This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

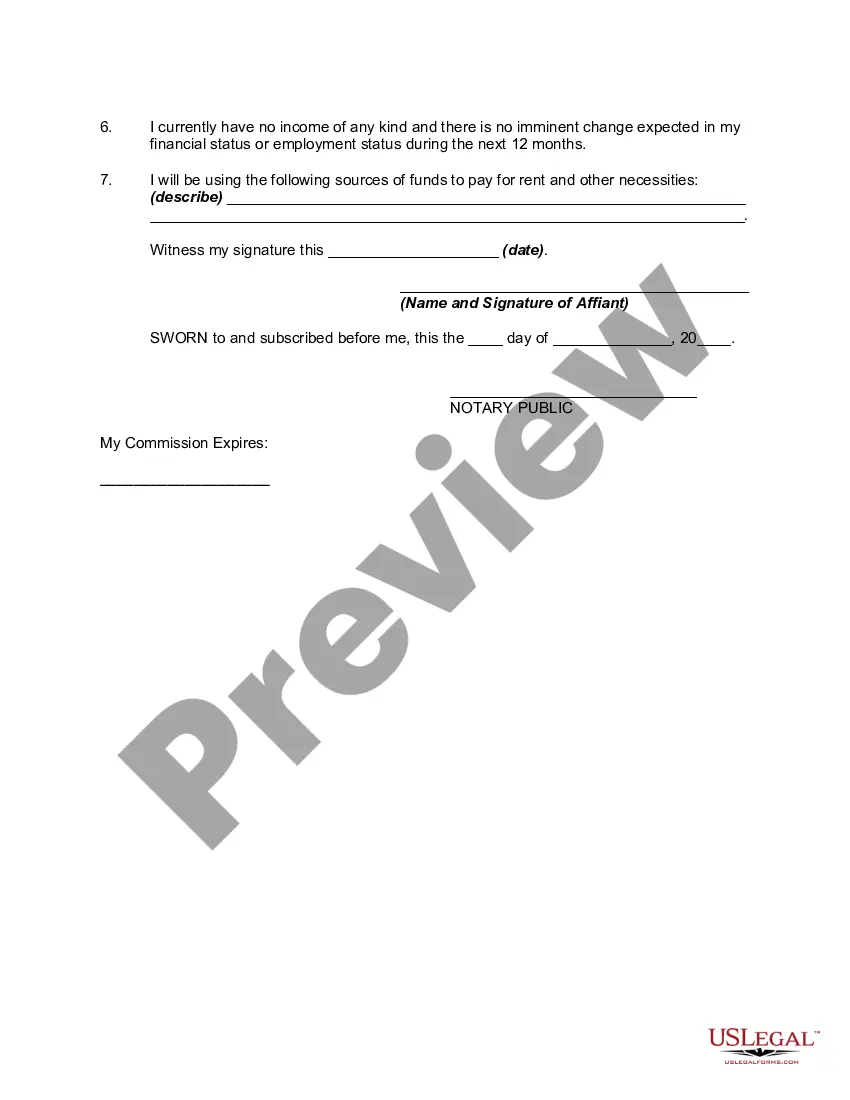

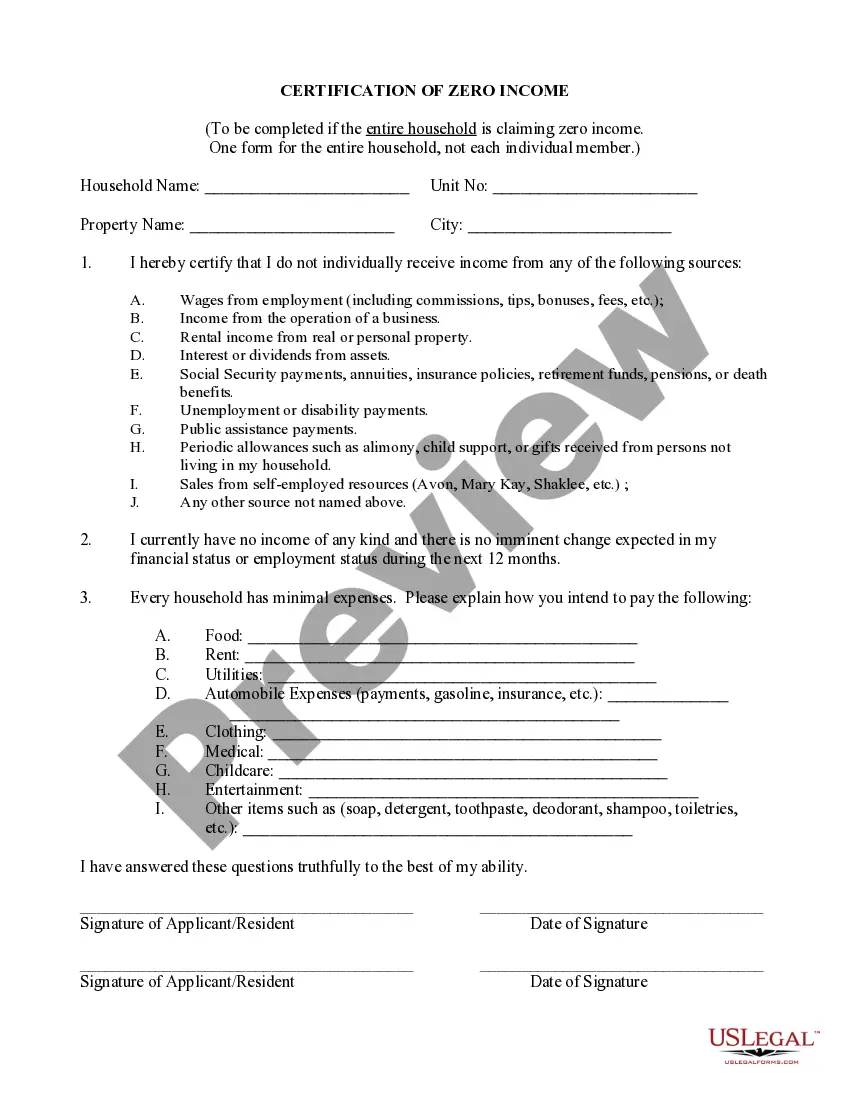

Guam Affidavit or Proof of No Income - Unemployed - Assets and Liabilities

Description

How to fill out Affidavit Or Proof Of No Income - Unemployed - Assets And Liabilities?

Selecting the optimal legal document template can be quite a challenge.

Naturally, there are numerous templates available online, but how do you find the legal form you require.

Utilize the US Legal Forms website.

First, ensure that you have chosen the correct form for your city/region. You can preview the form using the Review button and read the form description to confirm it is suitable for you.

- The service provides thousands of templates, including the Guam Affidavit or Proof of No Income - Unemployed - Assets and Liabilities, which you can utilize for business and personal purposes.

- All documents are reviewed by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and then click the Download button to obtain the Guam Affidavit or Proof of No Income - Unemployed - Assets and Liabilities.

- Use your account to browse the legal documents you have previously purchased.

- Proceed to the My documents section of your account to acquire another copy of the document you need.

- If you are a new user of US Legal Forms, here are some simple instructions for you to follow.

Form popularity

FAQ

To fill out a financial affidavit effectively, start by gathering all relevant information about your income, expenses, assets, and liabilities. When documenting your financial status, incorporate the Guam Affidavit or Proof of No Income - Unemployed - Assets and Liabilities to provide clarity on your situation. US Legal Forms offers resources and templates that simplify this process, ensuring you complete your affidavit accurately and confidently.

Filing the I-864 form without any income can seem challenging, but it’s manageable. First, you need to provide a Guam Affidavit or Proof of No Income - Unemployed - Assets and Liabilities to demonstrate your financial situation. You should detail your assets, any support from family or friends, and how you plan to meet financial obligations. Utilizing US Legal Forms can guide you through the process with easy-to-use templates.

To acquire proof of no income, consider preparing a Guam Affidavit or Proof of No Income - Unemployed - Assets and Liabilities. This document outlines your financial situation, detailing lack of income alongside any existing assets and liabilities. You can create this affidavit using user-friendly platforms like USLegalForms, which provide templates and guidance to ensure your affidavit meets all legal requirements.

To obtain a Guam GRT account number, you need to complete the necessary application form through the Guam Department of Revenue and Taxation. This process can typically be done online or in person, depending on your preference. Once you submit the application, you will receive your account number, which is essential for ensuring compliance with tax obligations, especially if you are using a Guam Affidavit or Proof of No Income - Unemployed - Assets and Liabilities.

Yes, residents of Guam can renew their driver's licenses online through the official government portal. This online service makes it convenient for individuals who may need to provide documentation like the Guam Affidavit or Proof of No Income - Unemployed - Assets and Liabilities. Always check the specific requirements on the portal to ensure you have the necessary documents for a successful renewal.

1 Guam is a form used for individual income tax filings in Guam. It plays a role similar to federal tax forms, helping residents report their income accurately. If you are looking to file the Guam Affidavit or Proof of No Income Unemployed Assets and Liabilities, you may also need to reference the 1 form as part of your overall tax responsibilities.

To contact Guam tax, reach out to the Department of Revenue and Taxation through their dedicated communication channels. They offer assistance for various inquiries, including understanding the Guam Affidavit or Proof of No Income - Unemployed - Assets and Liabilities. Utilize their official website to find the most accurate phone numbers, email addresses, and office locations.

The turnaround time for Guam tax returns can vary, but typically, electronic filings are processed faster than paper returns. When submitting forms, including the Guam Affidavit or Proof of No Income - Unemployed - Assets and Liabilities, expect processing times to range from a few weeks to a couple of months. It's advisable to check for updates after submission, particularly during peak tax season.

The director of revenue and taxation in Guam is responsible for overseeing tax collection and regulation. It is essential for residents to know who this individual is, especially when dealing with matters related to Guam Affidavit or Proof of No Income - Unemployed - Assets and Liabilities. You can find this information on the official Department of Revenue and Taxation website, which often provides updates and contact details.

Writing a proof of no income letter requires you to include your name, address, and the date. In the body, provide concise information about your current circumstances regarding unemployment and the absence of income. It’s important to sign the letter and include a date to validate it. Consider using the Guam Affidavit or Proof of No Income - Unemployed - Assets and Liabilities for formal documentation.