Guam Security Agreement involving Sale of Collateral by Debtor

Description

How to fill out Security Agreement Involving Sale Of Collateral By Debtor?

Are you in a scenario where you require documents for professional or personal purposes almost every day.

There are numerous authentic template documents accessible online, but locating trustworthy ones can be challenging.

US Legal Forms offers thousands of form templates, such as the Guam Security Agreement concerning Sale of Collateral by Debtor, designed to fulfill federal and state requirements.

Once you acquire the right form, click Get Now.

Choose the pricing plan you need, provide the necessary information to create your account, and complete the payment using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Guam Security Agreement regarding Sale of Collateral by Debtor template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct area/state.

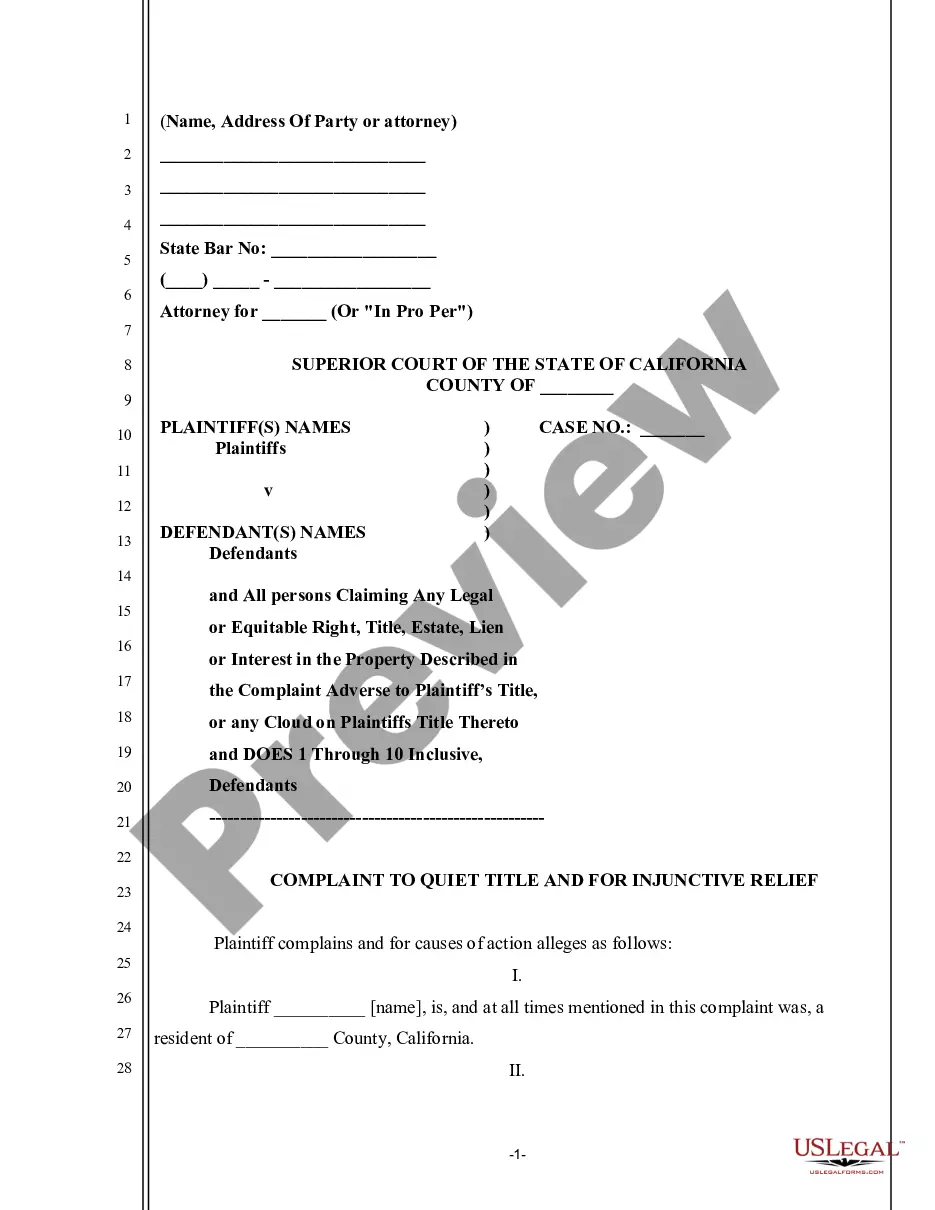

- Utilize the Preview button to review the form.

- Check the description to confirm you have selected the right form.

- If the form is not what you want, use the Search section to locate the form that fulfills your requirements.

Form popularity

FAQ

You typically file a security agreement at the state’s Secretary of State office where the debtor resides or where the collateral is located. This filing is crucial for creating a public record of the secured party's interest. Utilizing platforms like uslegalforms can simplify this process, ensuring your Guam Security Agreement involving Sale of Collateral by Debtor is properly filed to protect your interests.

If collateral is perfected in one state and later moved to another, the protection of the security interest may vary. Generally, a security interest remains effective for a limited time after relocation, typically within four months. After this period, the secured party will need to re-perfect the interest in the new state to ensure ongoing protection under the Guam Security Agreement involving Sale of Collateral by Debtor.

When collateral is sold, it typically affects the security interest of the creditor. The sale may release the debtor from obligations tied to that collateral, but it does not eliminate the obligation to the secured party. Under a Guam Security Agreement involving Sale of Collateral by Debtor, the secured party often retains rights to claim any proceeds from the sale, ensuring their security interest is protected.

The description of collateral in a security agreement identifies the assets that secure the debt. This can include various types of property, such as equipment, inventory, or receivables. A thorough and precise description is vital in a Guam Security Agreement involving Sale of Collateral by Debtor to prevent any ambiguities about what is secured.

To perfect a security agreement under the Uniform Commercial Code (UCC), you must file a financing statement or take possession of the collateral. This action establishes your legal claim to the collateral in the event of default. When it comes to a Guam Security Agreement involving Sale of Collateral by Debtor, perfecting the agreement is crucial for protecting the secured party's interests.

A secured creditor, under a Guam Security Agreement involving Sale of Collateral by Debtor, has the right to claim the collateral if the debtor defaults on their obligations. This includes the ability to take possession or sell the collateral to recoup owed amounts. Secured creditors also have priority over unsecured creditors in the event of the debtor's bankruptcy. Being informed about these rights allows secured creditors to safeguard their interests effectively.

Collateral rights refer to the legal entitlements a secured party has over the collateral specified in a Guam Security Agreement involving Sale of Collateral by Debtor. These rights allow them to enforce their claim against the collateral if the debtor fails to fulfill their obligations. Understanding these rights is pivotal for both parties involved, as they define the extent of each party's authority and responsibility. This knowledge can empower individuals to navigate their agreements more effectively.

In a Guam Security Agreement involving Sale of Collateral by Debtor, any property acquired by the debtor after the security agreement is often considered after-acquired property. This means that the secured party may have a claim to this property as collateral, even if it was not specifically mentioned in the original agreement. It’s important for debtors to recognize that their new assets could also be subject to the terms of the existing security agreement. Awareness of this concept helps ensure compliance and avoid unintended consequences.

Under the Uniform Commercial Code (UCC), the secured party holds several rights in a Guam Security Agreement involving Sale of Collateral by Debtor. These rights include the ability to take possession of the collateral if the debtor defaults on the agreement. Additionally, the secured party can also sell the collateral to recover the owed amount. Being aware of these rights helps both parties understand their roles in the agreement.

In a Guam Security Agreement involving Sale of Collateral by Debtor, the debtor retains the right to use the collateral while keeping up with their repayment obligations. This means the debtor can manage their assets even if they are secured under the agreement. However, the debtor must not sell or transfer the collateral without the consent of the secured party. Understanding these rights is crucial for maintaining financial stability.