Guam Charitable Remainder Inter Vivos Annuity Trust

Description

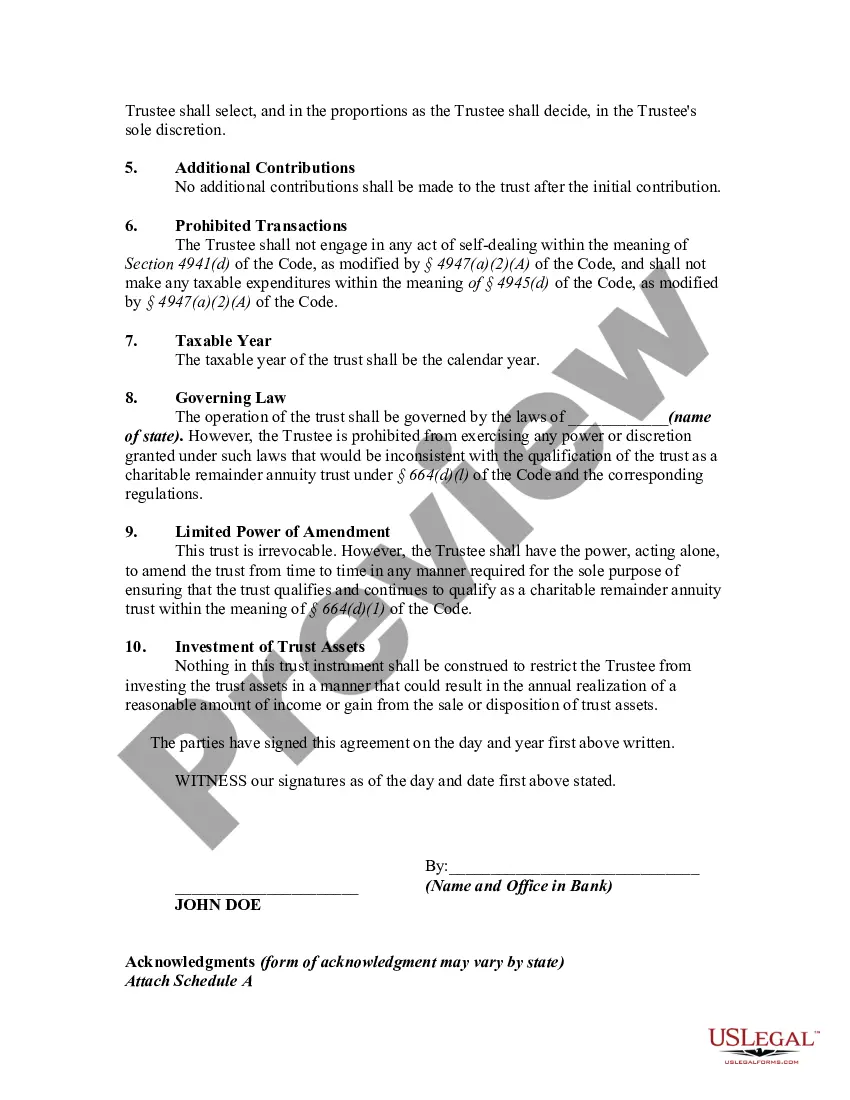

How to fill out Charitable Remainder Inter Vivos Annuity Trust?

US Legal Forms - one of the largest collections of legal templates in the United States - provides a vast selection of legal document templates that you can download or print.

By using the website, you can find thousands of forms for both business and personal use, organized by categories, states, or keywords. You can discover the most recent editions of forms such as the Guam Charitable Remainder Inter Vivos Annuity Trust in just a few moments.

If you have an account, Log In to download the Guam Charitable Remainder Inter Vivos Annuity Trust from the US Legal Forms collection. The Download button will be available for every form you view. You can access all previously saved forms from the My documents section of your account.

Select the format and download the form to your device.

Edit, fill out, print, and sign the saved Guam Charitable Remainder Inter Vivos Annuity Trust. Each template you add to your account does not expire and is yours indefinitely. Therefore, to download or print another copy, just go to the My documents section and click on the form you wish.

- Ensure you have selected the correct form for the city/state.

- Click on the Preview button to check the contents of the form.

- Review the form summary to ensure you have chosen the right one.

- If the form does not meet your needs, use the Search box at the top of the page to find another that does.

- If you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Proceed with the payment. Use your credit card or PayPal account to finalize the transaction.

Form popularity

FAQ

A Charitable Remainder Trust (CRT) and a Charitable Lead Trust (CLT) serve different purposes, particularly in the context of planning your Guam Charitable Remainder Inter Vivos Annuity Trust. A CRT provides income to the donor or beneficiaries for a set term before the remaining assets go to charity. Conversely, a CLT distributes income to charity for a period while the donor’s heirs receive the remainder. Understanding these distinctions allows for better estate planning.

The main form for reporting charitable trusts, including the Guam Charitable Remainder Inter Vivos Annuity Trust, is Form 5227. This form details the income and expenses associated with the trust, ensuring transparency and compliance with IRS regulations. It's essential to complete this form accurately to avoid potential issues with the IRS. You may consider using a reliable service like uslegalforms to simplify the process.

Yes, you can file Form 5227 electronically, which is especially convenient when managing your Guam Charitable Remainder Inter Vivos Annuity Trust. Electronic filing allows for quicker processing and reduces the chances of errors. By using an online platform, you can ensure that your information is submitted accurately and securely. Always check for the latest guidelines from the IRS to ensure compliance.

Yes, you can place an IRA into a Guam Charitable Remainder Inter Vivos Annuity Trust, but there are important considerations. When transferring an IRA to the trust, taxes may apply to the distributions, which could impact the overall benefits. It's essential to consult a tax professional to understand how this might affect your retirement funds and charitable goals. Additionally, using a reliable resource like uslegalforms can guide you through the complexities of this transaction.

If you find that a Guam Charitable Remainder Inter Vivos Annuity Trust doesn't meet your needs, there are alternative options available. One popular alternative is a charitable lead trust, where the charity receives income for a set period before passing the remaining assets to designated beneficiaries. Other options include direct donations to charities or establishing donor-advised funds, which offer more flexibility in charitable giving.

Although the Guam Charitable Remainder Inter Vivos Annuity Trust serves as a beneficial estate planning tool, it comes with disadvantages. Beneficiaries may face limited control over trust assets, making it challenging to adapt to changing financial circumstances. Furthermore, there may be regulatory constraints that complicate the trust structure, which could affect your long-term planning.

The 10 percent rule for a Guam Charitable Remainder Inter Vivos Annuity Trust states that the present value of the charitable remainder must be at least 10% of the total value of the trust's assets when you establish the trust. This rule ensures that a significant part of the trust assets benefits the designated charity after the beneficiaries receive their payments. Understanding this rule is crucial for effectively planning your charitable giving through a trust.

While a Guam Charitable Remainder Inter Vivos Annuity Trust provides tax benefits, there are disadvantages to consider. One major drawback is the potential loss of access to the assets you place into the trust, as they are committed to charitable purposes. Additionally, there may be administrative costs and complexities involved in setting up and maintaining the trust, which can be daunting for some individuals.

The main difference lies in the structure and benefits. A charitable gift annuity provides guaranteed payments to the donor for life, similar to the payments from a Guam Charitable Remainder Inter Vivos Annuity Trust, but it is simpler and requires less setup. The latter, however, potentially offers larger charitable deductions and handles multiple assets, allowing more sophisticated estate planning.

An example of a charitable remainder trust is the Guam Charitable Remainder Inter Vivos Annuity Trust. This might be established by an individual donating appreciated stocks while receiving a fixed income stream for a certain period. Upon the completion of the trust term, the remainder goes to a designated charity, fulfilling both a charitable intent and financial needs.