Title: Unveiling the Essence of Guam Complaints regarding Group Insurance Contracts: Types and Detailed Descriptions Introduction: Guam's Group Insurance Contracts play an integral role in safeguarding the health and well-being of individuals and organizations. However, complaints regarding these contracts can arise, raising concerns regarding policy terms, coverage, claim processes, and more. This article dives deep into the various types of Guam Complaints regarding Group Insurance Contracts, shedding light on their nature and providing a detailed description. 1. Coverage Limitation Complaints: These complaints arise when policyholders feel that the group insurance contract restricts coverage for specific medical procedures, therapies, medications, or treatments. The complainants may argue that the limitations imposed on coverage hinder their access to essential services, leading to dissatisfaction and financial strain. 2. Claim Denial Complaints: Claim denial complaints occur when policyholders' submitted claims are rejected by the insurance provider. Such complaints may stem from alleged inadequacies in the claims process, discrepancies in policy interpretation, or issues with medical necessity determinations. Complainants may argue that legitimate claims are being unfairly declined, thereby creating frustration and financial burden. 3. Premium Increase Complaints: Policyholders may raise complaints about substantial premium increases within their group insurance contracts. These grievances become pertinent when individuals or organizations experience sudden and unexplained spikes in premiums, straining their financial capabilities. Complaints may focus on the perceived lack of transparency, inadequacy of communication, or unreasonable premium hikes. 4. Network Limitation Complaints: Group insurance contracts often specify a network of approved healthcare providers. Network limitation complaints arise when policyholders feel that the approved network is too restrictive, limiting their ability to seek care from their preferred healthcare professionals or facilities. Frustrations may mount due to challenges in accessing specialized care or dissatisfaction with the available network options. 5. Policy Provision Complaints: Policy provision complaints involve grievances related to the contract's fine print. Complainants may argue that certain clauses or conditions within the group insurance contract are unfairly biased towards the insurance provider, leaving policyholders at a disadvantage. Common concerns include lack of clarity in language, ambiguous terms, or provisions that limit coverage without clear justification. 6. Communication and Service Complaints: This category includes complaints centered around poor customer service, lack of responsiveness from insurers, delays in claim processing, or inadequate communication regarding policy updates, changes, or notifications. Policyholders may express frustration with the insurance provider's inability to address concerns promptly, leading to dissatisfaction and a sense of negligence. Conclusion: Guam Complaints regarding Group Insurance Contracts encompass a broad array of concerns raised by policyholders. These complaints primarily revolve around coverage limitations, claim denial, premium increases, network restrictions, policy provisions, and communication/service issues. By acknowledging and addressing these complaints, insurers and regulatory bodies can work towards ensuring fair and transparent group insurance contracts that prioritize policyholders' needs while fostering trust and satisfaction.

Guam Complaint regarding Group Insurance Contract

Description

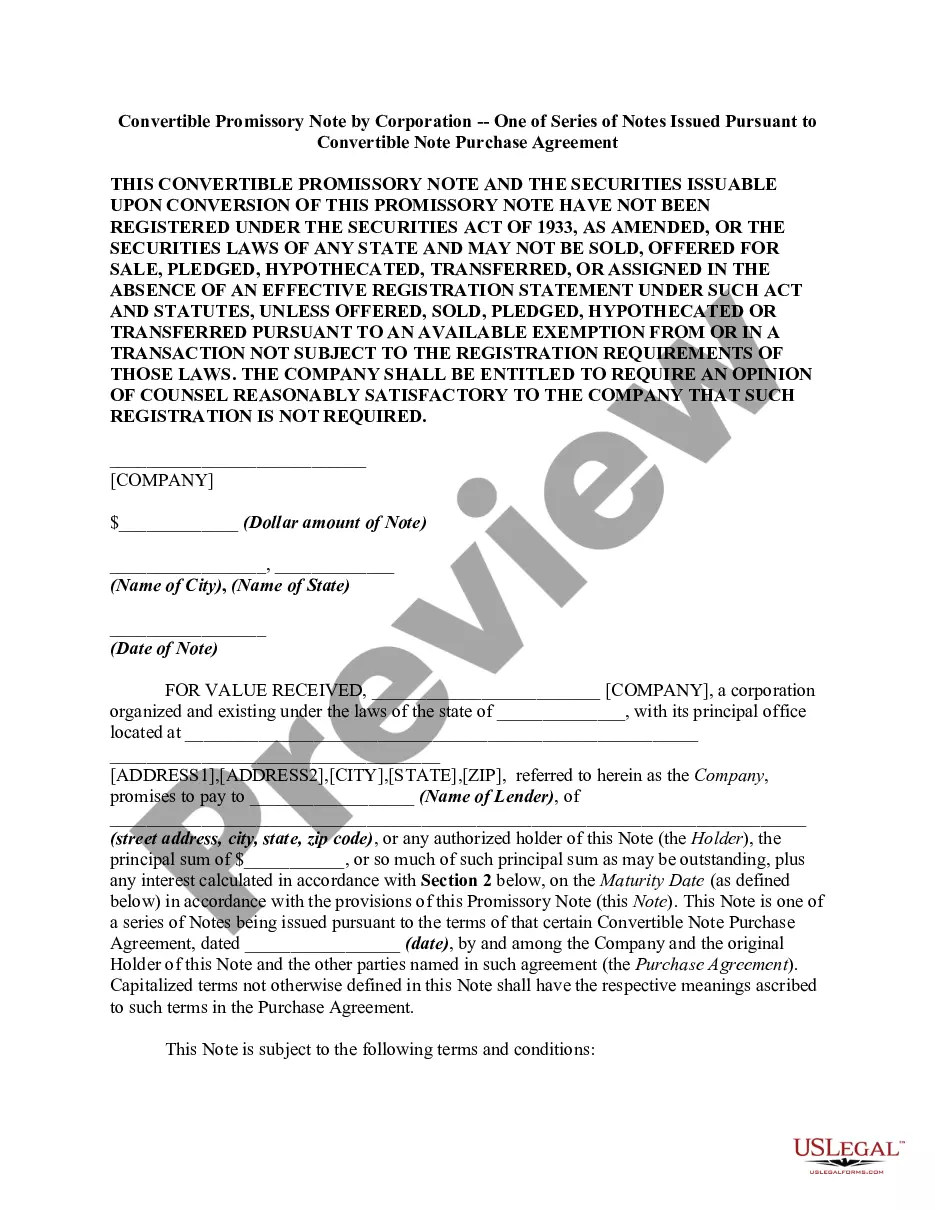

How to fill out Guam Complaint Regarding Group Insurance Contract?

You are able to spend hrs on-line attempting to find the lawful file design that suits the federal and state specifications you want. US Legal Forms provides thousands of lawful types that happen to be examined by pros. It is possible to obtain or printing the Guam Complaint regarding Group Insurance Contract from your support.

If you already have a US Legal Forms bank account, it is possible to log in and click on the Acquire option. Next, it is possible to comprehensive, modify, printing, or indicator the Guam Complaint regarding Group Insurance Contract. Each and every lawful file design you acquire is your own property permanently. To have one more backup of any obtained form, proceed to the My Forms tab and click on the corresponding option.

Should you use the US Legal Forms web site for the first time, follow the simple guidelines beneath:

- First, be sure that you have chosen the proper file design for your state/metropolis of your choosing. Look at the form explanation to ensure you have selected the right form. If accessible, use the Review option to appear throughout the file design too.

- If you wish to find one more variation of your form, use the Look for area to find the design that suits you and specifications.

- After you have identified the design you would like, simply click Buy now to proceed.

- Find the costs plan you would like, type your qualifications, and register for an account on US Legal Forms.

- Complete the transaction. You may use your Visa or Mastercard or PayPal bank account to cover the lawful form.

- Find the format of your file and obtain it in your device.

- Make modifications in your file if needed. You are able to comprehensive, modify and indicator and printing Guam Complaint regarding Group Insurance Contract.

Acquire and printing thousands of file themes utilizing the US Legal Forms Internet site, that offers the greatest assortment of lawful types. Use expert and state-particular themes to deal with your company or specific requirements.