Guam Lease Agreement - Office Space

Description

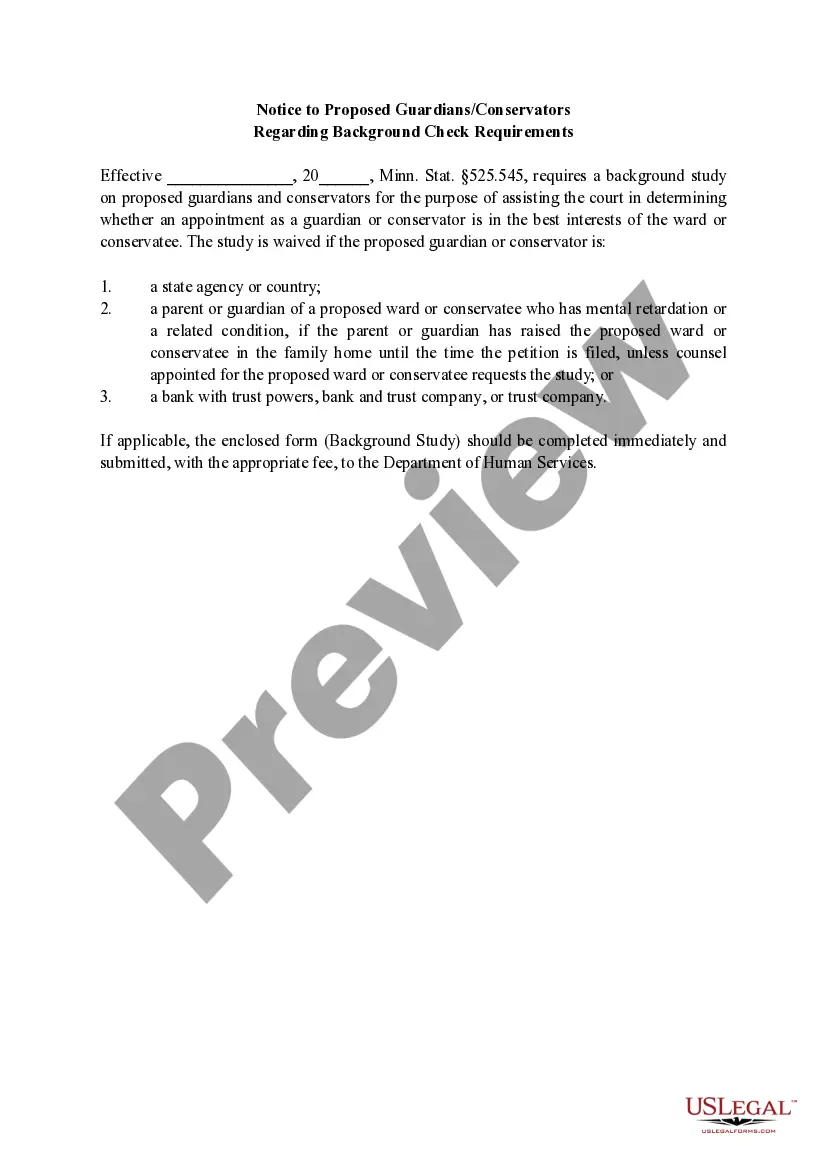

How to fill out Lease Agreement - Office Space?

If you need to acquire extensive, download, or create authentic document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the website's simple and user-friendly search to locate the documents you require.

Many templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. After locating the form you need, select the Buy now button. Choose the payment plan you prefer and enter your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finish the purchase.

- Utilize US Legal Forms to find the Guam Lease Agreement - Office Space in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to access the Guam Lease Agreement - Office Space.

- You can also retrieve forms you previously downloaded from the My documents tab in your account.

- If you are using US Legal Forms for the first time, refer to the instructions below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

- Step 2. Use the Review option to examine the content of the form. Don't forget to check the information.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find other versions of the legal form design.

Form popularity

FAQ

The most common commercial lease agreement is typically a gross lease, where the landlord covers various expenses such as property taxes, insurance, and maintenance. This arrangement allows tenants to budget more predictably by paying a fixed rent. Understanding these terms is essential when negotiating your Guam Lease Agreement - Office Space. Using professional resources can enhance your understanding and execution of the agreement.

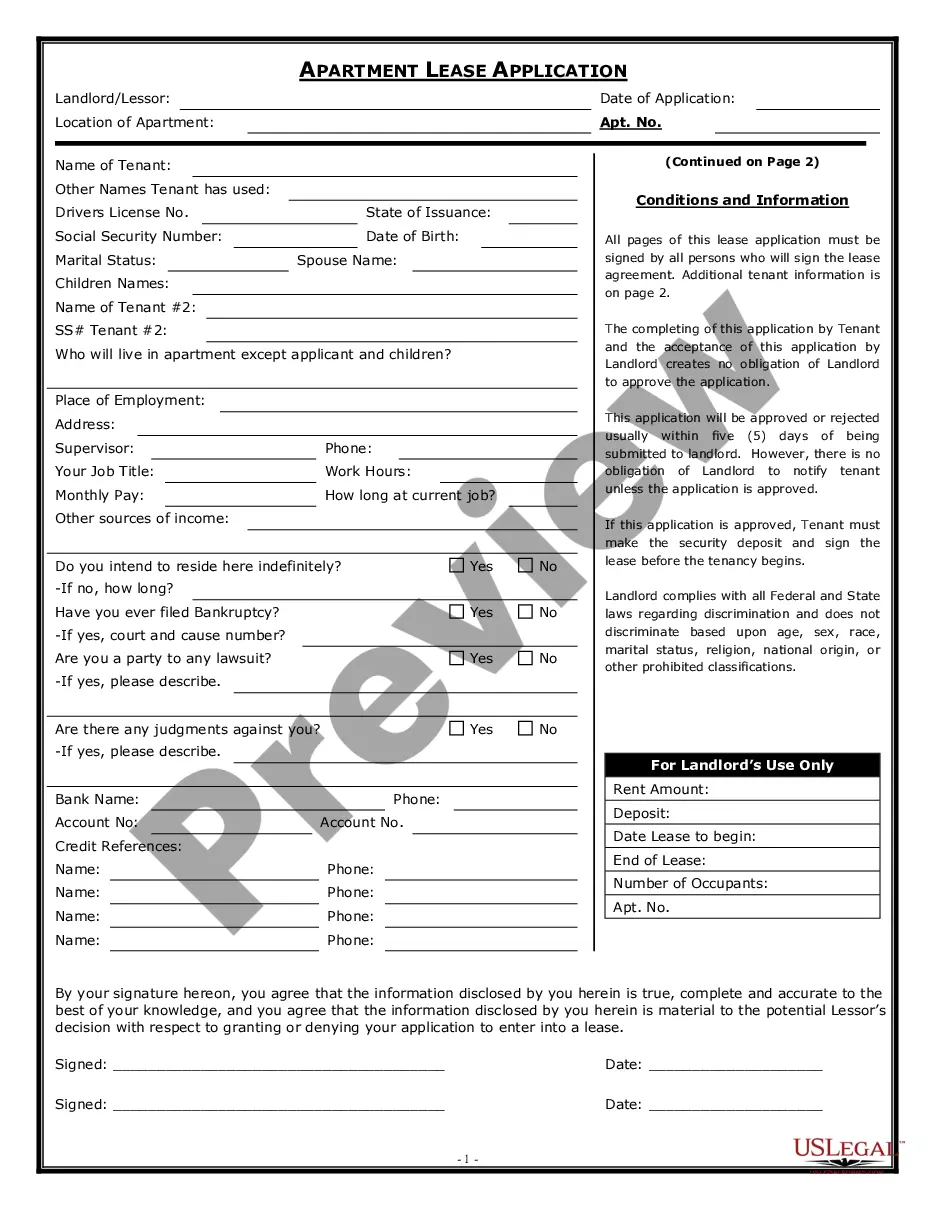

Writing a letter of intent for leasing commercial space involves a clear and concise presentation of your intent to occupy the space. Begin with your contact information and state your business's interest in the property. Include details such as proposed rental terms and reasons why the location suits your needs. For a professional touch, consider using US Legal Forms to create your Guam Lease Agreement - Office Space.

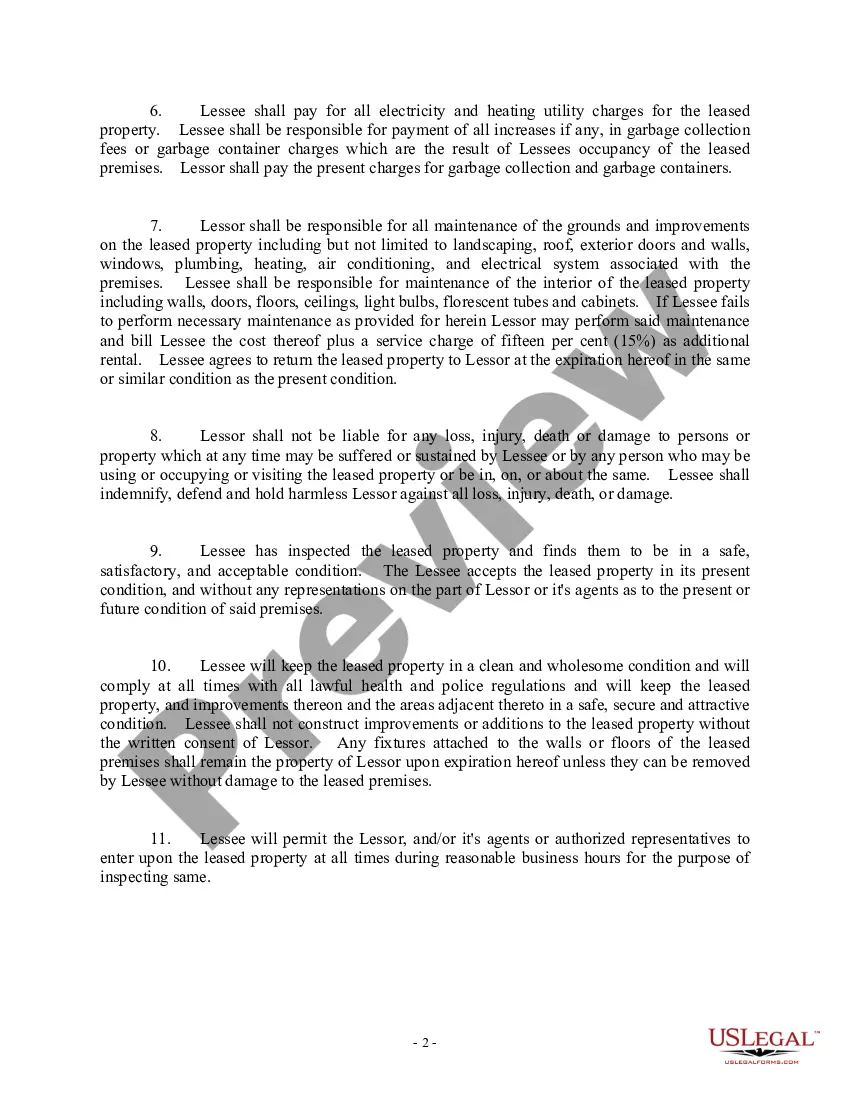

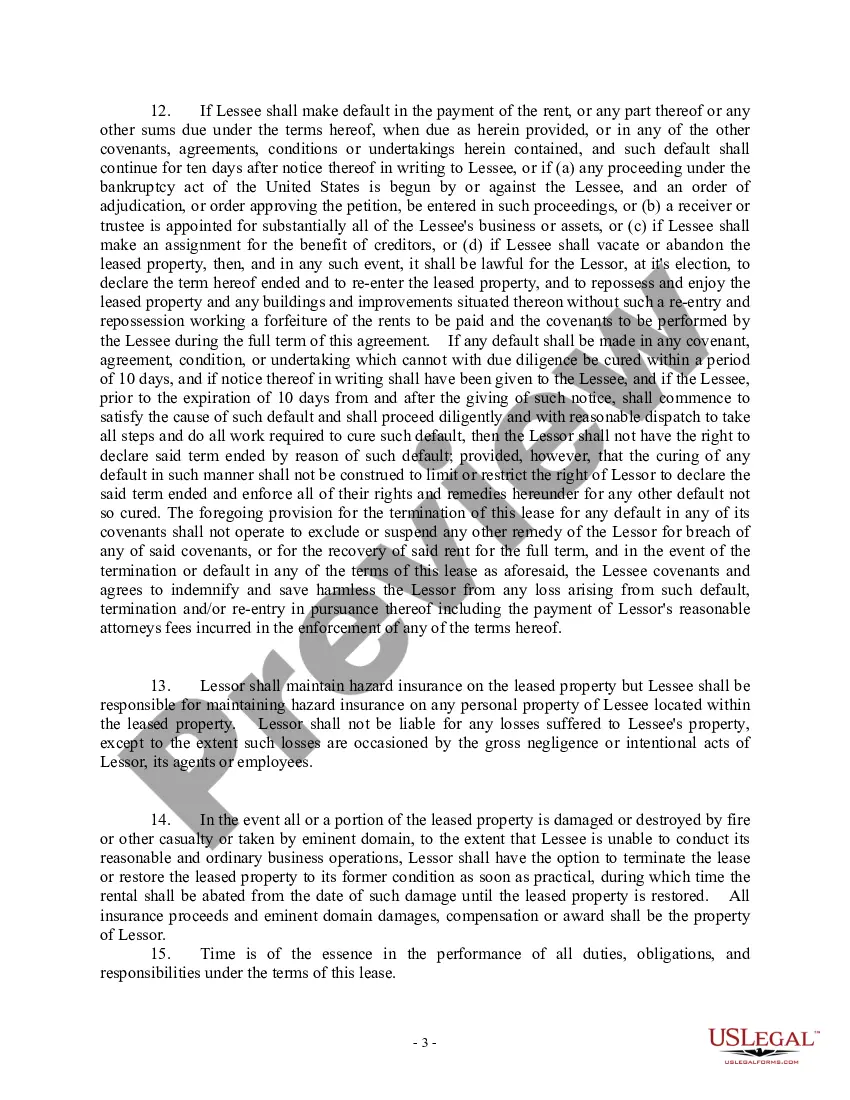

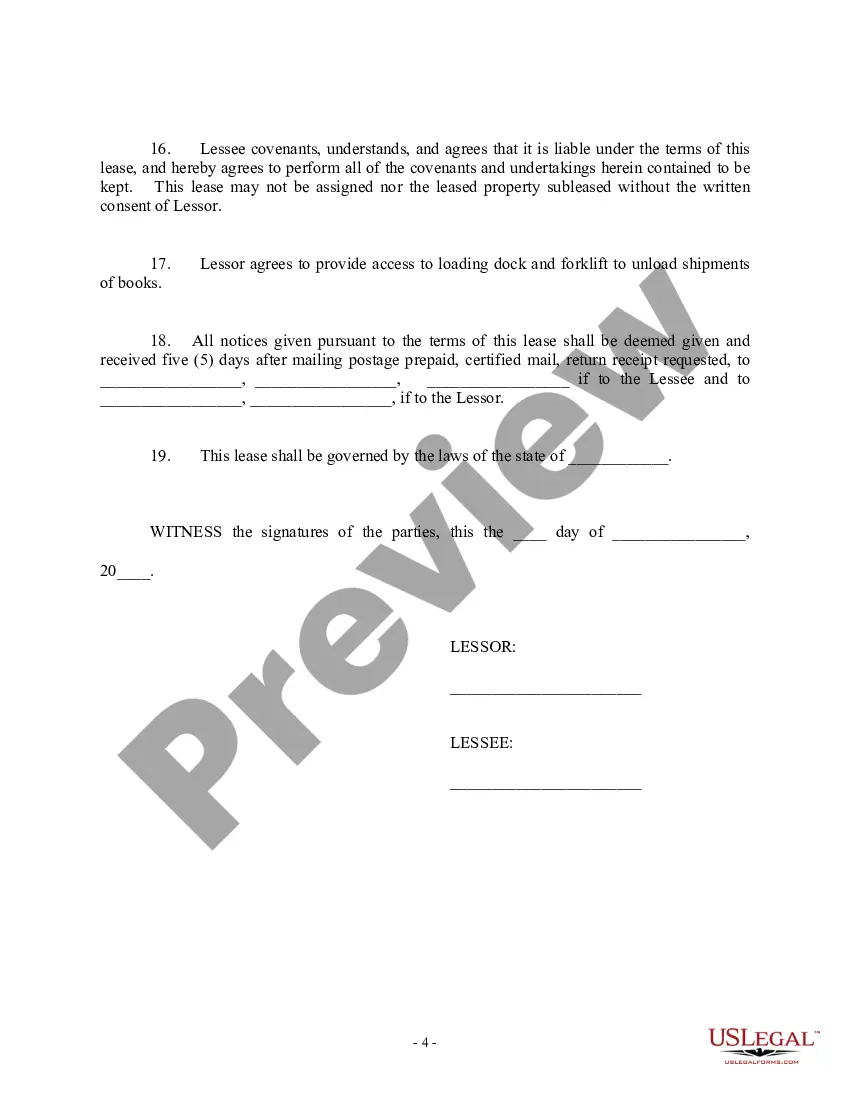

To fill out a commercial lease agreement, begin with the names and addresses of the lessor and lessee. Next, outline the terms, including the rent amount and duration. Don't forget to address any clauses concerning maintenance, utilities, and alterations to the property. Utilizing resources from US Legal Forms can simplify this process effectively for your Guam Lease Agreement - Office Space.

A comprehensive commercial lease agreement should cover several key components. These include the rental amount, length of the lease, maintenance responsibilities, and any renewal options. Additionally, make sure it addresses any specific rights and obligations for both parties. This ensures clarity and helps prevent disputes related to your Guam Lease Agreement - Office Space.

Filling out a commercial lease agreement is straightforward. Start by gathering the necessary details about the parties involved, the property, and the terms of the lease. Clearly state the rent amount, lease duration, and specific conditions. If needed, you can find helpful resources on US Legal Forms to guide you through creating your Guam Lease Agreement - Office Space.

Yes, you can write your own lease agreement for your office space in Guam. However, ensure you include all essential terms, such as duration, rent, and any rules regarding the use of the space. Consulting a legal expert is wise to ensure your Guam Lease Agreement - Office Space complies with local laws. For ease, consider using a reliable platform like US Legal Forms for templates.

Leasing commercial office space involves several steps, starting with identifying your ideal location and space requirements. Once you have a target area, research potential properties and negotiate terms with landlords. It is beneficial to consult a professional who can help draft a Guam Lease Agreement - Office Space that protects your interests and meets your business needs.

The most common lease types for offices include gross leases, net leases, and modified gross leases. Each has different structures for rent payments and maintenance responsibilities. For example, a gross lease typically includes all expenses within the rent, while net leases may require additional payments for taxes, insurance, and maintenance. When negotiating your Guam Lease Agreement - Office Space, it’s essential to choose the type that aligns with your business needs.

Yes, office space often falls under the category of operating leases. These leases allow businesses to lease office space without owning the property. They usually feature shorter durations and may include maintenance responsibilities for the landlord. If you're considering a Guam Lease Agreement - Office Space, thoroughly review the lease structure to understand your obligations.

A common lease term for an office lease is one to five years. This duration typically allows businesses to establish themselves without being tied down for too long. It's important to assess your business's growth plans when choosing your lease term. A Guam Lease Agreement - Office Space can help you secure the right duration for your needs.