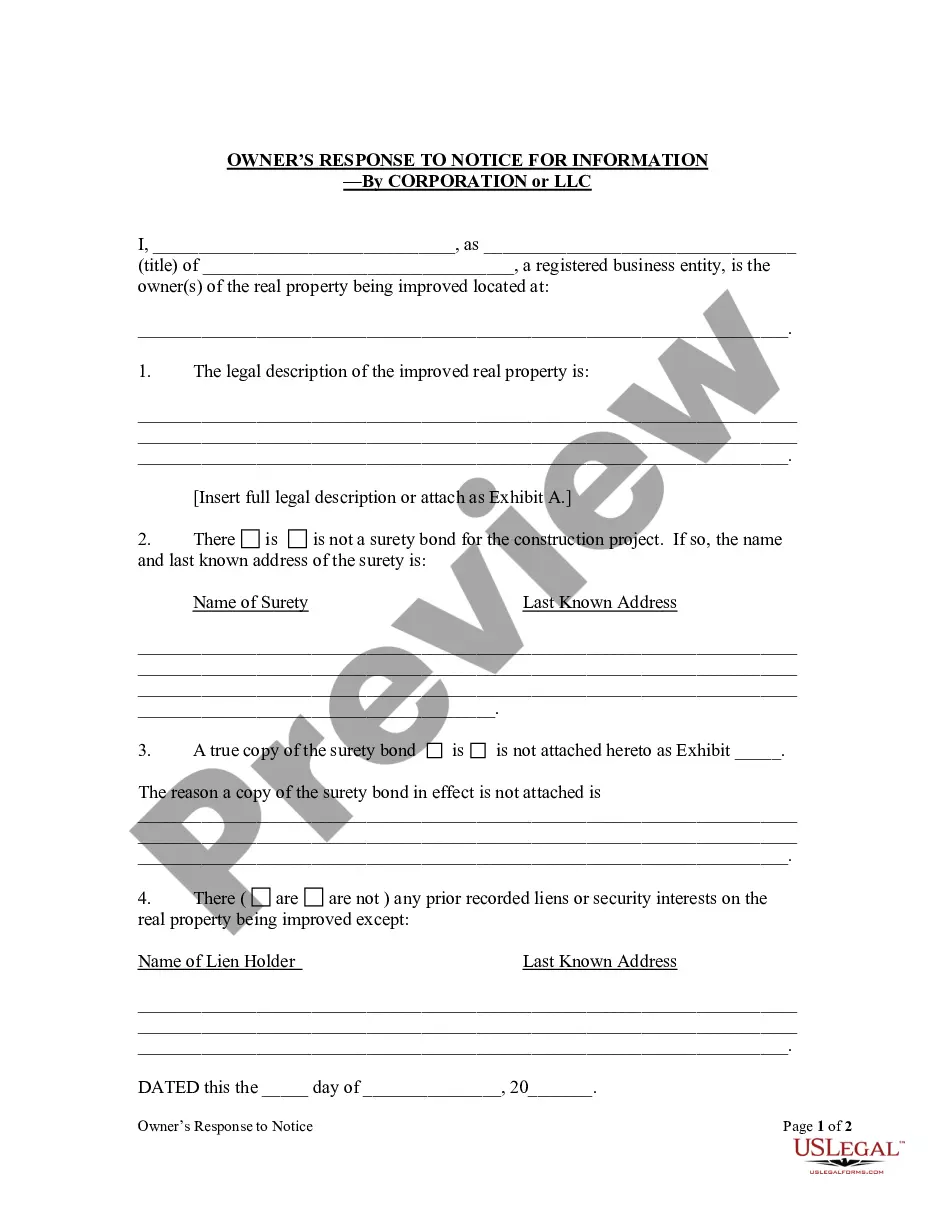

Agency is a relationship based on an agreement authorizing one person, the agent, to act for another, the principal. An agency can be created for the purpose of doing almost any act the principal could do. In this form, a person is being given the authority to collect money for a corporation, the principal.

Guam Notice to Debtor of Authority of Agent to Receive Payment

Description

How to fill out Notice To Debtor Of Authority Of Agent To Receive Payment?

If you need to acquire, procure, or print legal document templates, utilize US Legal Forms, the largest assortment of legal forms available on the web.

Take advantage of the site's straightforward and user-friendly search to locate the documents you require.

Numerous templates for business and personal purposes are organized by categories and states, or keywords.

Step 3. If you are not satisfied with the form, utilize the Search area at the top of the screen to find alternative versions of the legal form template.

Step 4. Once you have found the form you need, click on the Get now option. Choose the pricing plan you prefer and enter your details to register for the account.

- Utilize US Legal Forms to obtain the Guam Notice to Debtor of Authority of Agent to Receive Payment with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and select the Obtain option to find the Guam Notice to Debtor of Authority of Agent to Receive Payment.

- You can also access forms you previously obtained in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Use the Preview feature to examine the content of the form. Remember to read the description.

Form popularity

FAQ

Yes, if you earn income in Guam, you generally must file a Guam tax return. This requirement applies even if you live outside of Guam for part of the year. It’s essential to be aware of this obligation, especially when navigating financial transactions like the Guam Notice to Debtor of Authority of Agent to Receive Payment.

The W-1 form serves as a means for taxpayers in Guam to report their income and determine the credit available to them. It helps ensure that residents fulfill their tax responsibilities while acknowledging the unique tax system in Guam. Understanding its importance is crucial, especially when dealing with a Guam Notice to Debtor of Authority of Agent to Receive Payment.

Yes, Guam is considered a territory of the United States for tax purposes. Residents of Guam have a tax system that is closely aligned with federal tax laws, but there are distinct features that you should understand. When dealing with financial obligations, such as the Guam Notice to Debtor of Authority of Agent to Receive Payment, knowing your tax status in Guam is essential for proper compliance.

To contact Guam Revenue and Taxation via email, you can visit their official website for the correct email addresses based on your inquiry type. They greatly encourage digital communication for tax-related matters, making it more efficient for you as a user. When discussing the Guam Notice to Debtor of Authority of Agent to Receive Payment, email can provide a clear line of communication.

The GRT in Guam varies depending on the nature of the business activity, but it typically ranges from 4% to 5%. It's essential to check the specific rate that applies to your situation for accurate calculations. If you are addressing the Guam Notice to Debtor of Authority of Agent to Receive Payment, knowing the GRT is key for proper financial management.

Yes, you can file your Guam tax online through the Department of Revenue and Taxation’s website. Online filing offers convenience and helps ensure that your documentation is submitted smoothly and efficiently. When dealing with the Guam Notice to Debtor of Authority of Agent to Receive Payment, utilizing online services can streamline your tax responsibilities.

The sales tax rate in Guam currently stands at 4%. This tax is applied to a wide range of goods and services sold within the territory. If you’re navigating financial transactions related to the Guam Notice to Debtor of Authority of Agent to Receive Payment, knowing the sales tax will assist in accurate budgeting.

To file GRT tax in Guam, you will need to gather your gross receipts and complete the appropriate tax forms. It is important to submit your filing by the designated deadlines to avoid penalties. The Guam Notice to Debtor of Authority of Agent to Receive Payment might also be part of your documentation, ensuring that all financial aspects are covered legally.

1 Guam is a tax form used to report income and withholding for residents and businesses in Guam. It plays an essential role in the local tax system and helps individuals and corporations keep accurate records. If you’re dealing with the Guam Notice to Debtor of Authority of Agent to Receive Payment, understanding 1 Guam can aid in managing tax obligations effectively.

The GRT rate, or Gross Receipts Tax rate, refers to the tax applied to the total revenue received by businesses in Guam. This tax is important for ensuring compliance and accountability within the local economy. If you are a debtor aware of the Guam Notice to Debtor of Authority of Agent to Receive Payment, it might be useful to understand how GRT impacts financial responsibilities.