Georgia Complaint regarding Insurer's Failure to Pay Claim

Description

How to fill out Complaint Regarding Insurer's Failure To Pay Claim?

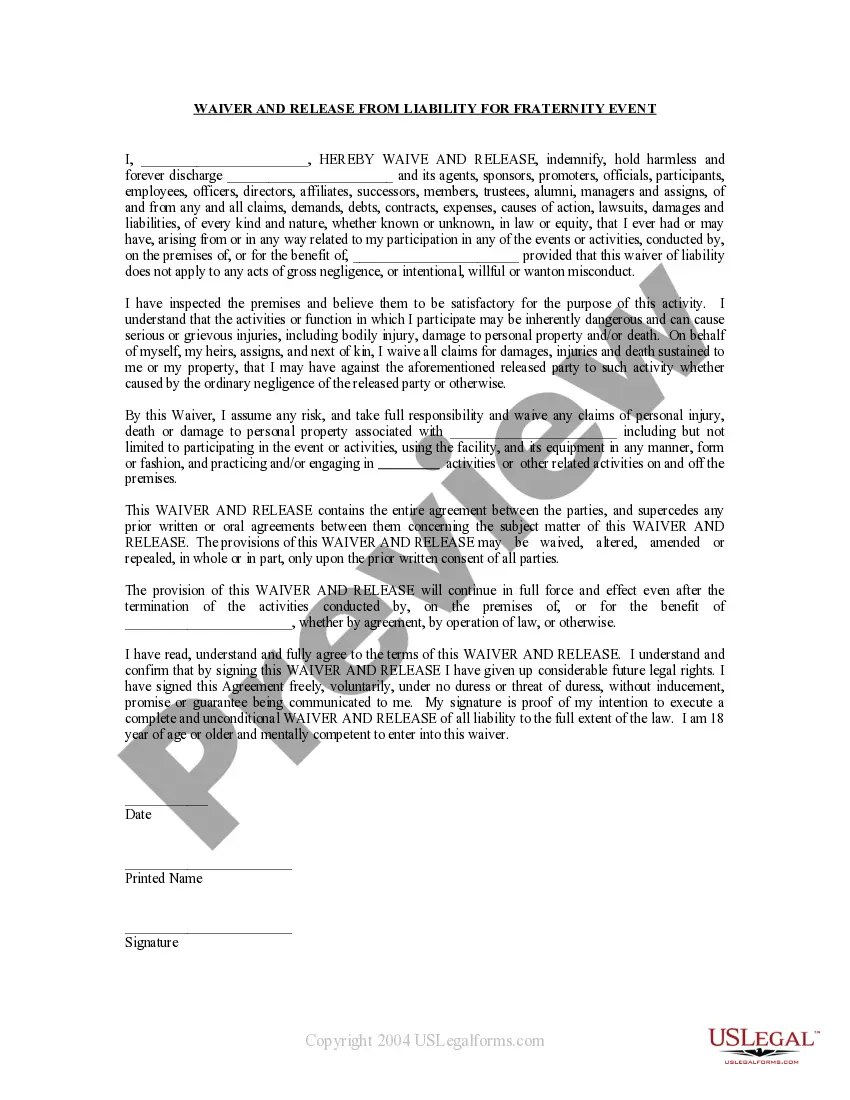

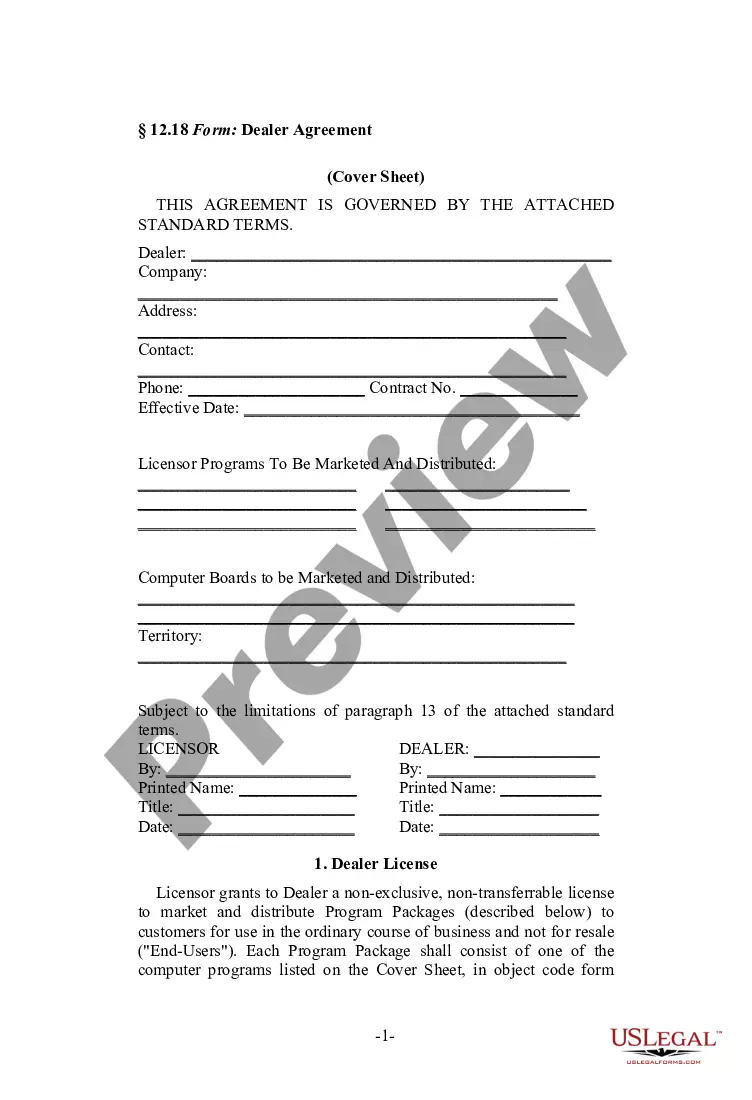

Are you presently inside a position the place you will need files for both company or individual uses virtually every day time? There are tons of authorized papers web templates available on the Internet, but discovering versions you can rely is not straightforward. US Legal Forms offers a large number of form web templates, such as the Georgia Complaint regarding Insurer's Failure to Pay Claim, that happen to be written to satisfy federal and state demands.

When you are presently familiar with US Legal Forms site and have a merchant account, merely log in. Following that, you may obtain the Georgia Complaint regarding Insurer's Failure to Pay Claim design.

Unless you come with an accounts and wish to begin to use US Legal Forms, adopt these measures:

- Discover the form you will need and make sure it is for your correct town/region.

- Take advantage of the Preview switch to review the shape.

- Read the explanation to ensure that you have selected the right form.

- When the form is not what you`re seeking, take advantage of the Research area to get the form that fits your needs and demands.

- If you find the correct form, click on Buy now.

- Pick the pricing strategy you need, fill out the specified details to produce your account, and buy the order utilizing your PayPal or Visa or Mastercard.

- Choose a convenient paper structure and obtain your copy.

Locate all the papers web templates you may have purchased in the My Forms food selection. You may get a additional copy of Georgia Complaint regarding Insurer's Failure to Pay Claim at any time, if needed. Just select the required form to obtain or printing the papers design.

Use US Legal Forms, one of the most extensive selection of authorized kinds, to conserve efforts and stay away from blunders. The services offers expertly manufactured authorized papers web templates that you can use for a selection of uses. Make a merchant account on US Legal Forms and initiate generating your lifestyle a little easier.

Form popularity

FAQ

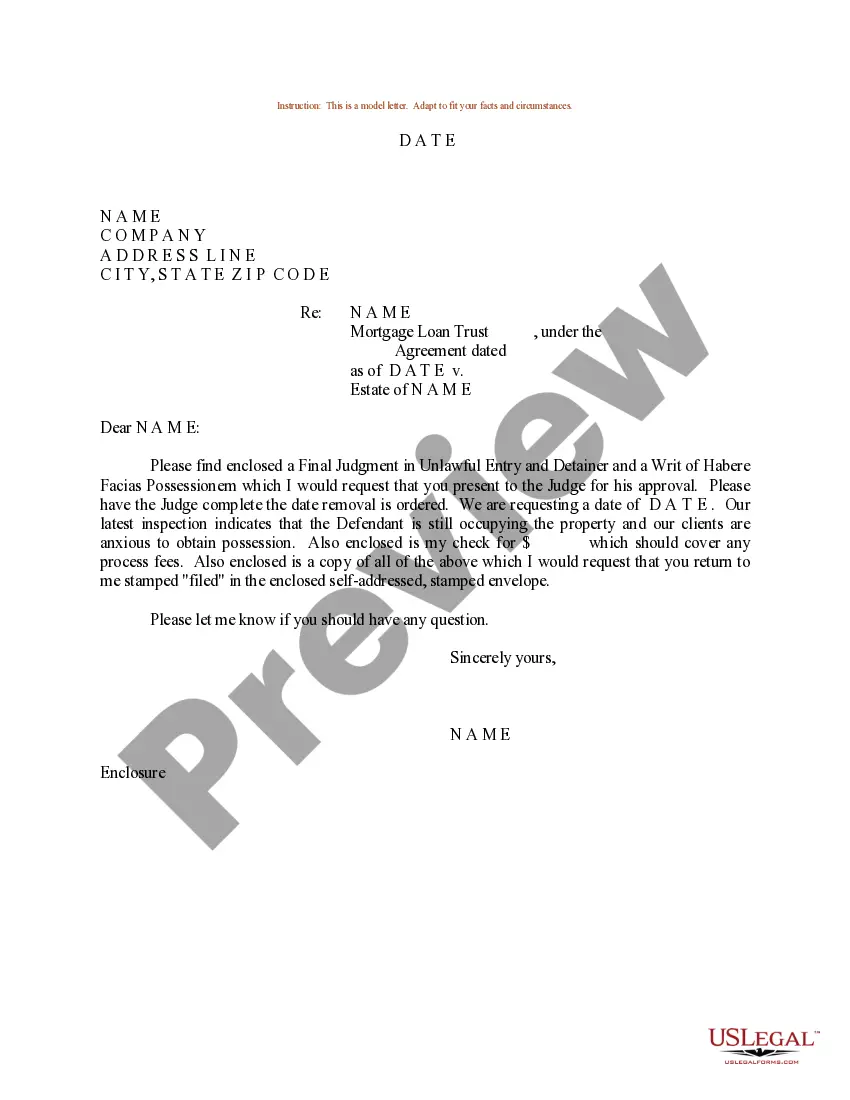

The Office of Insurance and Safety Fire Commissioner licenses and regulates insurance companies, investigates reports of insurance fraud, and inspects buildings to prevent fire.

Fill out the Complaint Form as instructed. The preferred and most efficient process is the online complaint process above. Email and mail are both slower processes. Mail to: Georgia Department of Insurance. 2 Martin Luther King Jr. Drive. Suite 716 West Tower. Atlanta, Georgia 30334.

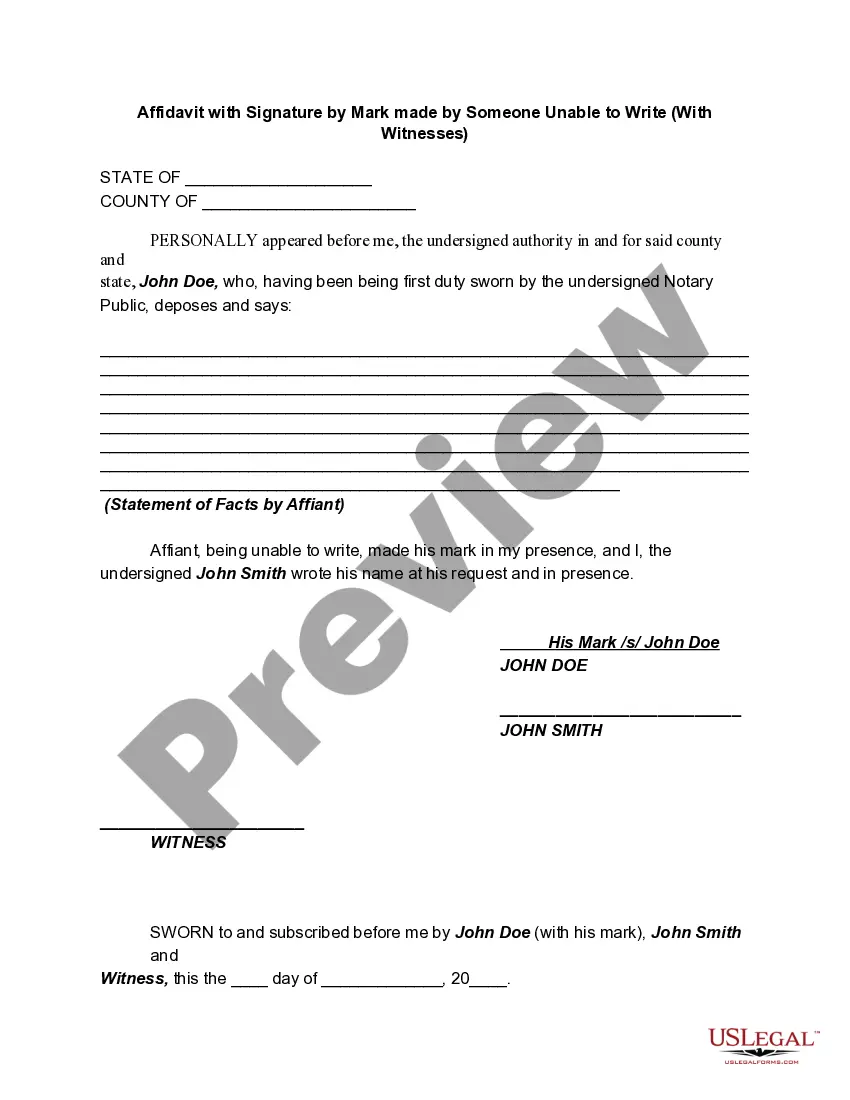

Bad faith insurance refers to an insurer's attempt to renege on its obligations to its clients, either through refusal to pay a policyholder's legitimate claim or investigate and process a policyholder's claim within a reasonable period.

Third-party bad faith cases typically fall under three categories: Failure to defend. Your insurance company has a duty to provide an adequate defense on your behalf in lawsuit. ... Failure to settle. Your provider has a duty to pay for any damages of which you are found liable in lawsuits. ... Negligent handling of the case.

In Georgia, individuals that have had their claims denied can sue their insurance company if they denied their claim in bad faith or in breach of contract. While the same conduct can be used to show bad faith and breach of contract, they are distinct claims.

Direct Actions Against Insurance Companies Some states, including Georgia, have statutes that allow an injured party to file suit directly against the insurance policy carrier, leaving the insured policy holder out of the legal proceedings entirely.

Fill out the Complaint Form as instructed. The preferred and most efficient process is the online complaint process above. Email and mail are both slower processes. Mail to: Georgia Department of Insurance. 2 Martin Luther King Jr. Drive. Suite 716 West Tower. Atlanta, Georgia 30334.

Insurance companies in Georgia have 40 days to settle a claim after it is filed. Georgia insurance companies also have specific time frames in which they must acknowledge the claim and then decide whether to accept it, before paying out the final settlement.