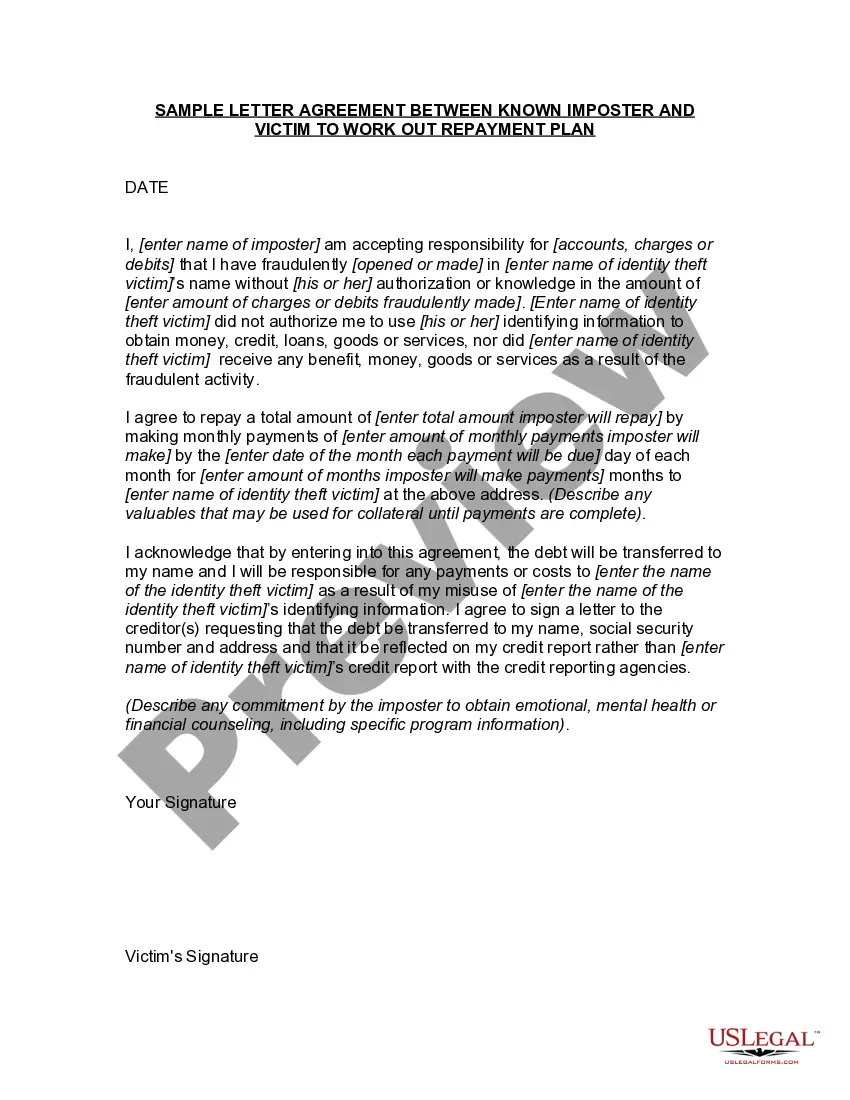

Title: Understanding the Guam Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan Introduction: The Guam Letter Agreement is a legal document that helps facilitate negotiations between a known imposter and their victim to establish a repayment plan for financial damages caused by fraudulent activities. This article aims to provide a detailed overview of the Guam Letter Agreement, its purpose, key components, and the process of working out a repayment plan. 1. Definition of the Guam Letter Agreement: The Guam Letter Agreement is a legally binding contract that outlines the terms and conditions agreed upon by both the known imposter (perpetrator of fraudulent activities) and the victim. It serves as a documented proof of their commitment to work together in resolving the financial loss incurred. 2. Purpose of the Guam Letter Agreement: The primary purpose of the Guam Letter Agreement is to provide a framework for initiating a repayment plan between the known imposter and their victim. It helps the victim recover the financial losses and move towards resolving the consequences of the fraudulent acts. 3. Key Components of the Guam Letter Agreement: i. Identification of Parties: The agreement should clearly identify the victim and the known imposter involved in the fraudulent activities. ii. Explanation of Fraudulent Activities: The agreement must provide an overview of the fraudulent acts committed by the imposter, including an itemized list of financial damages. iii. Repayment Plan: A detailed repayment plan should be included, outlining the method, frequency, and duration of payments to be made by the imposter. iv. Legal Considerations: The agreement should mention that legal action may be pursued if the repayment plan is not adhered to by the imposter. v. Confidentiality: Including a clause that ensures the confidentiality of the agreement and the nature of the fraudulent activities. 4. Process of Working Out a Repayment Plan: i. Communication: The victim and imposter must communicate to discuss the fraud and establish contact to start working out the repayment agreement. ii. Agreement Negotiation: Both parties should negotiate and agree upon the terms of the repayment plan, taking into consideration the imposter's financial capacity. iii. Drafting the Agreement: Once agreed upon, the agreement should be drafted, incorporating all the essential components mentioned above. iv. Signatures and Notarization: The agreement requires signatures from both parties, ensuring its legal validity. Consider involving a notary public for additional authentication. v. Execution and Monitoring: Repayment should commence according to the agreed timelines, while the victim carefully monitors the adherence to the plan. Types of Guam Letter Agreements: 1. Personal Finance Fraud Repayment Agreement: Focuses on cases where individuals defraud others through personal financial activities. 2. Business Fraud Repayment Agreement: Relevant to situations involving fraudulent activities in the business sector. 3. Identity Theft Repayment Agreement: Addresses cases where individuals assume false identities to carry out fraudulent acts. Conclusion: The Guam Letter Agreement holds significant importance in facilitating repayment plans between known imposters and their victims. It serves as a legal framework for resolving financial damages caused by fraudulent actions. By understanding its purpose, key components, and the process of negotiating a repayment plan, victims can use this agreement as a tool to seek restitution and resolve the unfortunate consequences of fraudulent activities.

Guam Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan

Description

How to fill out Guam Letter Agreement Between Known Imposter And Victim To Work Out Repayment Plan?

Choosing the best lawful papers template could be a struggle. Naturally, there are a lot of themes available online, but how will you get the lawful form you need? Utilize the US Legal Forms website. The service offers 1000s of themes, for example the Guam Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan, which you can use for business and private needs. Every one of the forms are inspected by experts and meet federal and state needs.

In case you are already signed up, log in for your profile and click the Obtain button to have the Guam Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan. Make use of profile to check with the lawful forms you may have purchased formerly. Check out the My Forms tab of the profile and obtain an additional copy from the papers you need.

In case you are a fresh consumer of US Legal Forms, listed below are basic directions that you can comply with:

- Initial, make sure you have selected the proper form for your personal metropolis/county. It is possible to look over the shape utilizing the Preview button and study the shape description to guarantee this is the right one for you.

- When the form will not meet your requirements, utilize the Seach discipline to get the right form.

- When you are certain that the shape is acceptable, click on the Buy now button to have the form.

- Pick the pricing plan you would like and type in the needed information. Make your profile and buy an order with your PayPal profile or Visa or Mastercard.

- Opt for the document structure and down load the lawful papers template for your gadget.

- Total, modify and print and indicator the acquired Guam Letter Agreement Between Known Imposter and Victim to Work Out Repayment Plan.

US Legal Forms is definitely the largest library of lawful forms where you will find a variety of papers themes. Utilize the service to down load expertly-produced files that comply with condition needs.

Form popularity

FAQ

Repayment is the act of paying back a lender the money you've borrowed. Typically, it consists of periodic payments toward the principal?the original amount borrowed?and interest, a fee for the ?privilege? of being lent the money.

A repayment agreement is a legal document between a borrower and a lender that specifies the loan (or other owed amount) terms as well as the responsibilities of both parties.

A Payment Agreement is a contract to repay a loan. Payment Agreements outline the important terms and conditions of a loan and help to document money that is owed to you or money that you owe to someone else.

State what each side agrees to do. Clearly write out the terms of the loan. Include information about the date of the loan, the payment terms, interest, schedule of payments, late charges, default, and any other details in the agreement. Explain that the contract represents the entire agreement.

Repayment agreements are necessary when a company is relocating an employee to a new city or country for work. If the employee decides to leave the company before the expiration of the time frame stated in the agreement, then they owe the company a portion of the relocation costs.

This legal document, called a promissory note, is a written instrument that contains a promise by one party to pay another party a definite sum of money either on demand or at a specified future date.

A Payment Agreement is a contract to repay a loan. Payment Agreements outline the important terms and conditions of a loan and help to document money that is owed to you or money that you owe to someone else.