Guam Stock Sale and Purchase Agreement: A Guam Stock Sale and Purchase Agreement refers to a legally binding document that outlines the terms and conditions for the sale and purchase of a corporation's stock to a purchaser. This agreement is instrumental when transferring ownership of a company in Guam. It includes important provisions relating to the sale, such as purchase price, payment terms, representations and warranties, and indemnification. Keywords: Guam Stock Sale and Purchase Agreement, sale of corporation, sale of stock, agreement terms, purchase price, purchaser, transfer of ownership, legal document, representations and warranties, indemnification, payment terms. Types of Guam Stock Sale and Purchase Agreements: 1. Share Purchase Agreement: This type of agreement involves the purchase of shares from existing shareholders by a purchaser. It outlines the number of shares being acquired, their price, and mechanisms for payment. 2. Asset Purchase Agreement: This type of agreement involves the purchase of a corporation's assets instead of its stock. It includes provisions related to the transfer of specific assets, liabilities, and responsibilities to the purchaser. 3. Merger Agreement: In the case of a merger, this agreement outlines the terms and conditions for combining two or more corporations into a single entity. It involves the sale of stock or assets, depending on the structure of the merger. 4. Stock Option Agreement: This agreement is specific to granting stock options, which allow individuals or employees to purchase company stock at a predetermined price within a specified time frame. 5. Stock Subscription Agreement: This agreement is used when a corporation offers new shares to potential investors or existing shareholders for purchase. It outlines the terms under which the shares can be subscribed to and purchased. In Guam, these different types of stock sale and purchase agreements serve distinct purposes and cater to specific requirements based on the nature of the transaction. Each agreement has its unique set of clauses and provisions that must be carefully considered and tailored to meet the needs of both the seller and the purchaser in order to ensure a smooth and legally compliant stock sale and purchase process.

Guam Stock Sale and Purchase Agreement - Sale of Corporation and all stock to Purchaser

Description

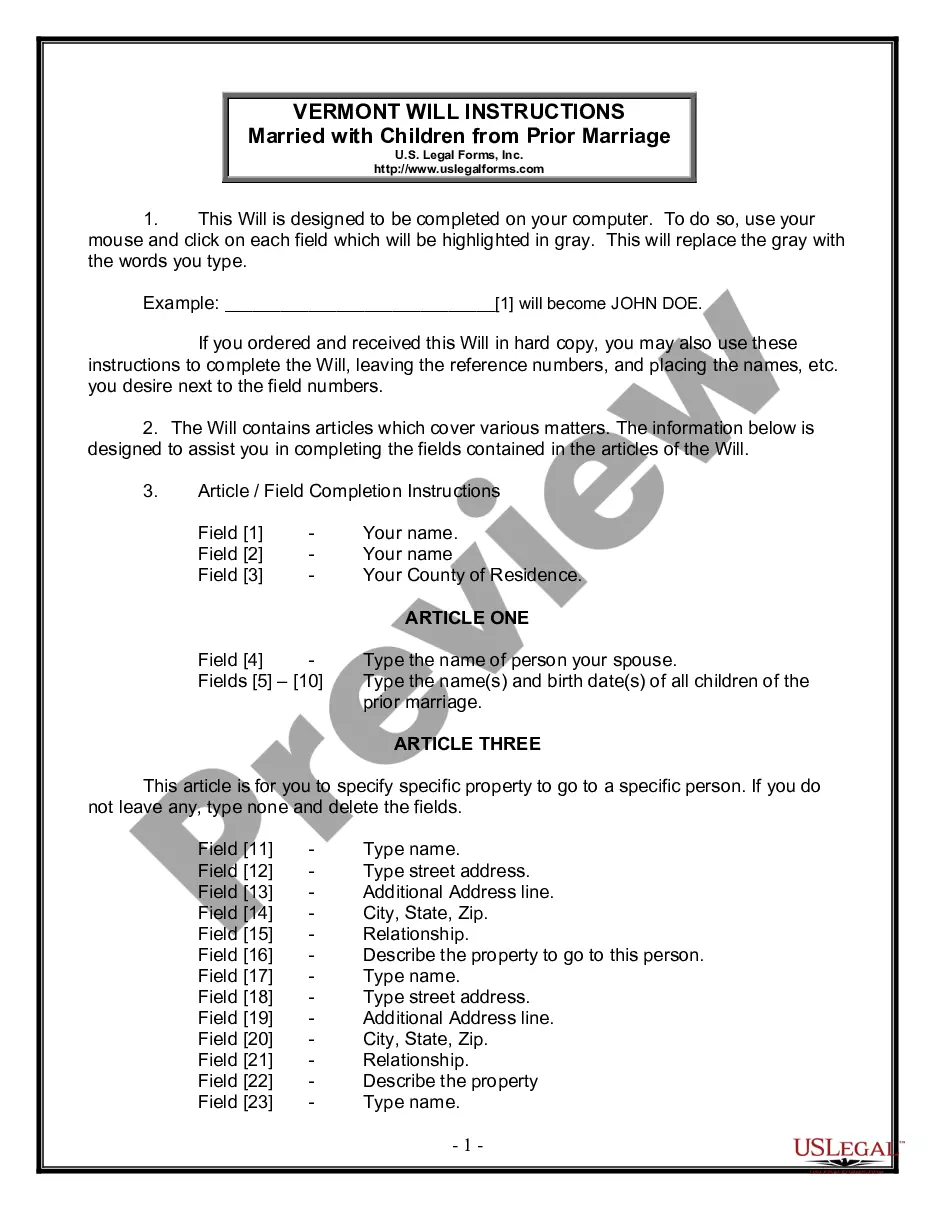

How to fill out Guam Stock Sale And Purchase Agreement - Sale Of Corporation And All Stock To Purchaser?

US Legal Forms - one of the largest compilations of legal documents in the USA - offers a vast selection of legal template forms you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can find the newest versions of documents such as the Guam Stock Sale and Purchase Agreement - Sale of Corporation and all equity to Purchaser in mere seconds.

Examine the form description to confirm that you have selected the right form.

If the form does not suit your needs, use the Search field at the top of the page to locate the appropriate one.

- If you have a monthly membership, Log In and obtain Guam Stock Sale and Purchase Agreement - Sale of Corporation and all equity to Purchaser from your US Legal Forms library.

- The Download button will appear on every form you view.

- You have access to all previously acquired forms in the My documents section of your account.

- To utilize US Legal Forms for the first time, here are some simple steps to get started.

- Make sure you have chosen the correct form for your locality/region.

- Select the Preview button to review the form’s content.

Form popularity

FAQ

A stock purchase agreement (SPA) is the contract that two parties, the buyers and the company or shareholders, written consent is required by law when shares of the company are being bought or sold for any dollar amount. In a stock deal, the buyer purchases shares directly from the shareholder.

The number and type of stock sold (i.e. common, preferred) the purchase price. when the transaction will take place. price per share.

Stock Purchase AgreementName of company. Par value of shares. Name of purchaser. Warranties and representations made by the seller and purchaser.

Stock purchase agreements are legal documents that lay out the terms and conditions for a sale of company stocks. They are legally binding contracts that create obligations and rights for all the parties involved.

A shares transfer agreement, also known as a stock purchase agreement, is an legal document used to transfer the ownership of shares of stock. The party transferring shares could be a person or a company.

The key provisions detail the terms of the transaction: the number and type of stock sold (i.e. common, preferred) the purchase price. when the transaction will take place.

Common Stock Agreement means an agreement between the Company and a Grantee evidencing the terms and conditions of an individual Common Stock grant. The Stock Grant agreement is subject to the terms and conditions of the Plan.

A stock purchase agreement is an agreement that two parties sign when shares of a company are being bought or sold. These agreements are often used by small corporations who sell stock. Either the company or shareholders in the organization can sell stock to buyers.

The Stock Purchase Agreement ("SPA") is the definitive agreement that finalizes all terms and conditions related to the purchase and sale of the shares of a company. It is different from an Asset Purchase Agreement ("APA") where the assets (not the shares) of a company are being bought/sold.

Once an asset purchase is complete, the assets and liabilities that have been purchased are moved to the new entity and the old entity (and any assets or liabilities it still owns) must be wound down. In a stock purchase, the buyer purchases the entire company, including all assets and liabilities.

More info

These terms are important because they determine the terms of a company's capital structure. These contracts are also subject to state, federal and local laws concerning the rights of shareholders as well as the proper treatment of those shares. As such, these contracts can have major implications for a corporation's business. The stock purchase agreement was enacted by the New Mexico legislature in 1986. In March and April 1988, the New Mexico Securities Commission (SEC) issued a public advisory opinion on the effect of the stock purchase agreement as part of a regulatory analysis of the stock purchase agreements. This analysis determined that the use of the stock purchase agreement is an investment contract and a legal contract.