Guam Release of Liability Form for Contractors

Description

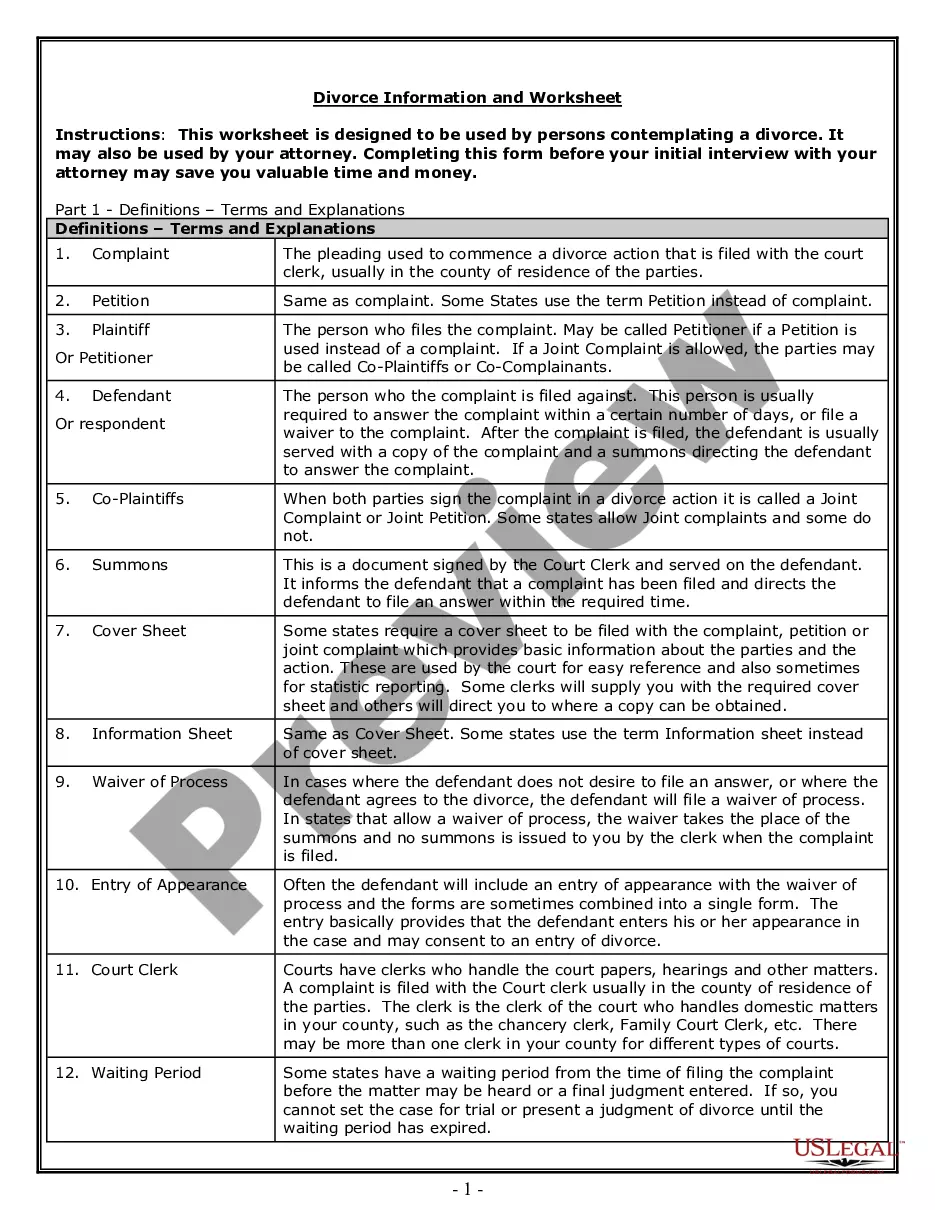

How to fill out Release Of Liability Form For Contractors?

It is feasible to spend hours online searching for the appropriate legal document format that meets the federal and state requirements you need.

US Legal Forms provides thousands of legal templates that are reviewed by experts.

You can easily download or print the Guam Release of Liability Form for Contractors from our service.

If available, use the Review button to look through the document format as well.

- If you already have a US Legal Forms account, you can Log In and click on the Download button.

- Then, you can fill out, edit, print, or sign the Guam Release of Liability Form for Contractors.

- Every legal document template you download is yours permanently.

- To get an additional copy of an acquired form, go to the My documents tab and click on the corresponding button.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- First, ensure you have selected the correct document format for the region/city of your choice.

- Read the form description to confirm you have chosen the right document.

Form popularity

FAQ

In most cases, a Guam Release of Liability Form for Contractors does not require notarization to be valid. However, having a notarized document can add an extra layer of authenticity and may help in enforcing the waiver in court. It’s important to check local regulations or specific contractual requirements, as some situations might necessitate notarization. Using reputable platforms like USLegalForms can guide you in ensuring your release of liability form meets all legal standards.

Yes, waivers, including the Guam Release of Liability Form for Contractors, need to be signed to be effective. Signing the waiver ensures that all parties involved acknowledge and accept the terms outlined in the document. Without signatures, the waiver may not hold up in court, leaving contractors vulnerable to potential claims. Therefore, it is critical to ensure that all parties sign the form before commencing any work.

Independent contractors should fill out a Guam Release of Liability Form for Contractors to protect themselves from potential legal claims. This form outlines the risks associated with the work being performed and waives the contractor's liability for any injuries or damages. By using this form, independent contractors can ensure that they have a formal agreement in place, which can be crucial in the event of a dispute. It's essential to choose a form that meets Guam's legal requirements to ensure its validity.

To fill out a Guam Release of Liability Form for Contractors, start by clearly identifying the parties involved, including the contractor and the individual or organization using their services. Specify the scope of work and outline the potential risks associated with the service. Next, ensure that the form includes a statement that releases the contractor from liability for injuries or damages that may occur during the project. Finally, both parties should sign and date the form to make it legally binding.

The business tax rate in Guam varies based on the type of business activity conducted, but generally falls in line with the gross receipts tax framework. Contractors using tools like the Guam Release of Liability Form for Contractors should be aware of how these tax rates apply to their earnings. Familiarizing yourself with local tax structures can help streamline your budgeting and tax strategy. Staying informed enables businesses to operate smoothly while meeting their tax obligations.

Gross Receipts Tax (GRT) in Guam is currently set at 5% for most businesses. This tax is charged on all income received from business activity, which may include transactions involving a Guam Release of Liability Form for Contractors. Managing GRT correctly is vital for financial health and compliance. Understanding how GRT affects your business operations will help you make better financial decisions.

Business tax privilege refers to the right of businesses to operate within Guam while fulfilling their tax obligations. This concept is important for contractors who must navigate regulations related to activities such as using a Guam Release of Liability Form for Contractors. Complying with business tax privilege ensures that companies can legally function without penalties. It highlights the importance of understanding local tax laws in maintaining a compliant business.

The business privilege tax in Guam acts like an income tax for businesses operating in the territory. It is essential for businesses, including those using a Guam Release of Liability Form for Contractors, as this form helps manage and mitigate risks. The tax applies to gross income earnings, ensuring businesses contribute to local funding. Understanding this tax is crucial for compliance and proper financial planning.

Yes, you can file your Guam taxes online, making the process quicker and less complicated. This option is especially helpful for contractors who need to stay organized and compliant. Remember to have your Guam Release of Liability Form for Contractors ready, as it serves as critical supporting documentation during tax season.

U.S. expatriates can file their taxes online, but they should be aware of their unique obligations regarding foreign income. Ensuring compliance is essential to avoid penalties. For contractors, pairing the online filing process with a Guam Release of Liability Form for Contractors can enhance your organizational efficiency.