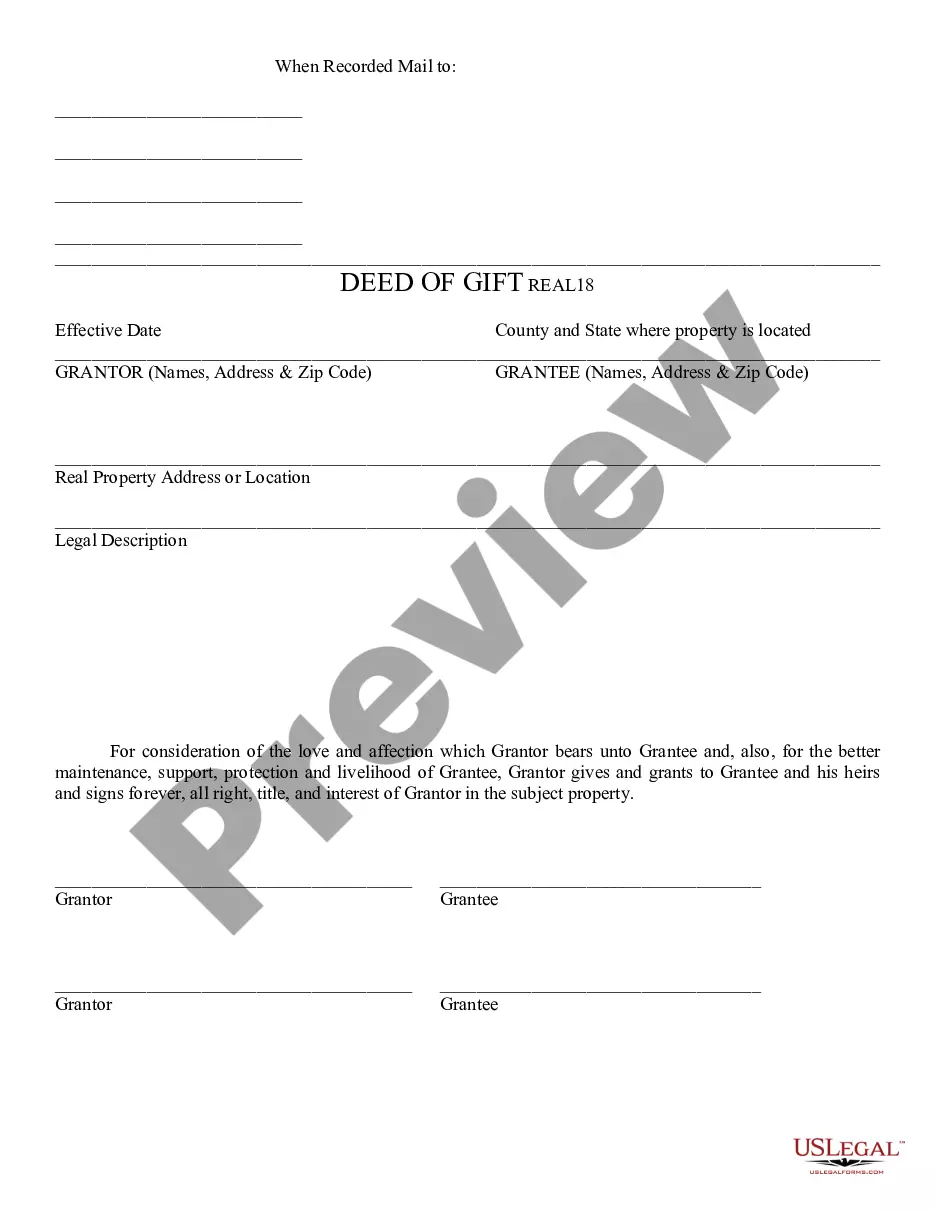

The Guam Special Cemetery Gift Trust Fund is a charitable initiative established to provide financial support for cemeteries on the island of Guam. This fund aids in the maintenance, preservation, and development of these sacred burial grounds, ensuring that they remain dignified and well cared for. Keywords: Guam, Special Cemetery, Gift Trust Fund, charitable initiative, financial support, cemeteries, maintenance, preservation, development, burial grounds, dignified, well cared for. Types of Guam Special Cemetery Gift Trust Funds: 1. Military Cemetery Gift Trust Fund: This specific type of Guam Special Cemetery Gift Trust Fund focuses on supporting military cemeteries. It aims to honor and maintain the burial grounds of the valiant individuals who served in the armed forces, providing the necessary resources for upkeep, restoration, and improvement. 2. Indigenous Cemetery Gift Trust Fund: The Guam Special Cemetery Gift Trust Fund also extends its reach to indigenous cemeteries, paying tribute to the rich cultural heritage and ancestral ties of the Chamorro people. This fund allocates its resources towards the preservation, enhancement, and protection of burial sites that hold significant historical value for indigenous communities. 3. Civilian Cemetery Gift Trust Fund: Dedicated to non-military and non-indigenous cemeteries, the Civilian Cemetery Gift Trust Fund aims to support the needs of these burial grounds across Guam. Through financial assistance, it ensures that all civilian cemeteries are well-maintained, allowing families and loved ones to pay their respects in a serene and dignified environment. In summary, the Guam Special Cemetery Gift Trust Fund is a charitable initiative that works towards preserving and enhancing cemeteries in Guam. With different types of funds dedicated to military, indigenous, and civilian cemeteries, this organization strives to ensure that these burial sites remain respectfully maintained, honoring the memory and legacy of those laid to rest there.

Guam Special Cemetery Gift Trust Fund

Description

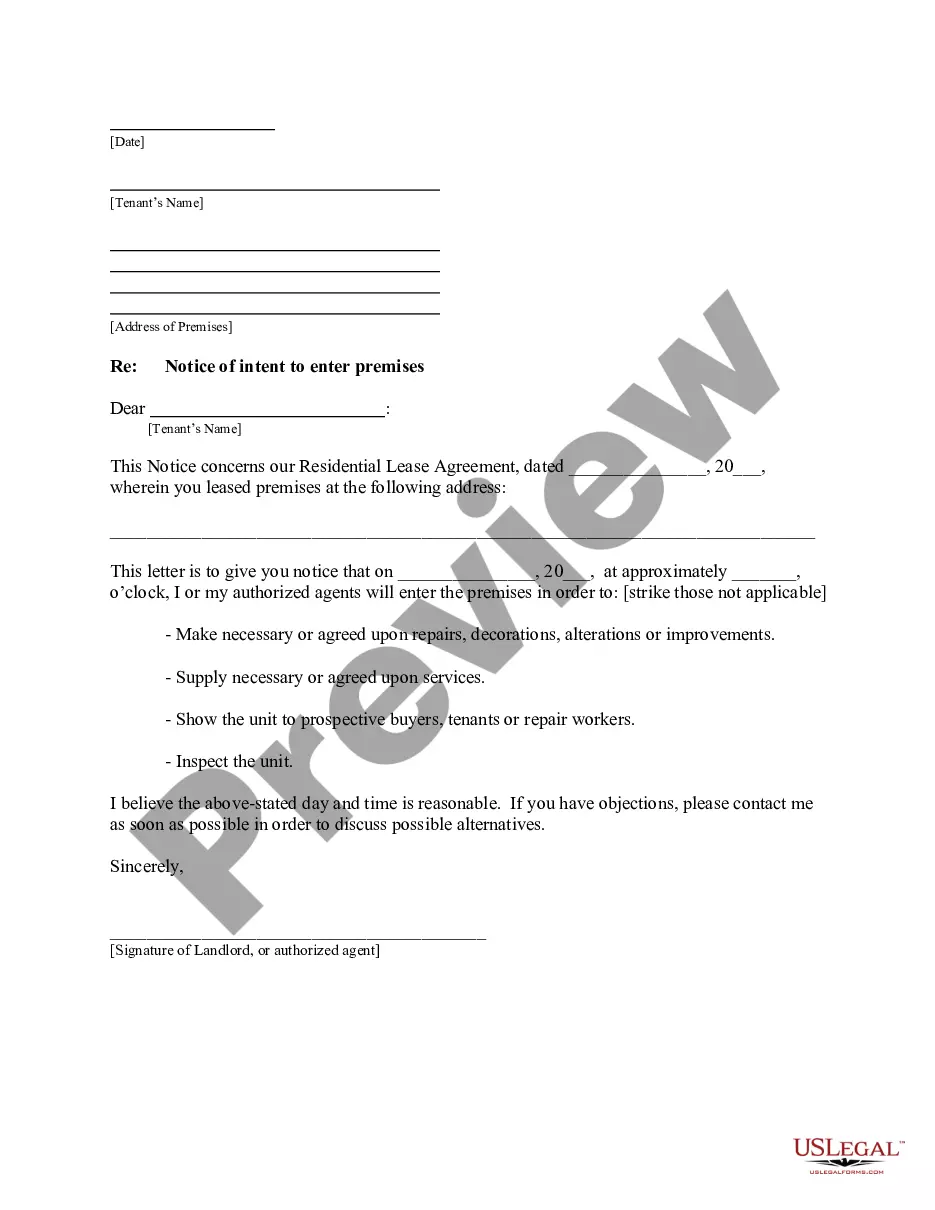

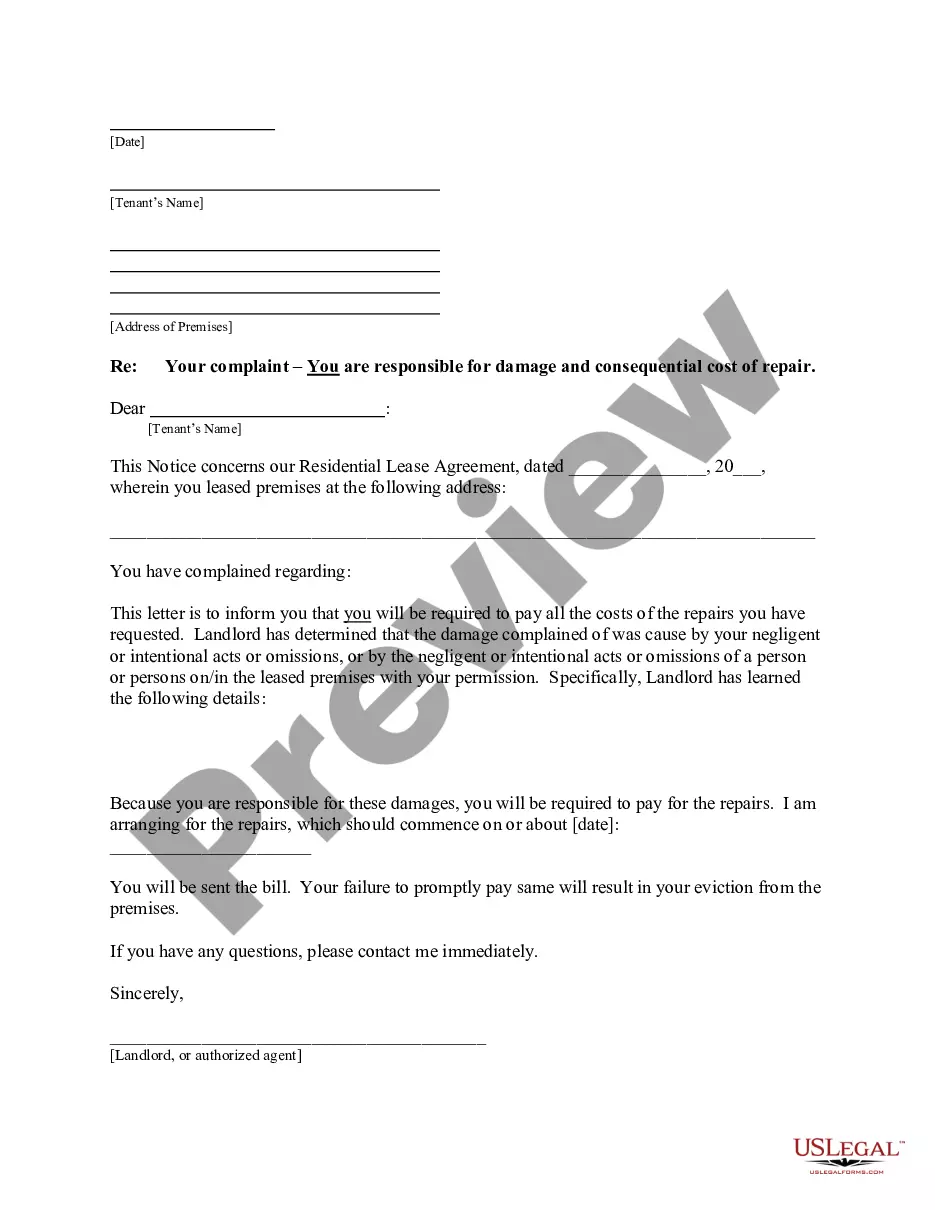

How to fill out Guam Special Cemetery Gift Trust Fund?

Are you currently in a role where you require documents for organizational or personal purposes almost every day.

There are numerous legitimate document templates available online, but locating trustworthy ones isn’t easy.

US Legal Forms provides a vast array of form templates, such as the Guam Special Cemetery Gift Trust Fund, designed to meet federal and state requirements.

Choose the pricing plan you prefer, fill in the required details to set up your account, and complete your purchase using PayPal, Visa, or Mastercard.

Select a convenient file format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can obtain the Guam Special Cemetery Gift Trust Fund template.

- If you don’t have an account and wish to use US Legal Forms, follow these steps.

- Select the form you need and ensure it is for the appropriate city/state.

- Use the Preview button to review the form.

- Check the description to confirm you have selected the right form.

- If the form isn’t what you are looking for, use the Search field to find the form that fits your needs.

- Once you find the correct form, click Get it now.

Form popularity

FAQ

Form 990-N (e-Postcard) is an annual notice. Form 990 is the IRS' primary tool for gathering information about tax-exempt organizations, educating organizations about tax law requirements and promoting compliance. Organizations also use the Form 990 to share information with the public about their programs.

Part IX of Form 990 requires those expenditures to be broken down into three classes: 1) program service expenses, 2) management and general expenses, and 3) fundraising expenses.

A gift in trust is a way to avoid taxes on gifts that exceed the annual gift tax exclusion amount. One type of gift in trust is a Crummey trust, which allows gifts to be given for a specific period, establishing the gifts as a present interest and eligible for the gift tax exclusion.

Check out the fair market value of assets.Observe the contributions made or grants and similar amounts paid.Note the total expenditures or Total Expenses.Look at the contributions made to the foundation or contributions and grants.Evaluate the grants.Look at the board of directors.More items...?15 July 2015

The IRS does not levy gift taxes on trusts, nor does it consider payments from the trust to a beneficiary as a gift (it may be taxable income to the beneficiary, however).

The trust allows the trustee to gift from the trust to the current beneficiary's issue up to the annual gift exclusion (currently $15K).

Check the box in the heading of Part X if Schedule O (Form 990 or 990-EZ) contains any information pertaining to this part. All organizations must complete Part X. No substitute balance sheet will be accepted.

In a nutshell, the form gives the IRS an overview of the organization's activities, governance and detailed financial information. Form 990 also includes a section for the organization to outline its accomplishments in the previous year to justify maintaining its tax-exempt status.

Mail your Form 990-EZ to the below address: Department of the Treasury, Internal Revenue Service Center, Ogden, UT 84201-0027.

The federal gift tax law provides that every person can give a present interest gift of up to $14,000 each year to any individual they want. This means that each parent can each give each of their children and grandchildren $14,000 (two parents permits a total gift per recipient of $28,000).

Interesting Questions

More info

And in the process, Irish Americans helped shape the way we think about death, how we honor the dead, and how we honor the living For the first time in its history, the United States is undergoing a massive transition from a society based on death to one driven by life “In many ways, the United States has moved backward, turning a blind eye to the reality that many families still have a strong and abiding fascination with death. And in many cases, the American public and even many elected officials are embracing an increasingly negative attitude toward death--all this despite growing empirical evidence that many people's attitudes, fears and anxieties are more linked to fears about violence, disease and terror than they are to the realities of death.