An invoice is a document or electronic statement stating the items sold and the amount payable. It is also called a bill. Invoicing is when invoices are produced and sent to customers. It is used to communicate to a buyer the specific items, price, and quantities they have delivered and now must be paid for by the buyer. Payment terms will usually accompany the billing information. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Guam Detailed Consultant Invoice

Description

How to fill out Detailed Consultant Invoice?

Locating the appropriate legal document template can be quite a challenge.

Clearly, there are numerous designs accessible online, but how can you obtain the legal format you require.

Utilize the US Legal Forms site.

If you are a new user of US Legal Forms, here are some simple steps for you to follow: First, ensure you have selected the correct form for your city/region. You can browse the form using the Preview button and review the form details to confirm it is the right one for you. If the form does not meet your requirements, use the Search field to locate the suitable form. Once you are confident that the form is appropriate, click the Get now button to obtain the form. Choose the payment plan you would like and enter the necessary information. Create your account and pay for your order using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, edit, print, and sign the received Guam Detailed Consultant Invoice. US Legal Forms is the largest collection of legal forms where you can find various document templates. Leverage the service to download properly crafted documents that adhere to state regulations.

- The service provides thousands of templates, like the Guam Detailed Consultant Invoice, which you can utilize for business and personal purposes.

- All of the forms are vetted by professionals and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Acquire button to find the Guam Detailed Consultant Invoice.

- Use your account to search for the legal forms you may have purchased previously.

- Navigate to the My documents tab of your account and download another copy of the document you need.

Form popularity

FAQ

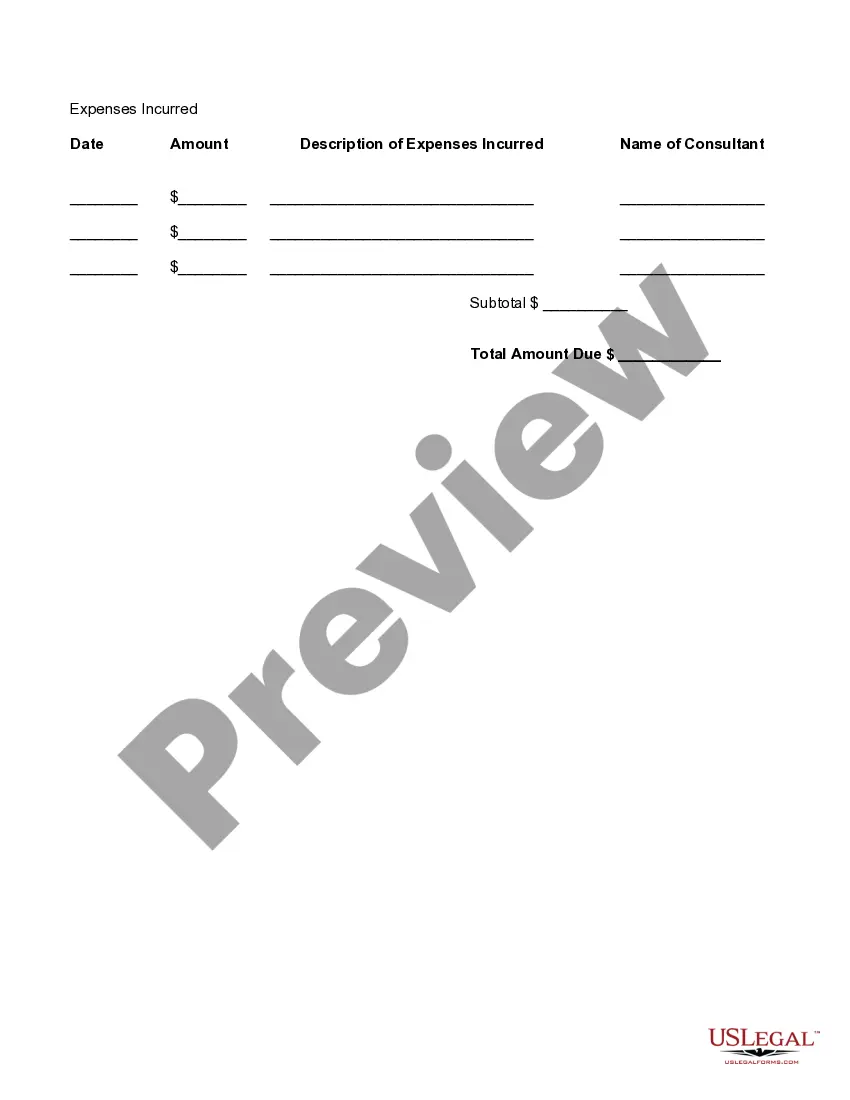

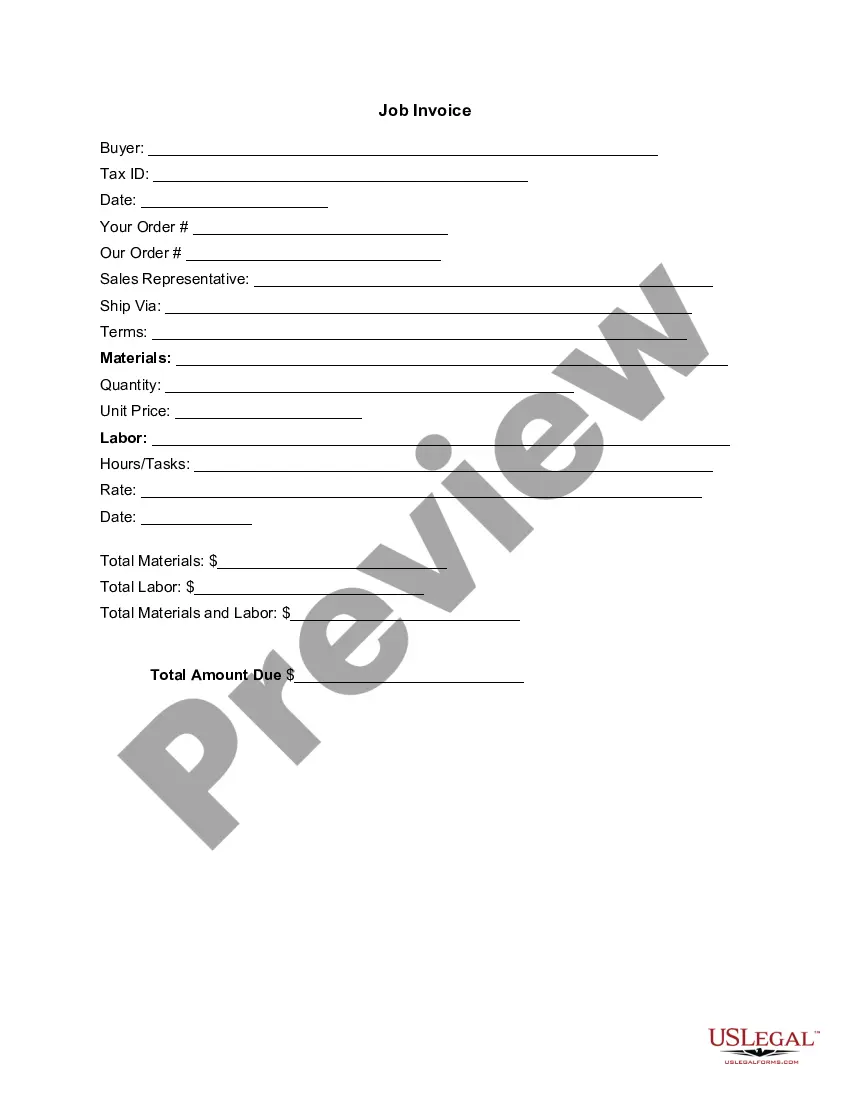

Filling out invoice details requires entering your business information and the client’s details upfront. Next, provide a breakdown of services or products, ensuring you list their quantities and prices accurately. It is also critical to include payment instructions and any applicable taxes or fees. A Guam Detailed Consultant Invoice can help you manage these details effectively, ensuring clarity for both you and your client.

To fill out a simple invoice, start by including your business name, address, and contact information at the top. List your client’s name and contact details, followed by a brief description of the services or products provided. Add the total amount due, and be sure to outline the payment terms. A Guam Detailed Consultant Invoice simplifies this task and helps present a professional image.

Filling out invoice details begins with entering your business contact information followed by client details. Clearly list the services provided, including specific descriptions, quantities, rates, and total amounts. Make sure to include your payment terms at the bottom. A Guam Detailed Consultant Invoice is a useful tool that guides you through ensuring each detail is correctly captured.

To fill out a contractor invoice, start by entering your business name and contact details at the top. Next, include the client's information and a detailed list of services provided, noting quantities and prices. Don’t forget to add payment terms, and ensure that the total amount due is clear. Using a Guam Detailed Consultant Invoice greatly simplifies this process, making it easy to maintain professional standards.

Invoicing details should include your business name and logo, client information, a unique invoice number, and the invoice date. You must also provide a clear breakdown of services or products rendered, their costs, and the total amount due. Including payment terms and methods will help the client understand how to complete the transaction. A Guam Detailed Consultant Invoice template ensures you cover all these essential elements.

To write a detailed invoice, begin by including your business name, contact information, and logo at the top. Next, list each service provided along with a description, the quantity, and specific rates. Make sure to clearly show the total amount due at the bottom, highlighting any payment terms. Using a Guam Detailed Consultant Invoice template can simplify this process and ensure you include all necessary details.

Your invoice should include all relevant information, while remaining easy to understand. Clear descriptions of each service, the rates, and the total due enhance client communication. A Guam Detailed Consultant Invoice template can help ensure you include all vital details, boosting your professionalism.

An invoice should be detailed enough to provide clarity but not overwhelmingly complicated. Listing services or products individually, along with quantities and prices, is essential for effective communication. A Guam Detailed Consultant Invoice strikes the right balance by providing the necessary information in a clear manner.

An invoice requires specific details, including contact information for both the sender and recipient, the invoice date, and a unique invoice number. Additionally, a description of services or products, quantities, prices, and payment terms must be included. For a comprehensive Guam Detailed Consultant Invoice, ensure you capture all these elements to avoid confusion.

Yes, invoices must be detailed to enhance transparency and facilitate payment. A detailed invoice helps clients understand the services rendered, along with their associated costs. For a Guam Detailed Consultant Invoice, including a thorough description of each service fosters trust and ensures timely payments.