure you have chosen the correct kind for your area/county. It is possible to examine the form while using Preview option and read the form explanation to make sure this is basically the best for you.

- In the event the kind is not going to satisfy your preferences, utilize the Seach field to get the correct kind.

- When you are sure that the form is acceptable, go through the Acquire now option to have the kind.

- Opt for the prices prepare you would like and type in the required information. Design your profile and buy your order with your PayPal profile or charge card.

- Opt for the document format and acquire the legitimate document design for your product.

- Total, modify and print and sign the received Georgia Exhibit Schedule of Oil and Gas Leases Form 2.

US Legal Forms may be the greatest collection of legitimate varieties that you can see various document layouts. Use the company to acquire professionally-produced paperwork that comply with state needs.

Form popularity

FAQ

Royalty Rates: The royalty agreement or rate is a percentage of total revenue gotten from the sale of oil and gas, and it's always outlined in the lease agreement. The royalty percentage is usually 12.5% to 15% but can change based on regional regulations or negotiations.

The period of time in the life of an oil & gas lease that begins after the expiration of the primary term. Production, operations, continuous drilling, or shut-in royalty payments are most often used to extend an oil & gas lease into its secondary term.

An assignment of oil and gas lease is a contractual agreement between a landowner and an oil or gas company in which the company gains the right to explore for, develop, and produce oil and gas from the property.

Search online database of new and updated oil and gas leases. Use Enverus analytics to focus search on specific geographies, lease dates and contract terms, production record and leasing costs.

The primary term on average is 3 years. Companies can add a 2-year extension if they wish. The company that executed the lease uses this time period to achieve drilling the well. Once that is completed, the secondary term begins and lasts for as long as the well is producing.

The Federal onshore oil and gas rate is 16.67% for leases issued after August 16, 2022. However, there are a few exceptions, including different royalty rates on older leases, reduced royalty rates on certain oil leases with declining production, and increased royalty rates for reinstated leases.

The oil and gas business; assignments are the documents used. to accomplish transfers of lease rights .1./ Although the. common form of assignment may appear to be a rather simple. document, the respective rights and obligations of the parties.

A mineral lease is a contractual agreement between the owner of a mineral estate (known as the lessor), and another party such as an oil and gas company (the lessee). The lease gives an oil or gas company the right to explore for and develop the oil and gas deposits in the area described in the lease.