An irrevocable trust is one that generally cannot be changed or canceled once it is set up without the consent of the beneficiary. Contributions cannot be taken out of the trust by the trustor. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Guam General Form of Irrevocable Trust Agreement

Description

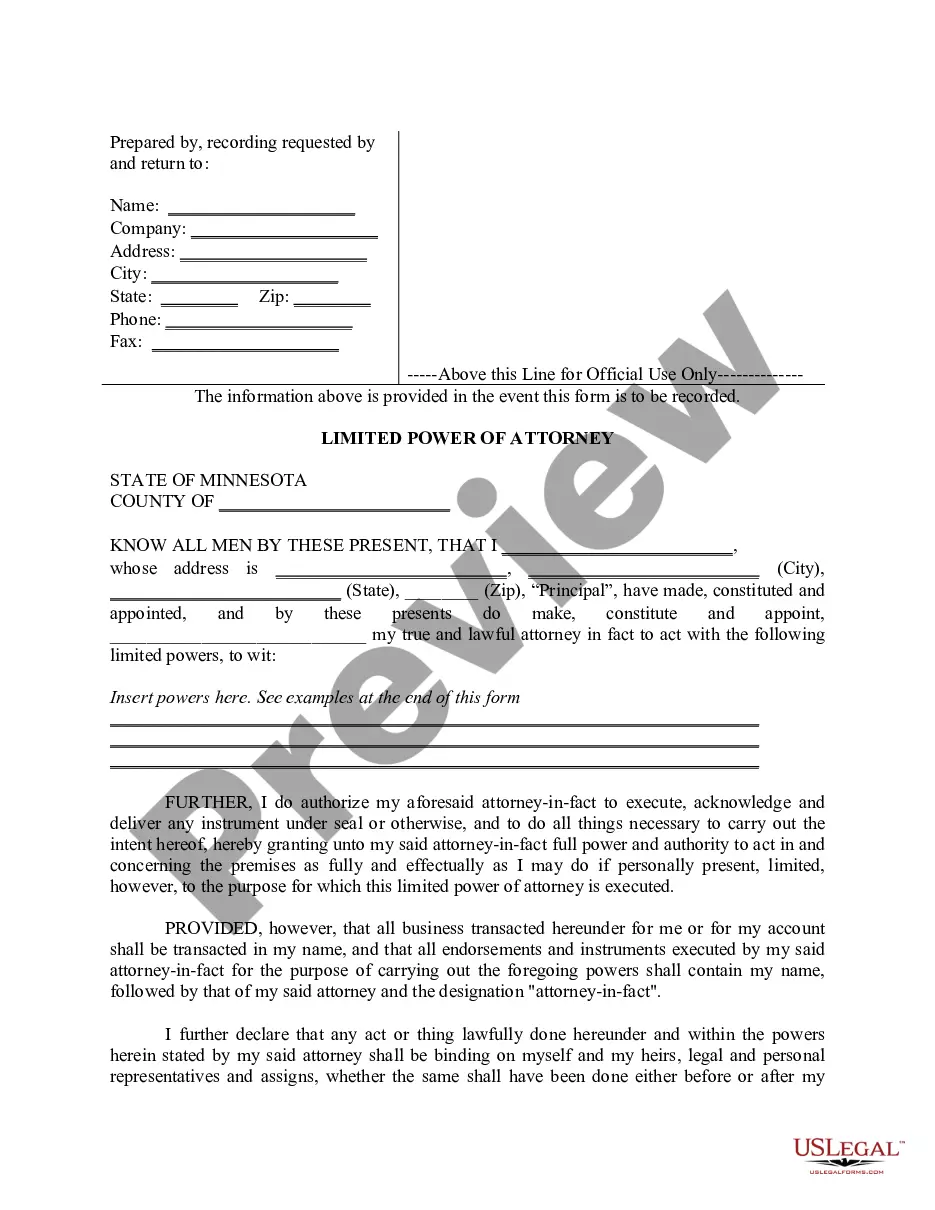

How to fill out General Form Of Irrevocable Trust Agreement?

You can dedicate several hours online searching for the authentic document template that fits the state and federal requirements you need.

US Legal Forms offers a vast collection of legal forms that are reviewed by professionals.

You can obtain or create the Guam General Form of Irrevocable Trust Agreement from their services.

If available, utilize the Preview button to review the document template as well.

- If you already have a US Legal Forms account, you may Log In and click on the Download button.

- Next, you may fill out, edit, create, or sign the Guam General Form of Irrevocable Trust Agreement.

- Every legal document template you purchase is yours forever.

- To obtain an additional copy for any purchased form, go to the My documents tab and click on the respective button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the area/city of your choice.

- Review the form details to confirm you have chosen the correct form.

Form popularity

FAQ

Filling out an irrevocable trust involves several key steps. Start with identifying the grantor, trustee, and beneficiaries, while clearly defining the distribution of assets. Utilizing the Guam General Form of Irrevocable Trust Agreement can guide you through this process seamlessly, ensuring that your trust is comprehensive and meets all legal standards.

Yes, you can write your own irrevocable trust, but it requires careful attention to legal language and structure. Using the Guam General Form of Irrevocable Trust Agreement as a guideline can simplify this process and help you avoid common mistakes. Ensure that your document accurately reflects your intentions and adheres to legal requirements to be effective.

To fill out a trust agreement, begin by gathering necessary information such as the names of the grantor, trustee, and beneficiaries. Next, clearly outline the assets being placed in the trust and specify how those assets should be managed. It's crucial to use a template like the Guam General Form of Irrevocable Trust Agreement to ensure that your trust complies with local laws and includes all essential clauses.

A trust document outlines how your assets are to be managed and distributed after your death. It provides instructions for the trustee and ensures your beneficiaries receive their intended share. By using a Guam General Form of Irrevocable Trust Agreement, you can create a clear mandate that serves your goals and protects your loved ones.

You cannot create an irrevocable trust for yourself in the sense that you retain control over your assets. Once established, you relinquish ownership, and a trustee manages the trust assets. However, you can create a Guam General Form of Irrevocable Trust Agreement that benefits your chosen individuals, providing them with financial security after your passing.

Yes, an irrevocable trust generally needs to be notarized to confirm its validity. Notarization adds a layer of protection against disputes and ensures that the trust is legally enforceable. Therefore, when setting up a Guam General Form of Irrevocable Trust Agreement, it is advisable to have it notarized for additional security.

A trust certificate serves as proof of the existence of a trust and often outlines basic information about it, such as the trustees and beneficiaries. In contrast, a trust agreement contains the detailed rules governing the trust's operation. Having clarity about these two documents helps when you are contemplating a Guam General Form of Irrevocable Trust Agreement.

A trust agreement document is a formal record that establishes the terms of a trust. It details how assets will be managed, who the beneficiaries are, and the responsibilities of the trustee. Utilizing a Guam General Form of Irrevocable Trust Agreement, you can create a comprehensive document that meets your specific needs and protects your assets effectively.

A trust deed is a legal document that conveys property to a trustee, while a trust agreement lays out the terms and conditions of managing that property. In simple terms, a deed transfers ownership, whereas an agreement specifies how the trustee should manage the assets. Understanding these differences is crucial when considering a Guam General Form of Irrevocable Trust Agreement.

The purpose of a trust agreement is to outline how your assets will be managed and distributed after your passing. It ensures your wishes are honored and provides for your beneficiaries in a structured way. A Guam General Form of Irrevocable Trust Agreement can help you secure your legacy while minimizing taxes and avoiding probate.