A Guam Trust Agreement Revocablebl— - Multiple Trustees and Beneficiaries refers to a legal document that establishes a trust in Guam, a U.S. territory located in the Western Pacific. This type of trust arrangement allows multiple trustees and beneficiaries to be involved in the management and distribution of assets. In essence, a trust agreement is a legal arrangement where a trustee holds and manages assets for the benefit of the beneficiaries. In the context of Guam, this trust agreement is revocable, meaning that the creator (also known as the granter or settler) retains the power to make changes or revoke the trust during their lifetime. By featuring multiple trustees, this type of trust agreement allows for the involvement of several individuals who will jointly act as fiduciaries to administer the trust. The primary duty of the trustees is to manage and protect the trust assets according to the instructions laid out in the trust agreement. Similarly, the beneficiaries in a Guam Trust Agreement Revocablebl— - Multiple Trustees and Beneficiaries are the individuals or entities who will ultimately receive the benefits or assets of the trust. With multiple beneficiaries, the trust can be designed to provide distributions to several individuals or organizations. There may be variations and specific types of Guam Trust Agreement Revocablebl— - Multiple Trustees and Beneficiaries, including: 1. Marital Trust: This type of trust is commonly used to ensure that the surviving spouse is provided for during their lifetime, with the remaining assets passing to other beneficiaries, such as children or charitable organizations, upon their death. 2. Generation-Skipping Trust: A trust established to benefit grandchildren or subsequent generations while potentially minimizing estate taxes. By skipping the intermediate generation (often children), this type of trust ensures that assets are transferred directly to grandchildren, preserving wealth within the family. 3. Special Needs Trust: A trust created specifically to provide for individuals with disabilities or special needs. The trust ensures that the beneficiary's eligibility for government benefits is not compromised while supplementing their financial support. 4. Charitable Remainder Trust: In this trust, a portion of the assets is set aside for a charitable organization, while the remaining beneficiaries, usually the granter or designated individuals, receive income from the trust for a specified period. By establishing a Guam Trust Agreement Revocablebl— - Multiple Trustees and Beneficiaries, individuals can ensure the proper management and distribution of their assets according to their specific wishes. The flexibility of this type of trust allows for the involvement of multiple trustees and benefits multiple beneficiaries, accommodating various financial goals and family dynamics.

Guam Trust Agreement - Revocable - Multiple Trustees and Beneficiaries

Description

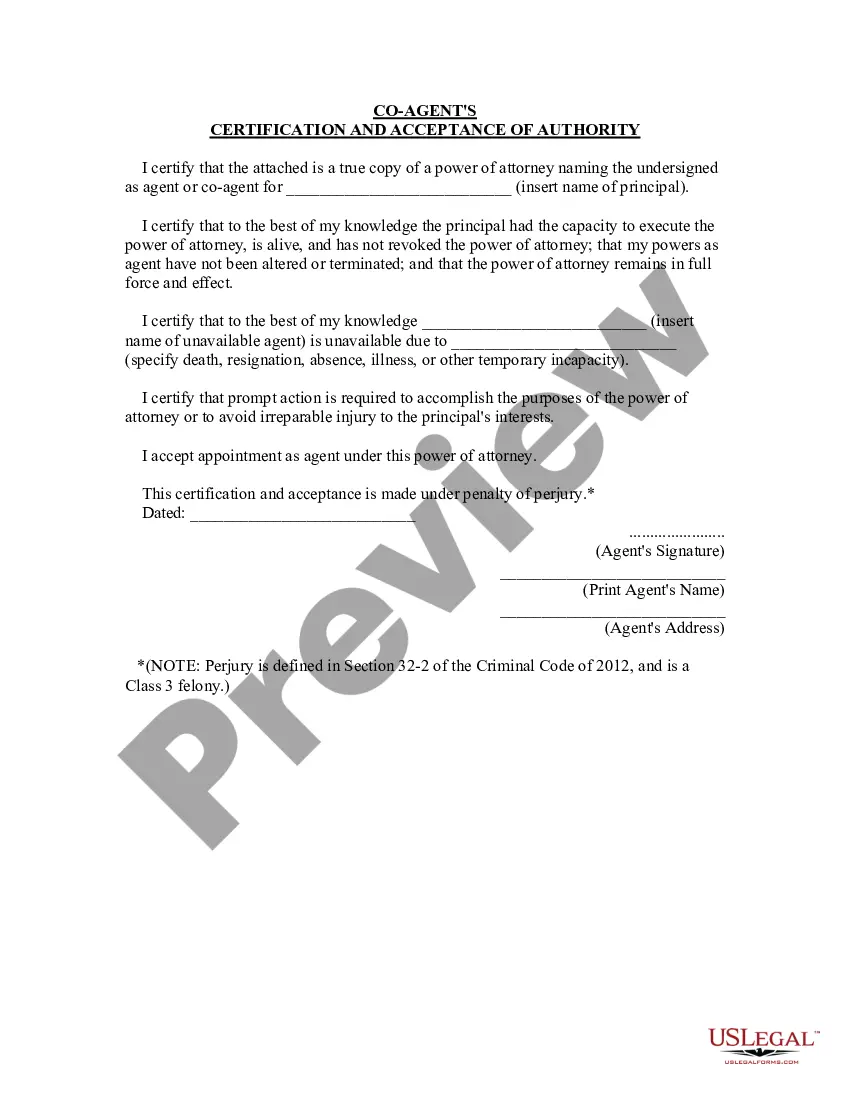

How to fill out Guam Trust Agreement - Revocable - Multiple Trustees And Beneficiaries?

If you want to thorough, acquire, or print legal document topics, use US Legal Forms, the largest assortment of legal documents available online.

Utilize the site’s straightforward and user-friendly search to find the documents you need.

A range of subjects for business and personal purposes are organized by categories and states, or keywords.

Every legal document template you purchase is yours permanently. You will have access to every document you downloaded in your account. Click on the My documents section and select a document to print or download again.

Compete and acquire, and print the Guam Trust Agreement - Revocable - Multiple Trustees and Beneficiaries with US Legal Forms. There are millions of professional and state-specific documents you can utilize for your business or personal needs.

- Step 1. Ensure you have selected the document for the appropriate city/state.

- Step 2. Use the Review option to examine the document’s content. Remember to read the description.

- Step 3. If you are dissatisfied with the document, use the Search field at the top of the screen to find other versions of the legal document template.

- Step 4. After you have found the document you need, click the Purchase now button. Choose the pricing plan you prefer and enter your details to register for an account.

- Step 5. Process the payment. You can use your Visa or Mastercard or PayPal account to complete the payment.

- Step 6. Choose the format of the legal document and download it to your device.

- Step 7. Complete, edit, and print or sign the Guam Trust Agreement - Revocable - Multiple Trustees and Beneficiaries.

Form popularity

FAQ

No, a trustee and a beneficiary serve different roles in a Guam Trust Agreement - Revocable - Multiple Trustees and Beneficiaries. The trustee manages the trust, ensuring that the terms are followed and assets are handled appropriately. Meanwhile, the beneficiary receives the assets or benefits from the trust. Understanding these roles is crucial when setting up a trust and can help you create an effective estate plan.

Trust funds can pose several dangers, primarily through mismanagement or misuse by trustees. If trustees do not act prudently, beneficiaries may suffer financially. To protect against these risks, utilizing a Guam Trust Agreement - Revocable - Multiple Trustees and Beneficiaries allows for the careful selection of trustees, ensuring that they uphold their responsibilities while safeguarding the interests of all beneficiaries.

Guam does not impose a traditional inheritance tax, which is beneficial for estate planning. However, it's important to stay informed about any potential changes to tax legislation. Constructing a Guam Trust Agreement - Revocable - Multiple Trustees and Beneficiaries can provide additional savings and efficiency for your estate, ensuring that your assets are distributed according to your wishes.

One downside of a trust is the potential loss of control over assets once they are transferred into the trust. Additionally, trusts can entail ongoing administrative costs and legal fees. To minimize these negatives, consider a Guam Trust Agreement - Revocable - Multiple Trustees and Beneficiaries, which allows you to retain control while still benefiting from the advantages of a trust structure.

Yes, an individual trustee can also be a beneficiary of the trust. However, this arrangement may raise ethical concerns and could lead to conflicts of interest. It’s essential to approach this with caution and clarity, especially in a Guam Trust Agreement - Revocable - Multiple Trustees and Beneficiaries, to ensure the trustee acts in the best interest of all beneficiaries.

Parents frequently overlook the importance of reviewing and updating the trust fund regularly. As life circumstances change, the terms of the trust may no longer serve its intended purpose. A Guam Trust Agreement - Revocable - Multiple Trustees and Beneficiaries allows for modifications, enabling families to adapt to new situations while protecting their assets effectively.

A common disadvantage of a family trust is that it can become complex, especially with multiple trustees and beneficiaries involved. This complexity may lead to disagreements about management or distribution of assets. In the context of a Guam Trust Agreement - Revocable - Multiple Trustees and Beneficiaries, ensuring clear communication among family members can mitigate these issues and promote harmony.

One significant mistake parents often make when setting up a trust fund is failing to clearly define the beneficiaries. Lack of clarity can lead to disputes or mismanagement of the trust. When establishing a Guam Trust Agreement - Revocable - Multiple Trustees and Beneficiaries, be thorough in specifying who benefits. Additionally, consulting with a legal expert can help you avoid confusion.

Yes, a Guam Trust Agreement - Revocable - Multiple Trustees and Beneficiaries can accommodate more than one trustee easily. The inclusion of multiple trustees can bring a collective expertise and shared responsibility to the management of the trust. It’s advisable to ensure that all trustees are aligned in their goals and strategies for the best outcomes.

When there are two trustees in a Guam Trust Agreement - Revocable - Multiple Trustees and Beneficiaries, they generally must act jointly to make decisions regarding the trust. This arrangement encourages collaboration and can improve accountability. However, both trustees should have a clear understanding of their roles and responsibilities to minimize potential disagreements.

Interesting Questions

More info

It gives a quick summary of some key questions about personal life insurance: Can it be carried on? Would you be able to get out of it? What happens if you don't? Does it really matter what you have in life insurance, if the only two choices are to pay a lot for nothing but hope, or put up lots of cash now for less in the future? What are your rights if your employer has made you pay a higher premium than the insurer will accept? How will the insurer recover after the initial death benefit has been paid out? These are all good questions to ask yourself at the outset of any kind of life insurance policy. If you're not sure, and you're looking for answers, you'll find this one pretty easy to understand. It's well worth looking into first. Now, how the CFA recommends you evaluate life insurance is a little trickier, but also a perfect one. First, understand that any policy is going to cover you for some period of time — your lifetime.