Guam Buy Sell or Stock Purchase Agreement Covering Common Stock in Closely Held Corporation with Option to Fund Purchase through Life Insurance

Description

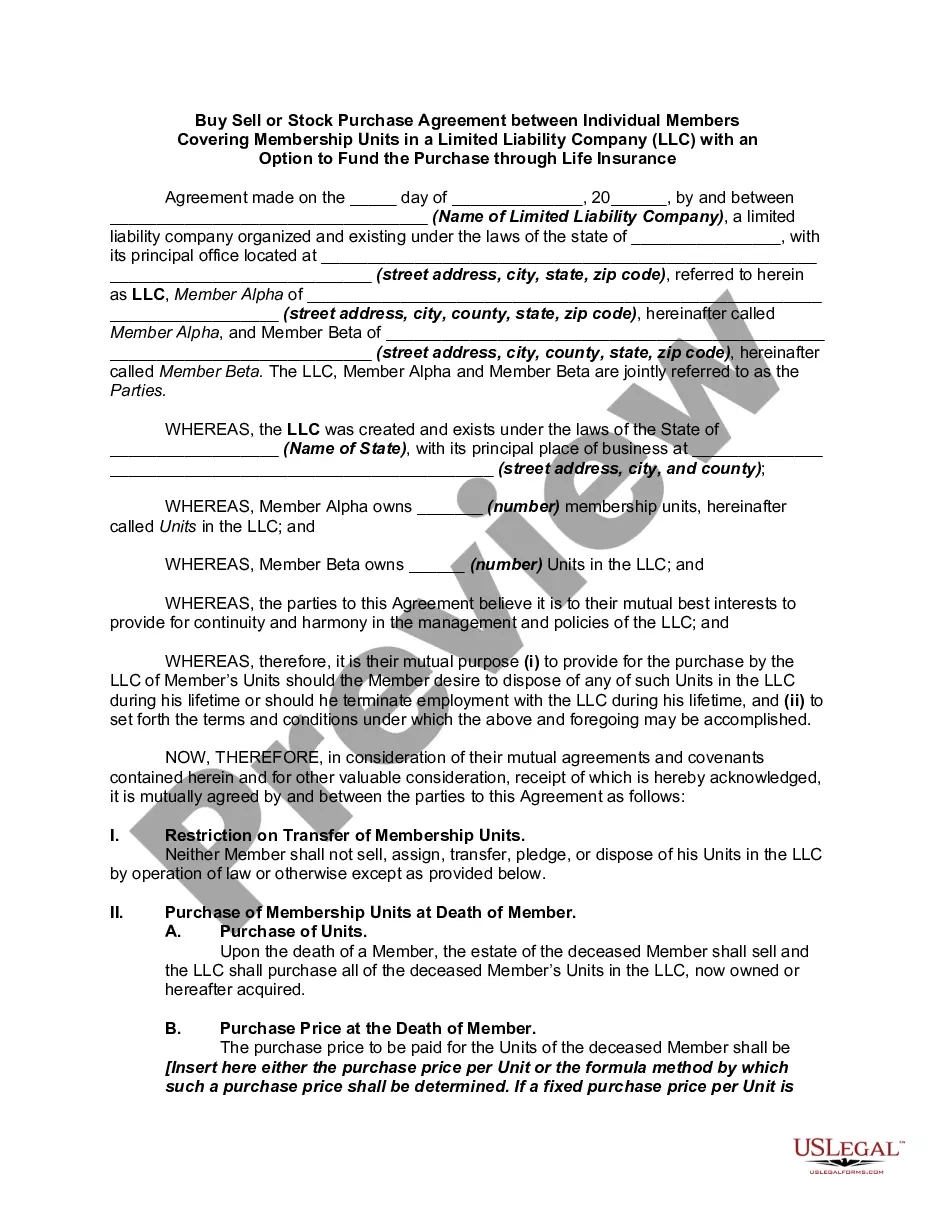

How to fill out Buy Sell Or Stock Purchase Agreement Covering Common Stock In Closely Held Corporation With Option To Fund Purchase Through Life Insurance?

Locating the appropriate legal document template can be a challenge. Indeed, there are numerous templates accessible online, but how do you identify the legal form you require? Utilize the US Legal Forms website. The platform offers thousands of templates, such as the Guam Buy Sell or Stock Purchase Agreement Covering Common Stock in Closely Held Corporation with Option to Fund Purchase through Life Insurance, suitable for both business and personal purposes. All templates are reviewed by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Obtain button to locate the Guam Buy Sell or Stock Purchase Agreement Covering Common Stock in Closely Held Corporation with Option to Fund Purchase through Life Insurance. Use your account to browse through the legal forms you have purchased before. Head to the My documents section of your account and obtain another copy of the document you need.

If you are a new user of US Legal Forms, here are simple steps to follow: Firstly, ensure that you have selected the correct form for your city/county. You can review the form using the Review button and examine the form details to confirm this is the right one for you. If the form does not meet your requirements, utilize the Search area to find the suitable form. Once you are confident that the form is appropriate, click on the Get now button to retrieve the form. Choose the pricing plan you want and input the required information. Create your account and complete the transaction using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, modify, print, and sign the obtained Guam Buy Sell or Stock Purchase Agreement Covering Common Stock in Closely Held Corporation with Option to Fund Purchase through Life Insurance.

US Legal Forms is the largest repository of legal forms where you can find a variety of document templates. Leverage the service to download professionally created paperwork that comply with state requirements.

Form popularity

FAQ

Most often, the buy and sell agreement stipulates that the available share be sold to the remaining partners or to the partnership. The buy and sell agreement is also known as a buy-sell agreement, a buyout agreement, a business will, or a business prenup.

Establish a market for the corporation's stock that might otherwise be difficult to sell; Ensure that the ownership of the business remains with individuals selected by the owners or remains closely held; Provide liquidity to the estate of a deceased shareholder to pay estate taxes and costs; and.

There are four common buyout structures:Traditional cross purchase plan. Each owner who is left in the business agrees to purchase the co-owner's shares if that individual dies or leaves the business.Entity redemption plan.One-way buy sell plan.Wait-and-see buy sell plan.

The two most-common buy and sell agreements are cross-purchase, and redemption; some agreements will combine the two. Cross-purchase agreements allow remaining owners to buy the interests of a deceased or selling owner. Redemption agreements require the business entity to buy the interests of the selling owner.

What is a Buy-Sell Agreement? Buy-sell agreements, also called buyout agreements and shareholder agreements, are legally binding documents between two business partners that govern how business interests are treated if one partner leaves unexpectedly.

The four types of buy sell agreements are:Cross-purchase agreement.Entity purchase agreement.Wait-and-See.Business-continuation general partnership.

Here is how buy-sell agreements work:Determine which events invoke a triggered buyout.Establish who has rights and purchase obligations.Identify the names and address of the purchasers.Set a purchase price or valuation with applicable discounts.Establish payment terms as well as their intervals.More items...

The two most common types of buy-sell agreements are entity-purchase and cross-purchase agreements.

Key Elements of a Good Buy-Sell AgreementValuation Clause. Your agreement should include detailed information about your business' worth.Identity the Parties. To have a valid buy-sell contract, you need an agreement from at least two parties.Identify Qualifying Events.Tax Considerations.31-Aug-2017