Subject: Request for Guidance on Tax Matters related to Decedent's Estate in Guam Dear [State Tax Commission's Name], I hope this letter finds you well. I am writing to seek your guidance and necessary information regarding the tax matters concerning the estate left behind by the deceased individual in Guam. Following the unfortunate passing of our loved one, we have taken on the responsibility of settling the decedent's estate. However, the complexities surrounding tax obligations in Guam have caused us some confusion and raised a few important questions. With your esteemed Commission's expertise in this area, we kindly request your assistance to address the following matters: 1. Determining Tax Liability: We need to ascertain the tax liability, if any, the decedent's estate may owe to the government of Guam. Could you please provide detailed guidelines or references regarding the calculation of taxes applicable to an estate in Guam? It would be immensely helpful if you could outline the specific taxes involved, such as estate tax, inheritance tax, or any other relevant taxes. 2. Filing Requirements and Deadlines: Could you please clarify the necessary steps, documentation, and deadlines for filing tax returns related to the decedent's estate in Guam? We would greatly appreciate any specific forms that need to be completed and submitted for this purpose, along with the required supporting documents. 3. Estate Appraisals and Valuations: In order to fulfill our tax obligations accurately, we would like to understand the valuation rules and appraisal processes relevant to determining the estate's worth in Guam. Could you kindly provide information on the acceptable methods for valuing assets, such as real estate, securities, personal property, or other assets present in the estate? 4. Exemptions and Deductions: We also seek clarification regarding any potential exemptions or deductions available to mitigate the tax burden on the estate. It would be useful to be informed about allowable deductions, such as administrative expenses, funeral expenses, or debts owed by the decedent at the time of death. 5. Communication and Assistance: Finally, we kindly request your guidance on how to effectively communicate our queries and concerns with the State Tax Commission's representatives. It would be immensely helpful if you could provide contact information for any specific department, branch, or individual that specializes in estate tax matters in Guam. We fully understand the importance of fulfilling our tax obligations diligently and providing accurate information to facilitate a smooth estate settlement process. Therefore, your expertise and guidance on the matters outlined above would be greatly appreciated. Thank you for your attention to our request, and we eagerly await your prompt response. Please feel free to contact us at the provided address or telephone number if there is any additional information required. Yours sincerely, [Your Name] [Your Address] [City, State, ZIP] [Phone number] [Email address] Potential types of Guam Sample Letters to State Tax Commission concerning Decedent's Estate: 1. Guam Sample Letter to State Tax Commission regarding Estate Tax Calculation 2. Guam Sample Letter to State Tax Commission seeking Deadline Information for Estate Tax Filing 3. Guam Sample Letter to State Tax Commission inquiring about Valuation Rules for Estate Appraisals 4. Guam Sample Letter to State Tax Commission regarding Estate Tax Exemptions and Deductions 5. Guam Sample Letter to State Tax Commission seeking Assistance with Estate Tax Matters.

Guam Sample Letter to State Tax Commission concerning Decedent's Estate

Description

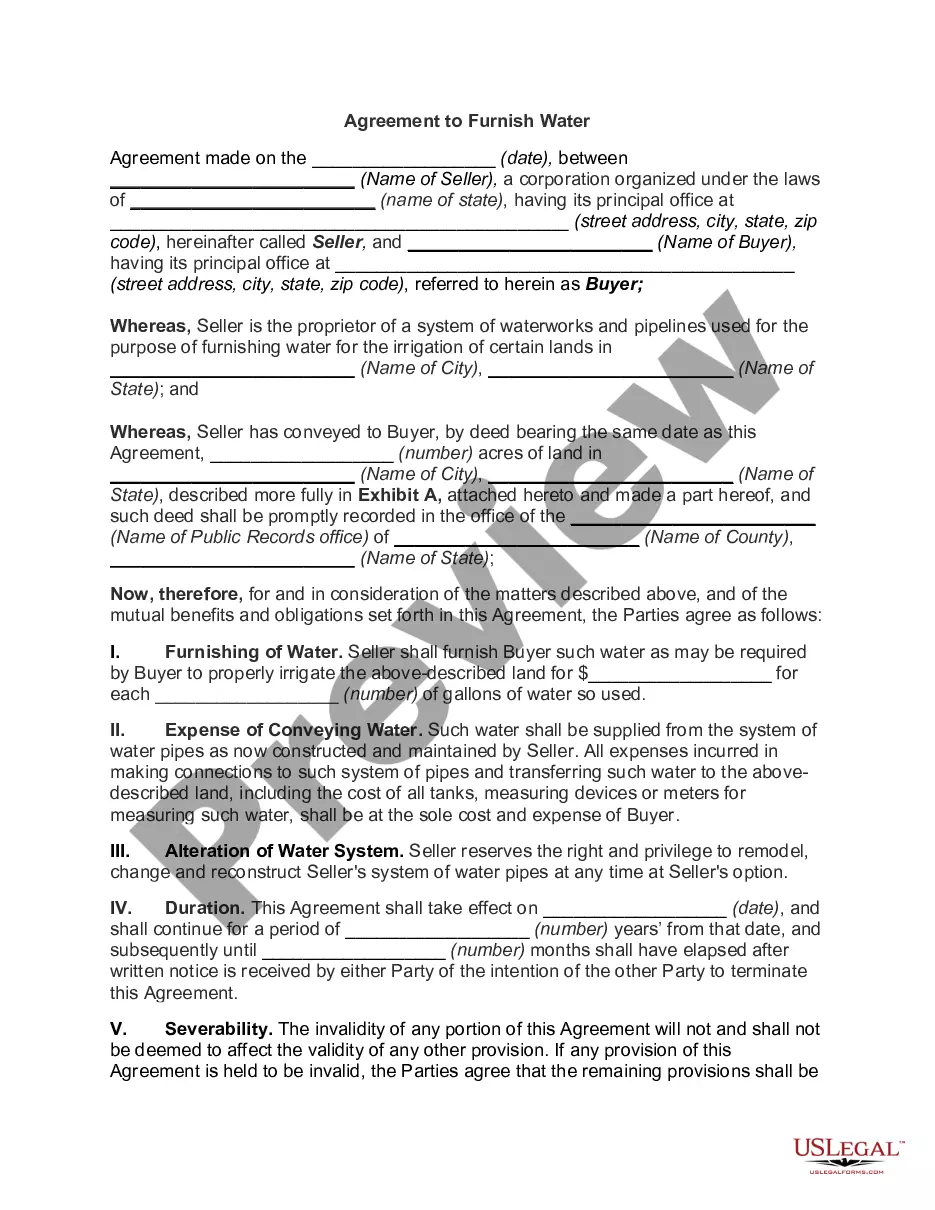

How to fill out Guam Sample Letter To State Tax Commission Concerning Decedent's Estate?

Finding the right legal record template could be a have difficulties. Naturally, there are a variety of themes available on the net, but how would you get the legal type you need? Utilize the US Legal Forms web site. The service gives a large number of themes, like the Guam Sample Letter to State Tax Commission concerning Decedent's Estate, that can be used for organization and private requires. All of the kinds are checked by pros and meet up with state and federal requirements.

When you are presently signed up, log in to your bank account and then click the Obtain key to obtain the Guam Sample Letter to State Tax Commission concerning Decedent's Estate. Make use of bank account to look through the legal kinds you might have ordered earlier. Check out the My Forms tab of your respective bank account and acquire yet another duplicate of the record you need.

When you are a brand new consumer of US Legal Forms, listed below are easy directions for you to follow:

- Initially, make sure you have chosen the right type to your city/state. You may look over the shape making use of the Review key and study the shape information to ensure it is the right one for you.

- In the event the type is not going to meet up with your needs, use the Seach area to get the proper type.

- When you are positive that the shape is acceptable, click the Purchase now key to obtain the type.

- Choose the pricing prepare you would like and enter in the required information and facts. Make your bank account and pay money for an order with your PayPal bank account or charge card.

- Opt for the data file formatting and obtain the legal record template to your product.

- Full, edit and printing and sign the obtained Guam Sample Letter to State Tax Commission concerning Decedent's Estate.

US Legal Forms will be the biggest local library of legal kinds for which you can find a variety of record themes. Utilize the company to obtain appropriately-made papers that follow status requirements.