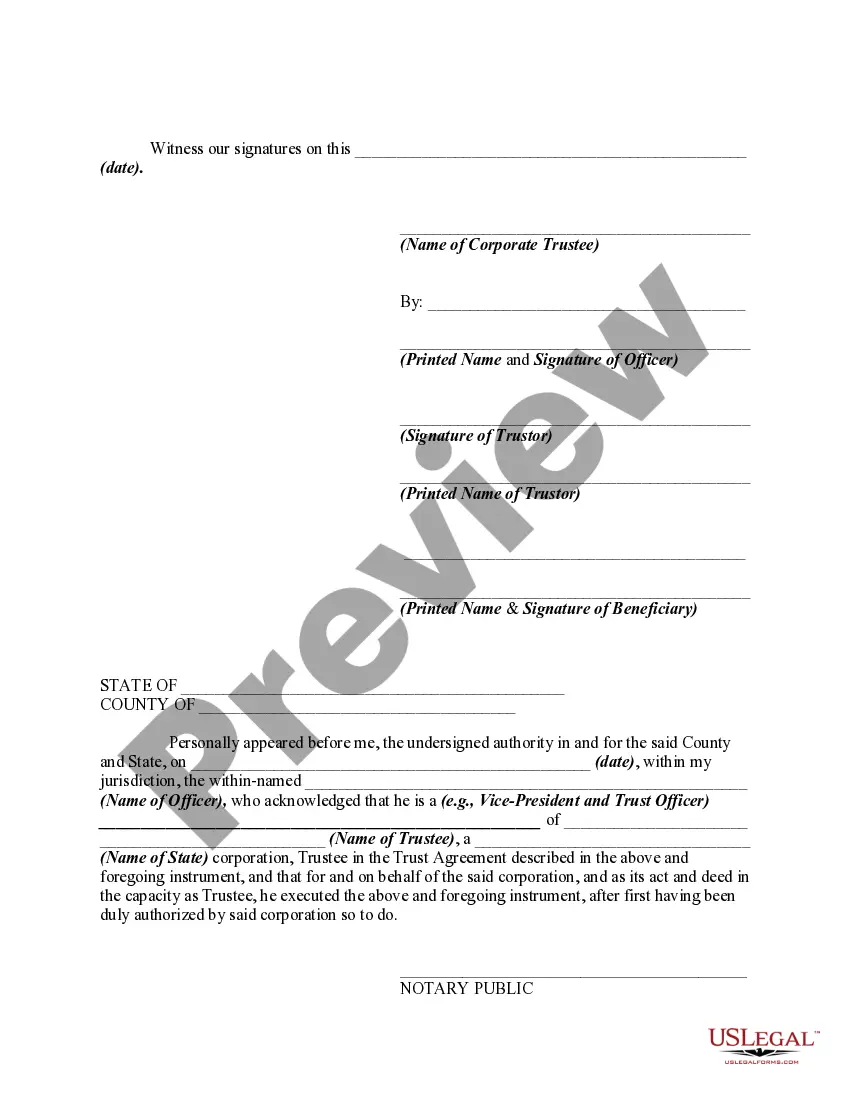

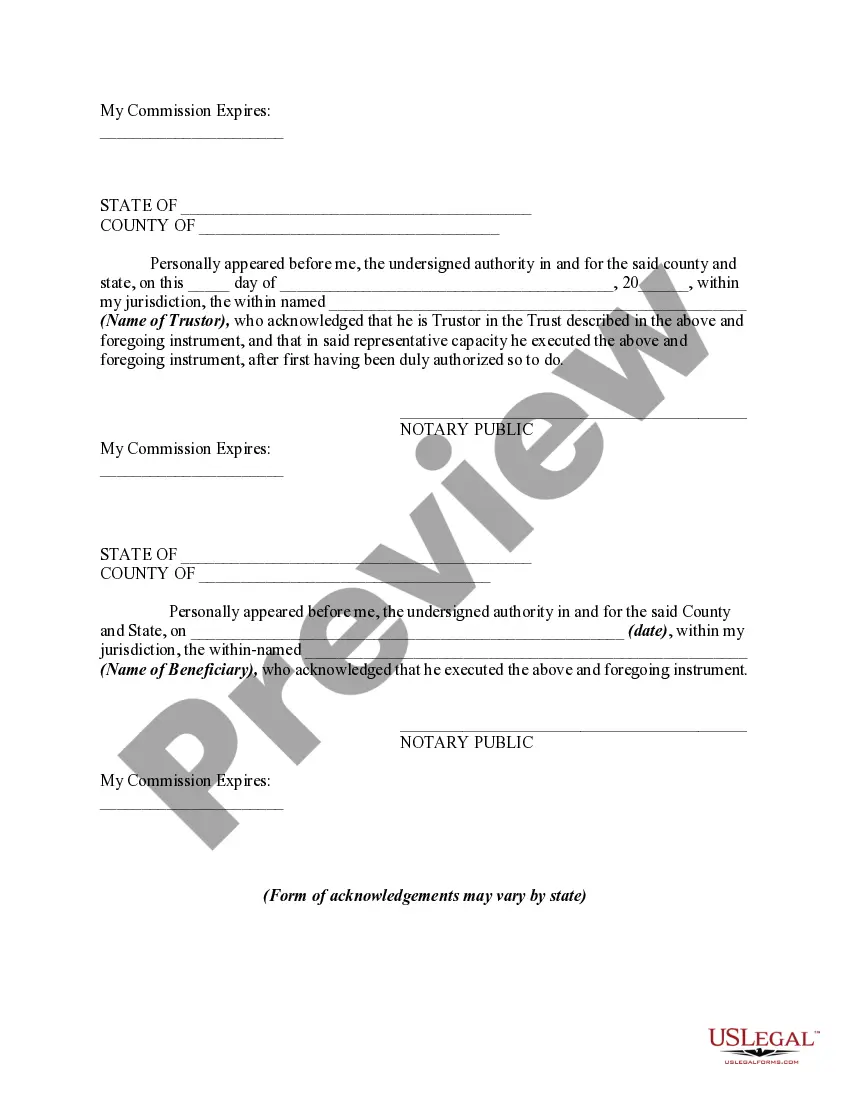

This form is a sample of an agreement to renew (extend) the term of a trust agreement. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Guam Agreement to Renew Trust Agreement

Description

How to fill out Agreement To Renew Trust Agreement?

You can spend hours online searching for the legal document template that meets the state and federal requirements you seek.

US Legal Forms offers numerous legal forms that have been evaluated by experts.

It is easy to download or print the Guam Agreement to Renew Trust Agreement from our service.

If available, use the Review button to examine the document template as well.

- If you already have a US Legal Forms account, you can Log In and then click the Obtain button.

- Next, you can complete, modify, print, or sign the Guam Agreement to Renew Trust Agreement.

- Each legal document template you purchase is yours permanently.

- To get another copy of the purchased form, go to the My documents section and click the corresponding option.

- If you are using the US Legal Forms website for the first time, follow the simple steps outlined below.

- First, ensure that you have chosen the correct document template for the region/district that you select.

- Review the form details to ensure you have chosen the appropriate form.

Form popularity

FAQ

The Gross Receipts Tax (GRT) in Guam is currently set at 5%. This tax applies to the gross revenues of businesses, regardless of their profits. When considering the implications of the Guam Agreement to Renew Trust Agreement, it's crucial to factor in GRT for budgeting and financial planning. Proper management of GRT can enhance your business's sustainability in the competitive market of Guam.

Business tax privilege refers to the legal framework that allows businesses to operate within a jurisdiction while benefiting from certain tax advantages. In Guam, this privilege includes exemptions and reduced rates for specific industries. Understanding the implications of the Guam Agreement to Renew Trust Agreement can help business owners navigate these benefits to maximize their profitability while maintaining compliance.

Filing the Gross Receipts Tax (GRT) in Guam requires you to collect the necessary financial documents and complete the appropriate forms provided by the Department of Revenue and Taxation. It's advisable to keep accurate records of your business income to simplify the process. When you consider the Guam Agreement to Renew Trust Agreement, ensuring that you adhere to these tax regulations will enhance your compliance and overall peace of mind. For a detailed guide, you may find resources on the US Legal Forms platform helpful.

Guam does not have a traditional state income tax like many states in the U.S. Instead, it has a tax structure that resembles income taxes, where residents must file federal income tax returns along with a Guam tax return. When considering the Guam Agreement to Renew Trust Agreement, it's important to understand your tax responsibilities to ensure compliance. You can consult local tax professionals who can guide you through the process.

The Gross Receipts Tax (GRT) rate in Guam is a vital component for both residents and businesses. This tax impacts how you report your earnings, which is pertinent when drafting a Guam Agreement to Renew Trust Agreement. Being informed about the current GRT rate ensures that your financial planning aligns with local regulations.

Public Law 37-47 in Guam addresses various governmental policies that affect business operations and resource allocation. Engaging with this law is beneficial for those managing agreements, including the Guam Agreement to Renew Trust Agreement. It promotes understanding of local regulations that might influence your legal commitments.

Public Law 27-106 in Guam pertains to specific regulations concerning real estate transactions and property management. Understanding this law is vital if you're involved in agreements like the Guam Agreement to Renew Trust Agreement, as it may impact property distribution and ownership considerations.

Yes, you can file your Guam taxes online, which streamlines the process and saves you time. Utilizing online platforms ensures you meet deadlines and maintain compliance with local regulations. If you're working on a Guam Agreement to Renew Trust Agreement, being organized with your taxes online can ease the overall management of your financial obligations.

Public Law 34-142 in Guam addresses significant changes in local tax procedures and regulations. If you are involved in creating or renewing agreements, such as the Guam Agreement to Renew Trust Agreement, be aware of how this law may affect your agreements, especially in terms of tax liabilities and compliance.

Public Law 27-41 in Guam relates to the establishment of regulations governing various aspects of local governance. This law can have implications for legal agreements, ensuring they adhere to the established guidelines, including agreements like the Guam Agreement to Renew Trust Agreement. Familiarity with this law assists in better business and legal decisions.