Guam Accounts Receivable - Guaranty

Description

How to fill out Accounts Receivable - Guaranty?

Finding the right authorized record web template can be a have difficulties. Of course, there are tons of themes available online, but how will you discover the authorized form you need? Use the US Legal Forms site. The assistance gives 1000s of themes, for example the Guam Accounts Receivable - Guaranty, which can be used for organization and personal demands. Each of the types are inspected by pros and satisfy federal and state needs.

Should you be currently listed, log in for your account and click the Download key to find the Guam Accounts Receivable - Guaranty. Make use of your account to search from the authorized types you have purchased in the past. Go to the My Forms tab of the account and get another version of your record you need.

Should you be a whole new user of US Legal Forms, listed here are easy guidelines that you can adhere to:

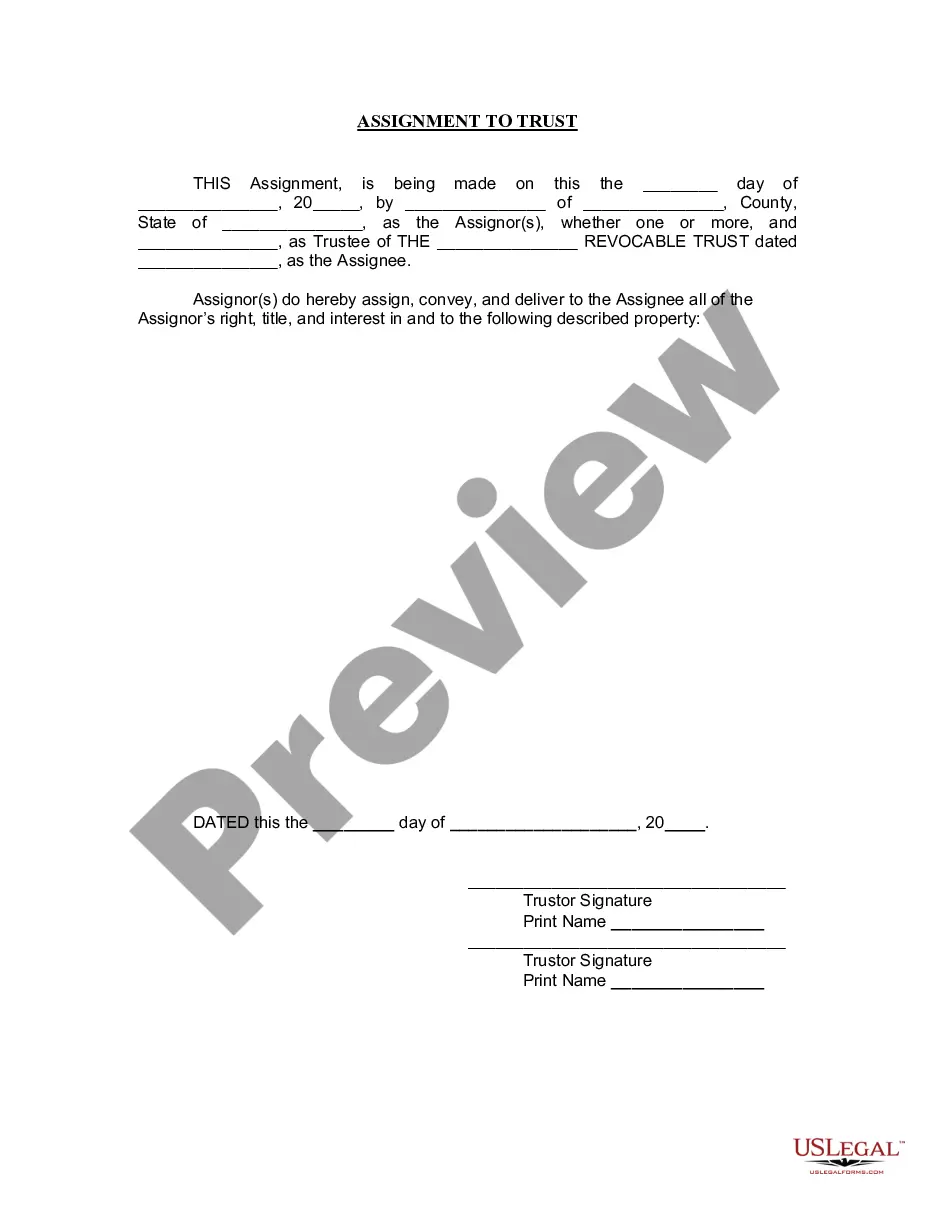

- First, make sure you have chosen the right form for the metropolis/state. You can look through the form using the Review key and read the form explanation to make certain this is basically the right one for you.

- In case the form does not satisfy your needs, use the Seach area to find the right form.

- Once you are sure that the form is suitable, click the Acquire now key to find the form.

- Pick the prices strategy you would like and enter the necessary information and facts. Create your account and purchase an order with your PayPal account or Visa or Mastercard.

- Choose the document structure and download the authorized record web template for your product.

- Complete, revise and printing and sign the acquired Guam Accounts Receivable - Guaranty.

US Legal Forms may be the biggest local library of authorized types in which you can find various record themes. Use the service to download appropriately-manufactured papers that adhere to state needs.

Form popularity

FAQ

Key Principles of ASC 460 Scope: ASC 460 applies to guarantees issued or modified after December 31, 2002, and covers various types of guarantees, including loan guarantees, performance guarantees, and indemnification agreements.

The value of the guaranteed obligation/loan is calculated by discounting the expected cash flows (principal and coupon payments under the risky rate) at the guaranteed rate, while the value of the non-guaranteed loan is discounted at the risky rate.

A common example of a financial guarantee contract is a parent company providing a guarantee over its subsidiary's borrowings. Because these contracts transfer significant insurance risk, they typically meet the definition of an insurance contract.

One common example of this type of situation is where a hospital lures a doctor to open a practice in an underserved community with a guarantee of fee income for an initial period. ASC 460 explicitly states that these types of assurances are guarantees and must be given accounting recognition.

Ing to US GAAP, the company's accounts receivable balance must be stated at ?net realizable value?. In basic terms, this just means that the accounts receivable balance presented in the company's financial statements must be equal to the amount of cash they expect to collect from customers.

A corporate guarantee means the company is standing behind the contract, and guaranteeing performance. A financial guarantee means that whoever ( corporation or individual) is indemnifying (guaranteeing) the financial performance of the contract.

In most cases, financial loan guarantees are required to be recorded as a liability in the balance sheet at their fair value when they are issued, with expected credit losses that exceed the initial fair value recognised subsequently.