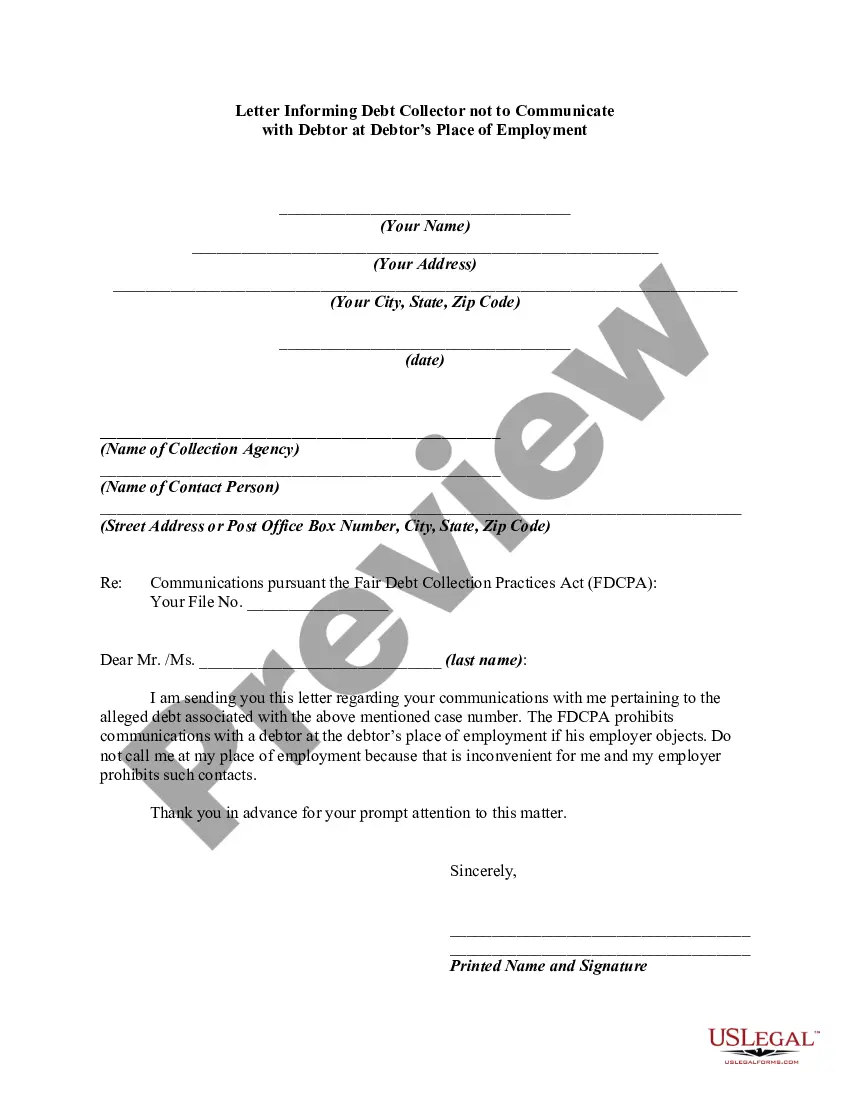

The Fair Debt Collection Practices Act (FDCPA) prohibits harassment or abuse in collecting a debt such as threatening violence, use of obscene or profane language, publishing lists of debtors who refuse to pay debts, or even harassing a debtor by repeatedly calling the debtor on the phone. This Act sets forth strict rules regarding communicating with the debtor.

The collector is restricted in the type of contact he can make with the debtor. He can't contact the debtor before 8:00 a.m. or after 9:00 p.m. He can contact the debtor at home, but cannot contact the debtor at the debtor's club or church or at a school meeting of some sort. The debtor cannot be contacted at work if his employer objects.

Title: Understanding the Guam Letter Informing Debt Collector not to Communicate with Debtor at Debtor's Place of Employment Introduction: The Guam Letter Informing Debt Collector not to Communicate with Debtor at Debtor's Place of Employment is an official legal document that debtors in Guam can utilize to prevent debt collectors from contacting them at their workplace. This letter serves as a means to protect debtors' privacy, maintain workplace professionalism, and ensure fair debt collection practices. In this article, we will delve into the purpose, significance, and various types of Guam letters used for this purpose. 1. What is a Guam Letter Informing Debt Collector not to Communicate with Debtor at Debtor's Place of Employment? — Definition and legal framework surrounding Guam letters — Purpose of the Guam letter; protecting debtor's workplace privacy — Importance of using official and legally binding formats 2. Key Elements to Include in the Guam Letter: — Debtor's personal information: full name, address, contact details — Details of the debt: debt amount, creditor's name, account number — Statement expressing the debtor's desire to prohibit contact at the workplace — Request for acknowledgment of receipt and compliance from the debt collector — Mention of possible legal action if the debt collector does not comply 3. Types of Guam Letters Informing Debt Collector not to Communicate with Debtor at Debtor's Place of Employment: a) Basic Guam Letter: — A simple and concise letter that covers the necessary elements mentioned above — Suitable for debtors preferring a straightforward approach b) Attorney Representation Guam Letter: — A letter prepared by an attorney on behalf of the debtor — Emphasizes legal representation and the seriousness of non-compliance c) Certified Mail Guam Letter: — Sending the letter via certified mail with a return receipt requested — Provides proof of receipt, which is necessary to validate the debtor's intentions d) Cease and Desist Guam Letter: — Similar to the basic Guam letter but includes a demand for the debt collector to cease all collection activities — Often used when debt collectors employ aggressive or unfair practices 4. Tips for Writing an Effective Guam Letter Informing Debt Collector not to Communicate with Debtor at Debtor's Place of Employment: — Use concise and professional language throughout the letter. — Clearly state the debtor's intentions while maintaining a respectful tone. — Keep copies of all correspondence and mailing receipts for future reference. — Consider seeking legal advice or using a sample letter template to ensure accuracy. Conclusion: A Guam Letter Informing Debt Collector not to Communicate with Debtor at Debtor's Place of Employment serves as a crucial tool for protecting debtors' rights and maintaining workplace dignity. By comprehending the purpose, key elements, and types of Guam letters available, debtors can effectively communicate their desire to curtail unwanted communications. It is essential to remain aware of the legal implications and take necessary steps to ensure compliance from debt collectors.Title: Understanding the Guam Letter Informing Debt Collector not to Communicate with Debtor at Debtor's Place of Employment Introduction: The Guam Letter Informing Debt Collector not to Communicate with Debtor at Debtor's Place of Employment is an official legal document that debtors in Guam can utilize to prevent debt collectors from contacting them at their workplace. This letter serves as a means to protect debtors' privacy, maintain workplace professionalism, and ensure fair debt collection practices. In this article, we will delve into the purpose, significance, and various types of Guam letters used for this purpose. 1. What is a Guam Letter Informing Debt Collector not to Communicate with Debtor at Debtor's Place of Employment? — Definition and legal framework surrounding Guam letters — Purpose of the Guam letter; protecting debtor's workplace privacy — Importance of using official and legally binding formats 2. Key Elements to Include in the Guam Letter: — Debtor's personal information: full name, address, contact details — Details of the debt: debt amount, creditor's name, account number — Statement expressing the debtor's desire to prohibit contact at the workplace — Request for acknowledgment of receipt and compliance from the debt collector — Mention of possible legal action if the debt collector does not comply 3. Types of Guam Letters Informing Debt Collector not to Communicate with Debtor at Debtor's Place of Employment: a) Basic Guam Letter: — A simple and concise letter that covers the necessary elements mentioned above — Suitable for debtors preferring a straightforward approach b) Attorney Representation Guam Letter: — A letter prepared by an attorney on behalf of the debtor — Emphasizes legal representation and the seriousness of non-compliance c) Certified Mail Guam Letter: — Sending the letter via certified mail with a return receipt requested — Provides proof of receipt, which is necessary to validate the debtor's intentions d) Cease and Desist Guam Letter: — Similar to the basic Guam letter but includes a demand for the debt collector to cease all collection activities — Often used when debt collectors employ aggressive or unfair practices 4. Tips for Writing an Effective Guam Letter Informing Debt Collector not to Communicate with Debtor at Debtor's Place of Employment: — Use concise and professional language throughout the letter. — Clearly state the debtor's intentions while maintaining a respectful tone. — Keep copies of all correspondence and mailing receipts for future reference. — Consider seeking legal advice or using a sample letter template to ensure accuracy. Conclusion: A Guam Letter Informing Debt Collector not to Communicate with Debtor at Debtor's Place of Employment serves as a crucial tool for protecting debtors' rights and maintaining workplace dignity. By comprehending the purpose, key elements, and types of Guam letters available, debtors can effectively communicate their desire to curtail unwanted communications. It is essential to remain aware of the legal implications and take necessary steps to ensure compliance from debt collectors.