Guam Financial Statement Form - Universal Use

Description

How to fill out Financial Statement Form - Universal Use?

If you intend to compile, acquire, or generate valid document templates, utilize US Legal Forms, the most extensive selection of valid forms available online.

Take advantage of the site's straightforward and convenient search to locate the documents you desire.

Numerous templates for business and personal use are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Buy now button. Select your preferred payment plan and enter your information to register for an account.

Step 5. Complete the purchase process. You can use your credit card or PayPal account to finalize the transaction.

- Utilize US Legal Forms to retrieve the Guam Financial Statement Form - Universal Use in just a couple of clicks.

- If you are already a US Legal Forms member, sign in to your account and click the Download button to obtain the Guam Financial Statement Form - Universal Use.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Confirm you have selected the correct form for your area/region.

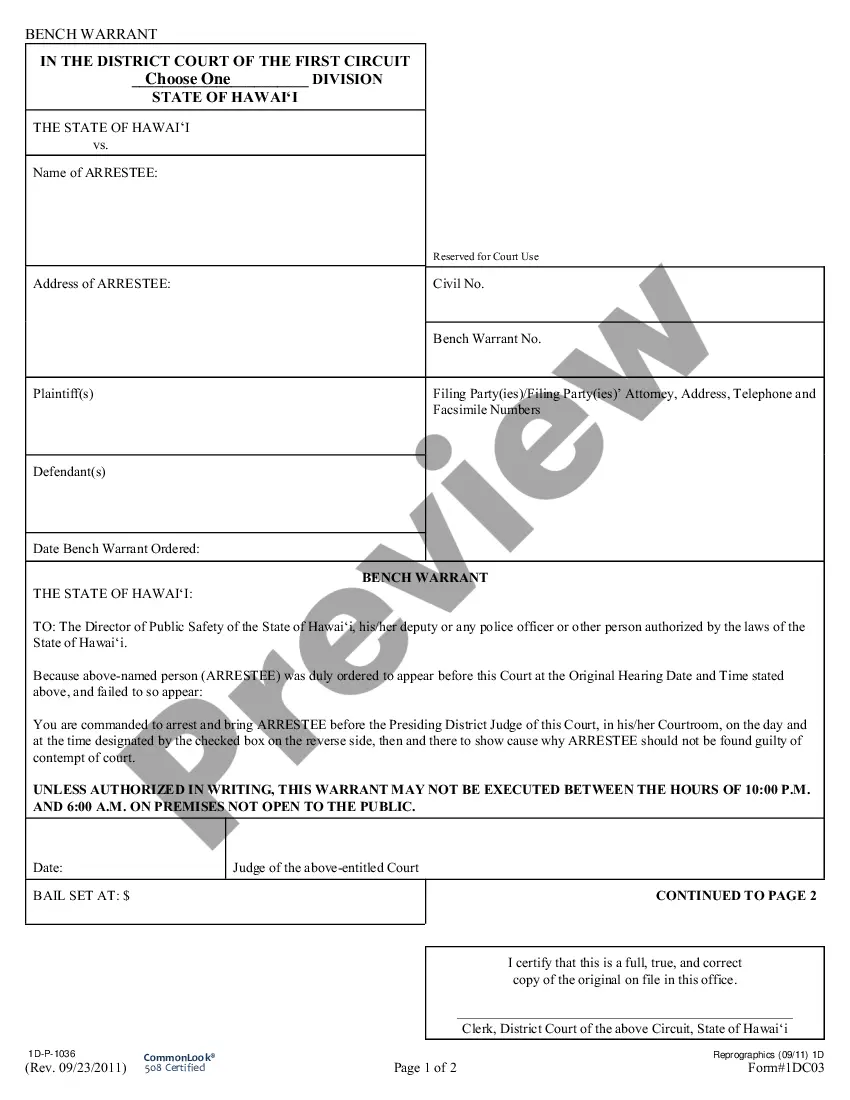

- Step 2. Use the Review option to inspect the form's content. Don't forget to check the outline.

- Step 3. If you are unsatisfied with the form, utilize the Search field at the top of the screen to find alternative versions of the valid form template.

Form popularity

FAQ

Yes, you can file your Guam tax online, making it a convenient option for residents. Many platforms, including uslegalforms, offer electronic filing solutions to streamline this process. Using the Guam Financial Statement Form - Universal Use ensures you meet all necessary requirements while filing efficiently.

Guam residents must file both Guam and federal US tax returns if they have income subject to these taxes. The process can seem complex, but the Guam Financial Statement Form - Universal Use is designed to help individuals understand and comply with their filing obligations across both tax systems.

Yes, Guam has its own tax system and residents are required to file taxes similar to those in the mainland US. The Guam government collects income taxes, sales taxes, and other levies. To facilitate your tax filing, consider applying the Guam Financial Statement Form - Universal Use to ensure accuracy.

Guam is classified as an unincorporated territory of the United States. This status grants it certain rights and responsibilities under US law. If you reside in Guam, using the Guam Financial Statement Form - Universal Use can assist you in understanding your financial reporting requirements.

Yes, Guam is considered a US territory for tax purposes. This means that residents and businesses in Guam must adhere to US tax laws, despite its unique status. The Guam Financial Statement Form - Universal Use can streamline the filing process for those navigating these regulations.

Foreigners may need to file US tax returns depending on their income sources. If they earn income from US sources, including Guam, they must report this to the IRS. To navigate these requirements, the Guam Financial Statement Form - Universal Use can help clarify their financial obligations.

The W-1 Guam form is a critical document for income reporting purposes in Guam. It serves as a means for individuals and businesses to provide a comprehensive financial overview. To engage with this requirement effectively, consider using the Guam Financial Statement Form - Universal Use, which simplifies the process and ensures compliance.

You are required to file a Guam tax return if you reside in Guam or earn income from Guam sources. This applies to both full-time residents and temporary workers. By leveraging the Guam Financial Statement Form - Universal Use, you can easily comply with the filing requirements and maximize your tax benefits.

Anyone earning income above a certain threshold in Guam holds the obligation to file a tax return. This requirement includes self-employed individuals and businesses. Utilizing the Guam Financial Statement Form - Universal Use simplifies the filing process, ensuring you meet all necessary regulations.

If you have generated income within Guam during the tax year, you likely need to file a Guam tax return. This requirement applies whether you are a resident or a non-resident. The Guam Financial Statement Form - Universal Use can help you understand your filing obligations, making the process clear and straightforward.