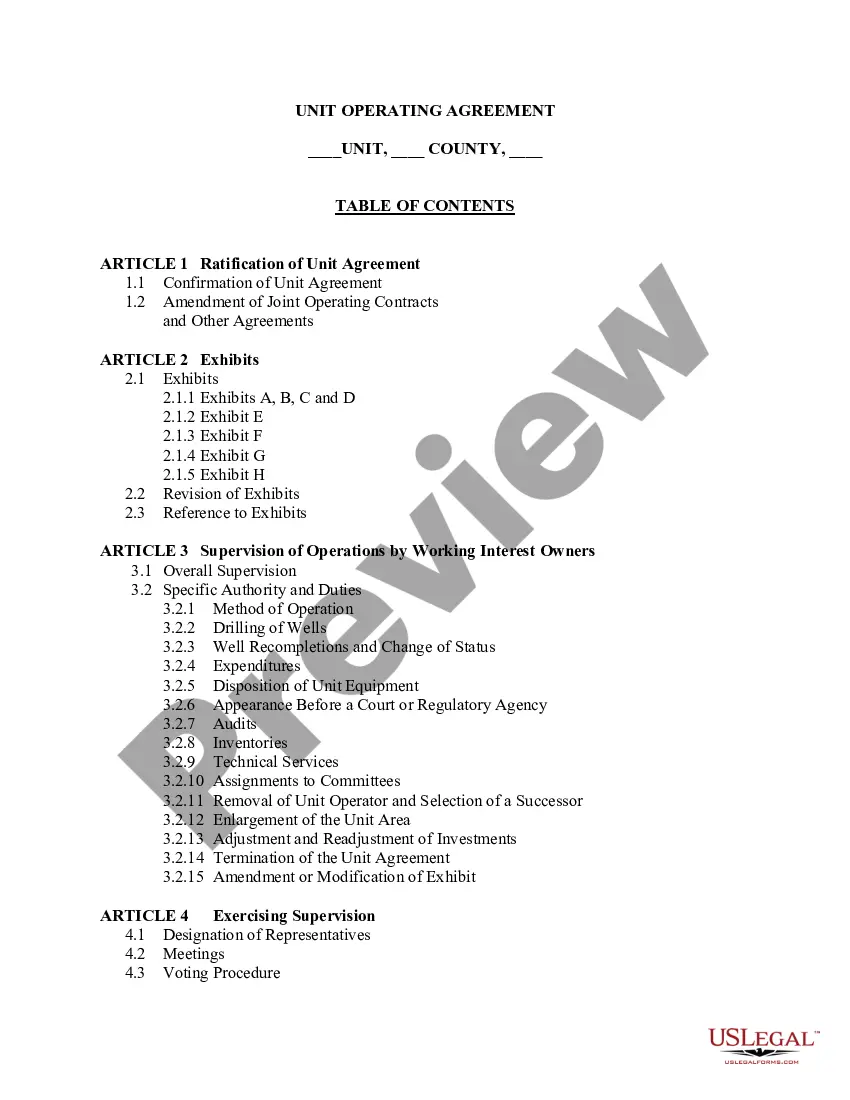

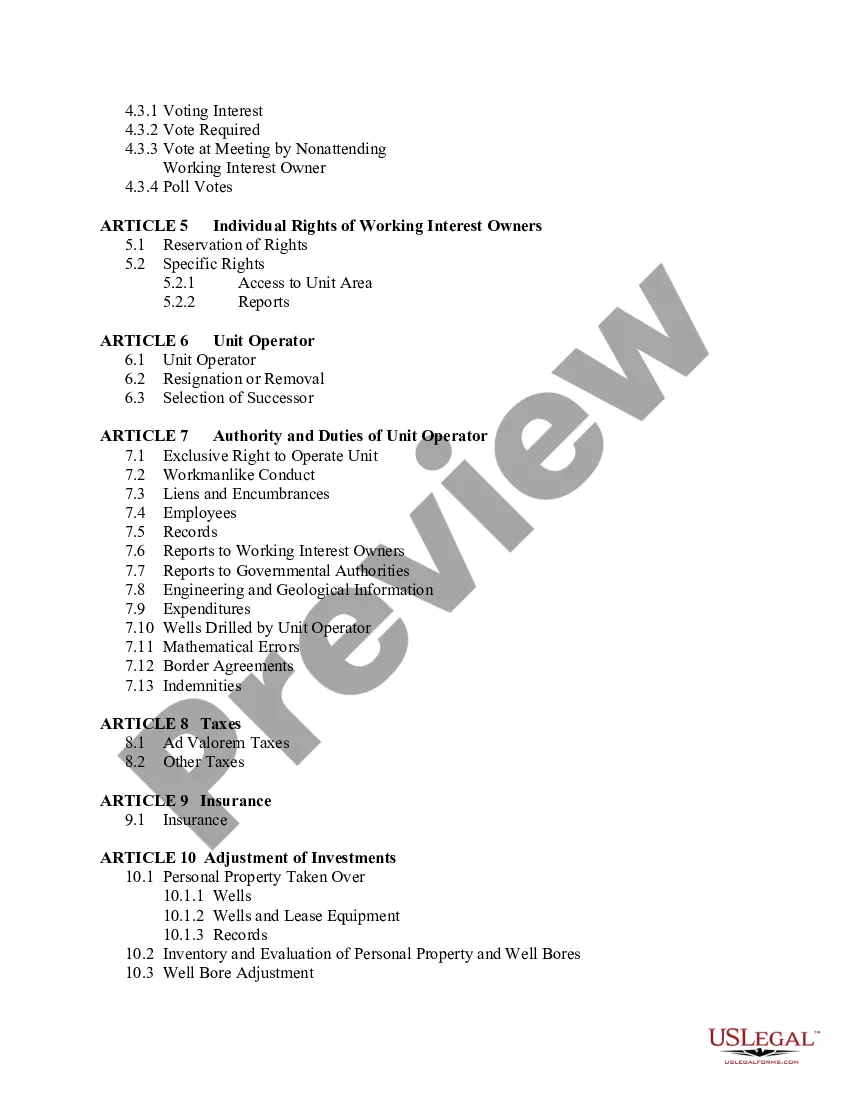

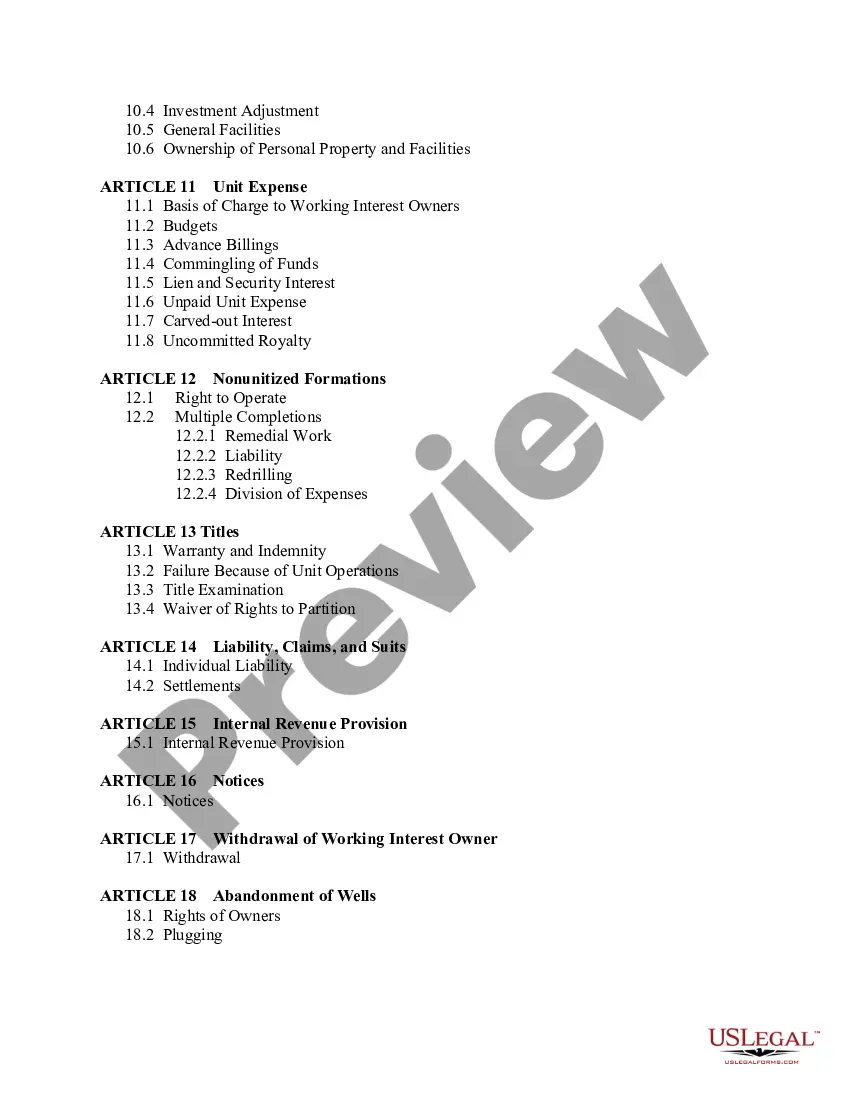

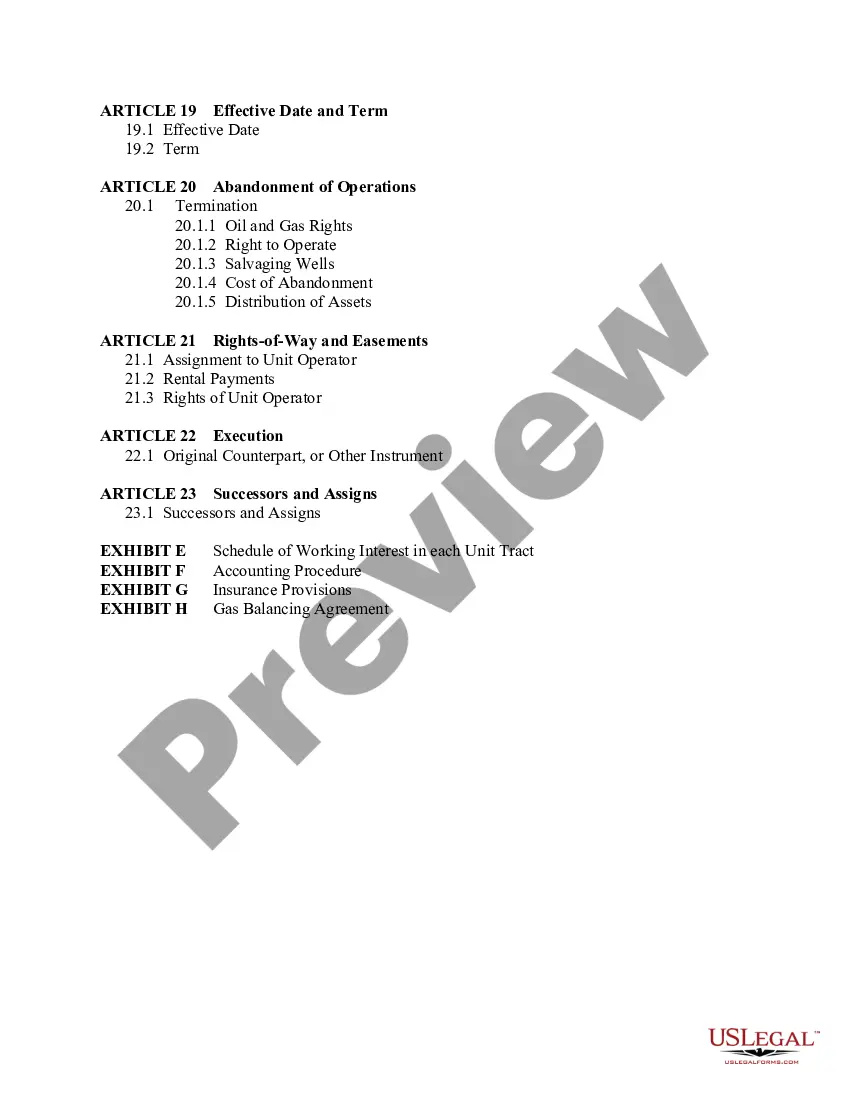

Georgia Unit Operating Agreement

Description

How to fill out Unit Operating Agreement?

Are you presently inside a situation that you will need paperwork for either company or individual reasons nearly every day time? There are plenty of lawful record themes available online, but discovering versions you can depend on is not easy. US Legal Forms gives a huge number of develop themes, much like the Georgia Unit Operating Agreement, which are written to satisfy federal and state specifications.

Should you be presently knowledgeable about US Legal Forms site and possess an account, simply log in. Afterward, you may obtain the Georgia Unit Operating Agreement template.

Should you not come with an account and want to begin using US Legal Forms, follow these steps:

- Get the develop you require and ensure it is for that correct city/area.

- Use the Preview option to review the form.

- Look at the explanation to actually have selected the correct develop.

- In case the develop is not what you`re trying to find, utilize the Research area to get the develop that meets your requirements and specifications.

- Once you discover the correct develop, click on Buy now.

- Pick the prices plan you need, fill in the specified details to generate your bank account, and buy an order with your PayPal or bank card.

- Decide on a practical data file format and obtain your copy.

Discover each of the record themes you might have bought in the My Forms food list. You may get a additional copy of Georgia Unit Operating Agreement whenever, if necessary. Just go through the required develop to obtain or printing the record template.

Use US Legal Forms, probably the most comprehensive variety of lawful forms, to save lots of efforts and avoid blunders. The service gives expertly manufactured lawful record themes that can be used for an array of reasons. Generate an account on US Legal Forms and begin making your way of life easier.

Form popularity

FAQ

How Are Georgia LLCs Taxed? Members of Georgia LLCs pay state income tax and the federal self-employment tax of 15.3% (12.4% for social security and 2.9% for Medicare). Single-member LLCs (SMLLC) are taxed as sole proprietors (aka ?disregarded entities?) by default, whereas multi-member LLCs are taxed as partnerships.

Georgia doesn't have a general business license for LLCs, so there are no fees there. If your business has to get an occupational license or municipal (city or county) permit, the fees are hard to predict. Depending on your LLC's location, and what type of business or industry you're in, the fee varies.

Disadvantages Georgia LLCs taxed as corporations must pay an annual corporate tax and net worth tax. Georgia payroll taxes are relatively high compared to other states for LLCs with employees. LLCs require more paperwork than a sole proprietorship or general partnership.

If you own an LLC, every year it is in business you must file an annual registration with the Secretary of State's Georgia Corporations Division. The annual deadline is April 1, unless you already filed for the current year via a multi-year registration.

An operating agreement, also known in some states as a limited liability company (LLC) agreement, is a contract that describes how a business plans to operate. Think of it as a legal business plan that reads like a prenup.

A Georgia LLC Operating Agreement is a legal document that outlines how a Georgia LLC will be run. Georgia LLC Operating Agreements list all LLC owners (known as ?Members?), their contribution amounts, and their ownership interest percentages.

Georgia does not require any LLC to have an Operating Agreement. This applies to single-member and multi-member LLCs. You can still create your own for use in your company, however.

Under the default rules, every member of the LLC is an agent of the LLC and can conduct business on behalf of the LLC. In other words, each member has the authority to bind the LLC in ordinary business transactions, whether or not the member has the consent of the other members. See OCGA §14-11-301.