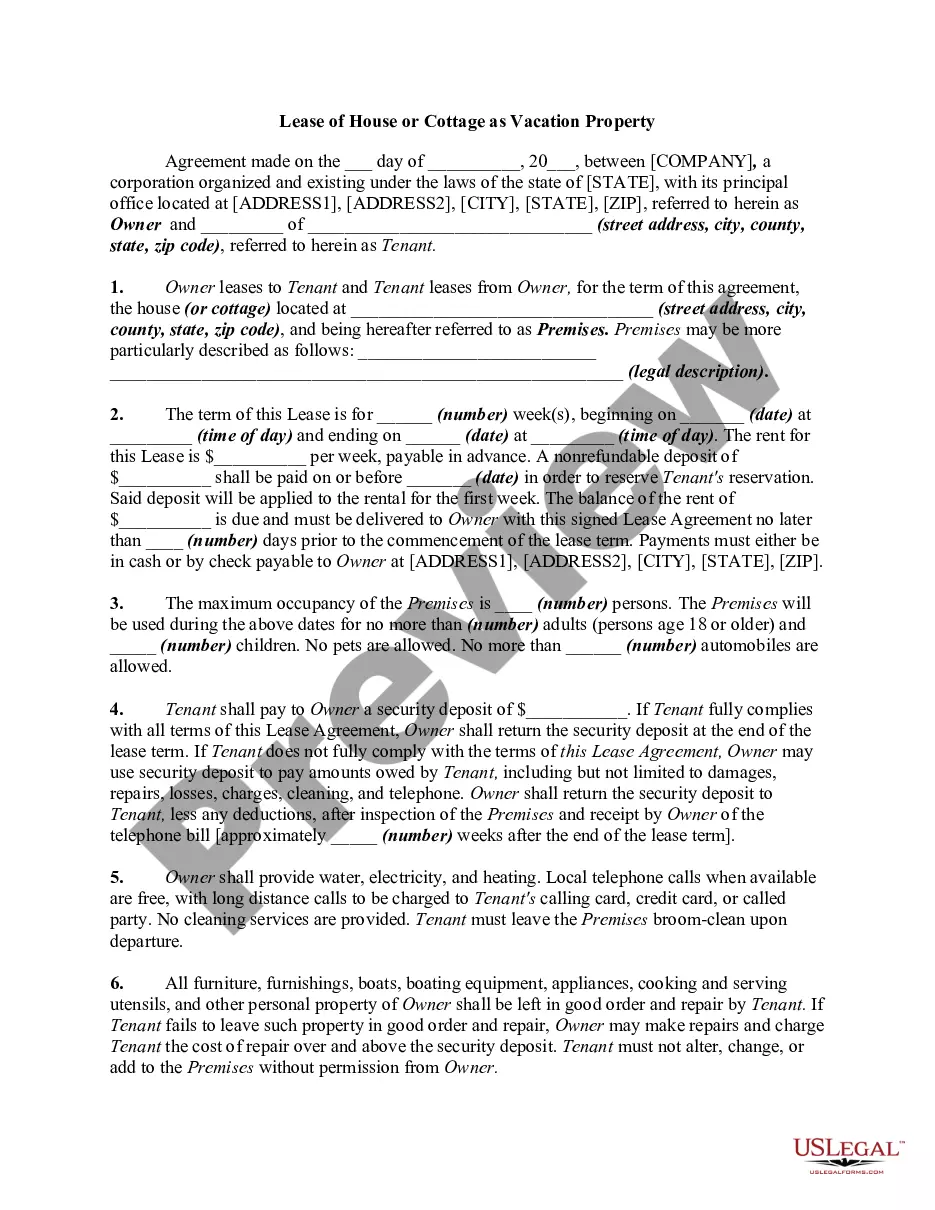

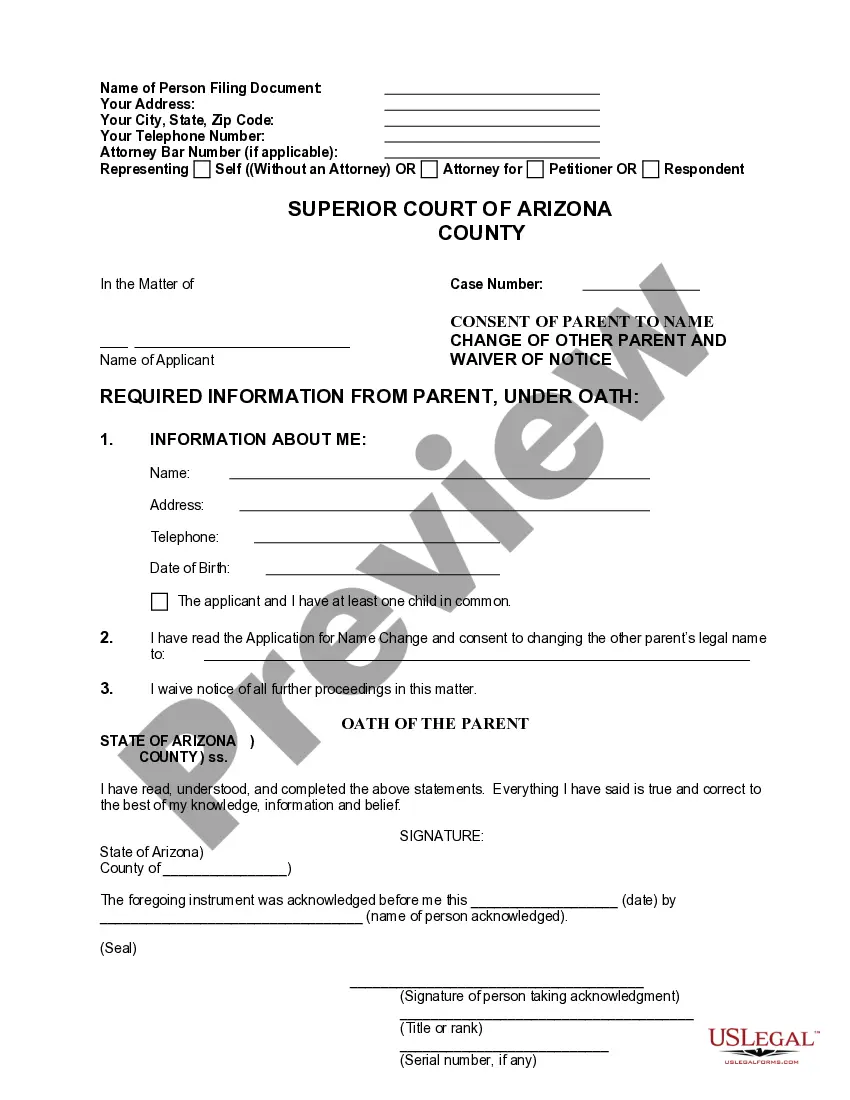

Subject: Payment Submission to Guam State Tax Commission Dear Guam State Tax Commission, I hope this letter finds you well. I am writing to submit my payment for the tax liabilities incurred in the state of Guam. In order to comply with my obligations, I have enclosed the necessary payment along with this letter. Firstly, I would like to express my gratitude to the Guam State Tax Commission for providing a streamlined and efficient tax payment system. Your commitment to facilitating a seamless tax payment process makes it easier for taxpayers like me to fulfill our responsibilities promptly. I am aware that Guam imposes various types of taxes, including income tax, property tax, sales tax, and business privilege tax. As an avid contributor to Guam's progress and development, I ensure my compliance with all relevant tax regulations. Enclosed with this letter, you will find a check/money order/bank draft payment in the amount of [insert amount] to settle my tax liability for the tax year [insert applicable year]. I have carefully reviewed my tax return forms and have calculated the exact amount owed based on the information provided. Moreover, please find attached all the necessary documentation required to support the accuracy of my tax payment, including copies of tax return forms, schedules, and any additional supporting documents. To ensure proper allocation of the payment, kindly credit the full amount to the appropriate tax account associated with my taxpayer identification number [insert TIN]. I kindly request you to update my records accordingly and issue a receipt as evidence of payment. Should there be any discrepancies or further information required, kindly contact me at [insert contact information], or by email at [insert email address]. I am more than willing to cooperate and provide any additional information that might be necessary to resolve the matter promptly. Once again, I commend the Guam State Tax Commission for its commitment to empowering taxpayers and facilitating efficient tax administration. Your dedication and professionalism ensure the continued growth and prosperity of both individuals and the state of Guam. Thank you for your prompt attention to this matter. I appreciate your time and consideration. Yours sincerely, [Your Full Name] [Your Address] [City, State, ZIP Code] [Phone number] [Email address] Keywords: Guam, State Tax Commission, payment submission, tax liabilities, income tax, property tax, sales tax, business privilege tax, taxpayer, tax return forms, check, money order, bank draft, tax year, documentation, supporting documents, taxpayer identification number, TIN, receipt, contact information, email address, tax administration, compliance.

Guam Sample Letter to State Tax Commission sending Payment

Description

How to fill out Guam Sample Letter To State Tax Commission Sending Payment?

US Legal Forms - one of many biggest libraries of lawful kinds in the USA - gives a wide range of lawful papers layouts it is possible to acquire or printing. Using the internet site, you can find a large number of kinds for organization and personal purposes, sorted by groups, states, or keywords and phrases.You will find the most up-to-date variations of kinds such as the Guam Sample Letter to State Tax Commission sending Payment in seconds.

If you already have a membership, log in and acquire Guam Sample Letter to State Tax Commission sending Payment through the US Legal Forms library. The Obtain switch will appear on each form you see. You have access to all formerly downloaded kinds inside the My Forms tab of your accounts.

If you want to use US Legal Forms the first time, listed below are simple directions to get you started:

- Ensure you have selected the best form to your town/area. Go through the Review switch to check the form`s content. Read the form explanation to ensure that you have chosen the right form.

- When the form doesn`t match your needs, utilize the Search area near the top of the display to find the the one that does.

- Should you be content with the shape, confirm your choice by simply clicking the Get now switch. Then, opt for the costs strategy you like and offer your credentials to sign up for the accounts.

- Approach the purchase. Make use of credit card or PayPal accounts to perform the purchase.

- Select the file format and acquire the shape on your own gadget.

- Make alterations. Fill up, revise and printing and indication the downloaded Guam Sample Letter to State Tax Commission sending Payment.

Each format you added to your account lacks an expiration time and is also yours for a long time. So, if you want to acquire or printing one more version, just proceed to the My Forms segment and click on around the form you want.

Get access to the Guam Sample Letter to State Tax Commission sending Payment with US Legal Forms, probably the most considerable library of lawful papers layouts. Use a large number of expert and condition-particular layouts that satisfy your business or personal requirements and needs.