Title: Understanding Guam Minutes of Meeting of the Directors regarding Bank Loan Introduction: Guam, a U.S. territory located in the Western Pacific Ocean, has its own unique set of rules and regulations when it comes to conducting business. To address financial matters, companies often convene meetings of their directors to discuss potential bank loans. This article aims to provide a detailed description of what Guam Minutes of Meeting of the Directors regarding Bank Loan entail, outlining the key points and different types of minutes that may be documented. 1. Overview of Guam Minutes of Meeting of the Directors: The Guam Minutes of Meeting of the Directors regarding Bank Loan serve as written records documenting the proceedings, discussions, decisions, and actions taken during a meeting among the directors of a company contemplating a bank loan. These minutes hold legal significance and act as proof of compliance with corporate governance requirements. 2. Key Elements Covered in Guam Minutes of Meeting of the Directors regarding Bank Loan: a. Attendance: The minutes begin with a list of directors present, confirming their participation and voting rights during the meeting. b. Opening Remarks: The chairperson or facilitator may introduce the purpose of the meeting, emphasizing the intent to discuss a potential bank loan. c. Review of Loan Proposal: The directors will delve into the specifics of the loan proposal received, including financial terms, interest rates, repayment schedule, collateral, and other relevant details. d. Discussion and Decision Making: The minutes detail the dialogue among the directors, capturing different viewpoints and opinions. Final decisions regarding loan approval or rejection, potential amendments, or additional inquiries are recorded. e. Actions and Resolutions: Any decisions made during the meeting will be documented, including approvals, rejections, amendments, or deferral of decision-making to a later date. Responsibilities are assigned, deadlines are set, and next steps are clarified. f. Voting and Consensus: If applicable, the minutes record the voting process, highlighting any unanimous decisions or highlighting the majority opinion. g. Adjournment: The minutes conclude with a note regarding the meeting's conclusion, capturing the date and time when the meeting was adjourned. Types of Guam Minutes of Meeting of the Directors regarding Bank Loan: 1. Initial Loan Discussion Minutes: These minutes outline the commencement of discussions regarding the bank loan. They may include the decision to explore loan options, identify potential lenders, and initiate the loan application process. 2. Loan Approval Minutes: This type of minutes document the meeting where the decision to approve the bank loan is made. It encompasses a detailed review of the loan proposal and highlights any additional conditions set forth by the directors. 3. Loan Amendment Minutes: These minutes are recorded when the directors return to discuss changes or modifications to an existing loan agreement. The minutes document the proposed amendments, rationale behind them, and the final decision reached. 4. Loan Rejection Minutes: In the event that the directors unanimously decide against pursuing a bank loan, these minutes contain the reasons for rejection, ensuring transparency and accountability. Conclusion: The Guam Minutes of Meeting of the Directors regarding Bank Loan play a vital role in ensuring transparent decision-making processes in the pursuit of financial support for businesses in Guam. Accurate record-keeping and adherence to corporate governance guidelines are of utmost importance in maintaining the integrity of these minutes. Understanding the different types of minutes allows directors to effectively navigate the loan application process and make informed choices that align with the objectives of their company.

Guam Minutes of Meeting of the Directors regarding Bank Loan

Description

How to fill out Guam Minutes Of Meeting Of The Directors Regarding Bank Loan?

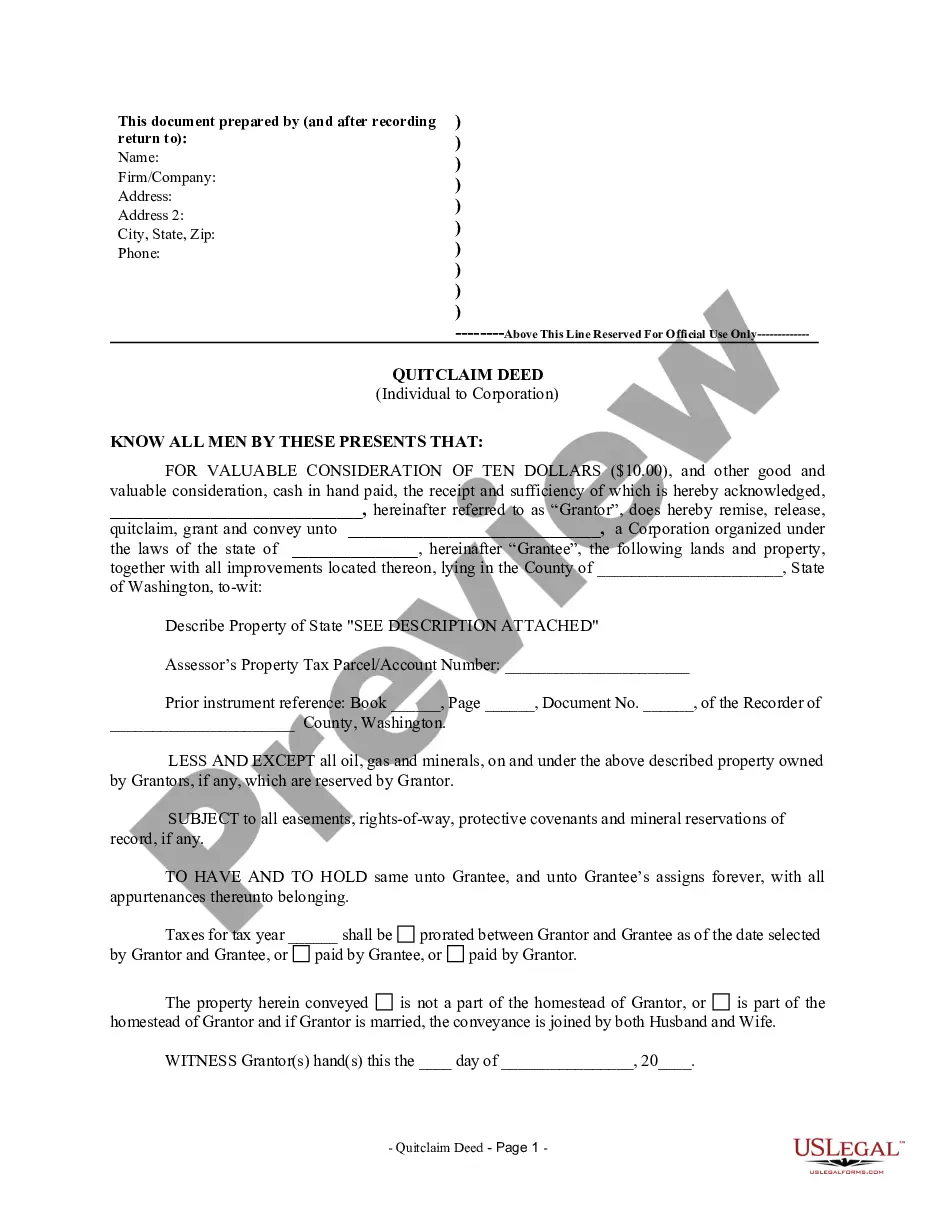

If you have to total, acquire, or printing legitimate record web templates, use US Legal Forms, the most important assortment of legitimate types, that can be found online. Take advantage of the site`s simple and hassle-free lookup to obtain the papers you will need. Numerous web templates for business and personal functions are categorized by classes and suggests, or key phrases. Use US Legal Forms to obtain the Guam Minutes of Meeting of the Directors regarding Bank Loan in just a handful of click throughs.

When you are previously a US Legal Forms customer, log in to the accounts and click on the Download key to obtain the Guam Minutes of Meeting of the Directors regarding Bank Loan. You can even entry types you earlier acquired inside the My Forms tab of the accounts.

If you work with US Legal Forms the very first time, follow the instructions under:

- Step 1. Be sure you have selected the form for the right metropolis/nation.

- Step 2. Utilize the Review option to check out the form`s content. Never forget about to read the information.

- Step 3. When you are unhappy together with the develop, make use of the Look for industry at the top of the display screen to discover other versions of the legitimate develop design.

- Step 4. Once you have located the form you will need, select the Acquire now key. Opt for the pricing program you like and add your qualifications to sign up for an accounts.

- Step 5. Method the transaction. You can use your credit card or PayPal accounts to perform the transaction.

- Step 6. Pick the file format of the legitimate develop and acquire it on your system.

- Step 7. Comprehensive, revise and printing or signal the Guam Minutes of Meeting of the Directors regarding Bank Loan.

Each legitimate record design you buy is your own eternally. You might have acces to every single develop you acquired in your acccount. Select the My Forms area and decide on a develop to printing or acquire again.

Be competitive and acquire, and printing the Guam Minutes of Meeting of the Directors regarding Bank Loan with US Legal Forms. There are millions of professional and condition-certain types you may use for the business or personal demands.