The Guam Deferred Compensation Agreement — Short Form is a legal document outlining an arrangement between an employer and employee in Guam regarding deferred compensation. This agreement allows employees to defer a portion of their compensation to be received at a later date, typically upon retirement or separation from the company. The purpose of this agreement is to provide employees with a means to save for the future and to potentially defer tax liabilities. This type of agreement may have different variations or types depending on the specific terms and conditions agreed upon by the employer and employee. Some possible variations of the Guam Deferred Compensation Agreement — Short Form include: 1. Salary Deferral Agreement: This type of agreement allows employees to defer a portion of their salary on a regular basis, usually deducted directly from their paycheck. The deferred amount is then invested or held by the employer until the agreed-upon distribution date. 2. Bonus Deferral Agreement: In this variation, employees have the option to defer a portion or the entirety of their bonus payments. By deferring bonuses, employees can secure tax advantages and potentially defer the income to a future year when their tax bracket may be lower. 3. Stock Option Deferral Agreement: This type of agreement applies specifically to employees who receive stock options as part of their compensation package. It allows them to defer exercising or selling their stock options until a later date, which may be advantageous for tax planning or investment purposes. 4. Nonqualified Deferred Compensation Agreement: This variation of the agreement is generally designed for highly compensated employees who wish to defer income above the maximum limits set for qualified retirement plans like 401(k)s or pension plans. Nonqualified deferred compensation plans offer flexibility in terms of contribution amounts and distribution options, but they do not receive the same tax advantages as qualified retirement plans. It is important to note that the specific terms and conditions of the Guam Deferred Compensation Agreement — Short Form, including the deferral period, distribution terms, investment options, and vesting schedules, can vary depending on the employer's plan and the employee's individual circumstances. Employees should carefully review the agreement and consult with their employer's human resources or legal department to fully understand the details and implications before signing.

Guam Deferred Compensation Agreement - Short Form

Description

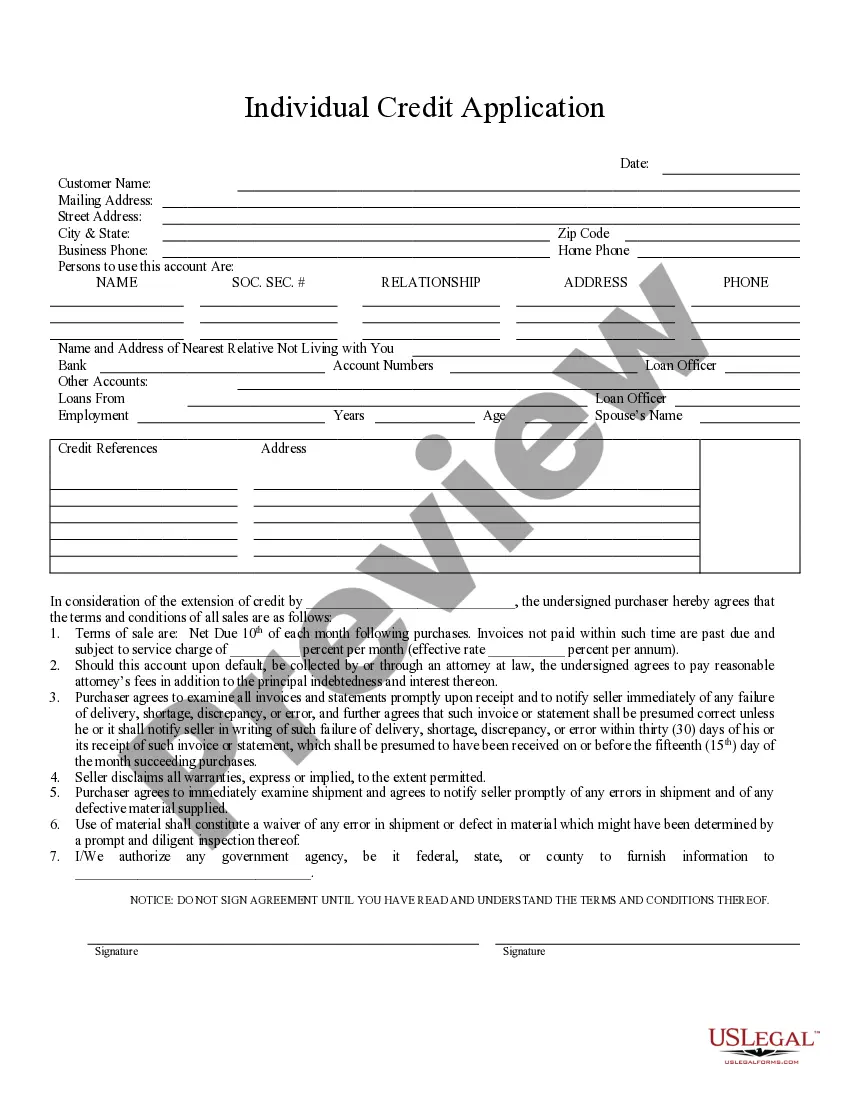

How to fill out Guam Deferred Compensation Agreement - Short Form?

Have you ever found yourself in a scenario where you need documents for either professional or personal purposes almost every day.

There are numerous legally acceptable document templates accessible online, but finding dependable ones can be challenging.

US Legal Forms provides thousands of form templates, such as the Guam Deferred Compensation Agreement - Short Form, that are designed to meet federal and state regulations.

Once you locate the right form, click on Buy now.

Select your desired pricing plan, provide the necessary information to set up your account, and complete the purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Guam Deferred Compensation Agreement - Short Form template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

- Use the Preview button to review the form.

- Review the details to confirm that you have selected the correct document.

- If the document is not what you are looking for, use the Search field to find the form that fits your requirements.

Form popularity

FAQ

An example of a deferred comp plan is an executive bonus scheme, where employers offer additional compensation that employees can access in the future. These plans, such as a Guam Deferred Compensation Agreement - Short Form, help attract and retain talent by providing financial incentives for long-term commitment. You can easily draft such agreements with the help of US Legal Forms, ensuring all necessary details are included.

Yes, a 401k is a type of deferred compensation plan. Employees contribute a portion of their earnings to the plan before taxes, which allows for tax-deferred growth until withdrawal. This can complement a Guam Deferred Compensation Agreement - Short Form by providing additional retirement savings. Take advantage of US Legal Forms to explore your retirement planning options.

A common example of a deferred compensation plan is a Guam Deferred Compensation Agreement - Short Form. This type of plan allows employees to postpone receiving a portion of their salary until a later date, often until retirement. It helps individuals save for the future while potentially reducing current taxable income. For tailored options, consider using the US Legal Forms platform to create your own agreement.

Box 11 on the W-2 shows the amount of deferred compensation related to nonqualified plans. This box is useful for tax reporting and understanding how your deferred compensation is managed. When considering the Guam Deferred Compensation Agreement - Short Form, it’s crucial to know what’s included here. If you require assistance with your tax documents, explore the resources available at USLegalForms.

Box 14 on the W-2 is used for additional information that employers choose to report. This may include details about tuition reimbursement, certain deductions, or deferred compensation amounts. Specifically, when dealing with a Guam Deferred Compensation Agreement - Short Form, your employer may use this box to elaborate on your deferred compensation details. USLegalForms can help you navigate this information effectively.

Deferred compensation is generally reported in Box 12 of the W-2, with a specific code to identify it properly. Employers may also provide additional details in Box 14 for clarity on the type of compensation. Understanding the Guam Deferred Compensation Agreement - Short Form can simplify this reporting process. For further support, turn to USLegalForms for comprehensive guidance.

You can find tax-deferred pension contributions listed in Box 12 of your W-2, similar to other retirement plan contributions. Look for a code adjacent to the amount that indicates it is a tax-deferred pension. The Guam Deferred Compensation Agreement - Short Form offers clarity on how these contributions affect your overall tax situation. If you need assistance, USLegalForms provides valuable resources.

To report deferred compensation on your W-2, your employer will include the amount in Box 12. You will see a specific code that indicates the type of deferred compensation, such as ‘D’ for 401(k) plans. Understanding the Guam Deferred Compensation Agreement - Short Form helps ensure you report this accurately. For personalized support, consider exploring resources from USLegalForms.

Yes, a U.S. citizen can retire in Guam, as it is a U.S. territory. Many retirees are drawn to Guam for its warm climate and vibrant culture. Utilizing a Guam Deferred Compensation Agreement - Short Form can enhance your retirement strategy by helping you allocate funds wisely. This way, you can enjoy your retirement in Guam without financial stress.

Currently, the retirement age in the United States is gradually increasing, with discussions about reaching 70 years for full benefits. However, it's crucial to check the latest regulations as they can change. Planning your retirement with options like the Guam Deferred Compensation Agreement - Short Form can provide peace of mind, allowing you to manage your retirement funds effectively. Always stay informed about the latest retirement guidelines to make the best decisions.