A Guam Sale of Business Noncom petitionon Agreement - Asset Purchase Transaction is a legal contract that outlines the terms and conditions for the sale of a business in Guam, a territory of the United States. This agreement includes provisions related to the transfer of assets, the noncom petition obligations of the seller, and the confidentiality of proprietary information. Keywords: Guam, Sale of Business, Noncom petition Agreement, Asset Purchase Transaction, legal contract, terms and conditions, transfer of assets, noncom petition obligations, confidentiality, proprietary information. Types of Guam Sale of Business Noncom petitionon Agreement - Asset Purchase Transaction: 1. Standard Asset Purchase Agreement: This type of agreement is the most common and comprehensive form used in Guam for the sale of a business. It includes provisions related to the purchase price, assets to be transferred, representations and warranties of both parties, and other standard terms and conditions. 2. Noncom petition Agreement: This agreement focuses primarily on the noncom petition obligations of the seller. It restricts the seller from engaging in similar business activities within a certain geographic area for a specified period of time. This agreement aims to protect the buyer's interests and prevent the seller from competing with the sold business. 3. Confidentiality Agreement: In some cases, a separate confidentiality agreement may be included as part of the sale of business transaction. This agreement ensures that any proprietary information, trade secrets, customer lists, and other sensitive data belonging to the business are not disclosed or used by the seller for their own benefit. 4. Specific Asset Purchase Agreement: This type of agreement focuses on the sale and purchase of specific assets or a specific division of a business, rather than the entire business itself. It outlines the particular assets being transferred, the associated liabilities, and other relevant terms. 5. Stock Purchase Agreement: While not specifically related to the sale of business assets, a stock purchase agreement may also be relevant in certain transactions. This type of agreement involves the sale or purchase of shares in a company, thereby transferring the ownership of the business. In conclusion, a Guam Sale of Business Noncom petitionon Agreement - Asset Purchase Transaction is a legally binding contract that governs the sale of a business in Guam. It covers the transfer of assets, noncom petition obligations, and may include separate agreements for confidentiality or specific asset purchases.

Guam Sale of Business - Noncompetition Agreement - Asset Purchase Transaction

Description

How to fill out Sale Of Business - Noncompetition Agreement - Asset Purchase Transaction?

US Legal Forms - one of the most prominent collections of legal documents in the United States - offers a variety of legal document templates that you can download or print.

By utilizing the website, you can access thousands of forms for business and personal purposes, sorted by categories, states, or keywords. You can retrieve the latest versions of forms such as the Guam Sale of Business - Noncompetition Agreement - Asset Purchase Transaction in moments.

If you have a monthly subscription, Log In to download the Guam Sale of Business - Noncompetition Agreement - Asset Purchase Transaction from the US Legal Forms catalog. The Download button will appear on every form you view. You can access all previously acquired forms in the My documents section of your account.

Process the transaction. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Make changes. Fill out, edit, print, and sign the downloaded Guam Sale of Business - Noncompetition Agreement - Asset Purchase Transaction. Every template added to your account does not expire and is yours permanently. So, to download or print another version, simply visit the My documents section and click on the form you want. Access the Guam Sale of Business - Noncompetition Agreement - Asset Purchase Transaction with US Legal Forms, the most comprehensive collection of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal requirements and specifications.

- Ensure you have selected the correct form for your city/region.

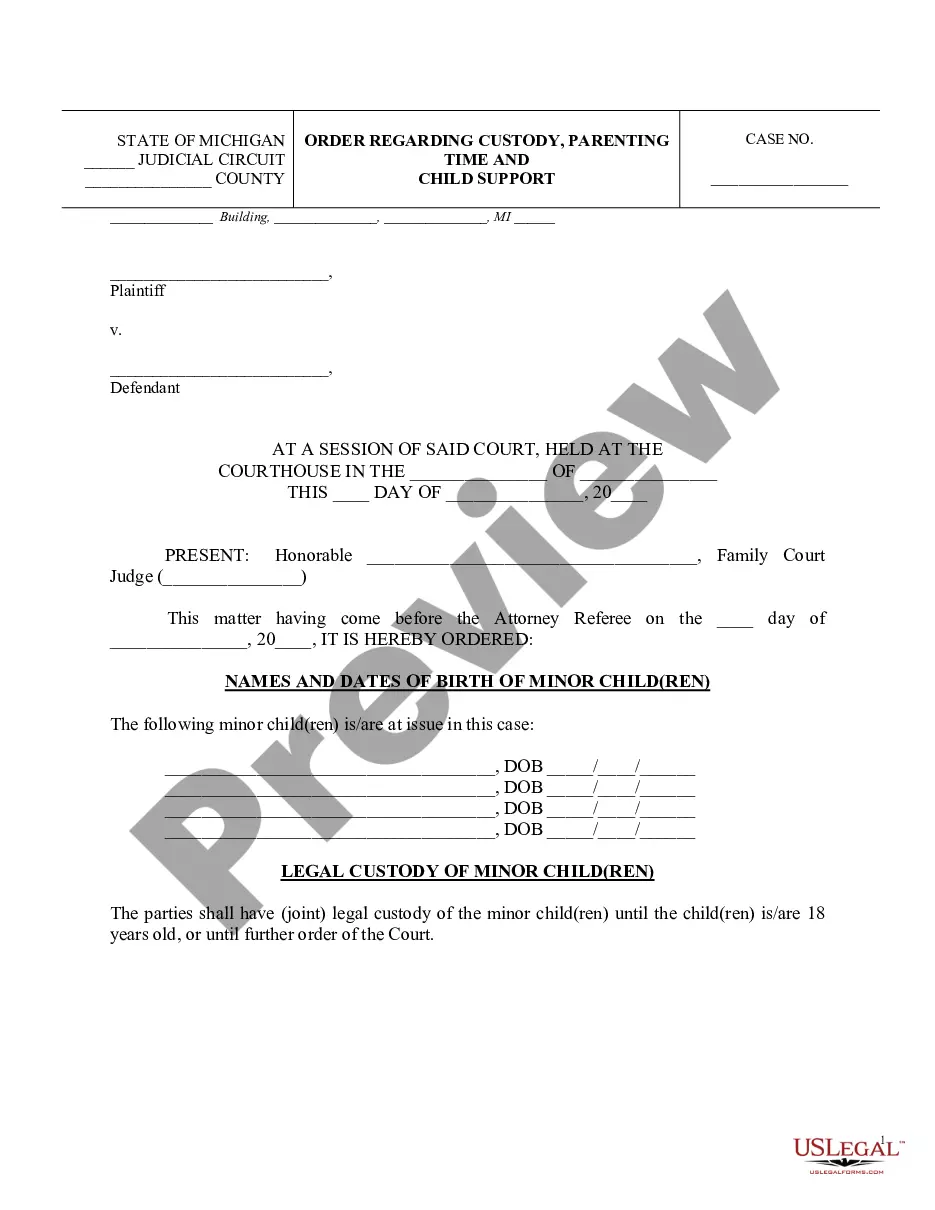

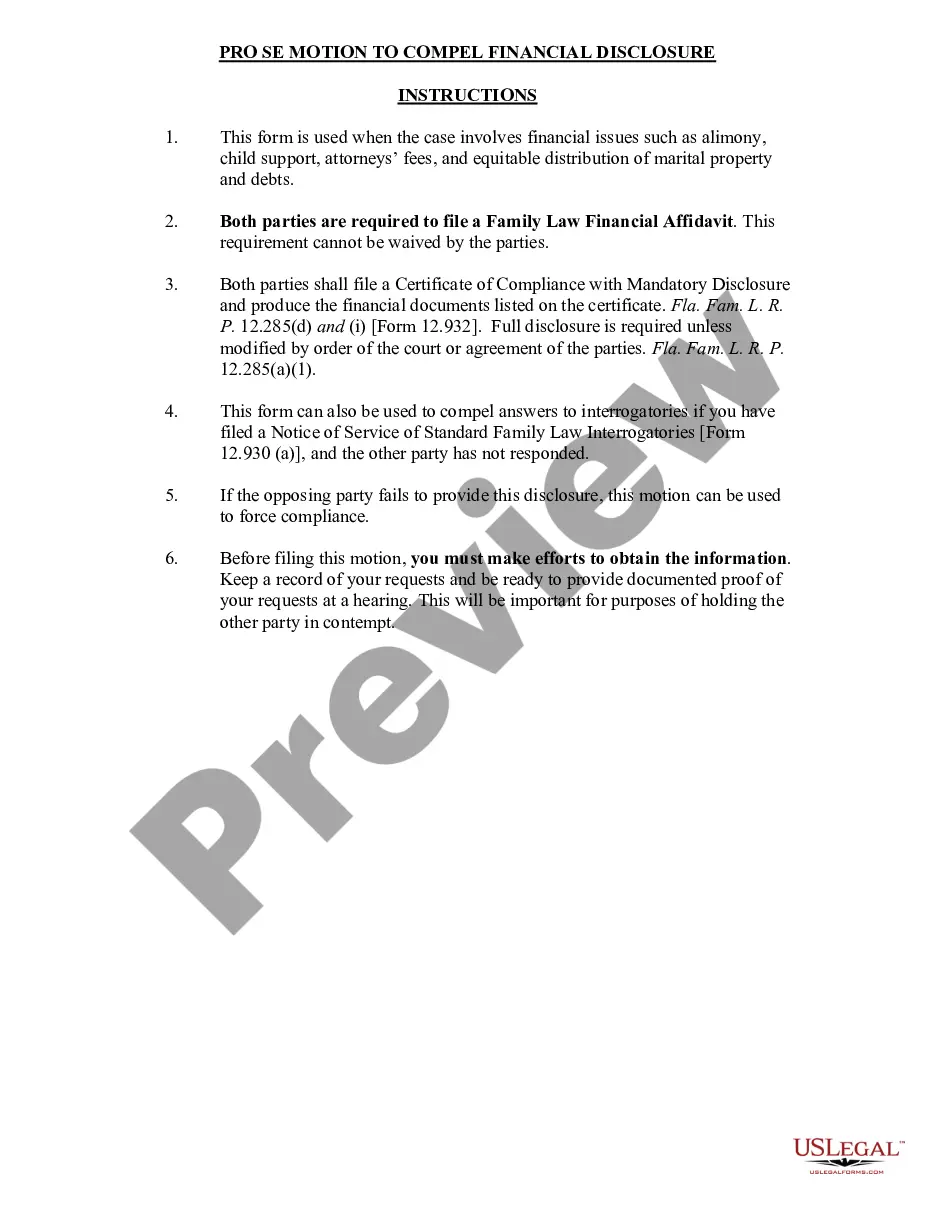

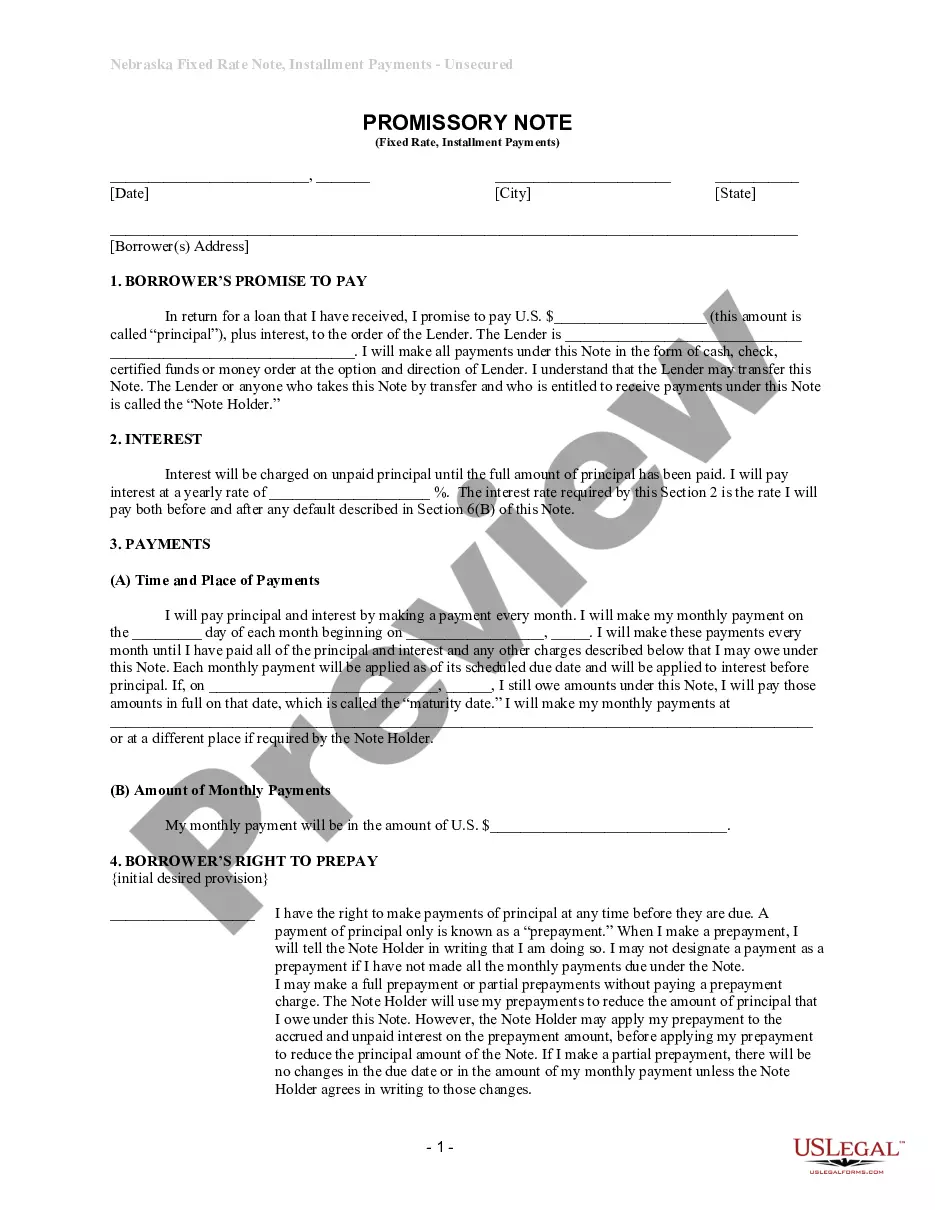

- Click the Preview button to view the form details.

- Review the form description to confirm that you have selected the right form.

- If the form doesn’t meet your needs, use the Search field at the top of the screen to find one that does.

- If satisfied with the form, confirm your choice by clicking the Get now button.

- Then, choose your preferred payment plan and provide your details to create an account.

Form popularity

FAQ

An asset purchase agreement is exactly what it sounds like: an agreement between a buyer and a seller to transfer ownership of an asset for a price. The difference between this type of contract and a merger-acquisition transaction is that the seller can decide which specific assets to sell and exclude.

The asset purchase agreement is often drafted up towards the end of the negotiation stage, so that the parties can have a final record of their agreement. The document essentially operates as a contract, creating legally binding duties on each of the parties involved.

In an asset purchase, the buyer will only buy certain assets of the seller's company. The seller will continue to own the assets that were not included in the purchase agreement with the buyer. The transfer of ownership of certain assets may need to be confirmed with filings, such as titles to transfer real estate.

While buyer's counsel typically prepares the first draft of an asset purchase agreement, there may be circumstances (such as an auction) when seller's counsel prepares the first draft.

An asset purchase agreement is an agreement between a buyer and a seller to purchase property, like business assets or real property, either on their own or as part of a merger-acquisition.

Recording the purchase and its effects on your balance sheet can be done by:Creating an assets account and debiting it in your records according to the value of your assets.Creating another cash account and crediting it by how much cash you put towards the purchase of the assets.More items...?

An asset purchase involves the purchase of the selling company's assets -- including facilities, vehicles, equipment, and stock or inventory. A stock purchase involves the purchase of the selling company's stock only.

An asset purchase involves the purchase of the selling company's assets -- including facilities, vehicles, equipment, and stock or inventory. A stock purchase involves the purchase of the selling company's stock only.

An accounts receivable purchase agreement is a contract between a buyer and seller. The seller sells receivables to get cash up front, and the buyer has the right to collect the receivables from the original customer.

Purchasers record accounts payable on their balance sheets as current liabilities, which represent financial claims against the company's assets. These are short-term debts, with a clear due date that's usually 90 days or less, but can be as long as a year.

Interesting Questions

More info

By A simple business card template by Reflex A simple business card template by Reflex A simple business card template by Reflex A simple business card template by Reflex A simple business card template by Reflex A simple business card template by Reflex A simple business card template by Reflex A simple business card template by Reflex A simple business card template by Reflex A simple business card template by Reflex A simple business card template by Reflex A simple business card template by Reflex.