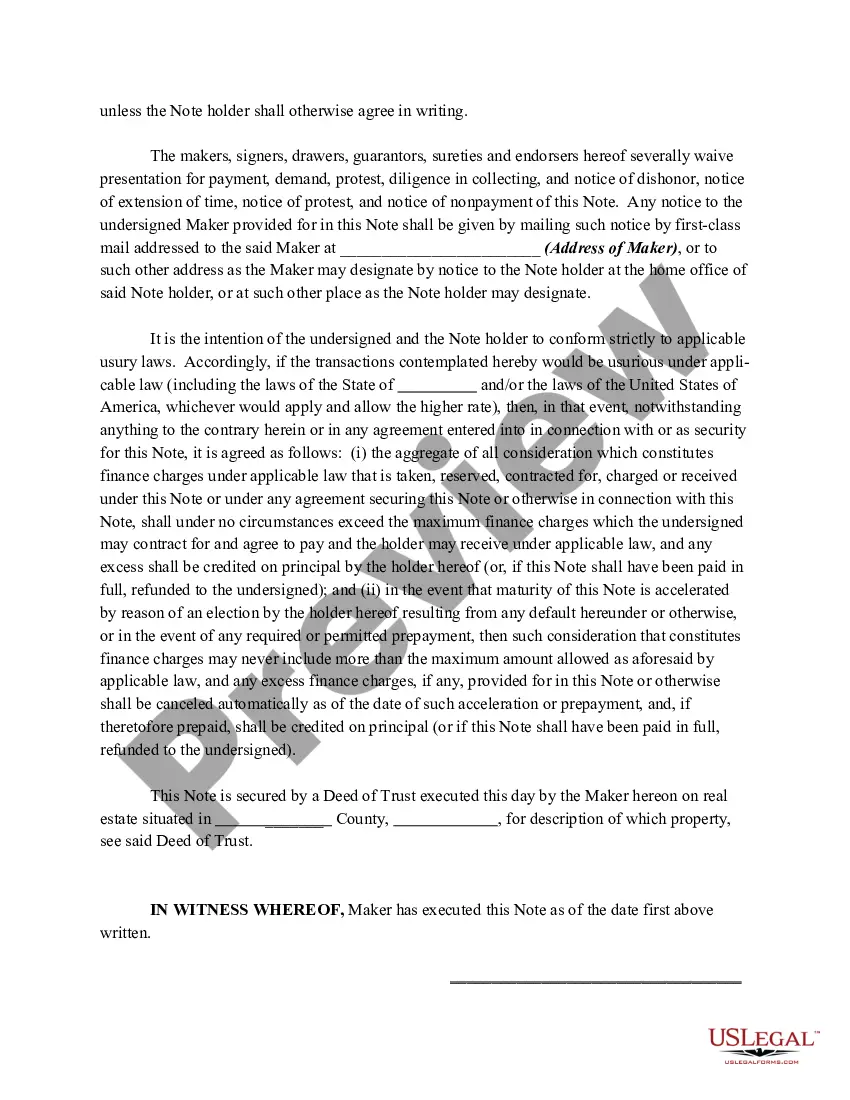

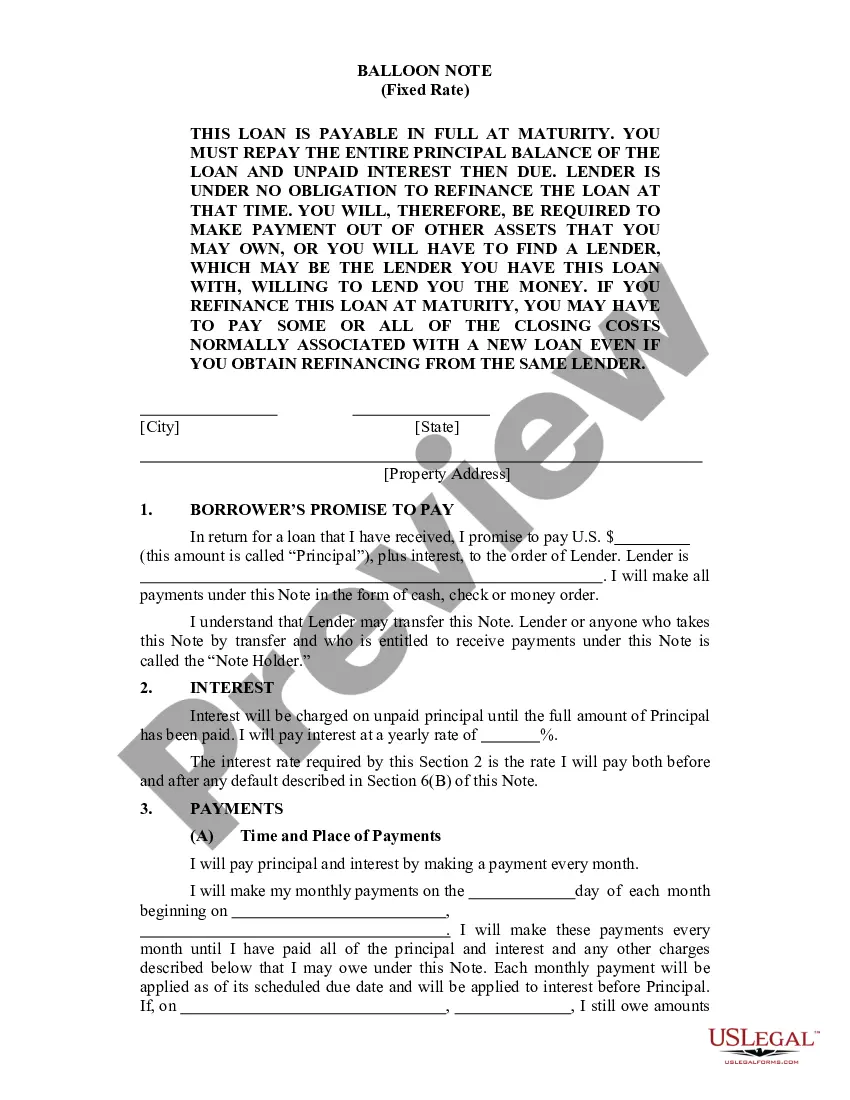

Guam Promissory Note - Balloon Note

Description

How to fill out Promissory Note - Balloon Note?

You can spend numerous hours online trying to locate the legal document template that meets the requirements of federal and state laws you need.

US Legal Forms offers a vast array of legal forms that can be examined by experts.

You can easily obtain or print the Guam Promissory Note - Balloon Note through my service.

First, ensure that you have selected the correct document template for your area/city of choice. Review the form details to confirm you have chosen the right form. If available, use the Review button to view the document template as well. If you want to find another variant of the form, use the Search area to locate the template that suits your needs and specifications. Once you have found the template you want, click on Acquire now to proceed. Select the pricing plan you desire, enter your details, and sign up for an account with US Legal Forms. Complete the transaction. You can use your credit card or PayPal account to pay for the legal form. Choose the format of the document and download it to your device. Make any necessary modifications to your document. You can complete, amend, and sign/print the Guam Promissory Note - Balloon Note. Obtain and print numerous document templates using the US Legal Forms website, which offers the largest collection of legal forms. Utilize professional and state-specific templates to address your business or individual requirements.

- If you possess a US Legal Forms account, you can Log In and click the Acquire button.

- Afterward, you can complete, modify, print, or sign the Guam Promissory Note - Balloon Note.

- Every legal document template you obtain belongs to you indefinitely.

- To receive an additional copy of the purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

Form popularity

FAQ

In the context of a Guam Promissory Note - Balloon Note, notarization is often recommended but not always legally required. Notarizing the release enhances its validity and helps prevent potential disputes in the future. It serves as an official acknowledgment that both parties agree to the terms laid out in the release. For peace of mind, consider using a reliable platform like USLegalForms to manage this process efficiently.

Claiming a Guam Promissory Note - Balloon Note generally involves following the terms laid out in the document. If you face difficulties collecting payment, you may need to initiate legal proceedings to enforce the terms. Utilizing the resources available through platforms like USLegalForms can streamline this process and provide guidance tailored to your needs.

While a Guam Promissory Note - Balloon Note does not legally require registration, doing so can enhance its enforceability. Registration provides a public record that may prove beneficial in the event of disputes. It is always wise to consider the risks and benefits of registering your note based on your particular circumstances.

When dealing with a Guam Promissory Note - Balloon Note, reporting on your taxes depends on the interest received from the note. You must include any interest earned as taxable income on your federal tax return. Consulting a tax professional can provide clarity on how to handle the specific reporting requirements for your situation.

Registering a Guam Promissory Note - Balloon Note typically involves submitting it to your local county office, where it can be recorded. You'll need to provide basic details, such as the names of the parties, the amount, and the terms of repayment. This step can help establish a legal claim against the borrower, should any disputes arise.

To legalize a Guam Promissory Note - Balloon Note, you should ensure it is properly signed by all parties involved. Additionally, notarization can add an extra layer of authenticity and legal recognition. Always consult local legal provisions to confirm that you meet all necessary requirements.

The major problem with balloon payments lies in the risk of default if borrowers cannot meet the large payment at the end of the term. In a Guam Promissory Note - Balloon Note, this can lead to significant financial strain or even foreclosure if the borrower has not adequately planned. Awareness of this risk is vital in choosing this payment structure.

Examples of balloon payments can include loans structured for real estate purchases, where borrowers make smaller payments for several years before a considerable lump sum is due. In the case of a Guam Promissory Note - Balloon Note, the principle remains, leading to a higher balance at the end. These arrangements can be beneficial if borrowers expect to refinance or sell the property before the payment is due.

To get a copy of your promissory note, check with the lender or individual who holds the original document. If you used US Legal Forms to create your Guam promissory note - balloon note, you may also retrieve a backup from your account on their platform. Keeping a digital or printed copy ensures that you always have access to your important legal documents.

Yes, you can write your own promissory note, but it is essential to ensure that it meets all legal requirements. Using a template from US Legal Forms can help you draft a Guam promissory note - balloon note that adheres to the necessary regulations. This approach saves time and assures you that the document is valid and enforceable.