Guam Receipt for Money Paid on Behalf of Another Person

Description

How to fill out Receipt For Money Paid On Behalf Of Another Person?

If you wish to obtain, download, or print official document templates, utilize US Legal Forms, the largest repository of legal forms available online.

Employ the site’s simple and user-friendly search to find the documentation you need.

A multitude of templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have located the form you need, click on the Purchase now button. Select the payment plan you prefer and enter your details to register for an account.

Step 6. Process the payment. You may use your credit card or PayPal account to complete the transaction.

- Utilize US Legal Forms to find the Guam Receipt for Money Paid on Behalf of Another Person in a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click on the Download button to obtain the Guam Receipt for Money Paid on Behalf of Another Person.

- You can also retrieve forms you previously stored from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct region/state.

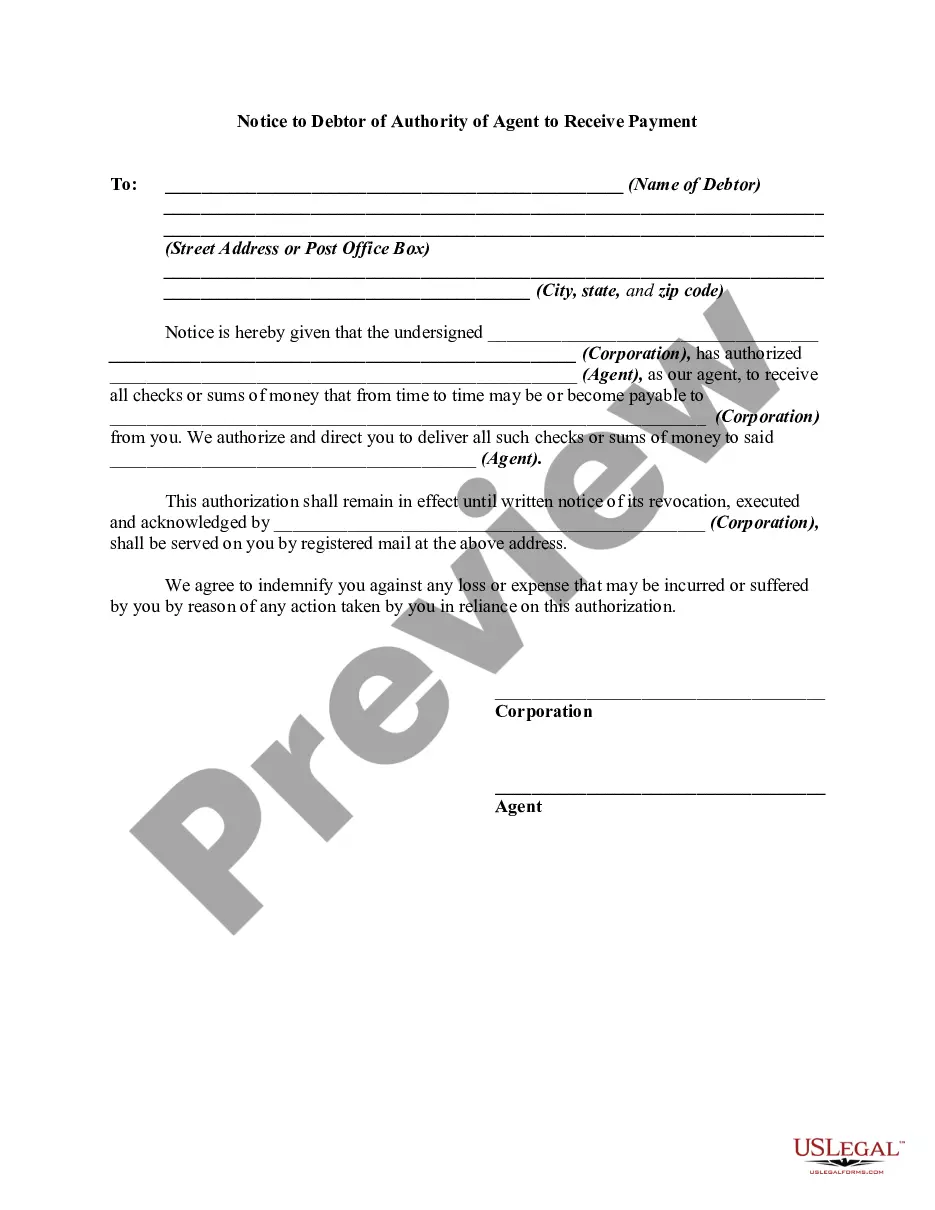

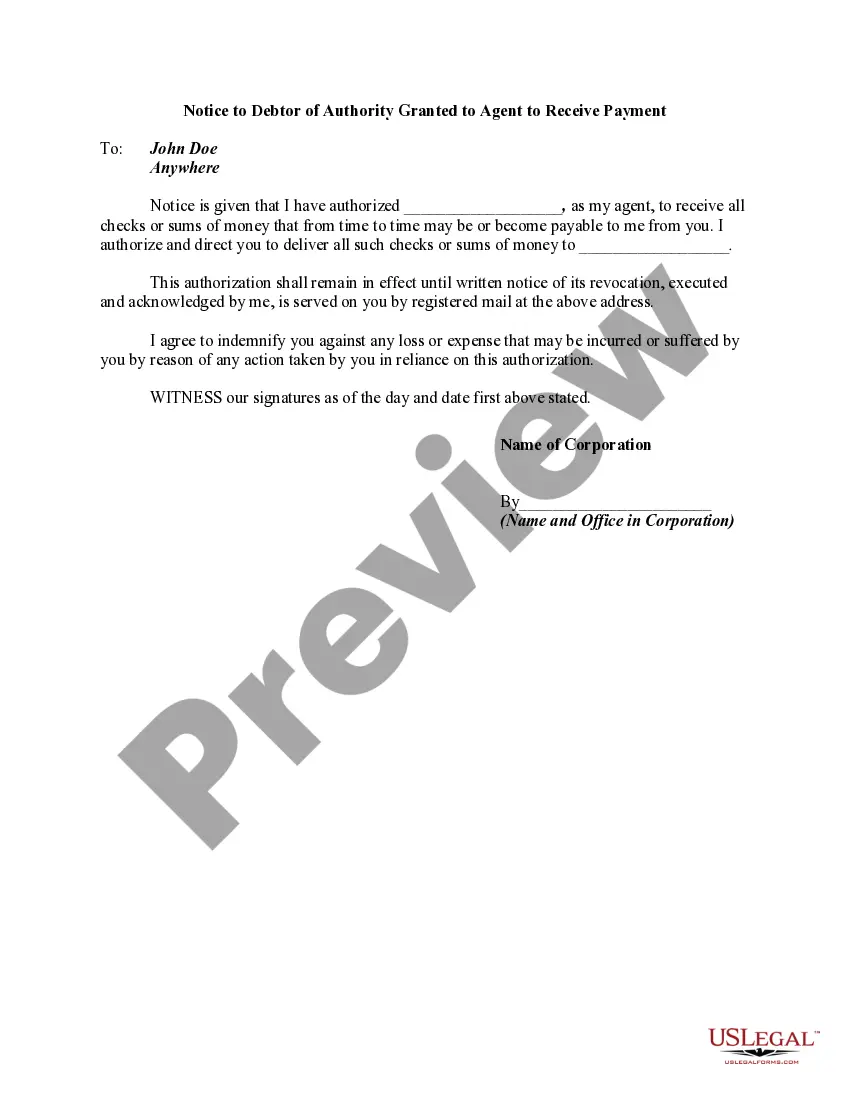

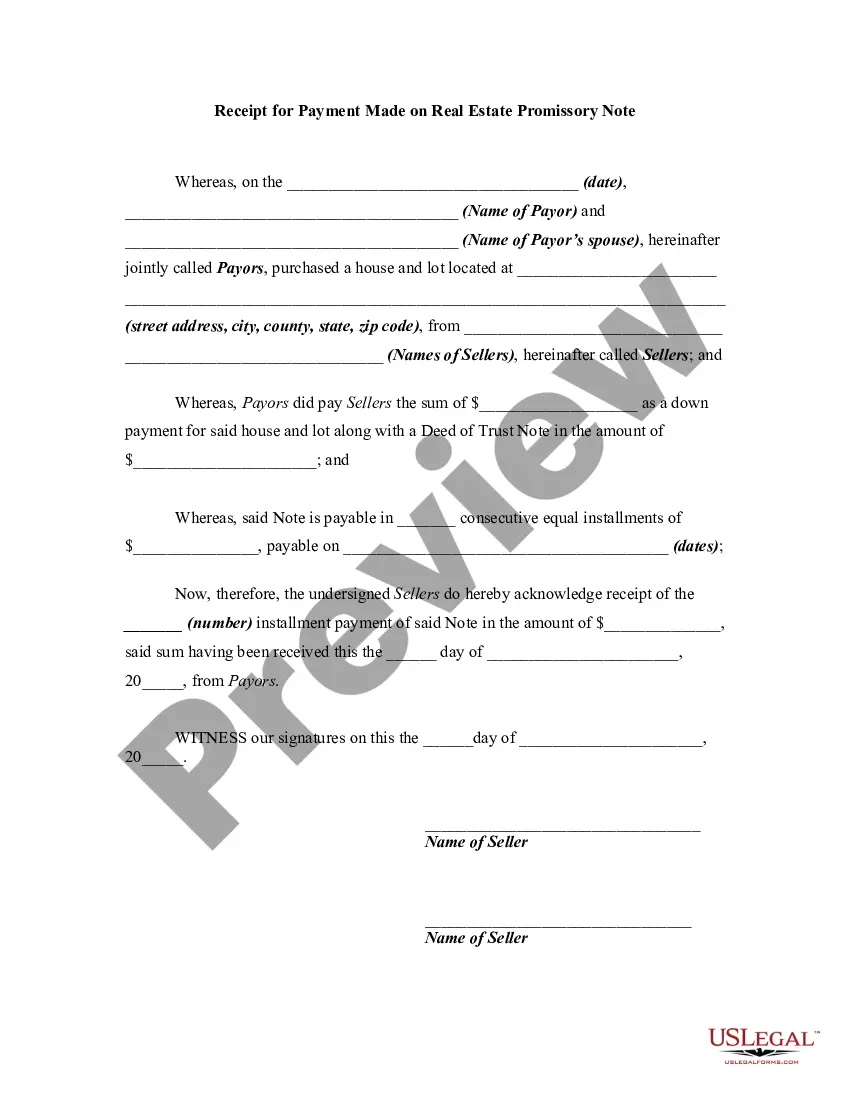

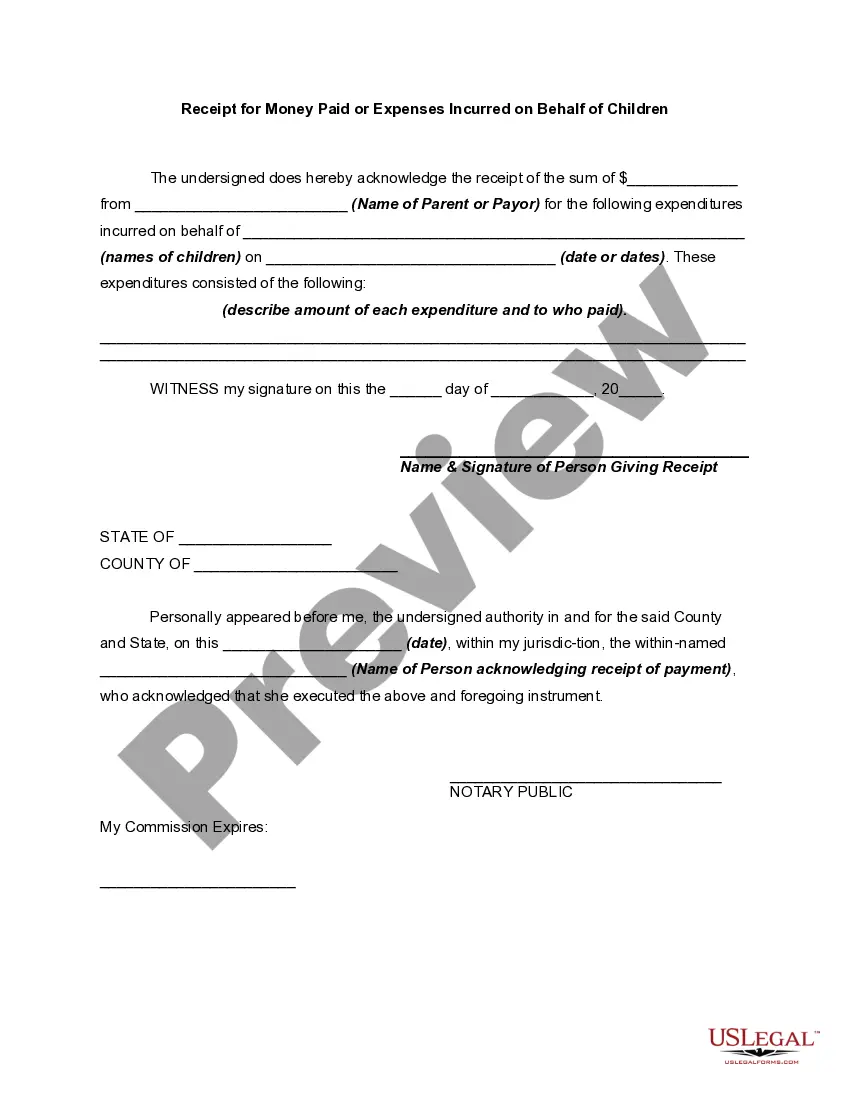

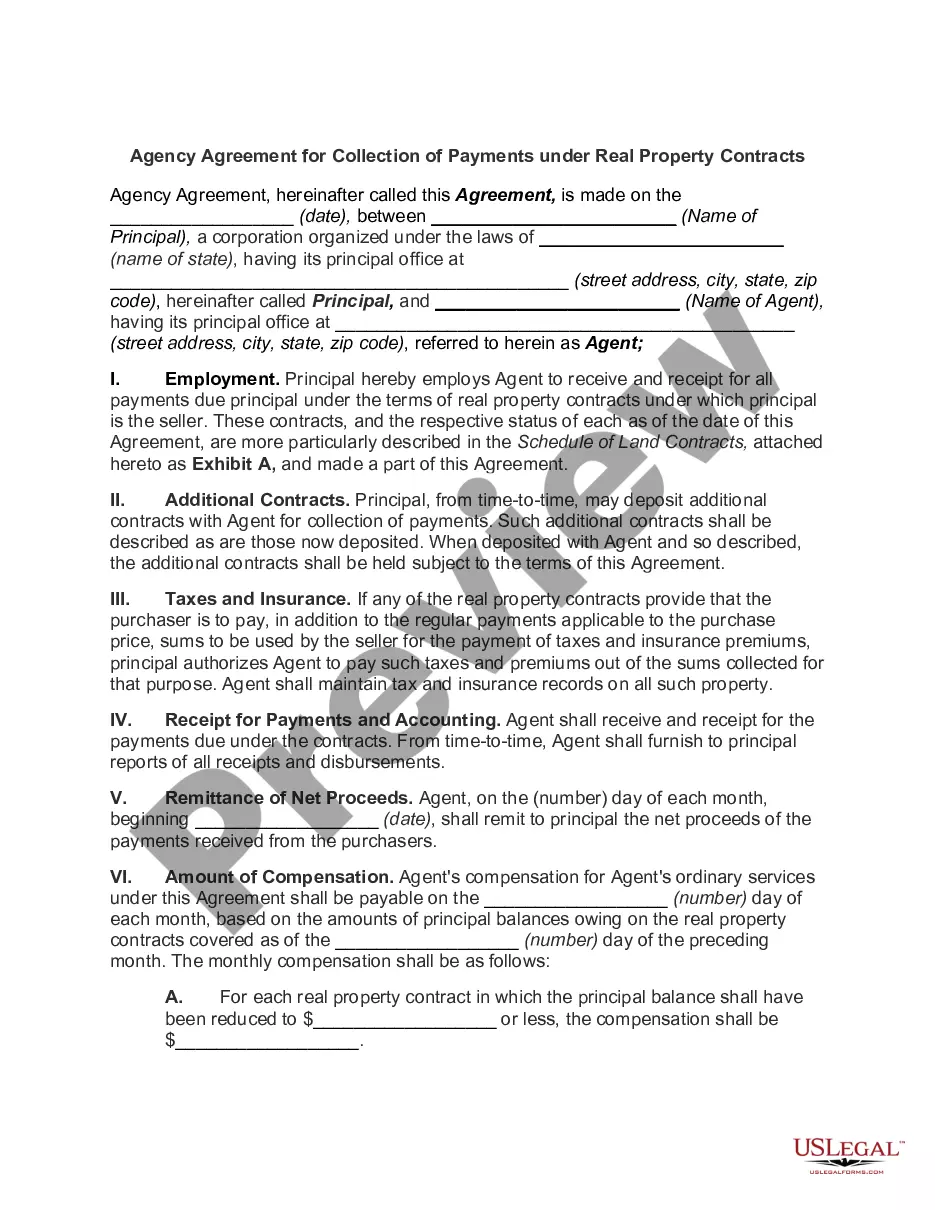

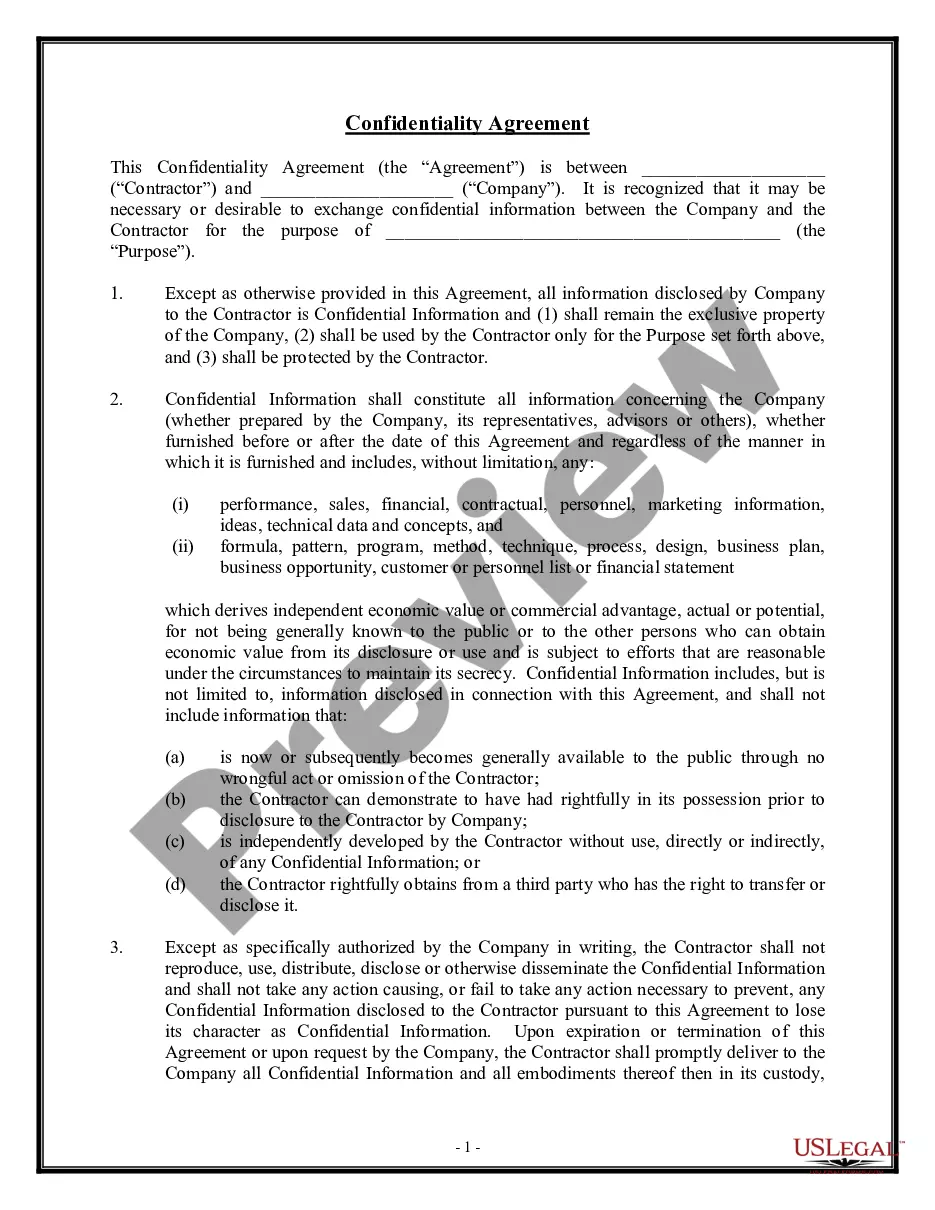

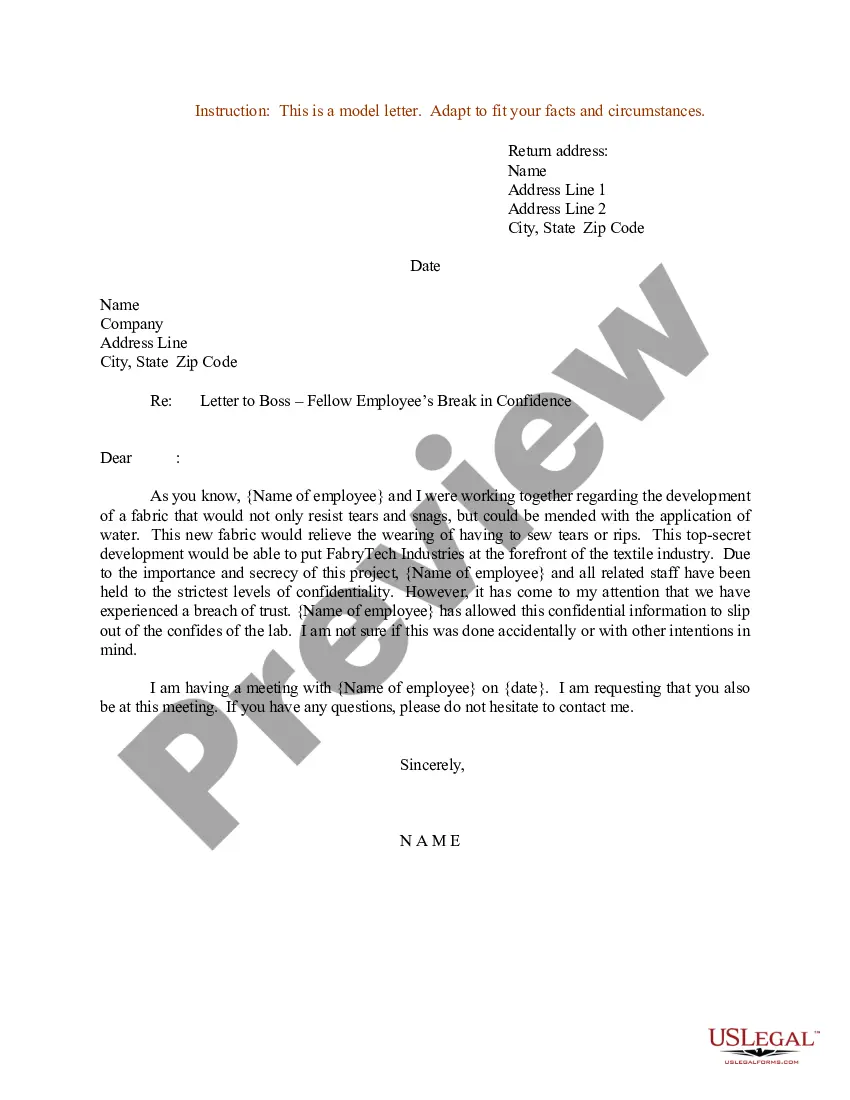

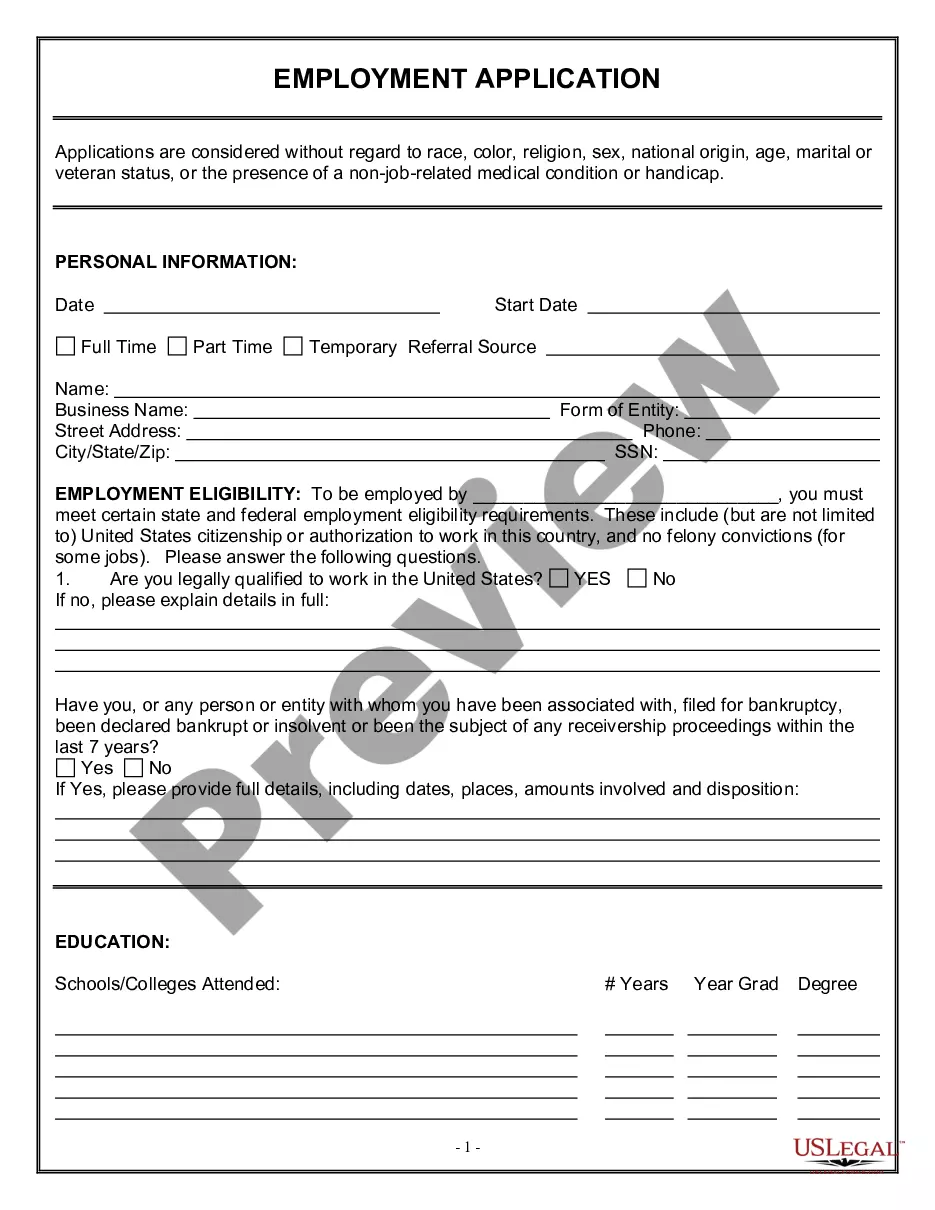

- Step 2. Use the Preview option to review the form’s content. Do not forget to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search area at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

The gross receipt tax in Guam is a tax levied on the total revenue generated by a business, without deductions for expenses. This tax is crucial for business owners to understand, especially when dealing with receipts related to payments made on behalf of another individual. Managing these receipts properly ensures compliance and can help avoid potential tax liabilities.

An NRI can claim a standard deduction of 30%, deduct property taxes, and benefit from an interest deduction of a home loan. The NRI is also allowed a deduction for principal repayment under Section 80C. Stamp duty and registration charges paid on purchasing a property can also be claimed under Section 80C.

An NRFC is generally taxable at 25% final withholding tax (FWT) and at 12% final withholding value-added tax (FWVAT). It is vital that you, as the withholding agent, perform your role, as the Bureau of Internal Revenue (BIR) can run after you, and not after the NRFC, to check up on your withholding tax compliance.

If you're employed by a foreign firm or an overseas branch or subsidiary of a US firm, you won't receive a Form W-2, however you will still need proof of your employment income and any foreign income tax deducted at source for when you file your US taxes.

How Do I Fill Out Form W-8BEN?Part I Identification of Beneficial Owner:Line 1: Enter your name as the beneficial owner.Line 2: Enter your country of citizenship.Line 3: Enter your permanent residence/mailing address.Line 4: Enter your mailing address, if different.More items...

It has most of the required fields, but they are quite easy to fill in.Name of your organization. Just write your full Company name.Country of incorporation of your organization.Name of a disregarded entity, receiving the payment.Your Entity Chapter 3 Status.Your entity FATCA status.Permanent residence address.

Non-resident citizens and aliens are subject to Philippines income tax on their Philippines-sourced income only, such as employment income and passive income.

Tax shift is a kind of economic phenomenon in which the taxpayer transfers the tax burden to the purchaser or supplier by increasing the sales price or depressing the purchase price during the process of commodity exchange. 1. Tax shift is the redistribution of tax burden.

You must give Form W-8BEN to the withholding agent or payer if you are a foreign person and you are the beneficial owner of an amount subject to withholding. Submit Form W-8BEN when requested by the withholding agent or payer whether or not you are claiming a reduced rate of, or exemption from, withholding.

See GRT E-Filing Help.Email grt@revtax.gov.gu.Call 671-635-1835/1836.Write to Department of Revenue and Taxation, BPTB, P.O. Box 23607, GMF, Guam, 96921.