Guam Direct Deposit Form for Chase

Description

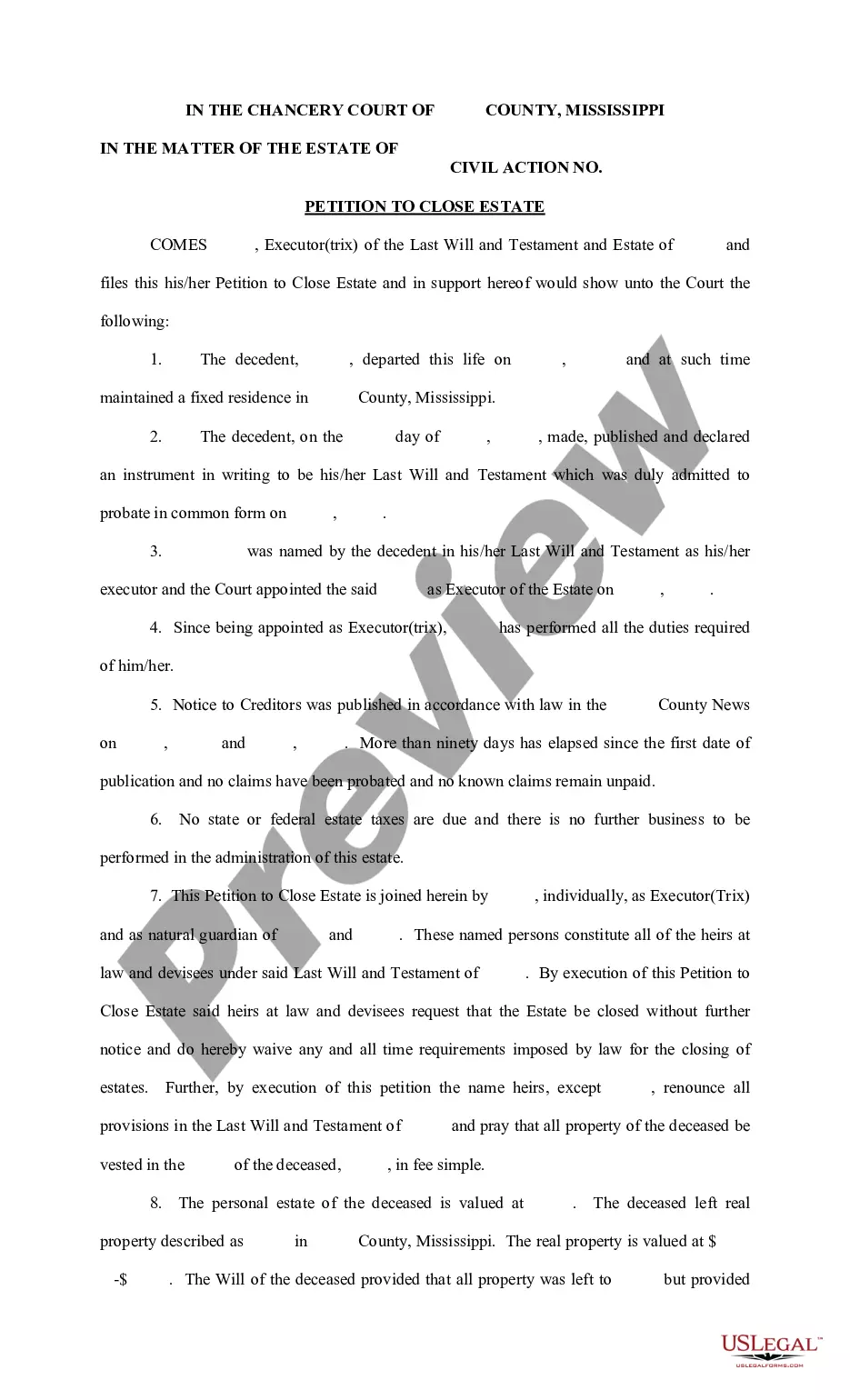

How to fill out Direct Deposit Form For Chase?

Selecting the appropriate valid document template can be a challenge.

Of course, there are numerous designs available online, but how can you locate the authentic document you require.

Utilize the US Legal Forms website. This service offers thousands of templates, including the Guam Direct Deposit Form for Chase, which can be used for both business and personal purposes.

You can preview the document using the Preview button and read the document description to confirm it is the right one for you.

- All templates are reviewed by experts and fulfill state and federal regulations.

- If you are already registered, sign in to your account and click the Download button to access the Guam Direct Deposit Form for Chase.

- Use your account to explore the legal documents you have previously acquired.

- Go to the My documents tab in your account to obtain another copy of the document you need.

- If you're a new user of US Legal Forms, here are some simple steps for you to follow.

- First, ensure you have selected the appropriate form for your region/area.

Form popularity

FAQ

Get your personalized pre-filled direct deposit formSign in to chase.com or the Chase Mobile® app.Choose the checking account you want to receive your direct deposit.Navigate to 'Account services' by scrolling up in the mobile app or in the drop down menu on chase.com.Click or tap on 'Set up direct deposit form'More items...

Sign In to Online Banking. Click on any of your accounts. Select View and Print Payroll Direct Deposit from the right navigation. Select the account you want to deposit your payroll to from the dropdown, then click on View and Print and your customized form will be presented to you.

Here is how:Go to the My Wallet section within your Chase Bank app.Now select the Payments option and a list of pending transactions will be displayed.Tap on any of the transactions you can see more details including the transaction date and amount of deposit as well as the expected deposit date.

Use our pre-filled form Or you can download a blank Direct Deposit/Automatic Payments Set-up Guide (PDF) and fill in the information yourself. For accounts with checks, a diagram on the form shows you where you can find the information you'll need.

Find your routing and account number by signing in to chase.com and choosing the last four digits of the account number that appears above your account information. You can then choose, 'See full account number' next to your account name and a box will open to display your account and routing number.

Proof of Income & Direct DepositPaychecks and Stubs. Even paychecks that are direct-deposited to your bank generate a pay stub.Government Checks.Bank Statements.Federal Tax Forms.

Click the Direct Deposit Form (PDF) link on your account page. The information will be displayed in a new window with the ability to print or save it on your computer.

Chase Mobile® app is available for select mobile devices....Here's where to find your numbers:The 9-digit number on the bottom left is your routing number.After the routing number is your account number on the bottom center.Following the account number is the check number at the the bottom right.

Setting Up Direct Deposit to Receive PaymentsBank account number.Routing number.Type of account (typically a checking account)Bank name and addressyou can use any branch of the bank or credit union you use.Name(s) of account holders listed on the account.

This nine-digit number is found on the bottom left of your checks. Your checking account number. This is the main number for your checking account that you use for all deposits and withdrawals. It is found on the bottom of the check directly to the right of the routing number.