An invoice is a document or electronic statement stating the items sold and the amount payable. It is also called a bill. Invoicing is when invoices are produced and sent to customers. It is used to communicate to a buyer the specific items, price, and quantities they have delivered and now must be paid for by the buyer. Payment terms will usually accompany the billing information. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Guam Consulting Invoice

Description

How to fill out Consulting Invoice?

Are you currently in a situation where you require documents for either business or personal purposes almost every day.

There are many legitimate document templates accessible online, but finding ones you can trust is not simple.

US Legal Forms offers thousands of form templates, such as the Guam Consulting Invoice, which are designed to meet federal and state requirements.

Once you find the suitable form, click Purchase now.

Select the pricing plan you desire, enter the necessary information to create your account, and pay for the order using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms site and possess an account, just Log In.

- Then, you can download the Guam Consulting Invoice template.

- If you do not have an account and wish to begin using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/state.

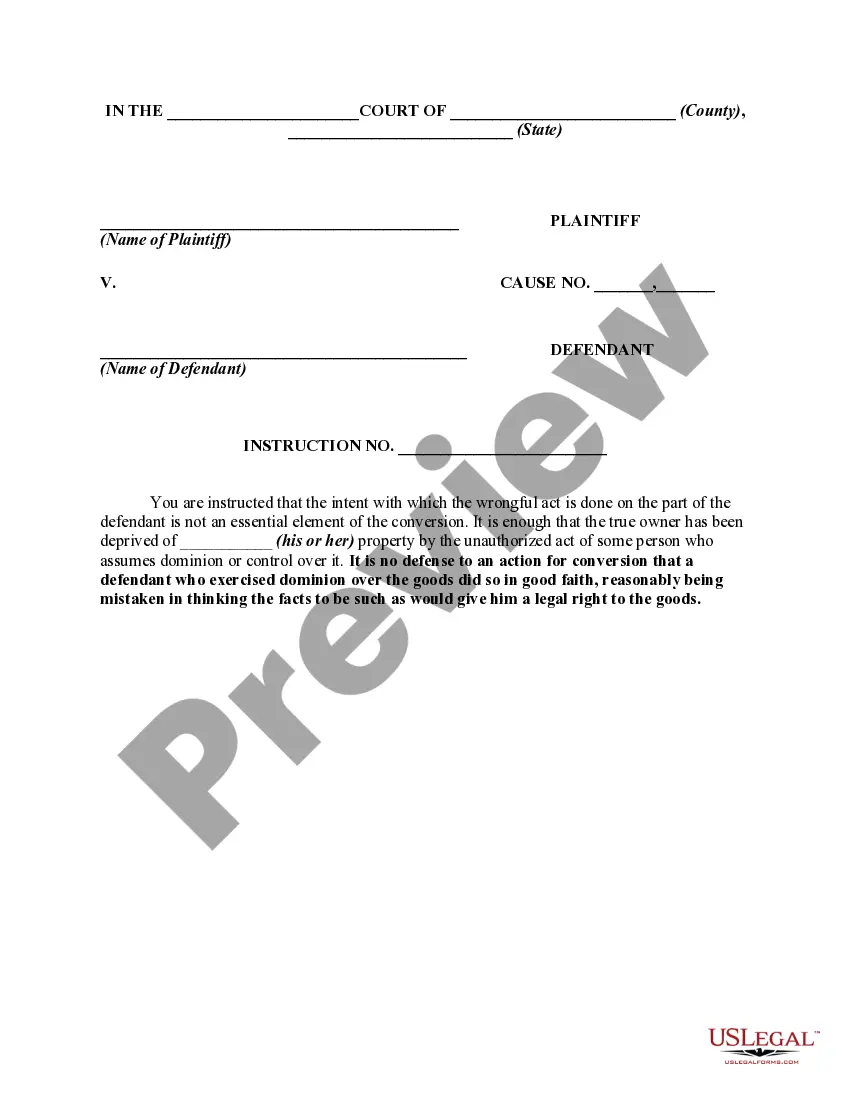

- Utilize the Preview button to review the form.

- Read the details to make sure you have selected the right form.

- If the form is not what you are looking for, use the Search field to find the form that fits your requirements.

Form popularity

FAQ

Filling out invoice details means ensuring each section of the invoice captures relevant information. Start by entering your business name, address, and contact details, followed by the client’s name and address. List the products or services provided, quantities, prices, and include the total amount due. Using a Guam Consulting Invoice format ensures that you don’t miss any important information.

Filling out an international commercial invoice requires specific details to ensure compliance with customs. Include the supplier and recipient's information, a detailed description of the goods, their value, and the total amount. Make sure to note the currency being used and any additional fees. A Guam Consulting Invoice may offer insights on documenting international transactions effectively.

To write a consulting invoice, start by listing your company name, your client’s information, and a unique invoice number. Next, provide a clear description of the consulting services rendered along with the rate and total due. Don't forget to specify the payment terms and due date. A Guam Consulting Invoice template can aid in ensuring all necessary components are included for your clients.

To make an invoice for consulting services, list all tasks completed and their corresponding costs. Include your contact information and the client's details, along with payment terms. Employing a Guam Consulting Invoice template ensures you present a clear and thorough request for payment.

Freelancers typically make invoices by detailing their services, rates, and payment terms. They can use tools or templates to ensure a professional appearance. A Guam Consulting Invoice provides an efficient solution, enabling freelancers to easily generate invoices while maintaining a consistent format.

Yes, a freelancer can issue an invoice for their services. This document serves as a formal request for payment and records the services rendered. A Guam Consulting Invoice can be an excellent solution for freelancers, as it contains all the necessary components to ensure proper billing.

Creating an invoice for your services involves outlining your work, setting your rates, and determining payment terms. You can simplify this process by using a Guam Consulting Invoice, which guides you in including all essential elements to make your invoice clear and professional.

To invoice someone as a consultant, start by identifying the services you provided. Clearly list the hours or scope of work, and specify your fees. Using a Guam Consulting Invoice streamlines this task by providing you with a professional layout that enhances clarity and credibility.

Invoicing as a freelance consultant requires you to organize your services accurately. You'll want to include a breakdown of tasks, hours worked, and rates applied. A Guam Consulting Invoice offers an efficient format that allows for easy customization while ensuring all critical information is captured.

Billing a client as a freelancer is straightforward. Begin by specifying the services rendered along with their corresponding charges. A Guam Consulting Invoice template helps ensure you include all necessary details, such as payment due dates and accepted payment methods.