Dear [Bank Name], I am writing to inform you that I am interested in depositing funds into my account at your esteemed institution. I am a resident of Guam, a beautiful U.S. island territory situated in the western Pacific Ocean. Guam, commonly referred to as America's "Micronesia Jewel," is renowned for its stunning beaches, rich cultural heritage, and vibrant tropical climate. As a popular tourist destination and strategic military outpost, Guam has grown into a thriving economic hub with a diverse and multicultural community. With an expanding economy, diverse industries, and a strong financial sector, Guam offers an ideal environment for individuals and businesses to invest and grow their wealth. It is in this context that I would like to entrust my funds with your bank, known for its reliability, security, and reputation. There are various types of Guam Sample Letters for Deposit of Funds available, depending on the purpose and nature of the deposit. Some common types include: 1. Personal Deposit Letter: This letter outlines the details of a personal deposit made by an individual into their own bank account. It typically includes the depositor's personal information, account number, deposit amount, and any specific instructions regarding the funds. 2. Business Deposit Letter: Businesses often require a specialized letter when depositing funds. This letter specifies the business entity, account details, deposit amount, and may include additional information such as invoices or related documents. 3. Joint Account Deposit Letter: A joint account deposit letter is used when multiple individuals share a single account. This letter typically includes the names and signatures of all account holders, the amount being deposited, and any specific instructions for the funds. 4. Trust Fund Deposit Letter: In cases where funds are being deposited into a trust fund, a specialized letter is required. This letter provides details of the trust, the trustee's information, the beneficiary's information, and any specific instructions for the deposit. 5. Fixed Deposit Letter: A fixed deposit letter pertains to a specific type of deposit where the funds are held for a fixed period of time, usually at a higher interest rate. This letter includes the deposit amount, term, interest rate, and maturity instructions. Regardless of the type of deposit, I am confident that your bank possesses the necessary expertise to handle my funds securely and efficiently. I kindly request you to provide me with the appropriate Guam Sample Letter for Deposit of Funds that suits my requirements. Thank you for your attention to this matter. I look forward to a mutually beneficial banking relationship. Sincerely, [Your Name]

Guam Sample Letter for Deposit of Funds

Description

How to fill out Guam Sample Letter For Deposit Of Funds?

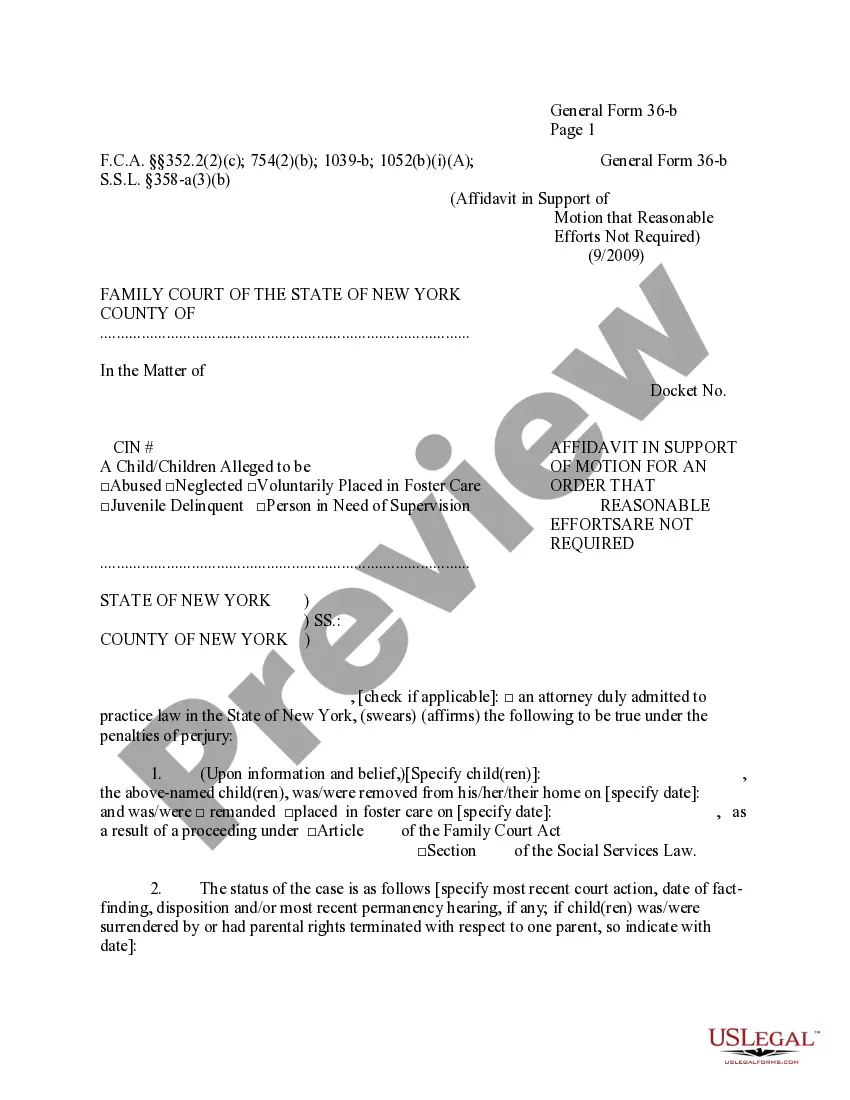

Finding the right authorized papers design can be a battle. Of course, there are a lot of templates available on the Internet, but how do you obtain the authorized kind you require? Take advantage of the US Legal Forms site. The assistance delivers thousands of templates, like the Guam Sample Letter for Deposit of Funds, which can be used for organization and personal needs. All the forms are checked by experts and satisfy state and federal needs.

In case you are presently authorized, log in to your accounts and click on the Download switch to have the Guam Sample Letter for Deposit of Funds. Utilize your accounts to check through the authorized forms you have acquired previously. Go to the My Forms tab of the accounts and obtain another backup of your papers you require.

In case you are a fresh customer of US Legal Forms, allow me to share straightforward guidelines that you can stick to:

- Initially, make certain you have selected the right kind to your metropolis/state. You can examine the form using the Preview switch and look at the form outline to ensure it is the best for you.

- In the event the kind will not satisfy your expectations, make use of the Seach discipline to find the right kind.

- Once you are sure that the form is proper, go through the Acquire now switch to have the kind.

- Choose the pricing program you would like and type in the necessary information and facts. Build your accounts and buy an order using your PayPal accounts or bank card.

- Choose the data file formatting and acquire the authorized papers design to your gadget.

- Comprehensive, revise and produce and indication the received Guam Sample Letter for Deposit of Funds.

US Legal Forms is the largest catalogue of authorized forms where you can see different papers templates. Take advantage of the company to acquire skillfully-produced documents that stick to state needs.