The decree of the bankruptcy court which terminates the bankruptcy proceedings is generally a discharge that releases the debtor from most debts. A bankruptcy court may refuse to grant a discharge under certain conditions.

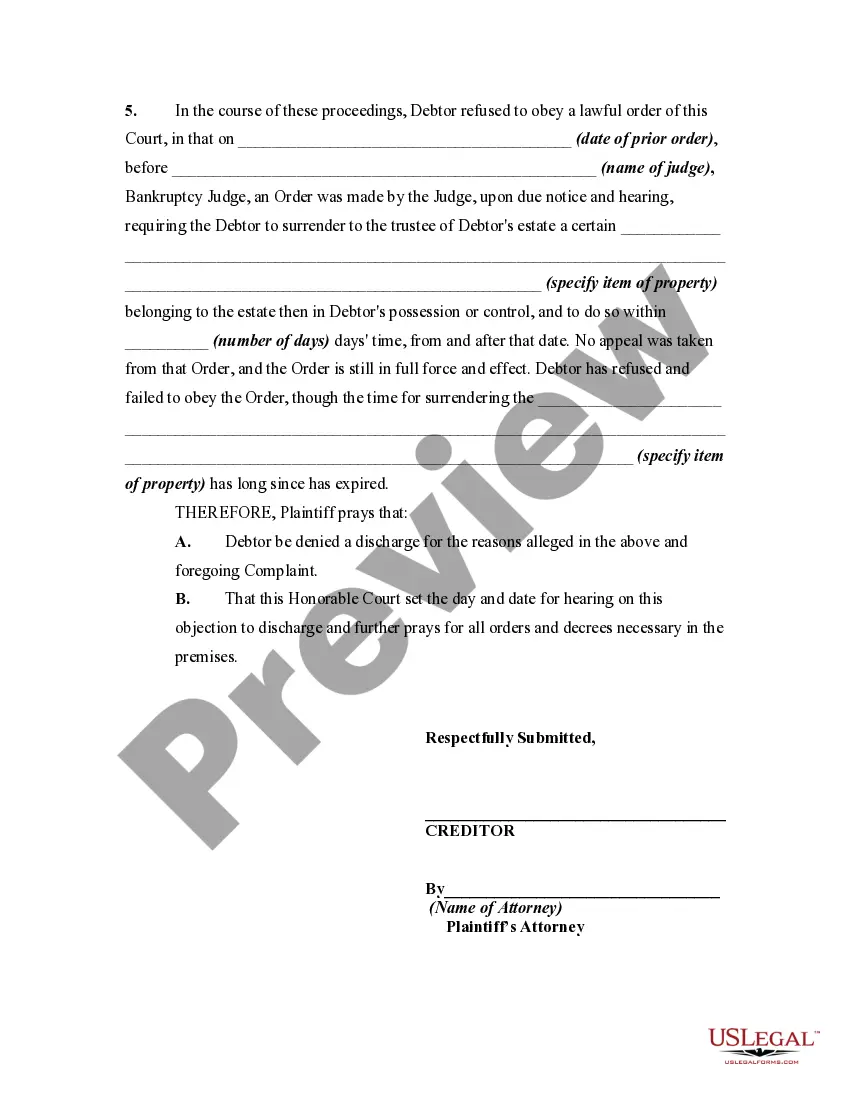

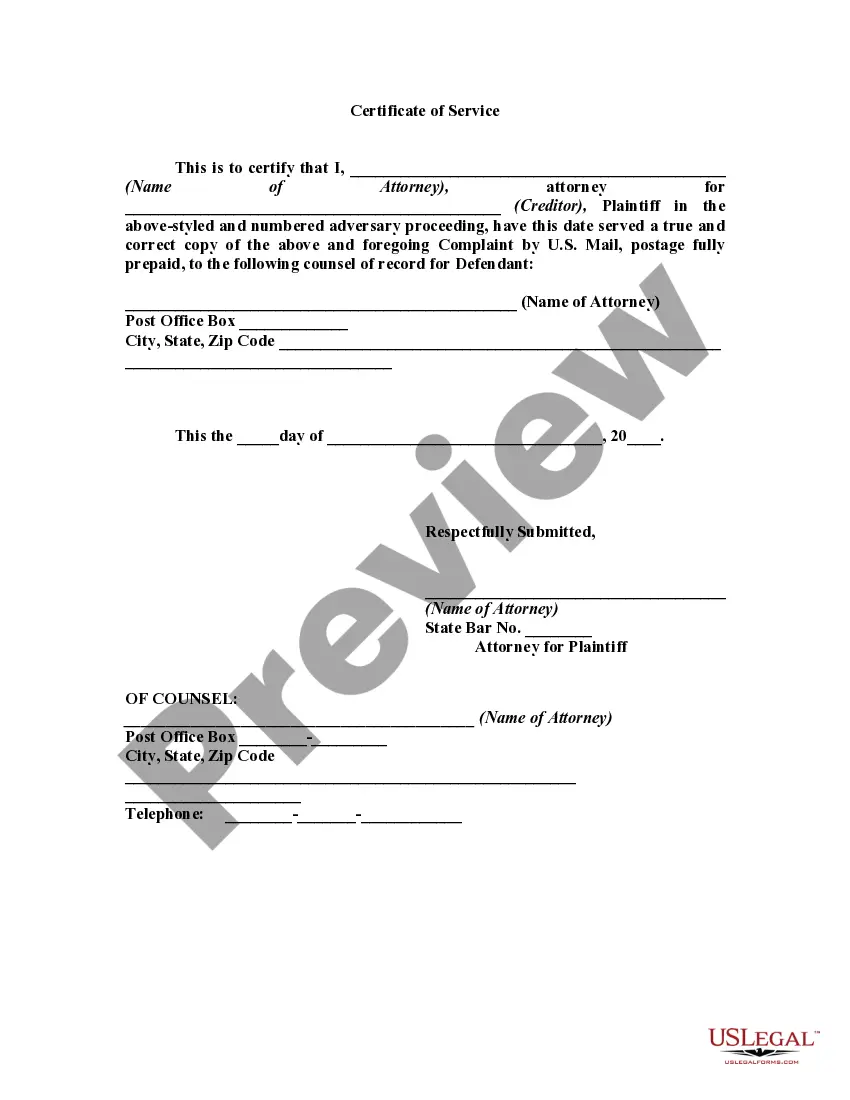

Guam Complaint Objecting to Discharge of Debtor in Bankruptcy Proceedings for Refusal By Debtor to Obey a Lawful Order of the Court

Description

How to fill out Complaint Objecting To Discharge Of Debtor In Bankruptcy Proceedings For Refusal By Debtor To Obey A Lawful Order Of The Court?

US Legal Forms - one of the largest libraries of legitimate varieties in America - delivers a wide array of legitimate file themes you can acquire or print. Using the website, you can find a large number of varieties for enterprise and personal uses, categorized by categories, claims, or keywords and phrases.You can get the most up-to-date variations of varieties much like the Guam Complaint Objecting to Discharge of Debtor in Bankruptcy Proceedings for Refusal By Debtor to Obey a Lawful Order of the within minutes.

If you have a membership, log in and acquire Guam Complaint Objecting to Discharge of Debtor in Bankruptcy Proceedings for Refusal By Debtor to Obey a Lawful Order of the from the US Legal Forms library. The Obtain switch will appear on every kind you look at. You gain access to all formerly acquired varieties from the My Forms tab of the account.

If you wish to use US Legal Forms initially, allow me to share simple directions to help you started out:

- Be sure to have chosen the right kind to your metropolis/county. Click on the Preview switch to review the form`s information. Read the kind description to ensure that you have selected the correct kind.

- If the kind does not satisfy your demands, take advantage of the Search field near the top of the display to obtain the the one that does.

- When you are happy with the form, affirm your selection by clicking the Purchase now switch. Then, choose the costs program you want and give your accreditations to register to have an account.

- Process the transaction. Make use of your charge card or PayPal account to finish the transaction.

- Select the file format and acquire the form on your own system.

- Make adjustments. Fill out, change and print and signal the acquired Guam Complaint Objecting to Discharge of Debtor in Bankruptcy Proceedings for Refusal By Debtor to Obey a Lawful Order of the.

Each and every web template you included with your money does not have an expiration time and it is your own property permanently. So, in order to acquire or print one more copy, just proceed to the My Forms portion and click around the kind you will need.

Obtain access to the Guam Complaint Objecting to Discharge of Debtor in Bankruptcy Proceedings for Refusal By Debtor to Obey a Lawful Order of the with US Legal Forms, by far the most considerable library of legitimate file themes. Use a large number of expert and status-distinct themes that meet your company or personal demands and demands.

Form popularity

FAQ

When the bankruptcy court denies your discharge in a Chapter 7 case, you remain responsible for paying back all your debts. Denial of your Chapter 7 discharge doesn't end the case, though. The Chapter 7 trustee will still gather and liquidate any non-exempt assets; all you lose is your fresh start free of those debts.

Filing for Chapter 7 bankruptcy eliminates credit card debt, medical bills and unsecured loans; however, there are some debts that cannot be discharged. Those debts include child support, spousal support obligations, student loans, judgments for damages resulting from drunk driving accidents, and most unpaid taxes.

An objection to discharge is a notice lodged with the Official Receiver by a trustee to induce a bankrupt to comply with their obligations. An objection will extend the period of bankruptcy so automatic discharge will not occur three years and one day after the bankrupt filed a statement of affairs.

The most common reason a denial of discharge is requested and granted is because the debtor is believed to have been dishonest on his or her bankruptcy petition or he or she failed to keep accurate financial records. Once filed, you will be served with the complaint to deny the discharge.

The court may deny an individual debtor's discharge in a chapter 7 or 13 case if the debtor fails to complete "an instructional course concerning financial management." The Bankruptcy Code provides limited exceptions to the "financial management" requirement if the U.S. trustee or bankruptcy administrator determines ...

A Chapter 7 bankruptcy case can be reopened after discharge and case closure under certain circumstances. Bankruptcy Code Section 350(b) authorizes the bankruptcy court to reopen a case for various reasons including to ?administer assets, to relief to the debtor, or for other cause.? Fed.

The court may deny a chapter 7 discharge for any of the reasons described in section 727(a) of the Bankruptcy Code, including failure to provide requested tax documents; failure to complete a course on personal financial management; transfer or concealment of property with intent to hinder, delay, or defraud creditors; ...

If a debt arose from the debtor's intentional wrongdoing, the creditor can object to discharging it. This might involve damages related to a drunk driving accident, for example, or costs caused by intentional damage to an apartment or other property.