Guam Triple Net Lease for Residential Property

Description

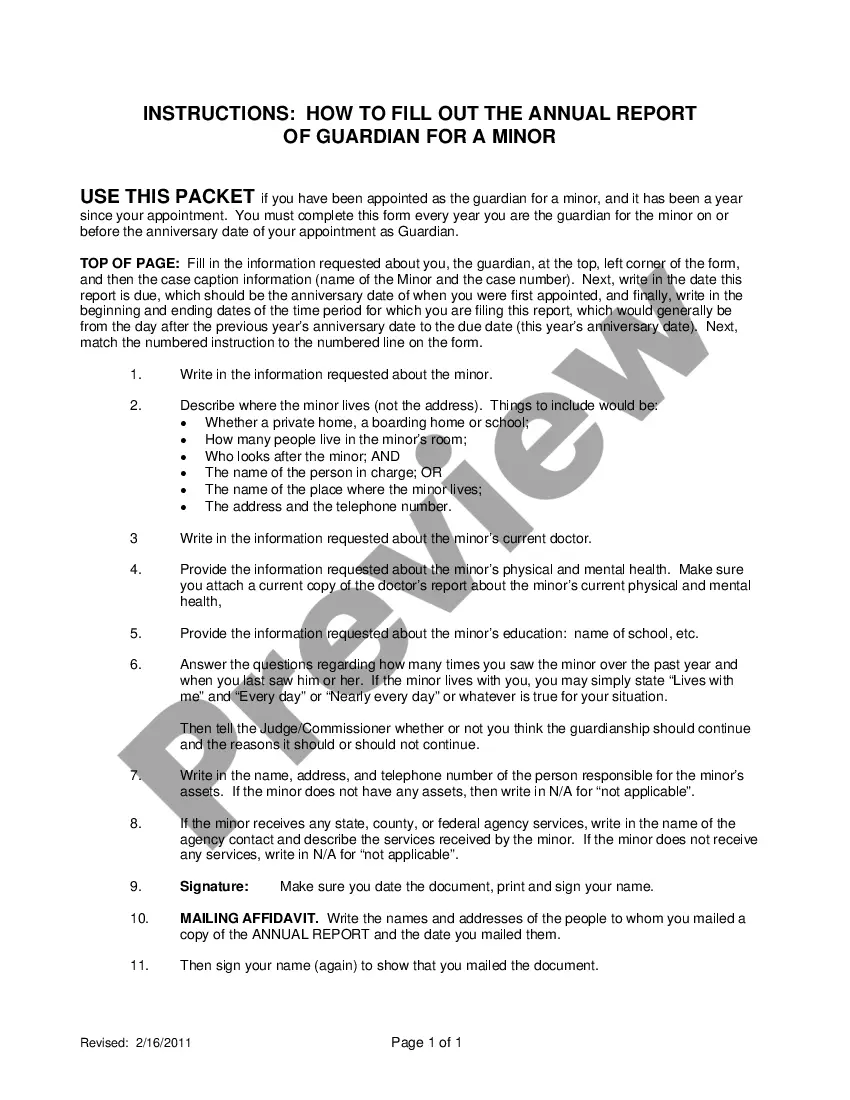

How to fill out Triple Net Lease For Residential Property?

You might spend hours online looking for the valid document template that meets the state and federal requirements you need.

US Legal Forms offers a multitude of legal forms that can be evaluated by professionals.

You can actually obtain or create the Guam Triple Net Lease for Residential Property using their service.

If available, utilize the Review option to examine the document template as well.

- If you already have a US Legal Forms account, you can Log In and then click the Acquire option.

- After that, you can complete, modify, print, or sign the Guam Triple Net Lease for Residential Property.

- Every legal document template you obtain is yours permanently.

- To get another copy of a purchased form, navigate to the My documents tab and click the corresponding option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the county/area that you choose.

- Review the form details to confirm that you have selected the appropriate document.

Form popularity

FAQ

Commercial properties are most commonly associated with triple net leases, including retail spaces and office buildings. However, certain residential properties may also utilize this lease type. When exploring a Guam Triple Net Lease for Residential Property, consider the specifics of the property and how the lease arrangements benefit both parties.

To secure a triple net lease, start by identifying suitable properties and understanding the lease terms. Engaging with real estate professionals can provide insight into available options. Consider using platforms like uslegalforms, which provide documentation and resources to help you navigate acquiring a Guam Triple Net Lease for Residential Property.

Not all residential leases are triple net, but some may incorporate similar elements. Generally, triple net leases are more prevalent in commercial real estate. However, if you're considering a Guam Triple Net Lease for Residential Property, it's essential to clarify the terms to ensure you understand your financial obligations.

NNN, or triple net lease, refers to a lease structure where the tenant pays for three primary expenses: property taxes, insurance, and maintenance costs. This type of lease is common in commercial real estate but can also apply to residential situations. For anyone exploring a Guam Triple Net Lease for Residential Property, understanding this structure is vital.

One downside of a triple net lease is the potential for unpredictable costs. Tenants may face varying expenses due to property taxes or maintenance issues, leading to budget strain. However, with proper management and awareness, a Guam Triple Net Lease for Residential Property can still be a beneficial arrangement.

Triple net leases can pose challenges for tenants, but they also offer distinct benefits. While the tenant assumes additional costs, this lease type often leads to lower base rent. It’s crucial to evaluate your financial situation and understand the implications of a Guam Triple Net Lease for Residential Property before making a decision.

To identify a triple net lease, look for specific language in the contract. It typically states that the tenant is responsible for property expenses, including taxes, insurance, and maintenance. Understanding these responsibilities is essential for anyone considering a Guam Triple Net Lease for Residential Property. Clarity in the terms can prevent misunderstandings later.

To calculate triple net leases, gather all relevant expenses related to the property, such as taxes, insurance, and maintenance. Then, add these costs to the base rent to arrive at the total lease amount. For those exploring a Guam Triple Net Lease for Residential Property, assistance from USLegalForms can ensure accurate calculations and comprehensive lease agreements that meet both parties' needs.

The term $20 NNN means that the base rent for the property is $20 per square foot, with the tenant also responsible for all additional expenses like taxes, insurance, and maintenance. In the context of a Guam Triple Net Lease for Residential Property, this structure can simplify budgeting for both landlords and tenants. Understanding such terms helps you gauge the financial commitment involved.

Calculating a triple net lease involves a straightforward formula. First, determine the property's base rent, then add the tenant's share of property taxes, insurance, and maintenance costs. For a Guam Triple Net Lease for Residential Property, it's crucial to estimate these additional expenses accurately to provide transparency and fairness in the lease agreement.