Guam College Education Trust Agreement

Description

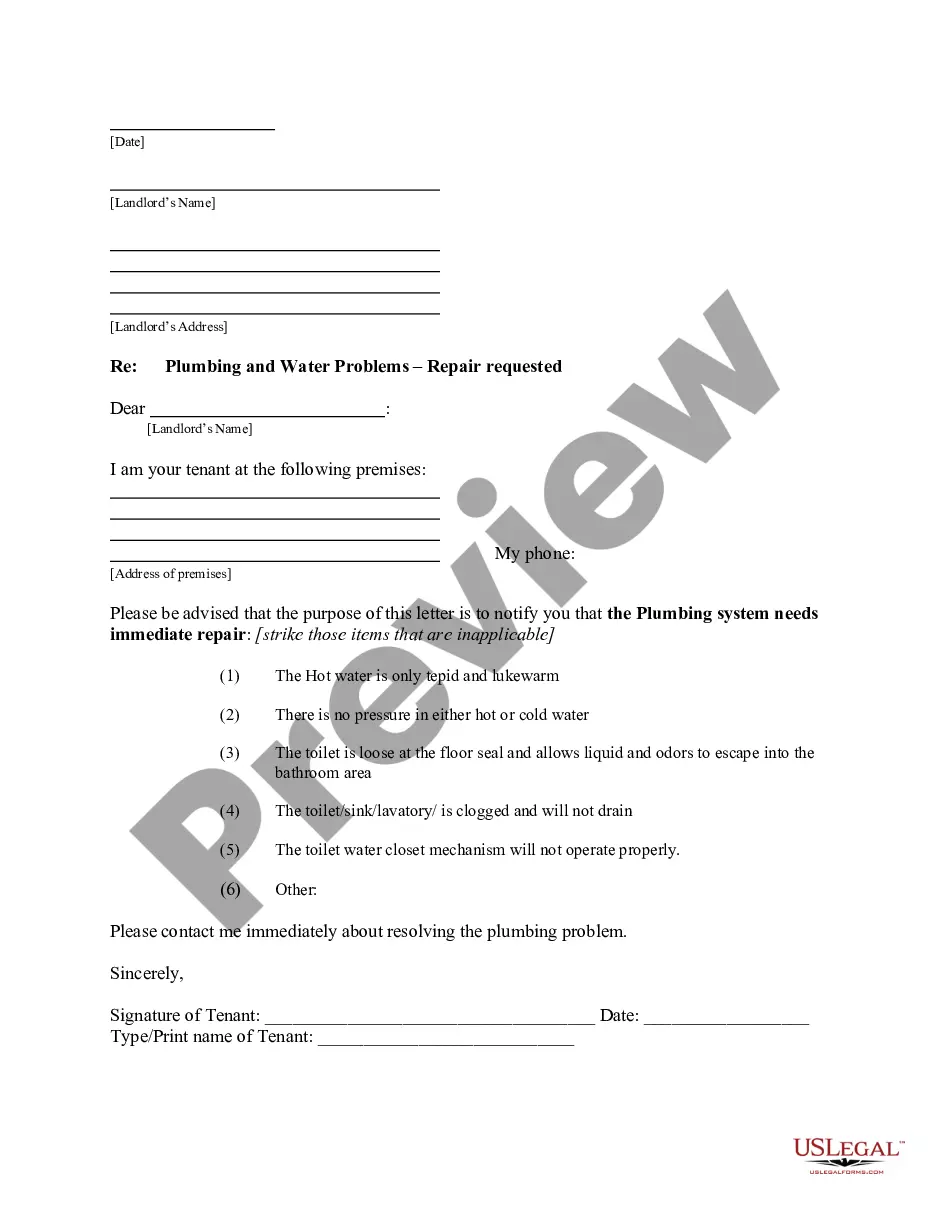

How to fill out College Education Trust Agreement?

You have the ability to spend hours online looking for the legal document template that meets the state and federal standards you require.

US Legal Forms provides thousands of legal templates that have been reviewed by professionals.

It is easy to acquire or generate the Guam College Education Trust Agreement from your service.

If available, use the Review option to examine the document template as well.

- If you possess a US Legal Forms account, you can Log In and select the Download option.

- Then, you can complete, edit, produce, or sign the Guam College Education Trust Agreement.

- Each legal document template you purchase is yours permanently.

- To obtain another copy of the purchased form, go to the My documents tab and select the appropriate option.

- If you are using the US Legal Forms website for the first time, follow the simple steps outlined below.

- First, ensure that you have selected the correct document template for the state/city of your preference.

- Review the form details to confirm you have chosen the right form.

Form popularity

FAQ

A Guam trust is a legal arrangement where a trustee manages assets on behalf of beneficiaries under Guam law. This type of trust can encompass various objectives, including providing financial support for education, as seen in a Guam College Education Trust Agreement. Establishing a Guam trust can streamline asset management while ensuring your loved ones receive the intended financial support. Your best choice is to utilize trusted platforms like uslegalforms to create a compliant and effective trust.

The requirements for a qualified trust generally include being established for a specific purpose, such as educational support, and having clearly defined beneficiaries. Trusts should comply with local laws and may need to be open for review by legal authorities. A Guam College Education Trust Agreement meets these standards by focusing directly on funding education. Consulting with professionals can help you tailor your trust to meet these requirements.

To qualify for a living trust in Guam, you must be a legal adult and have clear intent to create the trust. You will need to specify the assets that you wish to place into the trust, focusing on how they will benefit your beneficiaries. A Guam College Education Trust Agreement also emphasizes educational goals. Working with a trusted legal expert can ensure your eligibility and streamline the process.

The minimum amount for a living trust in Guam varies, but typically, it's advisable to have at least $100,000. This amount ensures that the trust can effectively manage and distribute assets as per your wishes. When considering a Guam College Education Trust Agreement, starting with a sufficient fund can help secure future educational expenses. Ultimately, the specific amount should align with your financial goals.

Same-beneficiary rollover Generally speaking, a withdrawal from a 529 plan is a tax-free rollover as long as the funds are transferred within 60 days to another 529 plan for the same beneficiary. (To simplify the process, most 529 plans will offer a direct "trustee-to-trustee" transfer.)

Here are five potential disadvantages of 529 plans that might affect your savings choice.There are significant upfront costs.Your child's need-based aid could be reduced.There are penalties for noneducational withdrawals.There are also penalties for ill-timed withdrawals.You have less say over your investments.

How to Open a 529 PlanChoose a 529 Plan. Parents and grandparents can invest in any state's 529 plan, not just their own state's 529 plan, so they should shop around.Determine the Type of 529 Plan Account.Complete the 529 Plan Application.Fund the 529 Plan.Choose Investments for the 529 Plan.

How to Open a 529 PlanChoose a 529 Plan. Parents and grandparents can invest in any state's 529 plan, not just their own state's 529 plan, so they should shop around.Determine the Type of 529 Plan Account.Complete the 529 Plan Application.Fund the 529 Plan.Choose Investments for the 529 Plan.

Plan early.Research 529 plans.Consider taxable accounts.Evaluate UGMAs and UTMAs if you are considering securities or real estate.Research Coverdell Education Savings Accounts.Consult a financial adviser.Calculate how different college trust funds will affect your child's ability to receive financial aid.More items...

The Trustee can be the same and very often is the same as the 529 Plan owner. A Trustee is not necessary for a 529 Plan but some have a Trust set up to manager the children's assets for their benefit. The account owner is the person who opens the 529.